Bitcoin Whales Driving The Rally Are Now Taking Profits, Data Suggests

December 07 2023 - 4:00PM

NEWSBTC

Data shows that the Bitcoin whales that may have been helping drive

the latest rally have switched to profit-taking instead. Bitcoin

Whales On BitMEX Have Changed Their Tune Recently An analyst in a

CryptoQuant Quicktake post explained that the BitMEX whales were

likely the ones helping fuel the latest rally. The relevant

indicator here is the “Open Interest,” which keeps track of the

total amount of Bitcoin derivative positions open on a centralized

exchange. When this metric’s value increases, investors are opening

up new contracts on the platform. On the other hand, a decline

suggests the holders are either getting liquidated or closing up

their positions of their own volition. Related Reading: Cardano

Could See 70% Rally To $0.75, Analyst Predicts When Now, here is a

chart that shows the trend in the Bitcoin Open Interest for two

exchanges, BitMEX and Binance, over the past few weeks: Looks like

the value of the metric has gone down for BitMEX in recent days |

Source: CryptoQuant The graph shows that the Bitcoin Open Interest

on BitMEX had observed a sharp rise at the start of the month when

the cryptocurrency’s price was still trading around the $38,000

level. This open interest increase followed a sharp rally for BTC

towards the $44,000 mark. As is visible in the chart, the

indicator’s value for Binance also registered an increase as the

rally occurred, but BitMEX’s rise stands out as it was huge and

pretty much happened in one go before the rally. Since BTC has hit

its local top above the $44,000 level, though, the BitMEX Open

Interest has plummeted, implying a large-scale closure of positions

on the platform has taken place. On the other hand, the metric’s

value for Binance has continued to stay high. The quant has also

attached charts of another metric for the two exchanges: the

“Funding Rates.” The funding rates keep track of the periodic fee

the derivative traders on an exchange currently pay each other.

When this indicator has a positive value, the longs are paying a

premium to the shorts to hold onto their positions right now. This

suggests that the traders on the platform share a majority of

bullish sentiment. The BitMEX Funding Rates had been favorable for

the duration that the Open Interest had been at high levels,

implying that most positions had been extended. However, with the

plunge in the indicator, the Funding Rates have returned to neutral

values. Related Reading: Is Bitcoin Overvalued Yet? What Historical

Data Suggests Based on this pattern, the analyst thinks the BitMEX

whales, potentially driving the rally earlier, have already taken

their profits, as they closed up a large chunk of their positions

near the top. The Open Interest hasn’t completely retraced itself

yet, but the fact that most of these whales have decided to pull

out may be a troubling sign for the rally’s continuation. BTC Price

Bitcoin has seen some retrace during the past day as the coin’s

price is now floating around $43,600. The value of the

cryptocurrency seems to have gone up sharply recently | Source:

BTCUSD on TradingView Featured image from Vivek Kumar on

Unsplash.com charts from TradingView.com, CryptoQuant.com

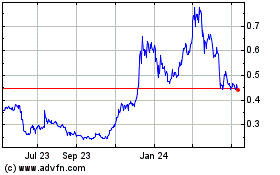

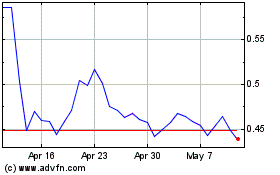

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cardano (COIN:ADAUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024