0001459417false00014594172023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 9, 2023

2U, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| | | | | | | | | | | |

| | Delaware | |

| | (STATE OF INCORPORATION) | |

| 001-36376 | | 26-2335939 |

(COMMISSION FILE NUMBER) | | (IRS EMPLOYER ID. NUMBER) |

| |

7900 Harkins Road | | 20706 |

Lanham, | MD | |

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES) | | (ZIP CODE) |

(301) 892-4350

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | TWOU | | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition

On November 9, 2023, 2U, Inc. (the “Company”) issued a press release announcing its results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 hereto and incorporated by reference herein.

The information in this Item 2.02, and Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any incorporation language in such a filing, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | Exhibit Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | 2U, Inc. |

| | |

| November 9, 2023 | By: | /s/ Paul S. Lalljie |

| | | Paul S. Lalljie |

| | | Chief Financial Officer |

2U Reports Results for Third Quarter 2023

LANHAM, Md. — November 9, 2023 — 2U, Inc. (Nasdaq: TWOU), a leading online education platform company, today reported financial and operating results for the quarter ended September 30, 2023.

Results for Third Quarter 2023 compared to Third Quarter 2022

•Revenue decreased 1% to $229.7 million

•Degree Program Segment revenue was flat at $137.6 million

•Alternative Credential Segment revenue decreased 3% to $92.1 million

•Net loss was $47.4 million, or $0.58 per share

Non-GAAP Results for Third Quarter 2023 compared to Third Quarter 2022

•Adjusted EBITDA decreased 12% to $28.6 million; a margin of 12%

•Adjusted net loss was $12.1 million, or $0.15 per share

“Our edX platform uniquely positions us to capitalize on the demand shift to more skill-based courses and the advancements in technology, including AI, with our diverse portfolio of offerings,” said Christopher “Chip” Paucek, Co-Founder and Chief Executive Officer of 2U. “We believe 2U will benefit from the meaningful long-term tailwinds from this shift in demand and our transition to a platform company. We remain committed to our platform strategy and its impact on students, university partners, and shareholders. While our third quarter results did not meet our expectations, there are bright spots in our return to profitable growth.”

“Our ongoing strategic initiatives are strengthening our business by re-aligning and refining our program offerings to better fit within our platform strategy—positioning us for long-term, sustainable and profitable growth,” added Paul Lalljie, Chief Financial Officer of 2U. “We are confident that these initiatives, along with a continued focus on improving operational efficiency across the business, will generate improved adjusted EBITDA and free cash flow going forward.”

Discussion of Third Quarter 2023 Results

Revenue for the quarter totaled $229.7 million, a 1% decrease from $232.2 million in the third quarter of 2022. Revenue from the Degree Program Segment was flat and included $25.8 million of revenue from portfolio management activities related to the mutually negotiated exit of certain degree programs. Portfolio management activities typically result in current period revenue recognition of the fees paid by university clients, which the company typically collects over 12 to 24 months. Average revenue per full course equivalent (“FCE”) enrollment increased by 26%, primarily driven by the revenue acceleration from fees received in connection with portfolio management activities. This increase was offset by a 21% decrease in FCE enrollments, primarily driven by portfolio management and the impact of our transition to a new marketing framework in mid-2022. Revenue from the Alternative Credential Segment decreased $2.9 million, or 3%, primarily due to lower enrollments in coding boot camp offerings, partially offset by 18% growth in FCE enrollments in executive education offerings.

Costs and expenses for the quarter totaled $256.6 million, a 24% decrease from $336.5 million in the third quarter of 2022. Costs and expenses for the third quarter of 2022 included $79.5 million of non-cash impairment charges in our Alternative Credential Segment, for which the company did not have a corresponding expense this quarter. The remaining decrease of $0.3 million was primarily driven by a $9.0 million decrease in personnel and personnel-related expense, partially offset by a $3.7 million increase in paid marketing costs and a $2.5 million increase in restructuring charges.

As of September 30, 2023, the company’s cash, cash equivalents, and restricted cash totaled $53.9 million, a decrease of $128.7 million from $182.6 million as of December 31, 2022, driven by the $187.0 million term loan repayment and the January 2023 refinancing. Cash used in operations was $17.5 million, cash used in investing activities was $36.6 million and cash used in financing activities was $73.5 million. Adjusted unlevered free cash flow was $31.9 million for the twelve months ended September 30, 2023 compared to adjusted unlevered free cash flow of $11.7 million for the twelve months ended June 30, 2023.

