Activision Moves Deeper Into Mobile Games With King Digital Deal -- Update

November 03 2015 - 5:50PM

Dow Jones News

By Sarah E. Needleman

Activision Blizzard Inc.'s planned purchase of King Digital

Entertainment PLC transforms it into a leader in mobile apps, a

cutthroat and fast-growing segment of the videogame industry.

The question is whether Activision can help King churn out

mobile games at the same pace and with the same success as it does

for its own franchise PC and consoles games such as "Call of Duty,"

which launches yet another sequel Friday.

The proposed $5.9 billion deal would add King's games--among the

top-grossing apps in the Apple Inc. and Google Inc. ecosystems--to

Activision's stable of hit franchises, which helped the company

report third-quarter earnings that beat Wall Street's

forecasts.

Investors on Tuesday sent shares of Activision up 3.6% to

$35.82.

Activision has only a handful of titles in the increasingly

competitive mobile market, including "Hearthstone: Heroes of

Warcraft," a free game for iOS and Android devices. Activision

credited the game with helping it increase adjusted digital revenue

to $697 million, a record.

While a strong early showing, the deal for King makes Activision

an immediate leader in a market where gamers' spending is expected

to reach $40 billion by 2019, according to IHS Global.

Activision expects the deal to be accretive to 2016 adjusted

revenue by about 30%. Still, there is no guarantee it will maintain

a mobile stronghold, nor that the deal will give King an umbrella

to hide under, since it will continue to operate independently.

King faces formidable rivals in Supercell Oy and Machine Zone

Inc., whose few cash-cow games barely budge from atop the

top-grossing app charts.

"Candy Crush" is still intensely profitable, but the market is

getting crowded. Hundreds of new, free games are added to app

stores every day and only a fraction of mobile gamers make any

in-game purchases. Tuesday, King said it had 474 million monthly

active users in its third quarter, down from 495 million a year

ago.

Rival Zynga, meanwhile, swung to a third-quarter profit but

offered a soft outlook Tuesday for the holiday quarter.

"The market hates the mobile-gaming industry," said Doug Cruetz,

a senior analyst at Cowen Group, explaining the attractive price

Activision paid for King. The $18 a share is a 20% premium to

King's 4 p.m. ET price on the New York Stock Exchange on Oct. 30,

but still less than where King traded at the end of a tough first

day of trading in March 2014.

Activision's counter will be a massive network of gamers.

Combined, the two companies will boast a total active monthly user

base of nearly 550 million people--a key metric in today's online

gaming universe, where publishers look to generate recurring

revenue.

The companies will also benefit from cross-promoting content, a

strategy King has used since 2013 in lieu of intrusive banner and

video ads. King, whose user base skews toward casual, female

gamers, gains access to Activision's die-hard gamers.

Another advantage: Activision's trove of classic games like

"Kaboom!" and "Pitfall!"

"With mobile, we now have the opportunity to reach new players,"

Activision Chief Executive Bobby Kotick said on an earnings call

with analysts. The company can now "take a lot of that great

content that we built over 35 years and create new content."

Mr. Kotick has a good track record of making lucrative deals,

analysts say. Shareholders were skeptical about Activision's deal

with Blizzard, said Ben Schachter, an analyst with Macquarie

Securities. But Blizzard franchises such as "StarCraft" still have

strong fan bases today.

"It takes a lot longer than people think" for games to reach a

critical number of users and then decline, Mr. Schachter said. "You

can generate a lot of cash until in between."

Write to Sarah E. Needleman at sarah.needleman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 03, 2015 17:35 ET (22:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

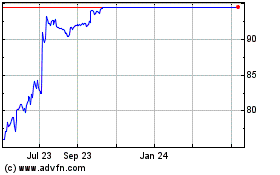

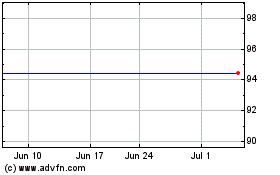

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jul 2023 to Jul 2024