Bitcoin Accumulation: You Won’t Believe How Much BTC Holders Have Bought Since The Crash

April 19 2024 - 5:00PM

NEWSBTC

Bitcoin holders have again reaffirmed their faith in the flagship

crypto despite its recent price declines. This follows recent data

showing that Bitcoin accumulation addresses recorded a new all-time

high (ATH) amidst the current market downward trend.

Accumulation Addresses Record New All-Time High Of Bitcoin Inflows

Data from the on-chain analytics platform CryptoQuant shows that

over 27,700 BTC was transferred into accumulation addresses between

April 16 and 17. This is a new all-time high (ATH) for these

addresses in terms of their daily Bitcoin inflows. Related

Reading: Crypto Analyst Predicts Cardano Rally To $3 As Price

Reaches ‘Ultimate Support Test’ Before now, the highest amount of

BTC sent to these addresses in a day stood at 25,500, recorded on

March 23 earlier this year. Interestingly, the March 23 record came

just about a month after Bitcoin inflows into accumulation

addresses hit an all-time high (ATH) of 25,300 BTC on February

21. Accumulation addresses are wallets with no outgoing

transactions and have a balance of over 10 BTC. Accounts belonging

to centralized exchanges and Bitcoin Miners are excluded from this

category. Meanwhile, these addresses must have received two

incoming transactions, with the most recent occurring within the

last seven years. These addresses can be considered the most

bullish on Bitcoin, and the growing accumulation trend from these

wallets shows how much faith these long-term holders have in the

flagship crypto. Furthermore, they are also believed to be

positioning themselves ahead of the bull run, as BTC may never drop

to these price levels once it comes into full force.

Meanwhile, CryptoQuant’s CEO, Ki Young Ju, also highlighted the

significance of this development, noting that on-chain accumulation

has remained “very active” even as the demand for Spot Bitcoin ETFs

has stagnated for four weeks. This suggests that Bitcoin bulls

could help shore up the demand gap left open by these ETFs.

BTC Price Shows Strength Bitcoin dropped below the $60,000 support

level following reports about Israel’s retaliatory attack on Iran.

However, the flagship crypto showed strength as it quickly

rebounded above the $60,000 price mark. This is significant

considering how much Bitcoin and the broader crypto market declined

rapidly following Iran’s attack against Israel on April 13.

Related Reading: XRP Whales Are On The Move Again, But Are They

Bullish Or Bearish? Furthermore, the quick price recovery also

suggests that Bitcoin has established strong support around the

$60,000 price range and could be set for a parabolic move to the

upside once this period of consolidation is over. Crypto analyst

Crypto Rover also recently commented on Bitcoin’s future

trajectory, stating that the crypto token will come out with a

“banger” soon enough. At the time of writing, Bitcoin is trading at

around $62,000, up in the last 24 hours according to data from

CoinMarketCap. BTC price recovers above $64,000 | Source:

BTCUSD on Tradingview.com Featured image from Crypto News, chart

from Tradingview.com

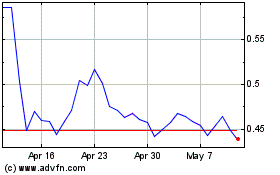

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

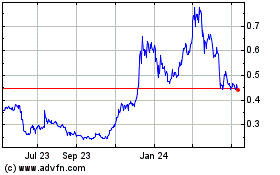

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024