- Q1 2022 revenues of €1,760m, +9.1% vs. Q1 2021, despite a

significant decrease in COVID related revenues

- Q1 2022 total revenue organic growth2 of +1.1% vs. Q1 2021,

impacted by the reduction in COVID related revenues (over €300m in

Q1 2022 vs. €400m in Q1 2021)

- The Core Business (excluding COVID-19 related clinical testing

and reagent revenues) delivered revenue organic growth of +6.5% vs.

Q1 2021 in line with recently upgraded growth plans announced on 22

February 2022

- Performance delivered despite disruptions from the Omicron wave

in terms of lockdown restrictions and employee absence, in a number

of geographies during this period but supported by slight working

day advantage vs. 2021

- Eurofins Viracor and Cornell University signed an exclusive

agreement to commercialise novel assays to detect organ and tissue

damage in transplant and COVID-19 patients

- Eurofins Genomics will conduct genotyping for up to 5 million

participants of Our Future Health, the UK’s largest ever health

research programme

- Eurofins Megalab will provide clinical analyses, genomic and

pathological studies for the DIPCAN study in Spain, which aims to

develop more personalised oncological treatment through the

integration of clinical, genomic and radiological image data

- COVID-19 related clinical testing activities and reagents sales

were still very intense in January and February in response to

Omicron, with reduced volumes since then, in-line with relaxation

of national testing requirements

- Despite significant slowdown in March, the FY 2022 COVID

revenue objective of €300m, announced on 22 February 2022 was

already exceeded in Q1, hence the full year COVID revenues

objective is revised upwards to €400m. This is only a €100m (33%)

increase given decisions made by governments in many countries

where the Covid crisis is considered to be over

- Should a new significant wave or another more pathogenic

variant arise, for instance in the Fall season, or medically

prescribed COVID or multi-pathogen testing continue at significant

levels, we might need to upgrade this objective further

- In line with their plans to accelerate growth, Eurofins

businesses continue to invest significantly for the long term,

organically and inorganically

- Further expansion in the BioPharma laboratory network

worldwide

- Amongst a total of 16 acquisitions, completed strategic

acquisitions to expand our presence in Asia, with Genetic Lab Co in

Japan, Genetic Testing Service in Vietnam, and in BioPharma

services with Inpac Medizintechnik in Germany

- Direct Russia & Ukraine revenues for Eurofins companies

were under €3m in 2021

Regulatory News:

Eurofins (Paris:ERF):

Outlook

Following the significant upgrade in objectives for long-term

organic growth rates announced at the FY 2021 results presentation

on last 22nd February 2022, the financial objectives of the Group,

including M&A, are revised upwards due to the 33% upwards

revision of Covid revenues objective for FY 2022 from €300m to

€400m as follows:

€m

FY 2022

FY 2023

FY 2024

Revenues

6,325 (was 6,225) (incl. €400m

COVID revenues (was €300m))

6,550 (zero COVID revenues)

7,250 (zero COVID revenues)

Adjusted3 EBITDA5

1,525 (was 1,500)

1,575

1,725

FCFF before investment in owned

sites11

865 (was 850)

900

950

All objectives are set at average 2021 currency exchange rates,

assuming 6.5% organic growth per year on the Core Business and

including potential revenues from acquisitions of €250m in each of

2022, 2023 and 2024 consolidated at mid-year.

Comments from the CEO, Dr Gilles Martin:

“The 2022 financial year has

started well and in spite of significant Omicron-related staff

absenteeism in Q1, growth was in-line with our recently upgraded

long-term annual organic growth targets of 6.5% p.a. Despite

current global challenges, the outlook of our business remains

strong, our markets’ potential undiminished, and our ambitious,

mid-term growth plans unchanged. Given the scale and breadth of

opportunities, we plan to continue to invest significantly in IT

and in organic developments, and M&A, especially in BioPharma,

clinical genetics and Asia.”

Conference Call

Eurofins will hold a conference call with analysts and investors

today at 15:00 CET to discuss the results and the performance of

Eurofins, as well as its outlook, and will be followed by a

questions and answers (Q&A) session.

Click here to Join Call >> No need to dial in. From

any device, click the link above to join the conference call.

