Acadia Medical - Aggressive Growth

January 10 2013 - 1:00AM

Zacks

Shares of

Acadia Medical (ACHC) reached a 52-week high of

$25.76 on January 8 following its accretive acquisition of

Greenleaf Center a day earlier. Several strategic investments of

late and impressive fiscal third-quarter results helped this

healthcare services provider become a Zacks Rank #1 (Strong Buy).

The company has delivered an average earnings surprise of 16.7%

over the past four quarters, including a 13.3% beat in the third

quarter. Given its expected long-term earnings growth rate of

29.0%, this stock looks like it would fit well into the portfolio

of a growth seeking investor.

Rank Drivers

On November 6, 2012, Acadia Medical reported fiscal third

quarter adjusted earnings per share (EPS) of 17 cents, beating the

Zacks Consensus Estimate by 13.3%. However, the result fell short

of the year-ago performance due to an increase in its shares

outstanding, completion of the PHC Inc. acquisition in November

2011 and an increase in interest expenses.

On January 7, 2013, Acadia Medical purchased Greenleaf Center, a

50-bed acute inpatient psychiatric facility in Georgia, from South

Georgia Medical Center. The company noted that Greenleaf, which has

$7 million of annual revenues, will remain accretive to its 2013

EPS.

Recently, Acadia Medical has made several strategic

acquisitions, including Behavioral Centers of America and AmiCare

Behavioral Centers on December 31, 2013. In November, it purchased

Park Royal Hospital, a 76-bed acute inpatient psychiatric hospital

in Florida.

Also in November, the company declared its intention to buy

Arkansas based AmiCare Behavioral Centers, which operates four

inpatient psychiatric facilities. Management expects this

transaction to be accretive to its 2013 financial results. The

company is greatly optimistic about these recent developments,

which are expected to act as major catalysts for future growth.

Earnings Estimates Moving Up

The Zacks Consensus Estimate for 2012 is 64 cents, up about

23.8% year over year. Meanwhile, over the past 30 days, the Zacks

Consensus Estimate for 2013 gained 4.3% to 98 cents per share,

representing year-over-year growth of about 52.9%.

Premium Valuation

Acadia Medical’s valuation looks stretched compared to its peers

by most metrics. Based on the 2012 earnings estimate, the company

is trading at a P/E of 25.21x, which is almost 1.7 times the peer

group average of 16.63x. The price-to-book ratio of 4.10x is also

substantially higher than the peer group average of 2.10x. The

premium is warranted given a higher long-term earnings growth rate

of 29.0%, compared with the industry average 12.7%.

However, with respect to return on assets (ROA), Acadia Medical

looks attractive at 3.9%, a marginal premium to the peer group

average of 3.5%.

Acadia’s price performance has been reasonably strong. Following

the release of its fiscal third-quarter results, the stock showed a

steep uptrend and is currently trading above both its 50- and

200-day averages.

Acadia Medical is a provider of inpatient behavioral healthcare

services. As of September 30, 2012, the company operates a network

of 33 behavioral health facilities with over 2,300 licensed beds in

19 states. Acadia provides psychiatric and chemical dependency

services to its patients in a variety of settings, including

inpatient psychiatric hospitals, residential treatment centers,

outpatient clinics and therapeutic school-based programs. The

company has a market cap of $1.04 billion.

Other Zacks #1 Rank (Strong Buy) medical devices stocks include

Spherix Inc. (SPEX) and Syneron Medical Ltd (ELOS).

Want More of Our Best Recommendations?

Zacks' Executive VP, Steve Reitmeister, knows when key trades

are about to be triggered and which of our experts has the hottest

hand. Then each week he hand-selects the most compelling trades and

serves them up to you in a new program called Zacks

Confidential.

Learn More>>

ACADIA HEALTHCR (ACHC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

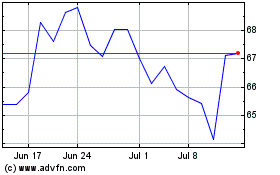

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jun 2024 to Jul 2024

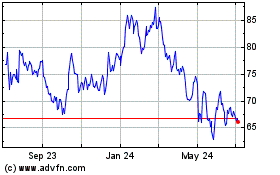

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Jul 2023 to Jul 2024