Is Bitcoin in a bear market or a bull market correction?

March 12 2025 - 1:29PM

NEWSBTC

Bitcoin has fallen sharply over the past 30 days, falling from a

record high of 109k to a low of 77k this week, a level that was

last seen in November last year. This puts losses at almost 30%.

Many investors fear a bear market, which is typically measured by a

drop of 20% from a recent high in stock indices. However, a 30%

decline in crypto doesn’t automatically mean that it has entered a

bear market, given the high levels of volatility that are often

seen in crypto pricing, and an even deeper selloff could still be

on the cards. But these corrections are very normal in Bitcoin’s

bull market. Bitcoin has seen multiple 30%+ corrections in previous

bull markets before hitting new highs. Let’s not forget that

during the bull run in the 2021 cycle, Bitcoin lost more than 50%

of its value in May, only to recover rapidly in the following

months and register fresh record highs by November.

Furthermore, Bitcoin declined 20% from its 2024 record high of 73k

at the start of 2024. This record level was reached shortly after

the Bitcoin ETFs were launched in January, boosting the price to

73K in March, a few months later, and BTC had fallen to 55k by

May. In this article, we’ll explore Bitcoin’s recent decline,

macroeconomic factors influencing its price, key on-chain metrics,

and what levels traders are watching. We’ll also look at how

multi-asset brokers like PrimeXBT provide tools and market access

to trade Bitcoin’s volatility, whether prices are rising or

falling. Macro factors weigh on BTC & risk assets The

weakness in Bitcoin comes as the stock market has also experienced

a steep decline, with the tech-heavy Nasdaq falling over 10% from

its record high into correction territory and the S&P 500 down

8.5%. Investors have sold out of risk assets across the

board as trade tensions targeting major US trading partners have

rattled the markets, fueling concerns surrounding the US economic

outlook. The latest data from the prediction platform Polymarket

assigns a 39% probability of a US recession in 2025, up from 23% at

the end of February. Furthermore, investment banks have also been

upwardly revising the possibility of a US downturn. Given the

close correlation between US stocks and Bitcoin, the cryptocurrency

could struggle to thrive while equities still fall. The macro

backdrop would need to stabilise, recession risks recede, and Fed

rate cut optimism be revived to lift risk sentiment and risk

assets. On-chain metrics turn cautious On-chain data

metrics are also starting to show signs of caution. According

to CryptoQuant, the Bitcoin Bull-Bear Market Cycle Indicator is at

its most bearish level this cycle. This level has preceded a sharp

correction in previous cycles and, in some instances, the start of

a more prolonged downturn. Meanwhile, whale

accumulation, which has traditionally helped support the BTC price

through vast levels of acquisitions, shows signs of slowing. Spot

BTC ETFs have also flipped to net sellers, highlighting weakness in

institutional demand and adding further pressure to prices.

What price is a Bitcoin bear market? While stock and stock

indices are said to be in a bear market after losses of 20% or more

from a recent high, this doesn’t work for Bitcoin, owing to its

inherently volatile nature. Instead, the 50 Simple Moving Average

on the weekly chart could be a valuable metric to follow. The

price falling below the weekly 50 SMA could provide the trigger to

call a bear market. The BTC price moved below this dynamic support

in the bear markets of 2022 and 2018. The weekly

50 SMA sits at 75k. Should the price see a weekly close below this

level, bears could take control. Why trade Bitcoin with

PrimeXBT? Whether Bitcoin is in a deep correction phase or

heading into a bear market, the increased market volatility can

also be a source of opportunity. When the market experiences big

moves, this brings plenty of trading potential. PrimeXBT, a

global regulated multi-asset broker, offers a powerful all-in-one

trading ecosystem that enables users to buy, sell, and store

cryptocurrencies and trade over 100 popular markets. These markets

include crypto futures and CFDs on crypto, forex, indices, and

commodities, utilizing both fiat and crypto funds.

PrimeXBT allows users to go long (buy to open) or short (sell to

open) in the market, meaning you can seize trading opportunities

regardless of whether the market is falling or rising. With

leverage of up to 200x for crypto, ultra-low fees, deep liquidity,

and tight spreads, PrimeXBT offers some of the best trading

conditions in the industry. To help traders navigate Bitcoin’s

volatility, PrimeXBT provides advanced tools, including

TradingView-powered charting, risk management features like stop

loss and take profit, and a seamless trading interface designed for

both beginners and professionals. Additionally, traders can benefit

from exclusive rewards and bonuses, weekly trading contests, and a

referral program with high commission. Start trading with PrimeXBT

Disclaimer: The content provided here is for informational purposes

only and is not intended as personal investment advice and does not

constitute a solicitation or invitation to engage in any financial

transactions, investments, or related activities. Past performance

is not a reliable indicator of future results. The financial

products offered by the Company are complex and come with a high

risk of losing money rapidly due to leverage. These products may

not be suitable for all investors. Before engaging, you should

consider whether you understand how these leveraged products work

and whether you can afford the high risk of losing your money. The

Company does not accept clients from the Restricted Jurisdictions

as indicated on its website. Some services or products may not be

available in your jurisdiction.

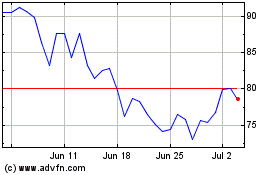

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

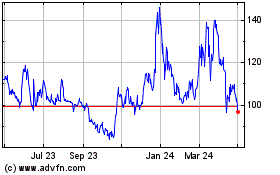

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025