Bull of the Day: Activision Blizzard (ATVI) - Bull of the Day

September 10 2013 - 4:43AM

Zacks

Video games have become a huge industry as both console gaming and

mobile apps remain quite popular with consumers. In fact, the video

game industry was recently valued at $67 billion, while growth is

expected to put the total valuation at $87 billion in 2017.

Given these figures, it is pretty clear that the trend is quite

solid in the video game space and that an allocation to this

growing market may not be a bad idea. One targeted way to do this

is with one of the top makers of games currently on the market,

Activision Blizzard (ATVI).

Activision Blizzard in Focus

ATVI is a company that has a big reach in the video game industry

as it is the producer of some of the segment’s most famous

products. This includes the

Call of Duty,

Guitar

Hero, and

Warcraft franchises, in addition to a

number of mobile games with operations across the globe.

The company has become a pretty big name thanks to many of these

titles, pushing this California-based company to a $19 billion

market capitalization. And with some new launches expected—a fresh

Call of Duty game is due out soon while new consoles are coming

online too—a further push up the charts is not out of the

question.

ATVI Fundamentals

This is especially true when investors consider the analyst outlook

for the company. Estimates have been jumping higher as of late, as

both the current year and next year periods haven’t seen a single

revision lower.

Meanwhile, the magnitude of these revisions has been absolutely

incredible, particularly when focusing on the next quarter and next

year time frames. For these two in particular, the consensus has

risen from 57 cents a share to 77 cents a share in the past two

months, while the next year figure has jumped from 90 cents to

$1.18/share over the same period.

With this kind of increase, some investors might be concerned that

ATVI might have difficulty in living up to the hype, but the recent

earnings history suggests otherwise. The company has thoroughly

crushed estimates lately, beating out the estimate by close to 50%

over the past four quarters.

Clearly, the company is firing on all cylinders and is well

positioned to take advantage of the positive trends in the video

game industry. Analysts seem to agree, and that is why we have

given ATVI a Zacks Rank #1 (Strong Buy).

Bottom Line

This strong buy rating means that we are looking for ATVI to

continue its run and outperform other stocks in the near term.

Plus, with its outperform Zacks Recommendation, the longer term

future is looking bright for this company as well.

So if you are looking to get in on the quickly growing video game

industry but don’t know where to begin, consider starting with an

allocation in ATVI. Activision Blizzard has several of the

industry’s most popular franchises, and with new titles and gaming

systems on the way, growth could definitely be ahead for this

industry titan for years to come.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ACTIVISION BLZD (ATVI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

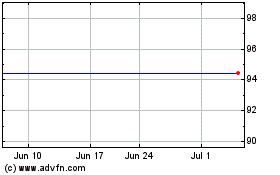

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

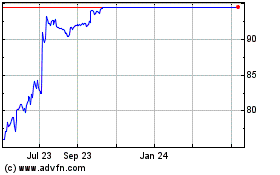

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Jul 2023 to Jul 2024