U.S. Dollar Advances As Traders Await CPI Data

January 11 2023 - 6:22AM

RTTF2

The U.S. dollar turned higher against its most major

counterparts in the New York session on Wednesday, as investors

awaited U.S. inflation data for more clues on interest rate

outlook.

U.S. CPI data is due on Thursday, with economists expecting

month-on-month reading to be flat.

On an annual basis, the CPI is expected to come in at 6.5

percent in December, down from 7.1 percent in November.

The data will be crucial to help determine whether the Fed would

slow the pace of interest rate hikes at the next meeting.

On Tuesday, Federal Reserve Governor Michelle Bowman signalled

more interest rate increases ahead and said that the central bank

would hold elevated rates at that level for some time in order to

restore price stability.

The greenback climbed to 5-day highs of 132.87 against the yen

and 0.9299 against the franc, up from its prior lows of 132.06 and

0.9204, respectively. The next possible resistance for the currency

is seen around 145.00 against the yen and 0.96 against the

franc.

The greenback was up against the pound, at a 2-day high of

1.2100. On the upside, 1.19 is possibly seen as its next resistance

level.

The greenback reached as high as 0.6334 against the kiwi,

setting a 2-day high. The greenback is seen finding resistance

around the 0.615 mark.

The greenback was higher against the aussie, at 0.6873. The

currency is likely to find resistance around the 0.66 level.

In contrast, the greenback fell against the loonie, with the

pair trading at 1.3404. If the greenback slides further, 1.30 is

possibly seen as its next support level.

The greenback touched 1.0776 against the euro, its weakest level

since May 31. Next likely support for the currency is seen around

the 1.12 level.

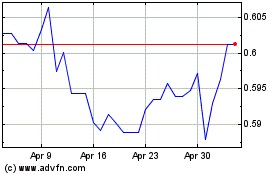

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Mar 2024 to Apr 2024

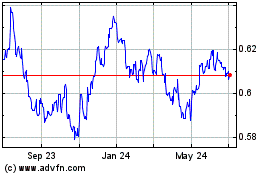

NZD vs US Dollar (FX:NZDUSD)

Forex Chart

From Apr 2023 to Apr 2024