Lawsuit Claims That Coinbase Pocketed Coins That Users Sent By Email

March 09 2018 - 12:08PM

ADVFN Crypto NewsWire

Bitcoin Global News (BGN)

March 09, 2018 -- ADVFN Crypto NewsWire -- Coinbase has been served

with a new class action lawsuit, filed March 2, alleging that it

“kept” funds that its users sent via email, but which recipients

never claimed. The Restis Law Firm filed the class action on behalf

of two Coinbase users seeking reimbursement of the funds sent using

email. The complaint claims that, “Defendant kept, and continues to

keep, unredeemed cryptocurrencies sent via email through

Coinbase.com...Imagine writing a cashier’s check to a friend. The

bank withdraws funds from your account, but your friend never

cashes the check. Does the bank get to keep the funds? The law

clearly says no. But this is exactly what has happened with

cryptocurrencies sent through Coinbase.com...Funds which cannot be

delivered to recipients due to stale email addresses are asked to

be turned over to the State of California in order to prevent

unjust enrichment of Coinbase.”

Coinbase at one time allowed its users to send Bitcoin,

Ethereum, Litecoin, and Bitcoin Cash to an external email addresses

instead of to a cryptocurrency wallet. The emails would link the

recipient to a Coinbase account setup landing page where the

recipient could ostensibly claim their cryptocurrency. However, not

every transaction was redeemed, and the plaintiffs are demanding to

know where the unredeemed funds went.

Anyone potentially affected by the Coinbase's alleged practice

of not returning emailed coins that went unclaimed can join the

class action, which states, “Until 2017, most people never heard of

a ‘bitcoin’ or cryptocurrency, so most of these emails were

disregarded. And most of the cryptocurrency went unclaimed. But

instead of notifying Plaintiffs and the Class they had unclaimed

cryptocurrencies, or turning those cryptocurrencies over to the

State of California as required by California’s Unclaimed Property

Law, Coinbase kept them.”

This new lawsuit comes right after a complaint filed against

Coinbase in San Francisco federal court regarding the launch of

Bitcoin Cash on Coinbase. That class action alleges insider trading

hurt Coinbase customers who placed purchase, sale, or trade orders

on the main exchange or its GDAX platform from December 19-21,

2017. The complaint claims that, “When Coinbase’s customers’ trades

were finally executed, it was only after the insiders had driven up

the price of BCH, and thus the remaining Bitcoin customers only

received their BCH at artificially inflated prices that had been

manipulated well beyond the fair market value of BCH at that

time.”

By: BGN Editorial Staff

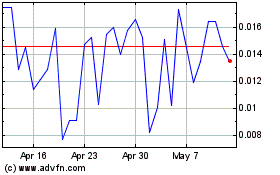

Enigma (COIN:ENGUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

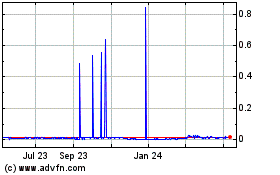

Enigma (COIN:ENGUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Enigma (Cryptocurrency): 0 recent articles

More Enigma News Articles