Ethereum Price Crash Looming? Celsius To Unstake $465 Million ETH

January 05 2024 - 1:00PM

NEWSBTC

Celsius Network, the bankrupt cryptocurrency lending company, is

gearing up to unstake approximately $465 million worth of Ethereum

(ETH) as part of its efforts to compensate creditors. This

development follows the company’s bankruptcy filing in July 2022,

leaving creditors in a prolonged 18-month wait for financial

recompense. Celsius’s decision to unstake a substantial amount of

ETH is seen as a necessary step to ensure liquidity for creditor

compensation. The company’s official announcement, made via X

(formerly Twitter), highlights the strategic nature of this move:

“In preparation of any asset distributions, Celsius has started the

process of recalling and rebalancing assets to ensure ample

liquidity. Celsius will unstake existing ETH holdings, which have

provided valuable staking rewards income to the estate, to offset

certain costs incurred throughout the restructuring process. The

significant unstaking activity in the next few days will unlock ETH

to ensure timely distributions to creditors,” the announcement

reads. Celsius Responsible For Over 86% Of ETH In Exit Queue?

Blockchain analytics firm Nansen states that Celsius possesses

approximately one third of the total Ether in the unstaking exit

queue, totaling around 206,300 ETH. This figure translates to

a market value of around $465 million. To date, Celsius has already

withdrawn over 40,249 ETH. Related Reading: Ethereum Price Tops At

100 SMA, Why ETH Could Struggle In Near Term Tom Wan, an on-chain

data analyst at 21.co (parent company of 21Shares), elaborated on

the situation, “Over 540k staked ETH (16,670 Validators) are

currently withdrawing from the Ethereum Beacon chain. To fully exit

and withdraw now, it will require 14.5 days.” The researcher added

that 352,000 ETH (54.7%) waiting to be withdrawn belongs to Figment

and 206,000 ETH (32%) belongs to Celsius. “It is also likely that

the withdrawal by Figment belongs to Celsius. Earlier in June, when

Celsius redeemed 428.000 stETH from Lido, they have re-staked

197.000 ETH via Figment,” he added. Therefore, Celsius might be

responsible for unstaking 86.7% of all ETH in the queue. Ethereum

Price Crash Looming? While some investors express concern that the

release of such a large volume of tokens from staking could

adversely impact Ethereum’s price, others maintain a more composed

outlook, believing that the market is robust enough to absorb this

additional volume. Related Reading: Solana Has Flipped Ethereum In

Yet Another Metric In Its Bid To Reach $200 Even in the unlikely

event that all ETH from the queue is sold, liquidity appears to be

strong enough to absorb such a process, which would be gradual

rather than sudden. According to Coinmarketcap, the current ETH

trading volume stands around $11.35 billion, suggesting that the

market could withstand the potential sale of Celsius’ entire ETH

holdings without any major ETH price crash. Fear-mongering is

therefore superfluous. After receiving approval for its settlement

plan, Celsius has allowed eligible users to withdraw 72.5% of their

cryptocurrency holdings, with this option available until February

28. A court document filed in the previous September revealed that

approximately 58,300 users possess a total of $210 million in

assets, which the court has classified as “custody assets.” At

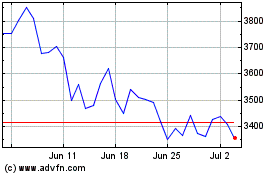

press time, ETH traded at $2,250. The 1-week chart for ETH/USD

indicates that, over the past five weeks, the price of Ethereum has

formed a consolidation range. The chart defines this zone with a

lower boundary at $2,125, indicated by the red area, and an upper

boundary at the 0.382 Fibonacci retracement level, located at

$2,441. Featured image from Shutterstock, chart from

TradingView.com

stETH (COIN:STETHUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

stETH (COIN:STETHUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024