Business Outlook

The company updated its guidance provided on August 8, 2023 as follows:

•Revenue to range from $965 million to $990 million, representing growth of 1.5% at the midpoint, including expected revenue of $80 million in the fourth quarter related to portfolio management activities;

•Net loss to range from $250 million to $240 million; and

•Adjusted EBITDA to range from $165 million to $175 million, representing growth of 36% at the midpoint.

Based on executed portfolio management activities and the company’s expectations for additional portfolio management activities in the fourth quarter of 2023, the company expects cash from portfolio management to be approximately $145 million over the next 12 to 24 months. We believe this cash will provide flexibility to launch new programs, invest in growth areas, and strengthen the company’s balance sheet. In addition, the company reduced headcount in the third quarter by 12%, resulting in an expected annualized cost savings of $55 million.

The company is in active discussions with noteholders to refinance its convertible notes to address impending maturities and strengthen its balance sheet, and aims to have a successful transaction in the near term.

Business Highlights

•Increased the targeted number of launches for 2024 to approximately 80 new degree programs, which are expected to generate annual revenue of $120 million at steady state

◦Existing program takeover of Maryville University’s online catalog of 28 undergraduate degrees and 11 graduate degrees

•New flex degree model offerings:

◦The University of Cape Town - three new one-year graduate diplomas in marketing, public sector accounting, and sports management

◦King’s College London - Master of Professional Studies

◦Albany College of Pharmacy and Health Sciences - Master of Science in Biomedical Sciences and a Master of Science in Biomanufacturing and Bioprocessing

◦Emerson College - Master of Marketing

◦Hawai’i Pacific University - four master’s degrees in data science, cybersecurity, social work and educational leadership

•Added 12 new professional certificate programs with King’s College London in the fields of law, technology, business, and healthcare

•Entered into a new strategic partnership with Verizon to accelerate skill-building for in-demand careers through the Verizon Skill Forward initiative

•Expanded a strategic partnership with Degreed to broaden enterprise access to edX offerings

•Added 159 new edX courses from 49 unique institutions

•Added new edX members, including Escola do Caos, Integrative Mental Health University, Institute of Product Leadership, International Compliance Association (ICA), New England Medical Innovation Center, Qualtrics, The External Studies Institute, and Xccelerate

Non-GAAP Measures

To provide investors and others with additional information regarding 2U’s results, the company has disclosed the following non-GAAP financial measures: adjusted EBITDA (loss), adjusted EBITDA margin, adjusted free cash flow, adjusted unlevered free cash flow, adjusted net income (loss), and adjusted net income (loss) per share. The company has provided a reconciliation of each non-GAAP financial measure used in this earnings release to the most directly comparable GAAP financial measure. The company defines adjusted EBITDA (loss) as net income or net loss, as applicable, before net interest income (expense), other income (expense), net, taxes, depreciation and amortization expense, transaction costs, integration costs, restructuring-related costs, stockholder activism costs, certain litigation-related costs, consisting of fees for certain non-ordinary course litigation and other proceedings, impairment charges, debt modification expense and loss on debt extinguishment, and stock-based compensation expense. The company defines adjusted EBITDA margin as adjusted EBITDA divided by revenue. The company defines adjusted free cash flow as net cash provided by (used in) operating activities, less capital expenditures, payments to university clients, and certain non-ordinary cash payments. The company defines adjusted unlevered free cash flow as adjusted free cash flow less cash interest payments on debt. The company defines adjusted net income (loss) as net income or net loss, as applicable, before other income (expense), net, acquisition-related gains or losses, deferred revenue fair value adjustments, transaction costs, integration costs, restructuring-related costs, stockholder activism costs, certain litigation-related costs, consisting of fees for certain non-ordinary course litigation and other proceedings, impairment charges, debt modification expense and loss on debt extinguishment, and stock-based compensation expense. Adjusted net income (loss) per share is calculated as adjusted net income (loss) divided by diluted weighted-average shares of common stock outstanding for periods that result in adjusted net income, and basic weighted-average shares outstanding for periods that result in an adjusted net loss. Some of the adjustments described above may not be applicable in any given reporting period and may vary from period to period.

