Capgemini Press Release// Capgemini announces proposal to acquire Australian digital services consultancy provider, RXP Servi...

November 10 2020 - 5:00PM

Capgemini Press Release// Capgemini announces proposal to acquire

Australian digital services consultancy provider, RXP Services

Hi,

Please find below the press release issued today at 9.00am

Sydney time.

Best regards,

Sam ConnattyDirector, Global Public Relations |

Group Marketing and Communications

Capgemini Group | LondonTel.: +44 (0) 370 904 3601 – Mob.: + 44

(0) 7811 486517Email: sam.connatty@capgemini.comt:

@SamConnatty_________________________

Press contact:Sam ConnattyTel.:

+44 370 904 3601 Email: sam.connatty@capgemini.com

Investor Relations

contact:Vincent BiraudTel.: +33 1 47 54 50 87Email:

vincent.biraud@capgemini.com

Capgemini announces proposal to acquire

Australian digital services consultancy provider, RXP

Services Acquisition will mark a step-change in

Capgemini’s Australia footprint

Paris, November 10, 2020 –

Capgemini announced today that it has

entered into an a scheme implementation deed (Scheme Implementation

Deed) with RXP Services (ASX: RXP) to acquire RXP Services under an

Australian statutory shareholder approved process (Scheme). With

over 550 professionals in four locations across Australia, this

acquisition would strengthen Capgemini’s capabilities in digital,

data and cloud in the country. This development supports

Capgemini’s strong growth ambition in the Asia-Pacific

region.

Headquartered in Melbourne, with locations in

Sydney, Canberra and Hobart, RXP Services (with FY revenues ended

30 June-2020 of A$127m) provides cohesive, end-to-end capabilities

to design, build and support digital solutions to clients in key

industries across Australia.

RXP Services has built dynamic partnerships with

market leading platforms and technology providers to deliver and

manage its digital solutions. Highly complementary to Capgemini’s

set of digital expertise successfully developed locally, RXP

Services would bring to Capgemini a well-established team of

specialist consultants across Microsoft, Salesforce and ServiceNow

technologies. The acquisition of RXP Services would increase

Capgemini’s capabilities in digital in Australia and New Zealand,

while strengthening its client portfolio across key industries. For

RXP Services, Capgemini’s breadth of service offerings and global

scale will help to meet its clients’ growing needs as well as

expand career opportunities for its team members. In addition, RXP

Services also owns leading branding, design and customer experience

agency “The Works” which will open a new chapter in Capgemini’s

local capabilities to enable, design and deliver end to end amazing

and differentiated digital experiences.

“The acquisition of RXP Services will make

Capgemini a market leader in Australia in digital, data and cloud,

enhancing our ability to provide our clients with value, scale and

world-class expertise” said Luc-Francois Salvador, Executive

Chairman of Capgemini in Asia Pacific and the Middle East. “This

transaction will be a step change for Capgemini in Australia and

illustrates Capgemini’s growth ambition in Asia Pacific. Both

companies share similar values and vision of the role of technology

and humanity in successfully transforming businesses and society.

Our strengths will enable us to use insights, design and technology

to create inclusive and sustainable futures for our clients.”

“At RXP Services we believe its critical that

digital consultancies focus on the people aspect of

technology-enabled solutions, hence Capgemini’s conviction that the

value of technology comes from and through people is very

complementary to our beliefs,” comments Ross Fielding, Chief

Executive Officer, RXP Services. “In addition to the natural fit,

joining Capgemini would offer a larger scale and capability for our

RXP Services teams to deliver end to end solutions that our clients

need and want, with the option to expand them globally. The RXP

Services board and I unanimously recommend that RXP Services

shareholders vote in favor of the Scheme in the absence of a

superior proposal and subject to the independent expert concluding

(and continuing to conclude) that the Scheme is in the best

interests of RXP Services shareholders.”

Capgemini currently has offices in Sydney,

Melbourne, Canberra, Brisbane, Perth, Auckland and Wellington.

Capgemini has been accelerating the digital transformation of its

clients across industries locally, offering capabilities in

strategy and transformation, application and technology, and

operations and engineering. Earlier this year, Capgemini announced

the acquisition of Australian MuleSoft specialist WhiteSky

Labs.

The total proposed consideration for the

acquisition of 100% of the share capital of RXP Services (on a

fully dilutive basis) would amount to A$95.5 million1. The

implementation of the Scheme remains subject to certain conditions

including RXP Services shareholder approval, court approval,

regulatory approvals and other customary conditions for a

transaction of this nature. Capgemini’s acquisition of RXP Services

is expected to close in early 2021.

About Capgemini

Capgemini is a global leader in consulting,

digital transformation, technology, and engineering services. The

Group is at the forefront of innovation to address the entire

breadth of clients’ opportunities in the evolving world of cloud,

digital and platforms. Building on its strong 50-year heritage and

deep industry-specific expertise, Capgemini enables organizations

to realize their business ambitions through an array of services

from strategy to operations. A responsible and multicultural

company of 265,000 people in nearly 50 countries, Capgemini’s

purpose is to unleash human energy through technology for an

inclusive and sustainable future. With Altran, the Group reported

2019 combined global revenues of €17 billion.

Visit us at www.capgemini.com.

1 Based on 173,119,378 shares and 453,806 performance

rights.

- Capgemini_-_2020-11-10_-_RXP_Services_acquisition_project

(1)

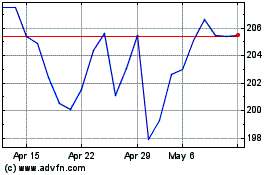

Capgemini (EU:CAP)

Historical Stock Chart

From Oct 2024 to Nov 2024

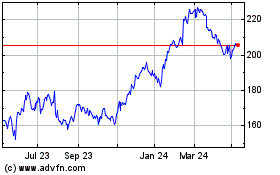

Capgemini (EU:CAP)

Historical Stock Chart

From Nov 2023 to Nov 2024