Issy-les-Moulineaux, July 2, 2024 (7am)Sodexo

(Euronext Paris FR 0000121220-OTC: SDXAY)

Sodexo Q3 Fiscal 2024: continued robust

growth, in line with expectations

- Organic

Revenue growth of +6.8%, or +7.2% excluding accounting

change

- Fiscal 2024

guidance confirmed:

- Organic

growth at the top of the +6% to +8% range

- Underlying

operating profit margin improvement of +30 to +40 bps, at constant

currencies

Q3 FISCAL 2024 REVENUES

|

REVENUES(in million euros) |

Q3 FY24 |

Q3 FY23 |

|

ORGANICGROWTH |

EXTERNALGROWTH |

CURRENCYEFFECT |

TOTALGROWTH |

|

North America |

2,904 |

2,658 |

|

+9.0 % |

-0.4 % |

+0.6 % |

+9.2 % |

|

Europe |

2,096 |

2,042 |

|

+5.4 % |

-2.7 % |

— % |

+2.7 % |

|

Rest of the World |

1,074 |

1,055 |

|

+3.6 % |

+0.6 % |

-2.3 % |

+1.9 % |

|

SODEXO |

6,074 |

5,755 |

|

+6.8 % |

-1.0 % |

-0.2 % |

+5.6 % |

The accounting change in Rest of the World (ROW) weighed on the

Group's growth by -0.4% and on ROW growth by -2.3%.

Commenting on the third quarter activity,

Sophie Bellon, Sodexo Chairwoman and CEO, said:

"We have continued to deliver solid organic growth

of +6.8% in the third quarter, up +8.6% in Food services and +3.5%

in FM services. This performance is in line with our expectations,

allowing us to confirm our full year guidance.

Our commercial momentum in Food services remains

strong, driven by continued first-time outsourcing opportunities,

the ramp-up of new operating models and the quality of our branded

offers.

Our strategic initiatives are delivering results as

we advance with our focus on tasty, healthy, and sustainable food

offerings, strong digital features to enhance consumer experience,

and increased selectivity in FM.

As we complete our final preparations to open the

largest restaurant in the world, the teams are excited to showcase

our sustainable culinary expertise and contribute to making the

Paris 2024 Olympic and Paralympic Games a memorable event!

We are decisively progressing towards our ambition

to be the world leader in sustainable food and valued

experiences."

Highlights of the period

- Third quarter

Fiscal 2024 consolidated revenues reached

6.1 billion euros, up +5.6% year-on-year including

a negative currency impact of -0.2%, a net contribution from

acquisitions and disposals of -1.0% and Organic revenue

growth of +6.8%.

- Organic

growth was impacted by an accounting change for project

works in a large contract in Rest of the World. Excluding this,

third quarter organic growth stood at +7.2%. The sequential

slowdown in growth compared to the second quarter was explained by,

on the one hand, lower pricing effect and a higher comparative base

in the third quarter, and, on the other hand, a positive leap year

impact in the second quarter.

- About half of the

organic growth was fueled by pricing which has fallen below 4% in

the quarter. The remaining half reflects the net new business

contribution and some volume growth.

- By geography:

- North

America achieved Organic growth of +9.0%. The ongoing

return to the workplace and a strong performance of Sodexo Live!,

particularly in the airline lounges, continue to drive growth, as

well as the contribution of new business and pricing.

-

Europe was up +5.4% organically, holding up well

despite the sequential slowdown in the pricing impact, with

increased volumes and the contribution of net new business.

- Rest of the

World was up +3.6% organically, or +5.9% excluding the

accounting change, slowing from the second quarter notably due to a

deceleration in price increases, and a mixed performance between

regions, with strong growth in India and Australia and a slowdown

in China and Chile.

- Food services

organic growth, at +8.6%, continued to outpace FM services, at

+3.5%, or +4.7% excluding the accounting change.

- At its meeting of

June 27, 2024, the Board of Directors decided to create a

Board-level Sustainability Committee starting

October 2024. This committee will play a pivotal role in the

governance of Sodexo's sustainability initiatives and their

alignment with the long-term business goals. Key responsibilities

of the committee will include:

- Sustainability oversight to monitor

and evaluate goals, initiatives, and performance;

- Ethical governance to ensure adherence

to highest ethical standards;

- Stakeholder engagement;

- Promotion of innovation and best CSR

practices;

- Reporting and transparency

quality.

The Sustainability Committee will include 7

Sodexo's Board members, with expertise in sustainability, ethics,

and corporate governance. It will be chaired by Véronique Laury,

who has a long-standing commitment to driving sustainable and

responsible business practices. By creating this committee, Sodexo

reinforces its commitment to sustainable and ethical business

practices and a better tomorrow for its employees, its communities,

and the planet.

