HIGHLIGHTS

- Bluescape to invest $60 million in

5E’s secured convertible notes

- Investment introduces a cornerstone

U.S. strategic financial partner focused on power and energy

transition

- Investment strengthens 5E’s balance

sheet, enhancing financial flexibility and liquidity

- Small-Scale Boron Facility (“SSBF”) progresses on-schedule

towards target mechanical completion in CQ4 2022

- Customer activities accelerating

after signing Letter of Intent with Corning Incorporated

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX:

5EA) (“5E,” “We,” “Our,” or the “Company”), an exploration stage

boron and lithium company with U.S. government Critical

Infrastructure designation for its Fort Cady asset, today announced

that it has entered into a definitive agreement with Bluescape

Energy Partners (“Bluescape”) for a $60 million private placement

of senior secured notes convertible into common stock of the

Company (“Investment”). Bluescape is a U.S. based institutional

investment manager with particular experience in building,

operating, and investing in real assets. Bluescape’s focus is in

the power and energy transition sector, with the Company expecting

to leverage Bluescape’s substantial experience and relationships

within the power and resources sectors, U.S. shareholder base, and

federal government.

5E is also pleased to provide a project and

company update as the boron and lithium markets remain favorable

and construction, commercial, and government activities progress on

schedule.

Commenting on the Investment and Company

Update, 5E President and CEO, Mr. Henri Tausch noted:

“We are pleased to

partner with Bluescape as they are a respected U.S. institutional

investor that offers value to our Company far beyond that of a

typical financial investment. They are a well-resourced, strategic

organization led by leaders in the power and energy transition

sector, including their CEO, John Wilder. We look forward to

working with Bluescape in creating value to all shareholders and

view this Investment as an attractive source of capital that

bolsters our balance sheet and project, while serving as an

indicator of the 5E value proposition.

We also continue to

see tremendous team effort as we advance construction of our

Small-Scale Boron Facility towards target CQ4 2022 mechanical

completion. We are pleased to report significant progress to date

as Fort Cady has become a beehive of activity with more than 54,000

hours logged this year. We are also pleased with our commercial

progress as boron prices have increased meaningfully and customer

conversations are progressing after signing an LOI with an

innovative leader in Corning Incorporated.”

Commenting on the Investment, Bluescape

Executive Chairman and CEO, Mr. John Wilder noted:

“We see tremendous

value in 5E and their boron and lithium resource in Southern

California. The asset aligns with many crucial issues today,

including the onshoring of critical materials, decarbonization, and

domestic security. We also have confidence in the 5E management

team as they possess a diverse skillset that is capable of

effectively commercializing this critical asset. We look forward to

partnering with 5E as we merge skills and relationships to generate

value for stakeholders.”

Investment Terms

Bluescape has agreed to purchase $60 million

aggregate principal amount of Senior Secured Convertible Notes due

2027 (the “Notes”), which will be convertible into shares of the

Company’s common stock. The Notes will bear interest at an annual

rate of 4.50% if paid in cash, or at an annual rate of 6.00%

through the issuance of additional Notes, at the Company’s

election.

The Notes will be convertible at an initial

Conversion Price of $17.60, which represents a 10% premium to a

Reference Price of $16.00. The $16.00 Reference Price represents a

1.45% premium to FEAM’s trailing 7-day VWAP ending on August 10,

2022. The Notes will mature on August 15, 2027, unless repurchased

or converted prior to such date. 5E will have the right, at any

time on or before the twenty-four (24) month anniversary of the

closing date of this Investment (“Closing Date”), to convert the

Notes to common stock in whole or in part if the closing price of

FEAM common stock is at least 200% of the Conversion Price of the

Notes (“Threshold Price”) for each of the twenty (20) consecutive

trading days prior to the time 5E delivers a conversion notice. The

Threshold Price for 5E’s right to convert the Notes decreases to

150% after the twenty-four (24) month anniversary of the Closing

Date and on or before the thirty-six (36) month anniversary of the

Closing, and 130% at any time after the thirty-six (36) month

anniversary of the Closing Date. 5E expects to use the net proceeds

from the transaction for general corporate purposes, including but

not limited to the further operation of its SSBF and the

development of its larger-scale Fort Cady Project.

Additional information regarding the Investment

is included in a Form 8-K that will be filed with the U.S.

Securities and Exchange Commission. BofA Securities acted as 5E’s

placement agent and Winston & Strawn LLP and Baker &

McKenzie LLP acted as legal advisors to the Company. Shearman &

Sterling LLP acted as legal advisor to BofA Securities. Kirkland

& Ellis LLP acted as legal advisor to Bluescape.

