FISCAL 2025 SECOND QUARTER KEY

FINANCIAL HIGHLIGHTS

- Second quarter revenues were $2.24 billion, a 5% increase

compared to $2.14 billion in the prior year, driven by growth at

the Digital Real Estate Services, Book Publishing and Dow Jones

segments

- Net income from continuing operations in the quarter was

$306 million, a 58% increase compared to $194 million in the prior

year

- Second quarter Total Segment EBITDA was $478 million, a 20%

increase compared to $400 million in the prior year

- In the quarter, reported EPS from continuing operations were

$0.40 as compared to $0.28 in the prior year - Adjusted EPS were

$0.33 compared to $0.27 in the prior year

- REA Group posted record revenues for the quarter of $343

million, a 17% increase compared to the prior year, driven by

continued strong Australian residential performance

- Dow Jones achieved record revenues for the quarter of $600

million, underpinned by improved circulation revenues and higher

professional information business revenues driven by growth of 11%

at Risk & Compliance and 10% at Dow Jones Energy

- Book Publishing revenues grew 8% in the quarter, while

Segment EBITDA increased 19%, driven by strong physical and digital

book sales

- Announced agreement to sell Foxtel to DAZN for A$3.4 billion

enterprise value. Results from Foxtel are reflected as discontinued

operations. This transaction will enable News Corp to further

simplify to drive long-term stockholder value and increase focus on

key growth pillars

News Corporation (“News Corp” or the “Company”) (Nasdaq: NWS,

NWSA; ASX: NWS, NWSLV) today reported financial results for the

three months ended December 31, 2024.

Commenting on the results, Chief Executive Robert Thomson

said:

“News Corp had a fruitful quarter, qualitatively and

quantitatively. Revenues on a continuing operations basis, which

excludes Foxtel, grew 5 percent to $2.24 billion, net income from

continuing operations surged 58 percent to $306 million and Total

Segment EBITDA rose 20 percent to $478 million.

The three pillars of growth—Digital Real Estate, Dow Jones and

Book Publishing—continued to expand Segment EBITDA robustly. We

also saw the positive impact of rigorous cost discipline and

digital development in the News Media segment, and our overall

margin rose meaningfully compared to the prior year.

With a keen eye on those core areas of growth, we took a

significant step towards simplification with the agreement to sell

Foxtel to DAZN, a premier global sports streaming provider, for a

total enterprise value of A$3.4 billion. The agreement is tangible

recognition of Foxtel’s successful digital transformation, and

should surely benefit our shareholders, our partners at DAZN and

all Australian sports fans.

We are providing priceless content for Generative AI, and remain

vigilant in our pursuit of degenerative AI. We are pleased with our

partnership with OpenAI and hope that other companies in the

segment take a similarly enlightened approach. Our legal action

against the perplexing Perplexity is underway and we look forward

with relish to document discovery. The sudden rise of DeepSeek is

itself a salutary lesson for all AI players. Data centers, chips,

and energy costs aside, we believe DeepSeek lacks the immediacy of

trusted news and, ultimately, content will be king in the world of

AI.”

SECOND QUARTER RESULTS

The Company reported fiscal 2025 second quarter total revenues

of $2.24 billion, a 5% increase compared to $2.14 billion in the

prior year period, primarily driven by higher Australian

residential revenues at REA Group, higher book sales at the Book

Publishing segment and higher circulation and subscription revenues

at the Dow Jones segment, in addition to an $11 million, or 1%,

positive impact from foreign currency fluctuations. The increase

was partly offset by modestly lower revenues at the News Media

segment. Adjusted Revenues (which excludes the foreign currency

impact, acquisitions and divestitures as defined in Note 2)

increased 4% compared to the prior year.

Net income from continuing operations for the quarter was $306

million, a 58% increase compared to $194 million in the prior year,

primarily driven by higher Total Segment EBITDA and higher Other,

net. These impacts were partially offset by higher income tax

expense.

The Company reported second quarter Total Segment EBITDA of $478

million, a 20% increase compared to $400 million in the prior year

due to strong contributions from all four operating segments.

Adjusted Total Segment EBITDA (as defined in Note 2) increased

20%.

Net income from continuing operations per share attributable to

News Corporation stockholders was $0.40 as compared to $0.28 in the

prior year.

Adjusted EPS (as defined in Note 3) were $0.33 compared to $0.27

in the prior year.

SEGMENT REVIEW

For the three months ended

December 31,

For the six months ended

December 31,

2024

2023

% Change

2024

2023

% Change

(in millions)

Better/

(Worse)

(in millions)

Better/

(Worse)

Revenues:

Dow Jones

$

600

$

584

3

%

$

1,152

$

1,121

3

%

Digital Real Estate Services

473

419

13

%

$

930

$

822

13

%

Book Publishing

595

550

8

%

1,141

1,075

6

%

News Media

570

582

(2

)%

1,111

1,148

(3

)%

Other

—

—

—

%

—

—

—

%

Total Revenues

$

2,238

$

2,135

5

%

$

4,334

$

4,166

4

%

Segment EBITDA:

Dow Jones

$

174

$

163

7

%

$

305

$

287

6

%

Digital Real Estate Services

185

147

26

%

325

269

21

%

Book Publishing

101

85

19

%

182

150

21

%

News Media

74

57

30

%

92

74

24

%

Other

(56

)

(52

)

(8

)%

(101

)

(106

)

5

%

Total Segment EBITDA

$

478

$

400

20

%

$

803

$

674

19

%

Dow Jones

Revenues in the quarter increased $16 million, or 3%, compared

to the prior year, driven by higher circulation and subscription

revenues from continued growth in the professional information

business, higher circulation revenues and higher content licensing

revenues, partially offset by lower print advertising revenues.