Outlook

Third quarter 2024 activity was in line with

expectations. Consequently, Fiscal 2024 guidance is confirmed:

- Organic

revenue growth is expected at the top of the +6 to +8%

range;

- Underlying

operating profit margin is anticipated to grow by +30 to 40 bps at

constant rates.

Conference call

Sodexo will hold a conference call (in

English) today at 9:00 a.m. (Paris time), 8:00 a.m. (London time)

to comment on its Q3 Fiscal 2024 revenues.

Those who wish to connect:

- From the UK: +44

121 281 8004, or

- From France: +33 1

70 91 87 04, or

- From the US: +1 718

705 8796,

Followed by the access code 07 26

13.

The live audio webcast will be available on

www.sodexo.com

The press release, presentation and webcast will be

available on the Group website www.sodexo.com in both the

“Newsroom” section and the “Investors – Financial Results”

section.

Financial calendar

|

Fiscal 2024 Full year Results |

October 24, 2024 |

|

Fiscal 2024 Annual Shareholders Meeting |

December 17, 2024 |

|

Fiscal 2025 First quarter Revenues |

January 07, 2025 |

These dates are indicative and may be subject to

change without notice.Regular updates are available in the calendar

on our website www.sodexo.com

About Sodexo

Founded in Marseille in 1966 by Pierre Bellon,

Sodexo is the global leader in sustainable food and valued

experiences at every moment in life: learn, work, heal and play.

The Group stands out for its independence, its founding family

shareholding and its responsible business model. Thanks to its two

activities of Food and Facilities Management Services, Sodexo meets

all the challenges of everyday life with a dual goal: to improve

the quality of life of our employees and those we serve, and

contribute to the economic, social and environmental progress in

the communities where we operate. For Sodexo, growth and social

commitment go hand in hand. Our purpose is to create a better

everyday for everyone to build a better life for all.

Sodexo is included in the CAC Next 20, Bloomberg

France 40, CAC 40 ESG, CAC SBT 1.5, FTSE 4 Good and DJSI

indices.

Key figures

- 22.6 billion euros

Fiscal 2023 consolidated revenues

- 430,000 employees

as at August 31, 2023

- #1 France-based

private employer worldwide

- 45 countries

- 80 million

consumers served daily

- 12.6 billion euros

in market capitalization (as at July 1, 2024)

|

|

|

|

|

|

|

|

Contacts |

|

|

|

| |

Analysts and Investors |

|

Media |

|

| |

Virginia Jeanson +33 1 57 75 80 56 virginia.jeanson@sodexo.com |

|

Mathieu Scaravetti +33 6 28 62 21 91

mathieu.scaravetti@sodexo.com |

|

| |

|

|

|

|

Q3 Fiscal 2024 Activity Report

Continued robust growth in revenues, in

line with expectations

|

REVENUES(in million euros) |

Q3 FY24 |

Q3 FY23 |

|

ORGANICGROWTH |

EXTERNALGROWTH |

CURRENCYEFFECT |

TOTALGROWTH |

|

North America |

2,904 |

2,658 |

|

+9.0 % |

-0.4 % |

+0.6 % |

+9.2 % |

|

Europe |

2,096 |

2,042 |

|

+5.4 % |

-2.7 % |

— % |

+2.7 % |

|

Rest of the World |

1,074 |

1,055 |

|

+3.6 % |

+0.6 % |

-2.3 % |

+1.9 % |

|

SODEXO |

6,074 |

5,755 |

|

+6.8 % |

-1.0 % |

-0.2 % |

+5.6 % |

In the third quarter Fiscal 2024, Sodexo revenues

reached 6.1 billion euros, up +5.6% year-on-year

including a negative currency impact of -0.2% and a net

contribution from acquisitions and disposals of -1.0%.

Consequently, organic growth for the third quarter

Fiscal 2024 was +6.8%, or +7.2% when adjusted for the negative

impact of an accounting change for project works in a large

contract in Rest of the World. The sequential slowdown in growth

compared to the second quarter was explained by, on the one hand,

lower pricing effect and a higher comparative base in the third

quarter, and, on the other hand, a positive leap year impact in the

second quarter.

About half of the organic growth was fueled by

pricing which has fallen below 4% in the quarter. The remaining

half reflects the net new business contribution and some volume

growth.

Organic growth in the quarter was driven by Food

services, up +8.6%, whereas FM services were up +3.5%, or +4.7%

when adjusted for the accounting change in Rest of the World.