The company’s management uses these non-GAAP financial measures to understand and compare operating results across accounting periods, to understand cash that is generated by or available for operational expenses and investment in the business after capital expenditures, for internal budgeting and forecasting purposes, for short- and long-term operating plans, and to evaluate the company’s financial performance. Management believes these non-GAAP financial measures reflect the company’s ongoing business in a manner that allows for meaningful period-to-period comparisons and analysis of trends in the company’s business as they exclude expenses that are not reflective of ongoing operating results. Management also believes that these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating the company’s operating results and prospects in the same manner as management and in comparing financial results across accounting periods and to those of peer companies.

The use of adjusted EBITDA (loss), adjusted free cash flow, adjusted unlevered free cash flow, adjusted net income (loss), and adjusted net income (loss) per share measures has certain limitations, as they do not reflect all items of income and expense that affect the company’s operations. The company compensates for these limitations by reconciling the non-GAAP financial measures to the most directly comparable GAAP financial measures. These non-GAAP financial measures should be considered in addition to, not as a substitute for or in isolation from, measures prepared in accordance with GAAP. Further, these non-GAAP measures may differ from the non-GAAP information used by other companies, including peer companies, and therefore comparability may be limited. Management encourages investors and others to review the company’s financial information in its entirety and not rely on a single financial measure.

Conference Call Information

| | | | | | | | |

| What: | | 2U’s third quarter 2023 financial results conference call |

| When: | | Thursday, November 9, 2023 |

| Time: | | 4:30 p.m. ET |

| Live Call: | | (888) 330-2446 |

| Conference ID #: | | 1153388 |

| Webcast: | | investor.2U.com |

About 2U, Inc. (Nasdaq: TWOU)

2U is a global leader in online education. Guided by its founding mission to eliminate the back row in higher education, 2U has spent 15 years advancing the technology and innovation to deliver world-class learning outcomes at scale. Through its global online learning platform edX, 2U connects more than 81 million people with thousands of affordable, career-relevant learning opportunities in partnership with 250 of the world's leading universities, institutions, and industry experts. From free courses to full degrees, 2U is creating a better future for all through the power of high-quality online education. Learn more at 2U.com.

Cautionary Language Concerning Forward-Looking Statements

This press release contains forward-looking statements regarding 2U, Inc.’s future business expectations, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this press release, including statements regarding future results of operations and financial position of 2U, including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. 2U has based these forward-looking statements largely on its estimates of its financial results and its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs as of the date of this press release. The company undertakes no obligation to update these statements as a result of new information or future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from the results predicted, including, but not limited to:

•trends in the higher education market and the market for online education, and expectations for growth in those markets;

•the company’s ability to maintain minimum recurring revenues or other financial ratios through the maturity date of its amended term loan facilities;

•the acceptance, adoption and growth of online learning by colleges and universities, faculty, students, employers, accreditors and state and federal licensing bodies;

•the impact of competition on the company’s industry and innovations by competitors;

•the company’s ability to comply with evolving regulations and legal obligations related to data privacy, data protection and information security;

•the company’s expectations about the potential benefits of its cloud-based software-as-a-service technology and technology-enabled services to university clients and students;

•the company’s dependence on third parties to provide certain technological services or components used in its platform;

•the company’s expectations about the predictability, visibility and recurring nature of its business model;

•the company’s ability to meet the anticipated launch dates of its offerings;

•the company’s ability to acquire new clients and expand its offerings with existing university clients;

•the company’s ability to strategically exit certain programs that no longer align with its business objectives;

•the company’s ability to successfully integrate the operations of its acquisitions, including the edX acquisition, to achieve the expected benefits of its acquisitions and manage, expand and grow the combined company;

•the company’s ability to refinance its indebtedness on attractive terms, if at all, to better align with its focus on profitability and address impending maturities;

•the company’s ability to service its substantial indebtedness and comply with the covenants and conversion obligations contained in the indentures governing its 2.25% convertible senior notes due 2025 and 4.50% convertible senior notes due 2030 and the credit agreement governing its revolving credit facility;

•the company’s ability to implement its platform strategy and achieve the expected benefits;

•the company’s ability to generate sufficient future operating cash flows from recent acquisitions to ensure related goodwill is not impaired;

•the company’s ability to execute its growth strategy, including internationally and growing its enterprise business;

•the company’s ability to continue to recruit prospective students for its offerings;

•the company’s ability to maintain or increase student retention rates in its degree programs;

•the company’s ability to attract, hire and retain qualified employees;

•the company’s expectations about the scalability of its cloud-based platform;

•potential changes in laws, regulations or guidance applicable to the company or its university clients;

•the company’s expectations regarding the amount of time its cash balances and other available financial resources will be sufficient to fund its operations;

•the impact and cost of stockholder activism;

•the potential negative impact of the significant decline in the market price of the company’s common stock, including the impairment of goodwill and indefinite-lived intangible assets;

•the impact of any natural disasters or public health emergencies, such as the COVID-19 pandemic;

•the company’s expectations regarding the effect of the capped call transactions and regarding actions of the option counterparties and/or their respective affiliates; and

•other factors beyond the company’s control.

