VEON’s Jazz Secures Pakistan’s Largest Long-Term Private Sector Syndicated Credit Facility of up to PKR 75 billion

July 22 2024 - 2:15PM

UK Regulatory

VEON’s Jazz Secures Pakistan’s Largest Long-Term Private Sector

Syndicated Credit Facility of up to PKR 75 billion

Amsterdam and Karachi, 22 July

2024: VEON Ltd. (NASDAQ, Euronext Amsterdam: VEON), a

global digital operator that provides converged connectivity and

online services, announces that Jazz, its digital operator in

Pakistan, has secured the country’s largest long-term private

sector syndicated credit facility of up to PKR 75 billion (c. USD

270 million). This 10-year financing arrangement will power Jazz’s

growth ambitions as the country’s leading provider of 4G

connectivity and digital services to millions of consumers and

enterprises.

The banking consortium was led by The Bank of

Punjab, along with the following other prominent financial

institutions that act as mandated lead advisors and arrangers:

Habib Bank, Bank Alfalah, Meezan Bank, MCB Bank, Allied Bank,

Askari Bank, Habib Metropolitan Bank, Soneri Bank, Bank Islami

Pakistan and MCB Islamic Bank. The signing of the credit facility,

originally entered into in May 20241, was marked with a

ceremony held in Karachi in the presence of VEON Group CEO Kaan

Terzioglu, Jazz CEO Aamir Ibrahim, and the Presidents, Chairs and

Chief Executives of the participating banks.

"This credit facility will be a game-changer for

Pakistan's digital landscape helping us accelerate the deployment

of cutting-edge digital infrastructure, focusing on services that

Pakistan need to realize the potential of its young and dynamic

population and vibrant business landscape. I would like to thank

our distinguished partners in the banking consortium for seeing the

immense growth potential that Jazz’s value proposition entails for

Pakistan. I would also like to congratulate the Jazz team for the

successful delivery of services to millions of Pakistanis that has

fuelled the robust growth of our Pakistan operations. This

agreement is a further sign of the trust and the support that Jazz

enjoys as the leading digital growth engine of the country,” said

Kaan Terzioglu, Group CEO of VEON.

“This landmark syndicated credit facility will

help expand and enhance our digital infrastructure across Pakistan,

as we transition from a telco to a ServiceCo and invest in sunrise

industries like cloud, software, financial services in addition to

consumer connectivity. I would like to thank The Bank of Punjab and

our esteemed banking consortium partners for their unwavering

support and confidence in Jazz's vision. This financing arrangement

reaffirms our commitment to driving Pakistan's digital

transformation as our focus remains on delivering innovative

solutions that empower individuals and businesses, fostering

socio-economic growth," said Aamir Ibrahim, CEO of Jazz.

“Leading this landmark transaction in the

telecom sector exemplifies our strategic focus on digital

transformation in Pakistan. Our partnership with Jazz underscores

The Bank dedication to advancing technological progress and

supporting the growth of the telecom industry. This deal is a

testament to our commitment to driving innovation and fostering

economic development in the country,” said Zafar Masud, President

and CEO of The Bank of Punjab.

About VEON

VEON is a digital operator that provides converged connectivity and

digital services to nearly 160 million customers. Operating

across six countries that are home to more than 7% of the world’s

population, VEON is transforming lives through technology-driven

services that empower individuals and drive economic growth.

Headquartered in Amsterdam, VEON is listed on Nasdaq and Euronext.

For more information visit: https://www.veon.com.

About Jazz

Jazz is Pakistan’s leading digital operator with

over 71 million subscribers. Jazz offers the most extensive

portfolio of digital services including JazzCash, Pakistan’s

leading fintech; Garaj, the largest onshore cloud and cybersecurity

platform; and Tamasha, Pakistan’s largest homegrown OTT video

streaming and entertainment platform.

Disclaimer

This release contains “forward-looking statements,” as the phrase

is defined in Section 27A of the U.S. Securities Act of 1933, as

amended, and Section 21E of the U.S. Securities Exchange Act of

1934, as amended. Forward-looking statements are not historical

facts, and include statements relating to, among other things,

VEON’s digital, commercial and investment plans. Forward-looking

statements are inherently subject to risks and uncertainties, many

of which VEON cannot predict with accuracy and some of which VEON

might not even anticipate. The forward-looking statements contained

in this release speak only as of the date of this release. VEON

does not undertake to publicly update, except as required by U.S.

federal securities laws, any forward-looking statement to reflect

events or circumstances after such dates or to reflect the

occurrence of unanticipated events. There can be no assurance that

the initiatives referred to above will be successful.

Contact Information

Hande Asik

Group Director of Communications

pr@veon.com

Julian Tanner

TUVA Partners

Julian.tanner@tuvapartners.com

1 PKR 65 billion of the facility was already secured

in May 2024 as disclosed in the “Unaudited Interim Condensed

Consolidated Financial Statements VEON Ltd. as of and for the

three-month period ended March 31, 2024” available on

www.veon.com

- VEON’s Jazz Secures Pakistan’s Largest Long-Term Private Sector

Syndicated Credit Facility of up to PKR 75 billion

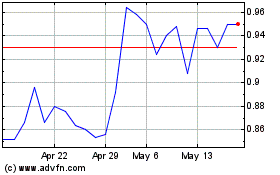

VEON (EU:VEON)

Historical Stock Chart

From Nov 2024 to Dec 2024

VEON (EU:VEON)

Historical Stock Chart

From Dec 2023 to Dec 2024