Why Isn’t XRP Price Moving? Crypto Pundit Claims The Answer

October 14 2024 - 8:30AM

NEWSBTC

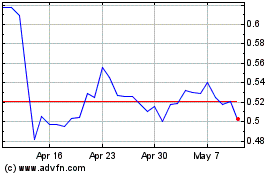

XRP has been one of the underperformers in the current crypto

market cycle, remaining approximately 86% below its all-time high

of $3.84 reached on January 4, 2018. Remarkably, despite

significant fluctuations in the meantime, XRP is trading at a price

similar to where it was one two years ago in October 2022. Crypto

pundit known as CryptoTank (@Tank2033js) shared an explanation on X

to clarify why the XRP price isn’t moving as some might anticipate.

With 214,000 views, the thread gained a lot of attention. Why Is

XRP Price Stagnating? When Will It Change? “I’m getting a lot of

comments about XRP price and why it’s not moving,” began

CryptoTank. “Let me explain once more how XRP price is determined

for the new people to this space and those that still have trouble

understanding.” According to his analysis, the price of XRP is

calculated by dividing the value or volume transacted on the XRP

Ledger (XRPL) by the circulating supply of XRP. However, he

emphasizes that the commonly referenced circulating supply figure

of approximately 56 billion XRP is misleading. “Just because 56

billion is in circulation, it does not mean that the whole 56

billion is on the ledger for use,” he noted. A significant portion

of XRP is held in private wallets, by large holders known as

“whales,” or stored on exchanges, and thus not actively

participating in daily transactions on the ledger. Related Reading:

Analyst Forecasts XRP Bullish Breakout – A 1,000% Opportunity?

“What matters for price is how much of that supply is active on the

ledger,” he asserts. Estimating that about 20% of the circulating

supply is active daily, he suggests that around 10 billion XRP are

in use within the ledger’s ecosystem. This active supply is crucial

for providing liquidity in Automated Market Maker (AMM) pools,

which facilitate transactions by pairing XRP with other tokens or

currencies such as RLUSD (Ripple USD). He explains that banks and

financial institutions planning to use the XRPL for settlements

will operate with their own tokens or central bank digital

currencies (CBDCs), pairing them with RLUSD and utilizing the

liquidity available in the AMM pools. The XRPL employs an algorithm

designed to find the most efficient path for settlements,

defaulting to XRP as the primary source unless an alternative

offers a better route. “This algorithm uses XRP as the default

source of settlement and will only use something else if it’s

better than XRP, which most likely won’t be the case,” he

elaborates. To illustrate the potential magnitude of value

transacted on the ledger, CryptoTank highlighted the daily

settlement volumes of several major financial institutions. SWIFT,

the global provider of secure financial messaging services,

processes approximately $5 trillion in daily settlements. J.P.

Morgan Chase, one of the largest banking institutions in the United

States, handles around $10 trillion daily. Bank of America

processes about $7 to $8 trillion each day, and SBI Holdings in

Japan settles approximately $2 trillion daily. “That’s about $25

trillion daily in settlement with just four banks/institutions,” he

points out. Moreover, Ripple, the company behind XRP, reportedly

has over 1,700 non-disclosure agreements (NDAs) with various banks

and financial institutions, suggesting a vast network of potential

users for the XRPL. By conservatively assuming that only 10% of the

settlement volume from these four institutions moves onto the XRPL,

he estimated an on-ledger transaction volume of $2.5 trillion

daily. To ensure smooth and frictionless transactions without

failures—a critical requirement for banks—the liquidity in the AMM

pools would need to be substantial. “These pools have to be about

double the $2.5 trillion value to avoid failed transactions and

friction within the pools. Banks cannot have failed transactions,”

he stressed. This means that the total value or volume on the

ledger would need to be approximately $5 trillion to accommodate

the settlements efficiently. Related Reading: XRP Could Surge To

$60 Overnight Using SWIFT Model, Expert Says Using these figures,

he calculates the necessary price of XRP to facilitate this level

of daily settlement. “To determine the price XRP needs to be to

avoid friction and have deep enough liquidity pools to settle

without failure between different currencies or CBDCs, you take the

$5 trillion and divide it by the 10 billion of XRP in the pools,”

he explains. This calculation yields a required XRP price of $500.

“XRP’s price would need to be $500 to facilitate settlement daily,”

he emphasizes. “This is a very basic example of what will happen

when these banks start using XRP daily for settlement,” he adds. He

acknowledged that other factors could further enhance the value on

the ledger, such as the tokenization of assets, debt, and real

estate. “There are other factors like tokenized assets, tokenized

debt, tokenized real estate, etc., that will all add value to the

ledger in the future,” he notes. Addressing skeptics who doubt the

potential for XRP to reach such high valuations, he states: “For

anyone saying XRP will never be a high price, you really don’t

understand what XRP is going to be used for or how it works. Retail

doesn’t matter, market cap doesn’t matter, charts are nice to look

at but don’t matter either.” He argues that traditional metrics

used to assess cryptocurrency value are less relevant in the

context of XRP’s intended utility for institutional settlements.

“You can’t chart how much liquidity or depth of AMM pools will be

needed to handle the settlement of those 1,700+ NDAs on a daily

basis,” he contends. “Nobody has any clue how high that number will

be. XRP must be a high price or it won’t work efficiently to do

what it was designed to do, which is handle large transactions fast

and cheap.” However, not everyone in the crypto community agrees

with his assessment. A user representing chart analysts on X

responded to his thread, stating: “Wrong: The chart is the only

thing that matters. Buy coins based on chart technical analysis and

you do a lot better than buying narratives and hoping for it to

pump. That’s why 99% of retail fails. Sad but true.” In response,

CryptoTank defended his position, emphasizing the impending shift

in the crypto landscape due to institutional adoption. “You clearly

have no idea how utility tokens work or what is about to take place

globally in this space,” he retorted. “Soon retail speculation will

be dwarfed by institutional adoption and usage. 99% of coins will

become obsolete. The big money is coming into the game and

everything will change.” At press time, XRP traded at $0.542.

Featured image created with DALL.E, chart from TradingView.com

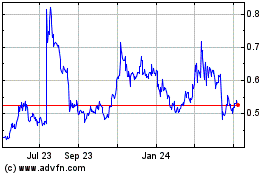

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024