These and other potential risks and uncertainties that could cause actual results to differ from the results predicted are more fully detailed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and other SEC filings. Moreover, 2U operates in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for 2U management to predict all risks, nor can 2U assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements 2U may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this press release may not occur and actual results could differ materially and adversely from those anticipated.

Investor Relations Contact: investorinfo@2U.com

Media Contact: media@2U.com

2U, Inc.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

| | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| | | |

| (unaudited) | | |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 41,141 | | | $ | 167,518 | |

| Restricted cash | 12,710 | | | 15,060 | |

| Accounts receivable, net | 113,202 | | | 62,826 | |

| Other receivables, net | 29,196 | | | 33,813 | |

| Prepaid expenses and other assets | 37,722 | | | 43,090 | |

| Total current assets | 233,971 | | | 322,307 | |

| Other receivables, net, non-current | 18,388 | | | 14,788 | |

| Property and equipment, net | 42,387 | | | 45,855 | |

| Right-of-use assets | 65,292 | | | 72,361 | |

| Goodwill | 712,644 | | | 734,620 | |

| Intangible assets, net | 386,272 | | | 549,755 | |

| Other assets, non-current | 78,981 | | | 71,173 | |

| Total assets | $ | 1,537,935 | | | $ | 1,810,859 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable and accrued expenses | $ | 128,316 | | | $ | 110,020 | |

| Deferred revenue | 116,276 | | | 90,161 | |

| Lease liability | 15,106 | | | 13,909 | |

| Accrued restructuring liability | 11,451 | | | 6,692 | |

| Other current liabilities | 43,485 | | | 58,210 | |

| Total current liabilities | 314,634 | | | 278,992 | |

| Long-term debt | 878,124 | | | 928,564 | |

| Deferred tax liabilities, net | 310 | | | 282 | |

| Lease liability, non-current | 86,381 | | | 99,709 | |

| Other liabilities, non-current | 2,007 | | | 1,796 | |

| Total liabilities | 1,281,456 | | | 1,309,343 | |

| Stockholders’ equity | | | |

Preferred stock, $0.001 par value, 5,000,000 shares authorized, none issued | — | | | — | |

Common stock, $0.001 par value, 200,000,000 shares authorized, 81,630,808 shares issued and outstanding as of September 30, 2023; 78,334,666 shares issued and outstanding as of December 31, 2022 | 82 | | | 78 | |

| Additional paid-in capital | 1,738,092 | | | 1,700,855 | |

| Accumulated deficit | (1,455,131) | | | (1,179,972) | |

| Accumulated other comprehensive loss | (26,564) | | | (19,445) | |

| Total stockholders’ equity | 256,479 | | | 501,516 | |

| Total liabilities and stockholders’ equity | $ | 1,537,935 | | | $ | 1,810,859 | |

2U, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) |

| Revenue | $ | 229,699 | | | $ | 232,238 | | | $ | 690,292 | | | $ | 727,031 | |

| Costs and expenses | | | | | | | |

| Curriculum and teaching | 32,143 | | | 31,558 | | | 99,085 | | | 96,933 | |

| Servicing and support | 31,484 | | | 36,110 | | | 101,178 | | | 112,795 | |

| Technology and content development | 45,877 | | | 43,976 | | | 135,611 | | | 140,649 | |

| Marketing and sales | 96,256 | | | 94,311 | | | 292,313 | | | 341,643 | |

| General and administrative | 36,801 | | | 39,388 | | | 108,708 | | | 131,146 | |

| Restructuring charges | 14,085 | | | 11,632 | | | 22,582 | | | 29,172 | |

| Impairment charges | — | | | 79,509 | | | 134,117 | | | 138,291 | |

| Total costs and expenses | 256,646 | | | 336,484 | | | 893,594 | | | 990,629 | |

| Loss from operations | (26,947) | | | (104,246) | | | (203,302) | | | (263,598) | |

