Analyst Says Polygon (MATIC) On Brink Of Major Move, Here’s Why

December 21 2023 - 11:00AM

NEWSBTC

A cryptocurrency analyst has explained that Polygon could be on the

brink of a major move due to a pattern in an on-chain indicator.

Polygon Whale Transactions Have Shot Up Recently In a new post on

X, analyst Ali has pointed out how the whales have shown a notable

surge in activity on the MATIC network recently. The relevant

indicator here is the “whale transaction count,” which keeps track

of the total number of Polygon transfers happening on the

blockchain that exceed a value of $100,000. When the value of this

metric is high, it means that the a large amount of such

transactions are taking place right now. Such a trend is a sign

that the whale entities have an active interest in trading the

cryptocurrency. Related Reading: XRP Whales Show Exchange Inflow

Activity, Bad Sign For Price? On the other hand, the indicator

being low implies the whales are potentially not paying much

attention to the asset currently, as they aren’t making too many

moves. Now, here is a chart that shows the trend in the Polygon

whale transaction count over the past month: The value of the

metric appears to have been quite high in recent days | Source:

@ali_charts on X As displayed in the above graph, the Polygon whale

transaction count has observed a sharp rise in the last few days

and has attained high levels not seen at any point during the past

month. In the chart, Ali has also attached the data for another

version of the metric that keeps track of only the MATIC

transactions that are carrying a value of at least $1 million.

These massive transactions are the ones more likely to move the

market and it would appear that they have also gone up in number

recently, implying that the whales haven’t been shy of moving

around large stacks. “Such significant movements often signal

impending price changes,” explains the analyst in the post. “So we

could be on the brink of a major MATIC price move!” Any volatility

that may arise of this high whale activity, however, could

theoretically go in either direction, as the whale transaction

count only tells us whether the whales are active or not, and

doesn’t contain any info about whether buying or selling is

dominant. Related Reading: Ethereum Retests Breakout Zone, Analyst

Sets $3,500 Target Considering that the transactions have spiked

after the price has registered a significant drawdown from its

recent local top above $0.94, though, it’s possible that the whales

are making these moves to buy at the current relatively low prices.

It now remains to be seen how the Polygon price develops in the

coming days given the high amount of trading activity that the

whales have been participating in. MATIC Price Following the recent

plunge, Polygon hasn’t been moving much in the last few days as its

price has gone rather stale below the $0.80 level. The below chart

shows how the cryptocurrency has performed during the last 30 days.

The price of the coin seems to have gone through a large drawdown

just a while ago | Source: MATICUSD on TradingView Featured image

from GuerrillaBuzz on Unsplash.com, charts from TradingView.com,

Santiment.net

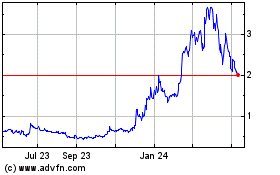

Stacks (COIN:STXUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

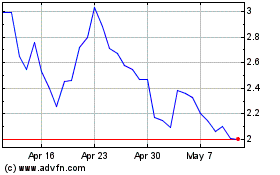

Stacks (COIN:STXUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024