Canadian Dollar Rises As Oil Prices Climb

May 08 2023 - 1:48AM

RTTF2

The Canadian dollar advanced against its most major counterparts

in the European session on Monday amid higher oil prices, as

stronger-than-expected U.S. jobs data allayed concerns about an

imminent recession.

Crude for June delivery rose $1.38 to 72.72 per barrel.

Strong jobs data renewed hopes that the U.S. economy could

achieve a "soft landing" and avoid a deep recession.

Investors awaited the release of key U.S. inflation data later

this week that could influence the Fed's monetary policy path.

Strong CPI data is likely to push back hopes for a rate cut

further into the future.

The loonie rose to a 3-week high of 1.3348 against the greenback

and a 6-day high of 101.17 against the yen, from early lows of

1.3387 and 100.67, respectively. The loonie is seen finding

resistance around 1.31 against the greenback and 103.00 against the

yen.

Against the euro, the loonie edged up to 1.4734 from an early

low of 1.4766. Next key resistance for the currency is seen around

the 1.45 level.

In contrast, the loonie dropped to 0.9067 against the aussie,

from an early 6-day high of 0.9020. The loonie is likely to

challenge support around the 0.92 region.

Looking ahead, U.S. wholesale inventories for March are slated

for release in the New York session.

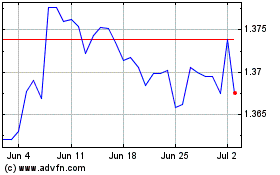

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2024 to May 2024

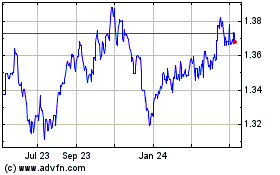

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From May 2023 to May 2024