Solana Outshines Rivals On Weekend Top 10 Roster With 18% Rally

October 07 2023 - 10:00AM

NEWSBTC

Solana experienced a significant surge of approximately 20% during

the last few days of September and into the first week of October.

This sudden price increase has piqued the interest of investors and

enthusiasts alike, sparking discussions about its underlying

causes. One prominent question on people’s minds is whether this

uptick in SOL’s value is directly correlated with Bitcoin’s

performance during the same period or if there are distinct factors

driving SOL’s price rise independently of Bitcoin’s movements.

Related Reading: Dogecoin Under Pressure: Will Bearish Momentum

Push Meme Coin Below $0.06? Before this increase, SOL had a tough

time because a U.S. court allowed the sale of $1.3 billion worth of

SOL from the bankrupt exchange FTX. So, there’s curiosity about

whether SOL’s recent price jump is connected to Bitcoin or if there

are other factors behind it. Solana: Challenges And Market Allure

The Solana (SOL) blockchain network has seen recent difficulties,

however it has garnered significant attention and demand in the

market. Despite the lackluster price performance of its native

token, the proof-of-stake (PoS) network has utilised the bear

market to improve its technological capabilities and forge

important alliances with prominent entities in the realm of

traditional banking. Source: Coingecko The bankruptcy court has

implemented mechanisms to mitigate the potential adverse impact of

FTX asset liquidation on the cryptocurrency market. These measures

involve mandating the sale of assets through a financial advisor in

weekly installments, adhering to predetermined regulations. At the

time of writing, SOL was trading at $23.43, down a measly 0.3% in

the last 24 hours, but gained sustained an 18% rally in the last

seven days, data from crypto market tracker Coingecko shows.

Related Reading: Trillions In Shiba Inu On The Move: What Lies

Ahead For The Meme Coin? SOL Liquidity Soars With Network Stability

Nansen, an on-chain analytics firm, recently published a report on

Solana, highlighting its key strengths and potential. Solana is

known for its cost-efficiency and high-speed transactions, earning

it the nickname “The Ethereum Killer.” It boasts a transaction

processing speed of over 3,000 transactions per second, which is

nearly 30 times faster than Ethereum. The chain’s liquidity

improved as a result of the dramatic increase in network stability.

At press time, the TVL in terms of SOL was $27.12 million, more

than double what it was at the start of the year. SOL market cap

currently at $9.7 billion. Chart: TradingView.com Solana’s Rise

Fueled by DApps And NFTs, Targets 5th-Largest Crypto Spot The surge

of SOL was further bolstered by the expansion in the adoption of

decentralized applications (DApps) and the rise in nonfungible

token (NFT) volumes on the Solana blockchain. The current price of

SOL is now making efforts to establish a support level at $23,

aiming to solidify its position as the fifth-largest cryptocurrency

(excluding stablecoins) in terms of market capitalization. In the

recent Epoch 512, 19.637 million SOL were unstaked, with a net

unstake of 16.516 million SOL (about $372 million). Most belonged

to a16z and the previous Alameda (now or ftx estate). a16z:

BZpEFk…oPPBm7 unstaked 5.006 million SOL, a16z-2: GCmFQL…ozXMwY

unstaked 2.033… — Wu Blockchain (@WuBlockchain) October 6, 2023

Meanwhile, recent updates to Solana Compass have revealed details

about recent activities on the Solana network, particularly during

the 512 epoch. The website that keeps tabs on SOL staking activity

suggests that there were around 19.637 million SOL coins that were

unstaked during this time. (This site’s content should not be

construed as investment advice. Investing involves risk. When you

invest, your capital is subject to risk). Featured image from

iStock

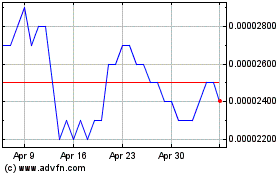

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024