North America

|

REVENUES BY SEGMENT(in million euros) |

Q3 FY24 |

Q3 FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

780 |

959 |

+12.1 % |

|

Sodexo Live! |

388 |

— |

+30.7 % |

|

Healthcare & Seniors |

869 |

855 |

+5.6 % |

|

Education |

867 |

844 |

+2.4 % |

|

NORTH AMERICA TOTAL |

2,904 |

2,658 |

+9.0 % |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

In the third quarter Fiscal 2024, North

America revenues totaled 2.9 billion

euros, up +9.0% organically. The ongoing return to the

workplace and a strong performance of Sodexo Live!, particularly in

the airline lounges, continue to drive growth, as well as the

contribution of new business and pricing.

Within Business &

Administrations, restated organic growth reached +12.1%,

propelled by new business, strong growth in Food services from

continued return to office and cross-sales, as well as project

works and strong retail sales growth.

Sodexo Live! restated organic

growth was +30.7%, driven by robust activity in all venues, and in

particular strong per capita spend in sports stadiums and elevated

attendance at conference centers and cultural destinations. Airline

lounges also saw strong growth driven by higher passenger count,

additional services and mobilization of new business.

Healthcare & Seniors restated

organic growth was +5.6%, supported by strong performance in

Healthcare through a combination of price increases, volume growth

in particular in retail, and positive net new contribution. This

growth was somewhat offset by Seniors contract losses at the end of

the prior fiscal year.

In Education, restated organic

revenue growth was +2.4%, affected by a calendar impact in

Universities and the reduction in number of sites of a large

schools contract.

Europe

|

REVENUES BY SEGMENT(in million euros) |

Q3 FY24 |

Q3 FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

1,179 |

1,324 |

+5.9 % |

|

Sodexo Live! |

137 |

— |

-0.4 % |

|

Healthcare & Seniors |

466 |

531 |

+4.4 % |

|

Education |

314 |

187 |

+7.7 % |

|

EUROPE TOTAL |

2,096 |

2,042 |

+5.4

% |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

In Europe, third

quarter Fiscal 2024 revenues amounted to 2.1 billion

euros, up +5.4% organically, holding up well despite the

sequential slowdown in the pricing impact, due to increased volumes

and the contribution of net new business.

In Business & Administrations,

restated organic growth was +5.9%. This was supported by Corporate

services, benefiting from both price increases, volume growth and

new openings, coupled with new Government business in the United

Kingdom. Türkiye also contributed with very strong growth, helped

by pricing pass-through.

Sodexo Live! restated organic

growth was slightly negative at -0.4%, affected by the base effect

of ticketing for the World Baseball Classic Hospitality in Japan

last year. Excluding this impact, restated organic growth was

+6.2%, driven by strong overall activity in France especially in

sports and cultural venues and event catering.

Healthcare & Seniors restated

organic growth stood at +4.4%, driven by inflation pass-through in

the United Kingdom, new business particularly in Spain along with

price revisions and new openings in France.

Education

restated organic revenue growth was +7.7%,

reflecting the significant positive impact of price revisions in

the UK and in France.

Rest of the World

|

REVENUES BY SEGMENT(in million euros) |

Q3 FY24 |

Q3 FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

932 |

946 |

+2.7 % |

|

Sodexo Live! |

12 |

— |

+88.3 % |

|

Healthcare & Seniors |

82 |

83 |

+3.9 % |

|

Education |

48 |

26 |

+10.8 % |

|

REST OF THE WORLD TOTAL |

1,074 |

1,055 |

+3.6

% |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

Rest of the World third quarter

Fiscal 2024 revenues totaled 1.1 billion euros, up

+3.6% organically, impacted by the change in revenue recognition on

project activity in Energy & Resources. Excluding this impact,

the organic growth was +5.9%, a slowdown from the second quarter,

due to a deceleration in price increases, and a slowdown in China

and Chile.

Business & Administrations

restated organic growth was +2.7%, or +5.3% excluding the

accounting change. Growth continues to be particularly strong this

quarter in India driven by new business and additional volumes on

existing sites, and in Australia fueled by strong development and

price renegotiation. Chile experienced a deceleration in growth in

this quarter due to lower price increases and the end of several

Energy & Resources fixed-term projects. In China, the activity

was affected by downsizing in the tech sector.

Sodexo Live! revenues (principally

airline lounges) almost doubled due to the opening of new lounges

in Hong Kong.

Healthcare & Seniors restated

organic growth was +3.9%, with strong growth in India and Latin

America, somewhat offset by Brazil and China.

Education restated organic growth

was +10.8%, fueled by new business and ramp ups in existing sites

in Brazil and India.