Alternatively, you may dial-in to the conference call via telephone

using one of the numbers below:

UK: + 44 330 165 4027 US: + 1 323 794 2551 FR: + 33 176 772 274

BE: + 32 240 406 59 DE: + 49 692 222 134 20 DK: + 45 351 580 49

Q1 2022 Organic Growth Calculation and Revenue

Reconciliation

In €m except otherwise stated

Q1 2021 reported revenues

1,614

+ 2021 acquisitions - revenue part not

consolidated in Q1 2021 at Q1 2021 FX rates

63

- Q1 2021 revenues of discontinued

activities / disposals10

0

= Q1 2021 pro-forma revenues (at Q1 2021

FX rates)

1,676

+ Q1 2022 FX impact on Q1 2021 pro-forma

revenues

47

= Q1 2021 pro-forma revenues (at Q1

2022 FX rates) (a)

1,723

Q1 2022 organic scope* revenues (at Q1

2022 FX rates) (b)

1,742

Q1 2022 organic growth rate

(b/a-1)

1.1%

Q1 2022 acquisitions - revenue part

consolidated in Q1 2022 at Q1 2022 FX rates

18

Q1 2022 revenues of discontinued

activities / disposals10

0

Q1 2022 reported revenues

1,760

* Organic scope consists of all companies

that were part of the Group as at 01/01/2022. This corresponds to

the 2021 pro-forma scope.

Geographical Revenue Breakdown

€m

Q1 2022

As % of total

Q1 2021

As % of total

Growth %

Europe

1,000

57%

1,000

62%

0.0%

North America

584

33%

490

30%

19.0%

Rest of the World

176

10%

123

8%

43.3%

Total

1,760

100%

1,614

100%

9.1%

Growth in Europe was significantly impacted by the reduction in

COVID related revenues in Q1 2022 vs. Q1 2021. Europe generated 57%

of Group revenues in Q1 2022.

North America delivered strong growth across all business lines

in Q1 2022, it now represents 33% of Group revenues.

Rest of the World delivered very robust growth in Q1 2022. The

proportion of revenues generated in Rest of the World continues to

increase in line with our objective to significantly expand our

presence in Asia over the coming years.

- Core Business excludes COVID-19 related clinical testing and

reagents revenues

- Organic growth for a given period (Q1, Q2, Q3, Half Year, Nine

Months or Full Year) – non-IFRS measure calculating the growth in

revenues during that period between 2 successive years for the same

scope of businesses using the same exchange rates (of year Y) but

excluding discontinued operations10. For the purpose of organic

growth calculation for year Y, the relevant scope used is the scope

of businesses that have been consolidated in the Group's income

statement of the previous financial year (Y-1). Revenue

contribution from companies acquired in the course of Y-1 but not

consolidated for the full year are adjusted as if they had been

consolidated as of 1st January Y-1. All revenues from businesses

acquired since 1st January Y are excluded from the

calculation.

- Adjusted results – reflect the ongoing performance of the

mature9 and recurring activities excluding “separately disclosed

items4”.

- Separately disclosed items – include one-off costs from

integration and reorganisation, discontinued operations, other

non-recurring income and costs, temporary losses and other costs

related to network expansion, start-ups and new acquisitions

undergoing significant restructuring, share-based payment charge,

impairment of goodwill, amortisation of acquired intangible assets

and negative goodwill, loss/gain on disposal and transaction costs

related to acquisitions as well as income from reversal of such

costs and from unused amounts due for business acquisitions, net

finance costs related to borrowing and investing excess cash and

one-off financial effects (net of finance income), net finance

costs related to hybrid capital, and the related tax effects.

- EBITDA – Earnings before interest, taxes, depreciation and

amortisation, share-based payment charge6, impairment of goodwill,

amortisation of acquired intangible assets, negative goodwill,

loss/gain on disposal and transaction costs related to acquisitions

as well as income from reversal of such costs and from unused

amounts due for business acquisitions.

- Share-based payment charge and acquisition-related expenses,

net – Share-based payment charge, impairment of goodwill,

amortisation of acquired intangible assets, negative goodwill,

loss/gain on disposal and transaction costs related to acquisitions

as well as income from reversal of such costs and from unused

amounts due for business acquisitions.

- Net capex – Purchase of intangible assets, property, plant and

equipment, less proceeds from disposals of such assets.

- Free Cash Flow to the Firm - Net cash provided by operating

activities, less Net capex.

