Sales Up 17%, Operating Income Up 111% Compared to 2005 Fourth

Quarter FORT COLLINS, Colo., April 26 /PRNewswire-FirstCall/ --

Advanced Energy Industries, Inc. (NASDAQ:AEIS) today announced

financial results for the first quarter ended March 31, 2006.

(Logo: http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO )

Sales were $94.0 million for the first quarter of 2006, up 16.9%

compared to $80.4 million in the fourth quarter of 2005, and up

14.3% compared to $82.2 million in the first quarter of 2005. Gross

profit was $38.6 million, or 41.0% of sales, compared to $30.2

million, or 37.6% of sales for the fourth quarter of 2005, and

$27.3 million, or 33.2% of sales in the first quarter of 2005.

First quarter 2006 income from operations was $13.2 million, or

14.0% of sales, an increase of 111.3% compared to $6.2 million, or

7.8% of sales, in the fourth quarter of 2005. This compares to

first quarter 2005 income from operations of $2.5 million, or 3.1%

of sales. First quarter 2006 income from operations includes

$641,000 of stock-based compensation expense due to the adoption of

SFAS 123(R). First quarter 2005 income from operations includes

$1.3 million of restructuring charges related to employee severance

and termination costs. First quarter 2006 net income was $12.8

million, or $0.28 per diluted share, compared to net income of

$10.0 million, or $0.22 per diluted share in the fourth quarter of

2005, and $734,000 in the first quarter of 2005, or $0.02 per

diluted share. First quarter 2006 net income includes a $1.4

million gain, primarily related to the sale of equity securities,

which favorably impacts diluted earnings per share by approximately

$0.02. First quarter 2006 net income reflects a tax rate of 15%,

which is lower than the Company's anticipated tax rate of 20% due

to the mix of foreign and domestic income in the respective taxing

jurisdictions and the utilization of the net operating loss

carryforwards which had valuation allowances recorded against them.

Dr. Hans Betz, president and chief executive officer of Advanced

Energy, said, "Our first quarter performance demonstrates a strong

demand environment for our innovative power generation solutions.

The sequential sales increase was primarily driven by sales to the

semiconductor industry. Shipments of our Pinnacle(R) DC power

supply for use in semiconductor and Generation 5 flat panel display

applications were at near record levels. Today, we announced a

significant win for our Crystal(R) AC power solutions for a major

architectural glass retrofit opportunity that is expected to drive

increased sales to this market over the next twelve months. Outside

of our core markets, we also marked another milestone in our

objective to penetrate the solar cell manufacturing market, winning

a new position at ECD Ovonics to provide process power using our

Cesar(R) RF generators and VarioMatch(TM) matching networks." Dr.

Betz continued, "We also continue to make significant progress in

our financial performance. We were encouraged by the operating

performance as our factory in Shenzhen, China is fully ramped, and

gross margin this quarter was at its highest level in five years.

Based on the continued strength in end market demand, we currently

expect second quarter 2006 sales to be in the range of $98 million

to $102 million. We anticipate earnings per share in the range of

$0.27 to $0.29." First Quarter 2006 Conference Call Management will

host a conference call today, Wednesday, April 26, 2006 at 5:00 pm

Eastern time to discuss Advanced Energy's financial results. You

may access this conference call by dialing 888-713-4717.

International callers may access the call by dialing 706-679-7720.

For a replay of this teleconference, please call 706-645-9291, and

enter the pass code 7779721. The replay will be available through

May 3, 2006. There will also be a webcast available on the Investor

Relations webpage at http://ir.advanced-energy.com/. About Advanced

Energy Advanced Energy is a global leader in the development and

support of technologies critical to high-technology, high-growth

manufacturing processes used in the production of semiconductors,

flat panel displays, data storage products, solar cells,

architectural glass, and other advanced product applications.

Leveraging a diverse product portfolio and technology leadership,

Advanced Energy creates solutions that maximize process impact,

improve productivity and lower the cost of ownership for its

customers. This portfolio includes a comprehensive line of

technology solutions in power, flow, thermal management, and plasma

and ion beam sources for original equipment manufacturers (OEMs)

and end-users around the world. Advanced Energy operates in

regional centers in North America, Asia and Europe and offers

global sales and support through direct offices, representatives

and distributors. Founded in 1981, Advanced Energy is a publicly

held company traded on the Nasdaq National Market under the symbol

AEIS. For more information, please visit our corporate website:

http://www.advanced-energy.com/. This press release contains

certain forward-looking statements, including the company's

expectations with respect to Advanced Energy's financial results

for the second quarter of 2006 as well as other matters discussed

in this news release that are not purely historical data, are

forward-looking statements. Forward-looking statements are subject

to known and unknown risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by such statements. Such risks and uncertainties include, but are

not limited to: the volatility and cyclicality of the industries we

serve including the semiconductor capital equipment and flat panel

display industries, the timing of orders received from our

customers, our ability to realize cost improvement benefits from

the manufacturing initiatives underway, unanticipated changes to

our effective tax rate, and other risks described in Advanced

Energy's Form 10-K, Forms 10-Q and other reports and statements, as

filed with the Securities and Exchange Commission. Forward-looking

statements are made and based on information available to us on the

date of this press release. We do not assume, and expressly

disclaim, any obligation to update this information. These reports

and statements are available on the SEC's website at

http://www.sec.gov/. Copies may also be obtained from Advanced

Energy's website at http://www.advanced-energy.com/ or by

contacting Advanced Energy's investor relations at 970-221-4670.

