Maker Sees 7% Upswing As Key Indicators Signal $2,662 Resistance Test

August 14 2024 - 12:00PM

NEWSBTC

Maker (MKR) is currently demonstrating bullish moves with a 7%

upswing, positioning it for a critical resistance test at $2,662.

This surge reflects growing optimistic sentiment as key technical

indicators suggest that the cryptocurrency could be on the verge of

a significant breakout. As the market turns green, expectations are

that the price of Maker maintain this momentum and push through the

$2,662 resistance level, potentially setting the stage for further

gains. This article tends to offer a clear understanding of Maker’s

potential price trajectory by analyzing the recent price movement,

exploring technical indicators, and assessing the significance of

the $2,662 resistance level. In the past 24 hours, Maker has

gone up by 7.01%, reaching around $2,133, with a market

capitalization of over $1.9 billion and a trading volume exceeding

$114 million at the time of writing. Maker’s market cap has

increased by 7.14%, while its trading volume has surged by 66.30%.

Understanding The 7% Surge: What’s Driving Maker’s Momentum?

Currently, the price of Maker on the 1-hour chart is bullish and is

approaching the 100-day Simple Moving Average (SMA) and the $2,662

mark. The digital asset has been on an upward spiral since it

failed to break below the key level of $1,731, which indicates that

the bulls are gaining control of the market and could drive the

price higher. Additionally, an analysis of the 1-hour Relative

Strength Index (RSI) shows that the signal line of the indicator

has successfully risen above 50% toward 70%, suggesting that buying

pressure greatly increases and the asset might experience further

upward movement. On the 4-hour, although Maker is still trading

below the 100-day SMA, it can be observed that the crypto asset is

attempting a bullish move toward the 100-day SMA, printing two

bullish momentum candlesticks. After the rebound at $1,731,

Maker has shown bullish resilience, keeping its pace above this

level. With this recent bullish sentiment, the digital asset could

extend its rally toward the $2,662 resistance level. Finally, on

the 4-hour chart, the RSI indicator also indicates a rising bullish

momentum for the cryptocurrency as the RSI signal line has moved

out of the overbought zone and is currently heading toward the 50%

level. Breaking Through $2,662: What It Could Mean For The Future

Of Maker If the bulls can sustain their strength in the market, the

price of Maker will continue to move upward toward the $2,662

resistance level. Should the price break and close above the $2,662

level, it may continue to rally toward the next resistance point at

$3,222 and possibly other levels. However, if Maker reverses

direction at the $2,662 resistance level, it would begin to drop

toward the direction of its previous support range at $1,731. When

the price breaches this support range, it could signal a deeper

bearish trend, leading to further price declines towards other

lower levels. Featured image from Adobe Stock, chart from

Tradingview.com

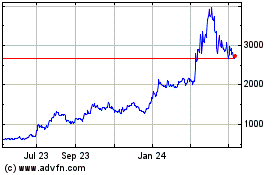

Maker (COIN:MKRUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

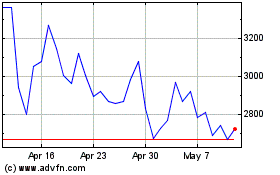

Maker (COIN:MKRUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025