Prosus Increases Cash Offer for Just Eat to GBP5.1 Billion -- 2nd Update

December 09 2019 - 6:56AM

Dow Jones News

--Prosus increases its offer for Just Eat to 740 pence a share

from 710 pence, valuing the company at GBP5.1 billion

--The move marks an intensification in the bidding fight between

Prosus and Takeaway

--Just Eat said its board is reviewing the increased offer and

advised shareholders to take no action

By Adria Calatayud

Prosus NV (PRX.AE) on Monday raised its offer for Just Eat PLC

(JE.LN) to 5.1 billion pounds ($6.70 billion), or 740 pence a

share, stepping up a bidding fight for the U.K. food-delivery

company with Takeaway.com NV (TKWY.AE).

Prosus, an Amsterdam-listed company which was spun out of South

African investor Naspers Ltd. (NPN.JO) earlier this year and is

best known for housing a major stake in Chinese tech giant Tencent

Holdings Ltd. (0700.HK), also lowered the level of acceptances

required for the offer to proceed to a simple majority, from 75%

previously.

The move by Prosus heats up the battle for control of a company

that has been under pressure from startups with deep-pocketed

backers like Deliveroo--which counts Amazon.com Inc. (AMZN) as one

of its biggest investors--and Uber Technologies Inc.'s (UBER)

meal-delivery arm Uber Eats.

The new offer represents a 4.2% increase on Prosus's latest

offer of 710 pence a share, which was rejected by Just Eat's board,

and comes at a premium to the value of Takeaway's agreed offer when

it was announced in July. However, the bid is still below Just

Eat's current share price. Just Eat shares at 1058 GMT traded 0.7%

higher at 782.40 pence.

Prosus said it raised the offer after listening to Just Eat

shareholders' views and following discussions with its own

shareholders. The new proposal gives Just Eat investors certainty

of value while allowing Prosus to target appropriate returns for

its shareholders, the company said.

"We believe the investment required is substantial and this

impacts our view of potential returns. As disciplined investors we

obviously need to factor the required investment into our value

considerations," Prosus Chief Executive Bob van Dijk said.

Just Eat said its board is currently reviewing the increased

offer, but advised shareholders to take no action at this time.

Takeaway's all-stock proposal, which has been recommended by

Just Eat's board, valued the U.K. company at 731 pence a share

based on the Dutch company's share price of 83.55 euros ($92.37) on

the last day before the deal was first disclosed in July, but its

value has declined since then due to a fall in Takeaway's share

price.

Takeaway urged Just Eat shareholders to back its proposed merger

with the U.K. company and ignore Prosus's revised bid, which it

called "opportunistic and derisory."

U.S. investor Cat Rock Capital Management LP, which holds stakes

in both Just Eat and Takeaway, said Prosus's revised offer

continues to undervalue the U.K. company and that its bid should be

raised at least to 925 pence a share to compete with a Takeaway

merger.

"Prosus is struggling to pay a fair price for Just Eat because

it lacks a credible plan for winning in the U.K. Throwing money at

the market under existing management is not a credible plan," Cat

Rock Managing Partner and founder Alex Captain said.

Adriano Marchese contributed to this article

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

December 09, 2019 06:41 ET (11:41 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

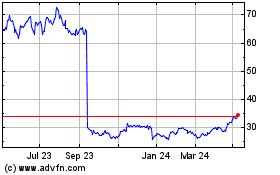

Prosus NV (EU:PRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

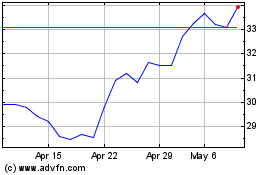

Prosus NV (EU:PRX)

Historical Stock Chart

From Feb 2024 to Feb 2025