- Mature scope: excludes start-ups and acquisitions in

significant restructuring. A business will generally be considered

mature when: i) The Group’s systems, structure and processes have

been deployed; ii) It has been audited, accredited and qualified

and used by the relevant regulatory bodies and the targeted client

base; iii) It no longer requires above-average annual capital

expenditures, exceptional restructuring or abnormally large costs

with respect to current revenues for deploying new Group IT

systems. The list of entities classified as mature is reviewed at

the beginning of each year and is relevant for the whole year.

- Discontinued activities / disposals: discontinued operations

are a component of the Group’s Core Business or product lines that

have been disposed of, or liquidated; or a specific business unit

or a branch of a business unit that has been shut down or

terminated, and is reported separately from continued operations.

For more information, please refer to Note 2.26 of the Consolidated

Financial Statements for the year ended 31 December 2021.

- FCFF before investment in owned sites: FCFF less Net capex

spent on purchase of land, buildings and investments to purchase,

build or modernise owned sites/buildings (excludes laboratory

equipment and IT).

About Eurofins – the global leader in bio-analysis

Eurofins is Testing for Life. Eurofins is the global leader in

food, environment, pharmaceutical and cosmetic product testing, and

in discovery pharmacology, forensics, advanced material sciences

and agroscience Contract Research services. Eurofins is also a

market leader in certain testing and laboratory services for

genomics, and in the support of clinical studies, as well as in

BioPharma Contract Development and Manufacturing. The Group also

has a rapidly developing presence in highly specialised and

molecular clinical diagnostic testing and in-vitro diagnostic

products.

With 58,000 staff across a decentralised and entrepreneurial

network of 900 laboratories in 54 countries, Eurofins offers a

portfolio of over 200,000 analytical methods to evaluate the

safety, identity, composition, authenticity, origin, traceability

and purity of a wide range of products, as well as providing

innovative clinical diagnostic testing services and in-vitro

diagnostic products.

The Group’s objective is to provide its customers with

high-quality services, innovative solutions and accurate results on

time. Eurofins is ideally positioned to support its clients’

increasingly stringent quality and safety standards and the

increasing demands of regulatory authorities as well as the

requirements of healthcare practitioners around the world.

In 2020 and 2021, Eurofins reacted quickly to meet the global

challenge of COVID-19, by creating the capacity to help over 20

million patients monthly who may have been impacted by the pandemic

with our testing products and our services and directly supporting

healthcare professionals working on the front line to fight the

virus. The Group has established widespread PCR testing

capabilities and has carried out over 40 million tests in its own

laboratories, is supporting the development of a number of vaccines

and has established its SAFER@WORK™ testing, monitoring and

consulting programmes to help ensure safer environments, travel and

events during COVID-19.

Eurofins has grown very strongly since its inception and its

strategy is to continue expanding its technology portfolio and its

geographic reach. Through R&D and acquisitions, the Group draws

on the latest developments in the field of biotechnology and

analytical chemistry to offer its clients unique analytical

solutions.

Shares in Eurofins Scientific are listed on the Euronext Paris

Stock Exchange (ISIN FR0014000MR3, Reuters EUFI.PA, Bloomberg ERF

FP).

Until it has been lawfully made public widely by Eurofins

through approved distribution channels, this document contains

inside information for the purpose of Regulation (EU) 596/2014 of

the European Parliament and of the Council of 16 April 2014 on

market abuse, as amended.

Important disclaimer:

This press release contains forward-looking statements and

estimates that involve risks and uncertainties. The forward-looking

statements and estimates contained herein represent the judgment of

Eurofins Scientific’s management as of the date of this release.

These forward-looking statements are not guarantees for future

performance, and the forward-looking events discussed in this

release may not occur. Eurofins Scientific disclaims any intent or

obligation to update any of these forward-looking statements and

estimates. All statements and estimates are made based on the

information available to the Company’s management as of the date of

publication, but no guarantees can be made as to their completeness

or validity.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220420006159/en/

Investor Relations Eurofins Scientific SE Phone: +32 2 766 1620

E-mail: ir@eurofins.com www.eurofins.com

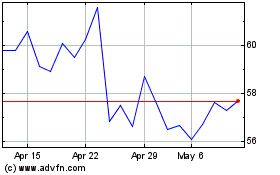

Eurofins Scientific (EU:ERF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Eurofins Scientific (EU:ERF)

Historical Stock Chart

From Jan 2024 to Jan 2025