Bulls Thrust Solana To $25 – What Traders Should Expect Next

October 20 2023 - 1:00PM

NEWSBTC

Solana (SOL) has witnessed an impressive resurgence, climbing to

$25.46, marking a remarkable 10% rally in the past 24 hours. This

surge is part of a broader trend, with SOL’s price experiencing a

seven-day surge of 19.4%, further solidifying its position as one

of the prominent players in the crypto sphere. Solana’s remarkable

journey to its current valuation is a testament to its resilience,

especially considering the tumultuous events it weathered nearly a

year ago. In November, the cryptocurrency faced a severe setback

due to the FTX implosion saga, which sent SOL plummeting to

$8. However, Solana has emerged from the ashes, and the

crypto community is taking notice of its remarkable recovery.

Related Reading: Why Is Bitcoin SV (BSV) Up 63% Today? Find Out

Here Solana Technical Signals Point To A Bullish Momentum The

recent surge in SOL’s price can be attributed to several key

factors. One notable driver is the increasing network activity and

substantial growth within the Solana ecosystem, particularly in the

realm of decentralized finance (DeFi). This snippet is from

my “Is Solana Dead” video. Despite the FTX fallout, $SOL still has

a lot going on behind the scenes! If you want to see the whole

video, its on my channel, I will post the link on my X profile!

pic.twitter.com/De6j5aNGxx — Frankie Candles (@Frankie_Candles)

October 19, 2023 The crypto world was offered a glimpse of this

growth in a video shared by @Frankie_Candles, which shed light on

the vibrant activity happening “behind the scenes” in the Solana

ecosystem. Notably, the total value locked in Solana’s DeFi smart

contracts has seen a significant upswing, soaring from $210 million

in January 2023 to $331 million in October, as reported by

DefiLlama. SOL TVL. Source: DefiLlama Furthermore, Solana bulls

have reinforced the bullish outlook by successfully maintaining

support at the $25 mark and breaching the upper dotted falling

trendline. The presence of a buy signal is often considered

an encouraging sign for traders, reinforcing confidence in the

cryptocurrency’s upward trajectory. One key technical aspect to

watch out for is the potential for a “golden cross.” A golden cross

occurs when a short-term moving average crosses above a long-term

moving average, typically signaling a possible bullish breakout.

This could be a pivotal moment for Solana, as it may provide

further confirmation of its bullish momentum. SOL has a market cap

of $11.26 billion as of today. Chart: TradingView.com SOL Neckline

Resistance Another significant element to monitor on the charts is

the possibility of Solana conquering the neckline resistance once

again. The neckline resistance represents a critical point that

acts as a threshold for bullish momentum. Historically, breaking

through this level has been a precursor to sustained uptrends,

suggesting the potential for further gains in the near future. If

Solana manages to achieve this, it will mark a strong resurgence,

reaffirming its position as a strong force in the ever-evolving

cryptocurrency landscape. Related Reading: ETH Price Watch: Impact

On Price As Traders Ditch Bitcoin On Derivatives Market (This

site’s content should not be construed as investment advice.

Investing involves risk. When you invest, your capital is subject

to risk). Featured image from Shutterstock

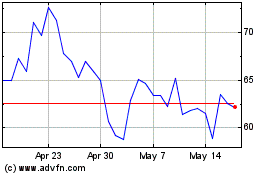

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

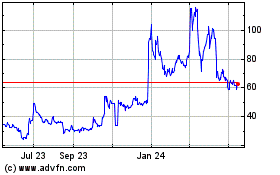

Bitcoin SV (COIN:BSVUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024