Tencent Investor Makes $6.3 Billion Bid for U.K. Food-Delivery Company -- Update

October 22 2019 - 9:44AM

Dow Jones News

By Parmy Olson and Alexandra Wexler

Europe's newest tech-investment giant made its first big move,

launching a GBP4.9 billion ($6.3 billion) offer for Just Eat PLC

and raising the pressure on the global food-delivery ambitions of

the likes of Amazon.com Inc. and Uber Technologies Inc.

The all-cash offer from Prosus NV, which owns a near third stake

in Chinese internet giant Tencent Holdings Ltd. and a host of other

tech assets, is the investment firm's first major move since being

spun out of South Africa's Naspers Ltd. earlier this year.

Prosus said Tuesday that it would put its 710 pence a share

offer directly to Just Eat's shareholders within the next 28 days,

gate-crashing the British company's planned merger with Dutch rival

Takeaway.com NV.

Prosus said its offer was 20% higher than Takeaway.com's

all-share bid made in July, based on the latter's closing price

Monday.

Just Eat urged shareholders to reject Prosus' offer, saying it

undervalued the company and its prospects on a stand-alone basis

and as part of the proposed merger with Takeaway.com.

Shares in Just Eat traded more than 26% higher.

The move by Prosus marks the latest sign of growing interest in

food delivery. The sector has been heating up as such businesses

become increasingly popular as a more convenient way to order meals

directly from restaurants via a smartphone.

Earlier this year, Amazon led a $575 million investment round

into Deliveroo, one of the U.K.'s leading food-delivery companies,

going head to head with Uber Eats. That investment is now being

reviewed by competition regulators.

Food-delivery services are fighting a fierce battle for

consumers in Britain -- where Just Eat is also a major player --

and other markets. In some cases, operators are striking

partnerships. In 2014, Just Eat invested in Brazil's iFood and

integrated its operations. iFood is also backed by Prosus.

Prosus, one of the world's largest technology-investment firms,

said it had already spent $2.8 billion across several investments

in food delivery, including Germany's Delivery Hero, India's Swiggy

and iFood. Online food delivery is one of Prosus' three key areas

of investment focus, along with online classifieds and

payments.

It said Just Eat needed more investment than planned by its

management to defend itself from "intense competition," noting its

recent trading update had shown a slowdown in order growth.

Should it be successful in its bid for Just Eat, Prosus would

have a food-delivery presence in more than 50 markets, with a

number one positioning in more than 40 of these, Prosus Chief

Executive Bob van Dijk said on a call with reporters.

"Food delivery is a space that we know well...and that we're

committed to for the long term," said Mr. Van Dijk.

Prosus said it had approached Just Eat's board of directors with

several proposals, but hadn't so far reached an agreement. "Prosus

is making this announcement in order to give Just Eat shareholders

the opportunity to consider the offer," the company said.

Just Eat quickly announced on Tuesday that it had rejected the

approach, and that it favored its planned tie-up with Takeaway.com,

which it said would allow both groups to bolster their competitive

positions.

However, that deal has already faced criticism from some of Just

Eat's biggest shareholders. Eminence Capital, a New York-based

hedge fund that owns 4.4% stake in Just Eat, said in September that

it would vote against the Takeaway.com deal, calling the financial

terms "grossly inadequate." Eminence Capital couldn't immediately

be reached for comment Tuesday.

Prosus was listed in Amsterdam in September to unlock value for

Naspers shareholders and attract new investors. Naspers, which owns

a majority stake in Prosus, had long traded at a discount to the

value of its assets. As well as its stake in Tencent, Prosus has

investments in Russian social-media operator Mail.ru Group Ltd. and

U.S. online marketplace LetGo -- a Craigslist Inc. competitor --

among others.

Write to Parmy Olson at parmy.olson@wsj.com and Alexandra Wexler

at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

October 22, 2019 09:29 ET (13:29 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

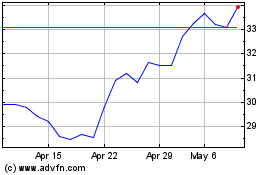

Prosus NV (EU:PRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

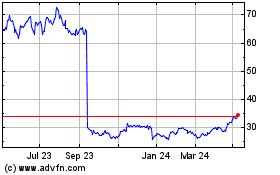

Prosus NV (EU:PRX)

Historical Stock Chart

From Feb 2024 to Feb 2025