Bitcoin Could Crash Into $50,000s Before Skyroacketing, Claims Fundstrat CEO

January 14 2025 - 6:00AM

NEWSBTC

In a recent appearance on CNBC’s “Squawk Box,” Tom Lee, Fundstrat

Capital CIO and head of research, suggested that Bitcoin may still

have a ways to fall before posting a substantial recovery. During

the January 13 segment, Lee spoke about the broader market

concerns—such as inflation, bond yields, and earnings—before

drawing a parallel to the crypto space, specifically Bitcoin’s

trajectory. Could Bitcoin Crash Into The $50,000s? “Bitcoin is down

roughly 15% from its highs which for a hyper volatile asset is a

normal correction and following global liquidity. We are early in

the halving cycle,” Lee remarked, underscoring that price swings of

this magnitude are common in the digital assets realm. He also

elaborated on technical markers indicating future volatility,

stating, “One level would be $70,000.” A less likely scenario, but

still possible, is a crash into the $50,000s. “It could go as low

as the $50,000s. But that’s again not a new level. That’s where it

touches before it begins to rally,” Lee remarked. Related Reading:

8 Bitcoin Price Predictions For 2025: What Banks, Hedge Funds And

Experts Say Lee’s perspective paints a picture of a two-pronged

price movement for Bitcoin: a potential drop to the “$50,000s,”

followed by a climb that could reach, in his words, “maybe $200,000

or $250,000.” He noted that despite the possibility of a downward

move, long-term holders should not be deterred. “Bitcoin is

something you need to be long-term focused on. I don’t think anyone

is losing money buying here at $90,000. If they are trying to time

this, maybe they get lucky and it goes to $70,000 but to me,

Bitcoin could be significantly higher this year, maybe $200,000 or

$250,000. So, I think $90,000 is still a great entry point,” the

Fundstrat CEO stated. Lee’s remarks came amid a broader discussion

on market dynamics. The conversation opened with the recent dip in

equities and whether the Federal Reserve’s decision to pause rate

cuts might spook investors. Lee pointed to upcoming inflation data

as a critical pivot, explaining, “We’ve been correcting now for

almost a month… I would like to see CPI come in below 2.5% or so. I

think that would give that jolt of confidence to markets on top of

earnings.” Related Reading: Could Bitcoin Hit Its Peak In Summer

2025? Analysts Weigh In He went on to highlight what he sees as

short-term noise around inflation statistics, which have been

muddled by external events such as hurricanes and fires. “The

hurricanes last year have muddled some of the inflation quality

because for instance, hotel reservations would go up… It will

muddle used car prices as well,” Lee said, adding that once these

anomalies clear, overall inflation could register lower. In

discussing Federal Reserve policy, Lee maintained a balanced

stance, saying, “I think the best case is the Fed doing one cut

because the economy’s strong enough and they are still dovish… They

will make their way to neutral. If they push the cuts to 2026 and

2027, that’s a longer rate to support markets.” He believes the

markets remain sensitive to policy uncertainty, particularly under

a new administration. When asked whether stocks were overvalued,

Lee drew a parallel to bond yields: “To me, the ten-year even if it

gets to 5%, is a 20 PE multiple on a ten-year bond… The median PE

is 17 times. I think stocks are giving you much better value than a

bond right now.” At press time, BTC traded at $95,618. Featured

image created with DALL.E, chart from TradingView.com

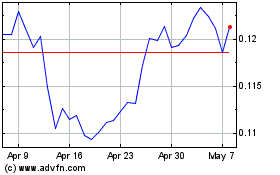

TRON (COIN:TRXUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025