CURRENCY EFFECTS

Exchange rate fluctuations do not generate

operational risks because each subsidiary bills its revenues and

incurs its expenses in the same currency.

|

1€= |

AVERAGE RATE9M FY 2024 |

AVERAGE RATE 9M FY 2023 |

AVERAGE RATE9M FY 2024VS.

9M FY 2023 |

CLOSING RATEAT 05/31/2024 |

CLOSING RATE AT 08/31/2023 |

CLOSING RATE05/31/2024VS.

08/31/2023 |

|

U.S. dollar |

1.081 |

1.049 |

-3.0 % |

1.085 |

1.087 |

+0.1 % |

|

Pound sterling |

0.861 |

0.875 |

+1.6 % |

0.854 |

0.857 |

+0.4 % |

|

Brazilian real |

5.400 |

5.443 |

+0.8 % |

5.642 |

5.308 |

-5.9 % |

The negative currency impact for third quarter

Fiscal 2024 of -0.2% results from the depreciation of the Chilean

Peso and the Turkish Lira, mainly offset by the appreciation of the

British pound.

The currency effect is determined by applying the

previous year’s average exchange rates to the current year

figures.

FINANCIAL POSITION

Apart from the seasonal changes in working capital,

there were no material changes in the Group's financial position as

of May 31, 2024, relative to that presented in the Fiscal 2023

Universal Registration Document filed with the AMF on November 3,

2023 and the Interim Financial Report published on April 19,

2024.

PRINCIPAL RISKS AND

UNCERTAINTIES

There were no significant changes to the principal

risks and uncertainties identified by the Group in the Risk Factors

section of the Fiscal 2023 Universal Registration Document filed

with the AMF on November 3, 2023.

ALTERNATIVE PERFORMANCE MEASURE

DEFINITIONS

Growth excluding currency

effect

The currency effect is determined by applying the

previous year’s average exchange rates to the current year figures

except in hyper-inflationary economies where all figures are

converted at the latest closing rate for both periods when the

impact is significant.

Organic growth

Organic growth corresponds to the increase in

revenue for a given period (the “current period”) compared to the

revenue reported for the same period of the prior fiscal year,

calculated using the exchange rate for the prior fiscal year; and

excluding the impact of business acquisitions (or gain of control)

and divestments, as follows:

- for businesses

acquired (or gain of control) during the current period, revenue

generated since the acquisition date is excluded from the organic

growth calculation;

- for businesses

acquired (or gain of control) during the prior fiscal year, revenue

generated during the current period up until the first anniversary

date of the acquisition is excluded;

- for businesses

divested (or loss of control) during the prior fiscal year, revenue

generated in the comparative period of the prior fiscal year until

the divestment date is excluded;

- for businesses

divested (or loss of control) during the current fiscal year,

revenue generated in the period commencing 12 months before

the divestment date up to the end of the comparative period of the

prior fiscal year is excluded.

Underlying operating profit

margin

The Underlying operating profit margin corresponds

to Underlying operating profit divided by revenues.

Underlying operating profit margin at

constant rates

The Underlying operating profit margin at constant

rates corresponds to Underlying operating profit divided by

revenues, calculated by converting 2024 figures at Fiscal 2023

rates, except for countries with hyperinflationary economies.

New segment reporting following evolution

of the organization

As part of the streamlining of the organization,

from Fiscal 2024, some contracts or operations have been

reallocated between segments, with main impacts in Europe from

Healthcare & Seniors to Education.

Restated revenue breakdown for Fiscal 2023:

|

REVENUES(in million euros) |

Fiscal 2023 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

Q4 2023 |

|

Published |

Restated |

Published |

Restated |

Published |

Restated |

Published |

Restated |

Published |

Restated |

|

North America |

10,479 |

10,479 |

2,992 |

2,992 |

2,506 |

2,506 |

2,658 |

2,658 |

2,322 |

2,322 |

|

Business & Administrations |

3,865 |

2,723 |

1,009 |

699 |

874 |

641 |

959 |

679 |

1,023 |

704 |

|

Sodexo Live! |

-- |

1,184 |

-- |

327 |

-- |

248 |

-- |

296 |

-- |

312 |

|

Healthcare & Seniors |

3,440 |

3,399 |

877 |

866 |

844 |

831 |

856 |

844 |

863 |

858 |

|

Education |

3,173 |

3,173 |

1,106 |

1,100 |

788 |

786 |

844 |

839 |

436 |

448 |

|

Europe |

8,071 |

8,071 |

2,047 |

2,047 |

1,980 |

1,980 |

2,042 |

2,042 |

2,002 |

2,002 |

|

Business & Administrations |

5,337 |

4,464 |

1,337 |

1,125 |

1,296 |

1,110 |

1,324 |

1,115 |

1,380 |

1,114 |

|

Sodexo Live! |

-- |

599 |

-- |

141 |

-- |

118 |

-- |

138 |

-- |

202 |

|

Healthcare & Seniors |

2,026 |

1,950 |

504 |

470 |

505 |

481 |

531 |

498 |

487 |

500 |

|

Education |

708 |

1,059 |

206 |

311 |

179 |

271 |

187 |

291 |

136 |

185 |

|

Rest of the World |

4,087 |

4,087 |

1,057 |

1,057 |

998 |

998 |

1,055 |

1,055 |

978 |

978 |

|

Business & Administrations |

3,659 |

3,546 |

941 |

914 |

898 |

871 |

946 |

916 |

874 |

845 |

|

Sodexo Live! |

-- |

23 |

-- |

3 |

-- |

5 |

-- |

6 |

-- |

9 |

|

Healthcare & Seniors |

337 |

376 |

87 |

95 |

81 |

92 |

83 |

93 |

87 |

96 |

|

Education |

91 |

142 |

29 |

45 |

19 |

30 |

26 |

39 |

17 |

28 |

|

Sodexo |

22,637 |

22,637 |

6,097 |

6,097 |

5,484 |

5,484 |

5,755 |

5,755 |

5,301 |

5,301 |

REVENUE FOR THE FIRST 9 MONTHS FISCAL

2024

|

REVENUES(in million euros) |

9M FY24 |

9M FY23 |

|

ORGANICGROWTH |

EXTERNALGROWTH |

CURRENCYEFFECT |

TOTALGROWTH |

|

North America |

8,660 |

8,157 |

|

+9.7 % |

-0.2 % |

-3.3 % |

+6.2 % |

|

Europe |

6,350 |

6,068 |

|

+7.1 % |

-2.1 % |

-0.4 % |

+4.6 % |

|

Rest of the World |

3,165 |

3,110 |

|

+5.0 % |

-0.2 % |

-3.0 % |

+1.8 % |

|

SODEXO |

18,175 |

17,335 |

|

+7.9 % |

-0.9 % |

-2.2 % |

+4.8 % |

|

REVENUES BY SEGMENT(in million euros) |

9M FY24 |

9M FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

8,536 |

9,585 |

+7.2 % |

|

Sodexo Live! |

1,560 |

— |

+24.3 % |

|

Healthcare & Seniors |

4,224 |

4,367 |

+6.0 % |

|

Education |

3,855 |

3,383 |

+6.2 % |

|

SODEXO |

18,175 |

17,335 |

+7.9 % |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

|

REVENUES BY SEGMENT(in million euros) |

9M FY24 |

9M FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

2,250 |

2,842 |

+12.8 % |

|

Sodexo Live! |

1,064 |

— |

+25.9 % |

|

Healthcare & Seniors |

2,556 |

2,578 |

+6.1 % |

|

Education |

2,790 |

2,737 |

+5.6 % |

|

NORTH AMERICA TOTAL |

8,660 |

8,157 |

+9.7

% |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

|

REVENUES BY SEGMENT(in million euros) |

9M FY24 |

9M FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

3,534 |

3,957 |

+6.1 % |

|

Sodexo Live! |

462 |

— |

+16.5 % |

|

Healthcare & Seniors |

1,416 |

1,539 |

+6.6 % |

|

Education |

938 |

572 |

+7.4 % |

|

EUROPE TOTAL |

6,350 |

6,068 |

+7.1 % |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

|

REVENUES BY SEGMENT(in million euros) |

9M FY24 |

9M FY23 |

RESTATED ORGANIC GROWTH(2) |

|

Business & Administrations(1) |

2,752 |

2,786 |

+4.3 % |

|

Sodexo Live! |

34 |

— |

+146.4 % |

|

Healthcare & Seniors |

252 |

250 |

+2.2 % |

|

Education |

127 |

74 |

+10.6 % |

|

REST OF THE WORLD TOTAL |

3,165 |

3,110 |

+5.0

% |

(1) From H1 FY24, Business & Administrations

excludes Sodexo Live!, reported separately.(2) As part of the

streamlining of the organization during Fiscal 2023, some contracts

or operations have been reallocated between segments.

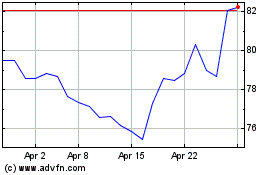

Sodexo (EU:SW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sodexo (EU:SW)

Historical Stock Chart

From Jul 2023 to Jul 2024