ArcelorMittal announces the publication of first quarter 2022 Ebitda sell-side analyst consensus figures

April 25 2022 - 8:15AM

25 April 2022,

14:15 CET

ArcelorMittal today announces the publication of its first

quarter 2022 EBITDA sell-side analysts’ consensus figures.

The consensus figures are based on analysts’ estimates recorded

on an external web-based tool provided and managed by an

independent company, Vuma Financial Services Limited (trade name:

Vuma Consensus).

To arrive at the consensus figures below, Vuma Consensus has

aggregated the expectations of sell-side analysts who, to the best

of our knowledge, cover ArcelorMittal on a continuous basis. This

is currently a group of approximately 15-20 brokers.

The listed analysts follow ArcelorMittal on their own initiative

and ArcelorMittal is not responsible for their views. ArcelorMittal

is neither involved in the collection of the information nor in the

compilation of the estimates.

EBITDA consensus estimates

|

Period |

Number of sell-side analysts

participation |

EBITDA consensus average $

million |

|

1Q 2022 |

17 |

$4,566 |

| |

|

|

The sell-side analysts who cover ArcelorMittal and whose

estimates are included in the 1Q 2022 group consensus outlined

above are the following:

- BancoSabedll - Óscar

Rodríguez Rouco

- Barclays – Tom

Zhang

- CITI – Ephrem

Ravi

- Credit Suisse -

Carsten Riek

- Deutsche Bank -

Bastian Synagowitz

- Exane – Seth

Rosenfeld

- Goldman Sachs - Jack

O’Brien

- Groupo Santander -

Robert Jackson

- GVC Gaesco Beka -

Iñigo Recio Pascual

- Jefferies - Alan

Spence

- JPM – Luke

Nelson

- Kepler - Rochus

Brauneiser

- Keybanc - Phil

Gibbs

- Morgan Stanley -

Alain Gabriel

- Oddo - Alain

Williams

- Renta4 - Iván San

Felix Carbajo

- UBS – Myles Allsop,

Andrew Jones

ENDS

About ArcelorMittal

ArcelorMittal is the world's leading steel and

mining company, with a presence in 60 countries and primary

steelmaking facilities in 16 countries. In 2021, ArcelorMittal had

revenues of $76.6 billion and crude steel production of 69.1

million metric tonnes, while iron ore production reached 50.9

million metric tonnes.

Our goal is to help build a better world with

smarter steels. Steels made using innovative processes which use

less energy, emit significantly less carbon and reduce costs.

Steels that are cleaner, stronger and reusable. Steels for electric

vehicles and renewable energy infrastructure that will support

societies as they transform through this century. With steel at our

core, our inventive people and an entrepreneurial culture at heart,

we will support the world in making that change. This is what we

believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges

of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and

on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and

Valencia (MTS).

For more information about ArcelorMittal please

visit: http://corporate.arcelormittal.com/

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20

3214 2419press@arcelormittal.com |

|

|

|

ArcelorMittal (EU:MT)

Historical Stock Chart

From Oct 2024 to Nov 2024

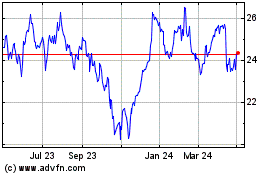

ArcelorMittal (EU:MT)

Historical Stock Chart

From Nov 2023 to Nov 2024