| Interest income | 363 | | | 269 | | | 1,099 | | | 767 | |

| Interest expense | (19,167) | | | (15,913) | | | (55,040) | | | (43,709) | |

| Debt modification expense and loss on debt extinguishment | — | | | — | | | (16,735) | | | — | |

| Other income (expense), net | (1,585) | | | (1,845) | | | (751) | | | (4,242) | |

| Loss before income taxes | (47,336) | | | (121,735) | | | (274,729) | | | (310,782) | |

| Income tax (expense) benefit | (107) | | | 59 | | | (430) | | | 474 | |

| Net loss | $ | (47,443) | | | $ | (121,676) | | | $ | (275,159) | | | $ | (310,308) | |

| Net loss per share, basic and diluted | $ | (0.58) | | | $ | (1.57) | | | $ | (3.42) | | | $ | (4.03) | |

Weighted-average shares of common stock outstanding, basic and diluted | 81,515,246 | | | 77,692,911 | | | 80,470,221 | | | 77,013,180 | |

| Other comprehensive income (loss) | | | | | | | |

Foreign currency translation adjustments, net of tax of $0 for all periods presented | 185 | | | (5,637) | | | (7,119) | | | (5,982) | |

| Comprehensive loss | $ | (47,258) | | | $ | (127,313) | | | $ | (282,278) | | | $ | (316,290) | |

2U, Inc.

Condensed Consolidated Statements of Cash Flows

(in thousands)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| | 2023 | | 2022 |

| (unaudited) |

| Cash flows from operating activities | | | |

| Net loss | $ | (275,159) | | | $ | (310,308) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Non-cash interest expense | 10,488 | | | 9,929 | |

| Depreciation and amortization expense | 86,846 | | | 95,070 | |

| Stock-based compensation expense | 35,986 | | | 62,740 | |

| Non-cash lease expense | 13,164 | | | 16,507 | |

| Restructuring | 838 | | | 9,523 | |

| Impairment charges | 134,117 | | | 138,291 | |

| Provision for credit losses | 6,558 | | | 6,129 | |

| Loss on debt extinguishment | 12,123 | | | — | |

| Other | 794 | | | 4,660 | |

| Changes in operating assets and liabilities, net of assets and liabilities acquired: | | | |

| Accounts receivable, net | (54,612) | | | (36,253) | |

| Other receivables, net | (2,207) | | | (2,867) | |

| Prepaid expenses and other assets | (1,095) | | | 1,973 | |

| Accounts payable and accrued expenses | 19,888 | | | (12,964) | |

| Deferred revenue | 26,348 | | | 43,252 | |

| Other liabilities, net | (31,597) | | | (27,124) | |

| Net cash used in operating activities | (17,520) | | | (1,442) | |

| Cash flows from investing activities | | | |

| Purchase of a business, net of cash acquired | — | | | 5,010 | |

| Additions of amortizable intangible assets | (32,442) | | | (50,155) | |

| Purchases of property and equipment | (4,335) | | | (8,777) | |

| Advances made to university clients | — | | | (310) | |

| Advances repaid by university clients | 200 | | | 200 | |

| Other | 1 | | | (17) | |

| Net cash used in investing activities | (36,576) | | | (54,049) | |

| Cash flows from financing activities | | | |

| Proceeds from debt | 309,223 | | | 530 | |

| Payments on debt | (373,914) | | | (5,313) | |

| Prepayment premium on extinguishment of senior secured term loan facility | (5,666) | | | — | |

| Payment of debt issuance costs | (4,411) | | | — | |

| Tax withholding payments associated with settlement of restricted stock units | (957) | | | (2,320) | |

| Proceeds from exercise of stock options | 110 | | | 1,083 | |

| Proceeds from employee stock purchase plan share purchases | 2,102 | | | 1,282 | |

| Net cash used in financing activities | (73,513) | | | (4,738) | |

| Effect of exchange rate changes on cash | (1,118) | | | (4,530) | |

| Net decrease in cash, cash equivalents and restricted cash | (128,727) | | | (64,759) | |

| Cash, cash equivalents and restricted cash, beginning of period | 182,578 | | | 249,909 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 53,851 | | | $ | 185,150 | |

2U, Inc.

