UPDATE: Accor Swings To Profit, Sees Growth In Hotels Sector

February 23 2011 - 12:30PM

Dow Jones News

Accor SA (AC.FR) Wednesday swung to a full-year profit after

getting a boost from the spin-off of its vouchers business and as

hotel bookings picked up.

Net profit for 2010 was EUR3.6 billion, up from a EUR282 million

loss in 2009, mainly due to a capital gain of over EUR4 billion

from the sale of Edenred (EDEN.FR) which became a separately-listed

company in June last year.

In the previous year, profit was hit by restructuring costs,

impairment charges and lower sales.

The group, which owns hotels ranging from the upscale Sofitel

chain to the U.S.-based Motel6 low-budget brand, said it expects

the hotel sector recovery to continue this year, chiefly from

rising occupancy rates and with some improvement expected in room

prices, said Finance Director Sophie Stabile on a conference call

with reporters.

Still, regions where the turnaround has been slower, such as

Italy, Spain, the Middle East and Africa, will likely remain

"difficult," she said.

The hotels sector, one of the first to see business drop off

during the economic slump, has begun to pick up as tourism

increases and companies lift bans on business travel.

U.K.-based rival InterContinental Hotels Group PLC (IHG) last

week said it expects a continued recovery in the sector this

year.

Accor's new CEO Denis Hennequin, a former McDonald's Corp. (MCD)

executive recruited for his expertise in extending the fast-food

chain's franchise stores in Europe, said the company will focus on

cultivating the reputation of its hotels brands to encourage

franchisees to pay higher fees.

Stripped of its highly-valuable vouchers division, which funded

the group's hotel expansion, the company is switching to a model

that emphasizes franchises and management contracts, selling off

property owned outright and reducing the proportion of hotels

paying fixed rent, making it less vulnerable to economic

swings.

Accor last month reported annual sales of EUR5.95 billion, up

7.1% on a like-for-like basis that strips out exchange rates and

disposals.

Hennequin Wednesday said he is not a "maniac" about

acquisitions, citing the company's potential to grow organically,

but said he would not rule them out.

Analysts said the earnings report met expectations and held few

surprises.

"Results sound good as Accor benefited from hotels' cyclical

upturn and asset disposals," noted Exane BNP Paribas in a research

note. Shares have risen nearly 8% over past three months, in line

with the CAC-40 index, up nearly 9% over the same period.

At 1653 GMT, Accor shares traded down 3.7% to EUR33.91,

underperforming the CAC-40, which was down 0.9%.

-By Mimosa Spencer, Dow Jones Newswires; +33 1 40 17 1773;

mimosa.spencer@dowjones.com

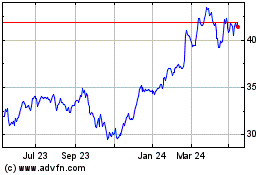

Accor (EU:AC)

Historical Stock Chart

From Dec 2024 to Jan 2025

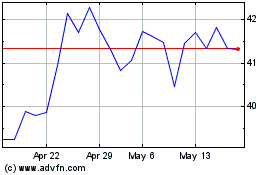

Accor (EU:AC)

Historical Stock Chart

From Jan 2024 to Jan 2025