Project and Company Update

Construction related activities for the SSBF are

progressing as planned with more than 54,000 hours recorded on-site

in 2022. Recent progress includes purchase and delivery of long

lead item equipment and materials, personnel and resource

additions, pad site and foundation development, and drilling and

completing all monitoring and production wells that will supply the

facility. We continue to target mechanical completion of the SSBF

in CQ4 2022 and will provide project updates in a new Project

Status section on our website.

We have continued to focus on developing

commercial partnerships as key consumers of boron and lithium

globally seek to manage a supply constrained environment. We

continue to see strong increases in boron prices, with average

boric acid prices up more than 50% during CQ1 2022, as compared to

average prices in 2020 and 2021. We recently executed a Letter of

Intent with Corning Incorporated, a Fortune 300 company and one of

the largest technical glass manufacturers in the world, and are

currently in discussions with other customers who are similarly

interested in ensuring domestic supply of boron and lithium.

Our government relations activities have also

accelerated after updating our project scope to focus on boron

specialty and advanced materials and lithium. We believe these

advanced materials offer incremental value-in-use to customers and

the U.S. government given their use in critical decarbonization and

military applications, scarcity in resource, and predominantly

imported supply.

About 5E Advanced Materials,

Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX:

5EA) is an exploration stage company focused on becoming a

vertically integrated global leader and supplier of boron specialty

and advanced materials, complemented by lithium production

capabilities. Our mission is to become a supplier of these critical

materials to industries addressing global decarbonization, food

production, and domestic security. We anticipate boron and lithium

products will target applications in the fields of electric

transportation, clean energy infrastructure such as solar and wind

power, fertilizers, and domestic security. Our business strategy

and objectives are to develop capabilities ranging from upstream

extraction and product sales of boric acid, lithium carbonate and

potentially other co-products, to downstream boron advanced

material processing and development. Our business is based on our

large domestic boron and lithium resource, which is located in

Southern California and designated as Critical Infrastructure by

the Department of Homeland Security’s Cybersecurity and

Infrastructure Security Agency, and we intend to leverage this

asset once commercially operational to internally supply our

proposed downstream advanced material development activities over

time.

Forward Looking Statements and

Disclosures

This press release contains “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 regarding our future expectations, plans and

prospects for the Company, and the planned offering. Words such as

“anticipates,” “estimates,” “expects,” “projects,” “forecasts,”

“intends,” “plans,” “will,” “believes” and words and terms of

similar substance used in connection with any discussion generally

identify forward-looking statements. These forward-looking

statements are based on management’s current expectations and

beliefs about future events and are inherently susceptible to

uncertainty and changes in circumstances. Various factors could

adversely affect the Company’s operations, business or financial

results in the future and cause the Company’s actual results to

differ materially from those contained in the forward-looking

statements. For additional information regarding these various

factors, you should carefully review the risk factors and other

disclosures in the Company’s amended Form 10 filed with the U.S.

Securities and Exchange Commission on March 7, 2022, and its Form

10-Q filed with the SEC on May 12, 2022, as well as the latest risk

factors described in the Form 8-K filed on or about the date of

this press release. Additional risks are also disclosed by 5E in

its filings with the Securities and Exchange Commission throughout

the year, including its Form 10-K, Form 10-Qs and Form 8-Ks, as

well as in its filings under the Australian Securities Exchange.

Any forward-looking statements are given only as of the date

hereof. Except as required by law, 5E expressly disclaims any

obligation to update or revise any such forward-looking statements.

Additionally, 5E undertakes no obligation to comment on third party

analyses or statements regarding 5E’s actual or expected financial

or operating results or its securities.

This press release is neither an offer to sell

nor a solicitation of an offer to buy any securities and shall not

constitute an offer to sell or a solicitation of an offer to buy,

or a sale of, any securities in any state or jurisdiction in which

such offer, solicitation, or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

The Notes to be offered and any shares of the

Company's common stock issuable upon conversion of the Notes have

not been registered under the Securities Act of 1933, as amended

(the "Securities Act"), or any state securities laws and unless so

registered, may not be offered or sold in the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws. The Notes will be offered only to persons

reasonably believed to be qualified institutional buyers in

reliance on Rule 144A under the Securities Act.

Authorized for release by:

Henri Tausch, President and Chief Executive Officer

For further information contact:

|

Chance PipitoneInvestor Relations –

U.S.info@5Eadvancedmaterials.com Ph: +1 (346) 433-8912 |

Elvis JurcevicInvestor Relations

– Australiaej@irxadvisors.comPh: + 61 408 268 271 |

Chris

SullivanMediachris@macmillancom.comPh: +1 (917) 902-0617 |

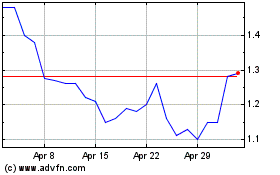

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Aug 2024 to Sep 2024

5E Advanced Materials (NASDAQ:FEAM)

Historical Stock Chart

From Sep 2023 to Sep 2024