Australian And New Zealand Dollars Slip As Most Asian Stocks Decline

February 25 2010 - 3:35AM

RTTF2

Thursday in Asia, the Australian and the New Zealand dollars

tumbled against their key counterparts as most Asian stocks

declined after Standard & Poor's said it could downgrade

Greece's credit rating within a month.

The Aussie slipped to a near 2-week low against the yen and a

3-day low versus the loonie. Meanwhile, the New Zealand currency

slipped to multi-week lows against the U.S. dollar and the yen.

Japan's Nikkei 225 index lost 0.95%, Hong Kong's Hang Seng fell

0.7%, South Korea's Kospi declined 1.6%, Australia's S&P 200

index slipped 1.2% and the All Ordinaries index dropped 1.1%.

However, the stock markets in China surged higher today.

At 1:40 am ET, the aussie plunged to a near 2-week low of 79.19

against the Japanese currency. As of now, the aussie-yen pair is

trading at 79.49, down from yesterday's close of 80.58.

At 1:40 am ET, the aussie fell to a 3-day low of 0.9377 against

the Canadian dollar. At present, the aussie-loonie pair is trading

at 0.939, compared to yesterday's close of 0.9415.

Against the U.S. dollar, the Australian dollar slipped to 0.8863

at 1:40 am ET. The present quote for the aussie-greenback pair is

0.8888, down from Wednesday's New York session close of 0.8936.

The aussie slipped to 1.5197 at 1:40 am ET against the euro. As

of now, the euro-aussie pair is trading at 1.5171. This level may

be compared to 1.5160 hit at yesterday's New York close.

The Australian dollar that rose to a new multi-month high of

1.2942 at 10:30 pm ET Wednesday against the kiwi, failed to sustain

the momentum thereafter. The aussie hit a low of 1.2911 at 2:15 am

ET against the kiwi. As of now, the aussie-kiwi pair is trading at

1.2917, up from Wednesday's close of 1.2897.

The New Zealand dollar declined steadily during Asian session

against the euro. At 2:20 am ET, the kiwi slipped to 1.9594 against

the euro. The current quote for the euro-kiwi pair is 1.9586,

compared to Wednesday's close of 1.9541.

The New Zealand dollar extended its downtrend against the yen.

The kiwi slipped to a multi-week low of 61.39 at 1:40 am ET. As of

now, the kiwi-yen pair is trading at 61.60, compared to 62.55 hit

at yesterday's New York close.

In Asian session, the New Zealand dollar lost its momentum

gradually against the U.S. dollar. At 1:40 am ET, the kiwi slipped

to a multi-week low of 0.6870 versus the U.S. currency. Presently,

the kiwi-greenback pair is worth 0.6888, down from yesterday's

close of 0.6936.

The Federal Reserve Chairman Ben Bernanke suggested during a

congressional hearing yesterday that U.S. low interest-rate policy

is likely to be in place for the time being because the job market

is weak and inflation will remain subdued. But he added the Fed

will begin monetary tightening ''at some point'' to stem

inflationary pressures

In the upcoming hours, Italian business confidence, German

unemployment data, and the Euro-zone economic confidence

reports-all for February are slated for release.

From the U.S., the durable goods orders report for January,

weekly jobless claims data for the week ended February 20 and the

house price index for December have been slated for release during

the North American session.

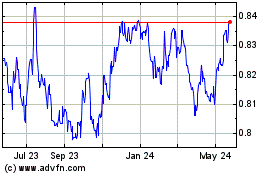

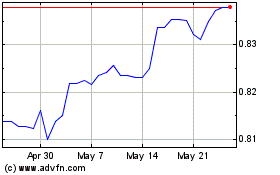

NZD vs CAD (FX:NZDCAD)

Forex Chart

From Dec 2024 to Jan 2025

NZD vs CAD (FX:NZDCAD)

Forex Chart

From Jan 2024 to Jan 2025