ArcelorMittal announces closing of its second share buyback program and launching of a third US$750 million share buyback pro...

June 18 2021 - 9:50AM

18 June

2021, 15:50

CET

ArcelorMittal (or the ‘Company’) today announces

that it has completed the second share buyback program announced on

4 March 2021 under the authorization given by the annual general

meeting of shareholders of 13 June 2020 (the ‘2020 AGM

Authorization’) and 8 June 2021 (the ‘2021 AGM Authorization’).

By market close on 17 June 2021, ArcelorMittal had repurchased

17,847,057 million shares for a total value of approximately

€468,812,110.90 (equivalent to US$569,999,745.42) at an approximate

average price per share of €26.2683. All details are available on

the Company’s website at:

https://corporate.arcelormittal.com/investors/equity-investors/share-buyback-program.

ArcelorMittal will today commence a third share buyback program

(the ‘Program’) under the authorization given by the 2021 AGM

Authorization for an aggregate amount of US$750 million. Pursuant

to today’s announcement [1] relating to the sale of the

Cleveland-Cliffs common stock, the proceeds of this sale will be

returned to the ArcelorMittal shareholders via the Program. This

Program will be completed by 31 December 2021.

The shares acquired under the Program are intended:

- to meet ArcelorMittal’s obligations under debt obligations

exchangeable into equity securities, and/or;

- to reduce its share capital.

ArcelorMittal intends to repurchase shares for an aggregate

maximum amount of US$750 million in accordance with the 2021 AGM

Authorization and applicable market abuse regulations. The Program

will commence today [2].

[1]

https://corporate.arcelormittal.com/media/press-releases/arcelormittal-announces-sale-of-cleveland-cliffs-common-stock-with-the-proceeds-to-be-returned-to-shareholders-via-a-750-million-share-buyback

[2] The Significant Shareholder has declared its intention to

enter into a share repurchase agreement with ArcelorMittal, to sell

each trading day on which ArcelorMittal has purchased shares under

the Program, an equivalent number of shares, at the proportion of

the Significant Shareholder’s stake in the Company of 36.34% of

issued and outstanding shares of ArcelorMittal, at the same price

as the shares repurchased on the market. The effect of the share

repurchase agreement is to maintain the Significant Shareholder’s

voting rights in ArcelorMittal’s issued share capital (net of

treasury shares) at the current level, pursuant to the Program.

ENDS

About ArcelorMittal

ArcelorMittal is the world's leading steel and

mining company, with a presence in 60 countries and primary

steelmaking facilities in 17 countries. In 2020, ArcelorMittal had

revenues of $53.3 billion and crude steel production of 71.5

million metric tonnes, while iron ore production reached 58.0

million metric tonnes.

Our goal is to help build a better world with

smarter steels. Steels made using innovative processes which use

less energy, emit significantly less carbon and reduce costs.

Steels that are cleaner, stronger and reusable. Steels for electric

vehicles and renewable energy infrastructure that will support

societies as they transform through this century. With steel at our

core, our inventive people and an entrepreneurial culture at heart,

we will support the world in making that change. This is what we

believe it takes to be the steel company of the future.

ArcelorMittal is listed on the stock exchanges

of New York (MT), Amsterdam (MT), Paris (MT), Luxembourg (MT) and

on the Spanish stock exchanges of Barcelona, Bilbao, Madrid and

Valencia (MTS).

For more information about ArcelorMittal please

visit: http://corporate.arcelormittal.com/

| |

|

| Contact

information ArcelorMittal Investor Relations |

|

| |

|

| General |

+44 20 7543

1128 |

| Retail |

+44 20 3214

2893 |

| SRI |

+44 20 3214

2801 |

|

Bonds/CreditE-mail |

+33 171 921

026investor.relations@arcelormittal.com |

|

|

|

|

|

|

| Contact

information ArcelorMittal Corporate Communications |

|

| Paul

WeighTel:E-mail: |

+44 20

3214 2419press@arcelormittal.com |

|

|

|

ArcelorMittal (EU:MT)

Historical Stock Chart

From Oct 2024 to Nov 2024

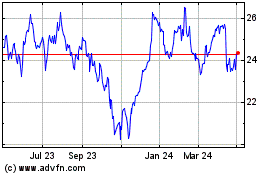

ArcelorMittal (EU:MT)

Historical Stock Chart

From Nov 2023 to Nov 2024