Reconciliation of Non-GAAP Measures - Adjusted EBITDA

(unaudited)

The following table presents a reconciliation of adjusted EBITDA to net loss for each of the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | (in thousands, except share and per share amounts) |

| Revenue | $ | 229,699 | | | $ | 232,238 | | | $ | 690,292 | | | $ | 727,031 | |

| | | | | | | |

| Net loss | $ | (47,443) | | | $ | (121,676) | | | $ | (275,159) | | | $ | (310,308) | |

| Stock-based compensation expense | 10,440 | | | 15,967 | | | 35,986 | | | 62,740 | |

| Other (income) expense, net | 1,585 | | | 1,845 | | | 751 | | | 4,242 | |

| Amortization of acquired intangible assets | 7,691 | | | 9,187 | | | 26,537 | | | 42,516 | |

Income tax benefit on amortization of acquired intangible assets | (19) | | | (326) | | | (57) | | | (1,201) | |

| Impairment charges | — | | | 79,509 | | | 134,117 | | | 138,291 | |

| Debt modification expense and loss on debt extinguishment | — | | | — | | | 16,735 | | | — | |

| Restructuring charges | 14,085 | | | 11,632 | | | 22,582 | | | 29,172 | |

| Other* | 1,553 | | | 343 | | | 4,383 | | | 5,025 | |

| Adjusted net loss | (12,108) | | | (3,519) | | | (34,125) | | | (29,523) | |

| Net interest expense | 18,804 | | | 15,644 | | | 53,941 | | | 42,942 | |

| Income tax expense | 126 | | | 267 | | | 487 | | | 727 | |

| Depreciation and amortization expense | 21,807 | | | 20,126 | | | 60,309 | | | 52,554 | |

| Adjusted EBITDA | $ | 28,629 | | | $ | 32,518 | | | $ | 80,612 | | | $ | 66,700 | |

| | | | | | | |

| Adjusted EBITDA margin | 12 | % | | 14 | % | | 12 | % | | 9 | % |

| Net loss per share, basic and diluted | $ | (0.58) | | | $ | (1.57) | | | $ | (3.42) | | | $ | (4.03) | |

| Adjusted net loss per share, basic and diluted | $ | (0.15) | | | $ | (0.05) | | | $ | (0.42) | | | $ | (0.38) | |

| Weighted-average shares of common stock outstanding, basic and diluted | 81,515,246 | | | 77,692,911 | | | 80,470,221 | | | 77,013,180 | |

| | | | | | | | | | | |

| | | |

| * | | Includes (i) transaction and integration expense of $0.1 million and $0.0 million for the three months ended September 30, 2023 and 2022, respectively, and $0.3 million and $3.4 million for the nine months ended September 30, 2023 and 2022, and (ii) litigation-related expense of $1.5 million and $0.3 million for the three months ended September 30, 2023 and 2022, respectively, and $4.1 million and $1.6 million for the nine months ended September 30, 2023 and 2022. |

2U, Inc.

Reconciliation of Non-GAAP Measures - Adjusted EBITDA by Segment

(unaudited)

The following table presents a reconciliation of adjusted EBITDA (loss) to net loss by segment for each of the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Degree Program Segment | | Alternative Credential Segment | | Consolidated |

| | Three Months Ended

September 30, | | Three Months Ended

September 30, | | Three Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | |

| | (in thousands) |

| Revenue | $ | 137,604 | | | $ | 137,242 | | | $ | 92,095 | | | $ | 94,996 | | | $ | 229,699 | | | $ | 232,238 | |

| | | | | | | | | | | |

| Net loss | $ | (12,458) | | | $ | (4,620) | | | $ | (34,985) | | | $ | (117,056) | | | $ | (47,443) | | | $ | (121,676) | |

| Adjustments: | | | | | | | | | | | |

| Stock-based compensation expense | 6,748 | | | 8,989 | | | 3,692 | | | 6,978 | | | 10,440 | | | 15,967 | |

| Other (income) expense, net | 407 | | | 441 | | | 1,178 | | | 1,404 | | | 1,585 | | | 1,845 | |

| Net interest expense (income) | 18,939 | | | 15,710 | | | (135) | | | (66) | | | 18,804 | | | 15,644 | |

| Income tax expense (benefit) | 69 | | | (38) | | | 38 | | | (21) | | | 107 | | | (59) | |

| Depreciation and amortization expense | 14,989 | | | 13,770 | | | 14,509 | | | 15,543 | | | 29,498 | | | 29,313 | |

| Impairment charges | — | | | — | | | — | | | 79,509 | | | — | | | 79,509 | |

| | | | | | | | | | | |

| Restructuring charges | 13,400 | | | 10,295 | | | 685 | | | 1,337 | | | 14,085 | | | 11,632 | |

