KKR-Led Consortium Aims to Invest in Ramsay Health Care's Growth

April 20 2022 - 9:30PM

Dow Jones News

By Stuart Condie

SYDNEY--The KKR & Co. Inc.-led consortium hoping to buy

Ramsay Health Care Ltd. anticipates further expansion for

Australia's largest private hospital operator, one of the

consortium members said.

Australian pension fund HESTA on Thursday confirmed that it was

part of the consortium that has made a takeover proposal that

values Ramsay at 20.1 billion Australian dollars (US$14.98

billion). The proposed acquisition is an opportunity to invest in

Ramsay's future growth, HESTA Chief Executive Debby Blakey

said.

Ramsay on Wednesday said it had received a nonbinding,

indicative proposal from a consortium of financial investors led by

New York-based KKR to it for A$88.00 per share. The stock jumped

24% on Wednesday, and is up 2.0% at A$81.61 shortly after

Thursday's open.

KKR on Thursday said that it aimed to finalize its nonexclusive

due diligence with a view to delivering a binding offer

expeditiously.

It said the consortium was confident that its offer represented

compelling shareholder value.

The Paul Ramsay Foundation--a philanthropic organization set up

by Ramsay's founder that held a 19% stake at March 31--said on

Wednesday it was supportive of the proposal.

Ms. Blakey said that Ramsay's healthcare professionals were a

key attraction to the consortium.

"They are vital to the ongoing success of Ramsay and are at the

forefront of the consortium's shared vision for expansion and

innovation," Ms. Blakey said.

Write to Stuart Condie at stuart.condie@wsj.com

(END) Dow Jones Newswires

April 20, 2022 21:15 ET (01:15 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

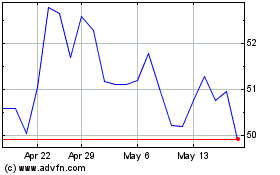

Ramsay Health Care (ASX:RHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

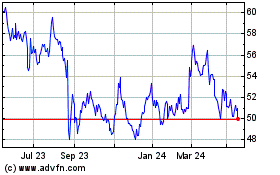

Ramsay Health Care (ASX:RHC)

Historical Stock Chart

From Dec 2023 to Dec 2024