The company assumes no obligation to update the information in this

press release. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED) (in thousands, except per share data) Three Months

Ended March 31, December 31, 2006 2005 2005 Sales $93,950 $82,176

$80,387 Cost of sales 55,400 54,854 50,196 Gross profit 38,550

27,322 30,191 Operating expenses: Research and development 10,459

10,255 9,635 Selling, general and administrative 14,405 12,725

13,671 Amortization of intangible assets 477 547 481 Restructuring

charges 29 1,262 166 Total operating expenses 25,370 24,789 23,953

Income from operations 13,180 2,533 6,238 Other income (expense),

net 1,833 (2,087) 123 Income from continuing operations before

income taxes 15,013 446 6,361 Provision for income taxes (2,252)

(529) (1,330) Income (loss) from continuing operations 12,761 (83)

5,031 Gain on sale of discontinued assets -- -- 5,210 Results of

discontinued operations -- 817 (216) Provision for income taxes --

-- -- Income from discontinued operations -- 817 4,994 Net income

$12,761 $734 $10,025 Net income (loss) per basic share Income

(loss) from continuing operations $0.29 $-- $0.11 Income from

discontinued operations $-- $0.02 $0.11 Basic earnings per share

$0.29 $0.02 $0.23 Net income (loss) per diluted share Income (loss)

from continuing operations $0.28 $-- $0.11 Income from discontinued

operations $-- $0.02 $0.11 Diluted earnings per share $0.28 $0.02

$0.22 Basic weighted-average common shares outstanding 44,571

32,755 44,416 Diluted weighted-average common shares outstanding

45,004 32,878 44,902 CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) (in thousands) March 31, December 31, 2006 2005 ASSETS

Current assets: Cash and cash equivalents $67,965 $52,874

Marketable securities 8,815 6,811 Accounts receivable, net 72,240

68,992 Inventories 55,940 56,199 Other current assets 4,700 6,773

Total current assets 209,660 191,649 Property and equipment, net

37,502 39,294 Deposits and other 1,877 3,808 Goodwill and

intangibles, net 69,716 69,843 Customer service equipment, net

1,848 2,407 Deferred income tax assets, net 5,059 3,116 Total

assets $325,662 $310,117 LIABILITIES AND STOCKHOLDERS' EQUITY

Current liabilities: Trade accounts payable $21,567 $22,028 Other

accrued expenses 23,928 23,977 Current portion of capital leases

and senior borrowings 1,601 2,011 Total current liabilities 47,096

48,016 Long-term liabilities: Capital leases and senior borrowings

2,028 2,179 Other long-term liabilities 2,556 2,492 Total long-term

liabilities 4,584 4,671 Total liabilities 51,680 52,687

Stockholders' equity 273,982 257,430 Total liabilities and

stockholders' equity $325,662 $310,117 CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands) Three Months

Ended March 31, 2006 2005 NET CASH PROVIDED BY OPERATING ACTIVITIES

$14,767 $18,140 NET CASH USED IN INVESTING ACTIVITIES (728) (3,355)

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES 879 (1,051)

EFFECT OF CURRENCY TRANSLATION ON CASH 173 (772) INCREASE IN CASH

AND CASH EQUIVALENTS 15,091 12,962 CASH AND EQUIVALENTS, beginning

of period 52,874 38,404 CASH AND EQUIVALENTS, end of period $67,965

$51,366 http://www.newscom.com/cgi-bin/prnh/20030825/AEISLOGO

http://photoarchive.ap.org/ DATASOURCE: Advanced Energy Industries,

Inc. CONTACT: Cathy Kawakami, Director, Corporate & Investor

Relations of Advanced Energy Industries, Inc., +1-970-407-6732, Web

site: http://www.advanced-energy.com/

Copyright

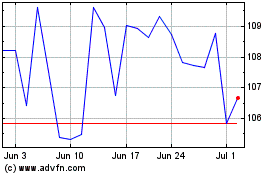

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

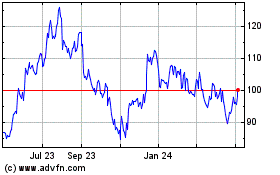

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024