| Other | 1,553 | | | 360 | | | — | | | (17) | | | 1,553 | | | 343 | |

| Total adjustments | 56,105 | | | 49,527 | | | 19,967 | | | 104,667 | | | 76,072 | | | 154,194 | |

| Total adjusted EBITDA (loss) | $ | 43,647 | | | $ | 44,907 | | | $ | (15,018) | | | $ | (12,389) | | | $ | 28,629 | | | $ | 32,518 | |

| | | | | | | | | | | |

| Adjusted EBITDA margin | 32 | % | | 33 | % | | (16) | % | | (13) | % | | 12 | % | | 14 | % |

2U, Inc.

Reconciliation of Non-GAAP Measures - Adjusted EBITDA by Segment

(unaudited)

The following table presents a reconciliation of adjusted EBITDA (loss) to net loss by segment for each of the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Degree Program Segment | | Alternative Credential Segment | | Consolidated |

| | Nine Months Ended

September 30, | | Nine Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | | | | |

| | (in thousands) |

| Revenue | $ | 397,578 | | | $ | 434,499 | | | $ | 292,714 | | | $ | 292,532 | | | $ | 690,292 | | | $ | 727,031 | |

| | | | | | | | | | | |

| Net loss | $ | (34,186) | | | $ | (25,890) | | | $ | (240,973) | | | $ | (284,418) | | | $ | (275,159) | | | $ | (310,308) | |

| Adjustments: | | | | | | | | | | | |

| Stock-based compensation expense | 21,202 | | | 34,624 | | | 14,784 | | | 28,116 | | | 35,986 | | | 62,740 | |

| Other (income) expense, net | (1,400) | | | 1,688 | | | 2,151 | | | 2,554 | | | 751 | | | 4,242 | |

| Net interest expense (income) | 54,263 | | | 43,144 | | | (322) | | | (202) | | | 53,941 | | | 42,942 | |

| Income tax expense (benefit) | 315 | | | (127) | | | 115 | | | (347) | | | 430 | | | (474) | |

| Depreciation and amortization expense | 42,252 | | | 41,273 | | | 44,594 | | | 53,797 | | | 86,846 | | | 95,070 | |

| Impairment charges | — | | | — | | | 134,117 | | | 138,291 | | | 134,117 | | | 138,291 | |

| Debt modification expense and loss on debt extinguishment | 16,735 | | | — | | | — | | | — | | | 16,735 | | | — | |

| Restructuring charges | 20,426 | | | 21,236 | | | 2,156 | | | 7,936 | | | 22,582 | | | 29,172 | |

| Other | 4,355 | | | 4,316 | | | 28 | | | 709 | | | 4,383 | | | 5,025 | |

| Total adjustments | 158,148 | | | 146,154 | | | 197,623 | | | 230,854 | | | 355,771 | | | 377,008 | |

| Total adjusted EBITDA (loss) | $ | 123,962 | | | $ | 120,264 | | | $ | (43,350) | | | $ | (53,564) | | | $ | 80,612 | | | $ | 66,700 | |

| | | | | | | | | | | |

| Adjusted EBITDA margin | 31 | % | | 28 | % | | (15) | % | | (18) | % | | 12 | % | | 9 | % |

2U, Inc.

Reconciliation of Non-GAAP Measures - Adjusted Free Cash Flow and Adjusted Unlevered Free Cash Flow

(unaudited)

The following table presents a reconciliation of adjusted unlevered free cash flow to net cash provided by (used in) operating activities for each of the twelve-month periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | |

| Trailing Twelve Months Ended |

| | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 |

| | | | | | | |

| | (in thousands) |

| Net cash (used in) provided by operating activities | $ | (5,149) | | | $ | (16,536) | | | $ | 38,472 | | | $ | 10,927 | |

| Additions of amortizable intangible assets | (44,733) | | | (50,619) | | | (55,544) | | | (62,445) | |

| Purchases of property and equipment | (7,313) | | | (8,640) | | | (11,210) | | | (11,755) | |

Payments to university clients | 1,050 | | | 3,550 | | | 6,425 | | | 6,775 | |

| Non-ordinary cash payments* | 34,618 | | | 36,101 | | | 32,282 | | | 24,157 | |

| Adjusted free cash flow | (21,527) | | | (36,144) | | | 10,425 | | | (32,341) | |

Cash interest payments on debt | 53,473 | | | 47,802 | | | 48,118 | | | 43,826 | |

| Adjusted unlevered free cash flow | $ | 31,946 | | | $ | 11,658 | | | $ | 58,543 | | | $ | 11,485 | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| | | |

| * | | Includes transaction, integration, restructuring-related, stockholder activism, and litigation-related expense. |

2U, Inc.

Reconciliation of Non-GAAP Measures

(unaudited)

The following table presents a reconciliation of adjusted EBITDA guidance to net loss guidance, at the midpoint of the ranges provided by the company, for the period indicated.

| | | | | |

| | Year Ending

December 31, 2023 |

| | (in millions) |

| Net loss | $ | (245.0) | |

| Stock-based compensation expense | 50.0 | |

| Amortization of acquired intangible assets | 36.0 | |

| Impairment charges | 134.1 | |

| Debt modification expense and loss on debt extinguishment | 16.7 | |

| Restructuring charges | 22.6 | |

| Other | 5.1 | |

| Adjusted net income | 19.5 | |

| Net interest expense | 72.0 | |

| Income tax expense | 0.5 | |

| Depreciation and amortization expense | 78.0 | |

| Adjusted EBITDA | $ | 170.0 | |

2U, Inc.

Key Financial Performance Metrics

(unaudited)

Full Course Equivalent Enrollments

Degree Program Segment

The following table presents FCE enrollments and average revenue per FCE enrollment in the company’s Degree Program Segment for the last eight quarters.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q3 ‘23 | | Q2 ‘23 | | Q1 ‘23 | | Q4 ‘22 | | Q3 ‘22 | | Q2 ‘22 | | Q1 ‘22 | | Q4 ‘21 |

| Degree Program Segment FCE enrollments | 45,284 | | | 50,490 | | | 55,491 | | | 53,631 | | | 57,092 | | | 60,303 | | | 62,609 | | | 58,967 | |

| Degree Program Segment average revenue per FCE enrollment* | $ | 3,039 | | | $ | 2,367 | | | $ | 2,532 | | | $ | 2,557 | | | $ | 2,404 | | | $ | 2,373 | | | $ | 2,462 | | | $ | 2,585 | |

| | | | | | | | | | | |

| | | |

| * | | Average revenue per FCE enrollment includes revenue from portfolio management activities. |

Alternative Credential Segment*

The following table presents FCE enrollments and average revenue per FCE enrollment in the company’s Alternative Credential Segment for the last eight quarters.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q3 ‘23 | | Q2 ‘23 | | Q1 ‘23 | | Q4 ‘22 | | Q3 ‘22 | | Q2 ‘22 | | Q1 ‘22 | | Q4 ‘21 |

| Alternative Credential Segment FCE enrollments | 25,318 | | | 25,840 | | | 21,990 | | | 24,236 | | | 23,128 | | | 23,443 | | | 22,664 | | | 21,153 | |

| Alternative Credential Segment average revenue per FCE enrollment | $ | 3,428 | | | $ | 3,591 | | | $ | 4,193 | | | $ | 3,840 | | | $ | 3,850 | | | $ | 3,891 | | | $ | 4,012 | | | $ | 4,312 | |

| | | | | | | | | | | |

| | | |

| * | | FCE enrollments and average revenue per FCE enrollment exclude the impact of enrollments in edX offerings and the related revenue of $5.3 million and $5.9 million for the three months ended September 30, 2023 and 2022, respectively, and $20.9 million and $21.3 million for the nine months ended September 30, 2023 and 2022, respectively. |

v3.23.3

Document and Entity Information Document

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

2U, INC.

|

| Entity Central Index Key |

0001459417

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36376

|

| Entity Tax Identification Number |

26-2335939

|

| Entity Address, Address Line One |

7900 Harkins Road

|

| Entity Address, City or Town |

Lanham,

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

20706

|

| City Area Code |

301

|

| Local Phone Number |

892-4350

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

TWOU

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

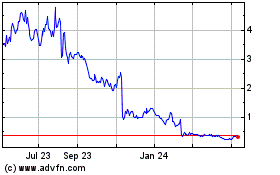

2U (NASDAQ:TWOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

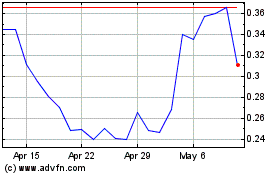

2U (NASDAQ:TWOU)

Historical Stock Chart

From Apr 2023 to Apr 2024