Digital revenues at Dow Jones in the quarter represented 81% of

total revenues compared to 78% in the prior year. Adjusted Revenues

increased 3%.

Circulation and subscription revenues increased $20 million, or

5%, reflecting a 4% increase in professional information business

revenues, led by 11% growth in Risk & Compliance revenues to

$80 million and 10% growth in Dow Jones Energy revenues to $68

million, partially offset by lower Factiva revenues primarily due

to an ongoing customer dispute. Circulation revenues increased 3%

compared to the prior year, as the continued growth in digital-only

subscriptions was partly offset by lower print volume. Digital

circulation revenues accounted for 73% of circulation revenues for

the quarter, compared to 70% in the prior year, while digital ARPU

improved sequentially.

During the second quarter, total average subscriptions to Dow

Jones’ consumer products were over 5.9 million, a 9% increase

compared to the prior year. Digital-only subscriptions to Dow

Jones’ consumer products grew 13% to over 5.3 million. Total

subscriptions to The Wall Street Journal grew 4% compared to the

prior year, to over 4.2 million average subscriptions in the

quarter. Digital-only subscriptions to The Wall Street Journal grew

7% to nearly 3.8 million average subscriptions in the quarter, and

represented 90% of total Wall Street Journal subscriptions.

For the three months ended

December 31,

2024

2023

% Change

(in thousands, except %)

Better/(Worse)

The Wall Street Journal

Digital-only subscriptions

3,787

3,528

7

%

Total subscriptions

4,225

4,052

4

%

Barron’s Group

Digital-only subscriptions

1,341

1,104

21

%

Total subscriptions

1,458

1,242

17

%

Total Consumer

Digital-only subscriptions

5,352

4,746

13

%

Total subscriptions

5,924

5,427

9

%

Advertising revenues decreased $5 million, or 4%, due to a 10%

decline in print advertising revenues, as digital advertising

revenues were flat. Digital advertising accounted for 64% of total

advertising revenues in the quarter, compared to 62% in the prior

year.

Segment EBITDA for the quarter increased $11 million, or 7%,

primarily as a result of the higher revenues discussed above and

lower newsprint, production and distribution costs, partially

offset by higher marketing costs. Adjusted Segment EBITDA increased

7%.

Digital Real Estate Services

Revenues in the quarter increased $54 million, or 13%, compared

to the prior year, driven by strong performance at REA Group, while

Move revenues increased for the first time in ten quarters. Segment

EBITDA in the quarter increased $38 million, or 26%, compared to

the prior year, due to higher contribution from REA Group. Adjusted

Revenues and Adjusted Segment EBITDA (as defined in Note 2)

increased 12% and 25%, respectively.

In the quarter, revenues at REA Group increased $51 million, or

17%, to $343 million, driven by higher Australian residential

revenues due to price increases, increased depth penetration and an

increase in national listings, higher revenues from REA India and a

$2 million positive impact from foreign currency fluctuations.

Australian national residential buy listing volumes in the quarter

increased 4% compared to the prior year, with listings in Sydney

and Melbourne each up 2%.

Move’s revenues in the quarter increased $3 million, or 2%, to

$130 million, primarily as a result of strong revenue growth in

seller, new homes and rentals, including the partnership with

Zillow, and increased advertising revenues, partially offset by the

ongoing impact of the macroeconomic environment on the housing

market, which led to lower lead and transaction volumes. Real

estate revenues, which represented 78% of total Move revenues, were

essentially flat. Based on Move’s internal data, average monthly

unique users of Realtor.com®’s web and mobile sites for the fiscal

second quarter decreased 6% compared to the prior year to 62

million. Lead volume was down 2% year over year as it continues to

be impacted by high mortgage rates and affordability issues.

Book Publishing

Revenues in the quarter increased $45 million, or 8%, compared

to the prior year, primarily driven by higher physical and digital

book sales. Key titles in the quarter included Cher: The Memoir by

Cher and Wicked by Gregory Maguire. Sales in the U.K. performed

well driven by multiple titles by Laurie Gilmore, as did Christian

publishing, driven by higher Bible sales. Adjusted Revenues

increased 8%.

Digital sales increased 9% compared to the prior year, driven by

13% growth from audiobook sales, which benefited from the continued

contribution from the Spotify partnership and strong market

conditions, in addition to higher e-book sales, which increased 6%

compared to the prior year. Digital sales represented 21% of

Consumer revenues for both the quarter and the prior year period.

Backlist sales represented approximately 61% of Consumer revenues

in the quarter compared to 60% in the prior year.

Segment EBITDA for the quarter increased $16 million, or 19%,

compared to the prior year, primarily due to the higher revenues

discussed above, partially offset by higher manufacturing costs due

to higher sales volume and higher employee costs. Adjusted Segment

EBITDA increased 19%.

News Media

Revenues in the quarter decreased $12 million, or 2%, as

compared to the prior year, primarily driven by lower revenues from

the transfer of third-party printing revenue contracts to News UK’s

joint venture with DMG Media and lower advertising revenues, partly

offset by a $7 million, or 1%, positive impact from foreign

currency fluctuations. Adjusted Revenues for the segment decreased

3% compared to the prior year.

Circulation and subscription revenues were flat compared to the

prior year, as cover price increases, higher digital subscribers

and the $5 million, or 2%, positive impact from foreign currency

fluctuations were offset by lower print volumes.

Advertising revenues decreased $4 million, or 2%, compared to

the prior year, primarily due to lower print advertising revenues

and lower digital advertising revenues at News UK mainly driven by

a decline in traffic at some mastheads due to algorithm changes at

certain platforms, partially offset by a $2 million, or 1%,

positive impact from foreign currency fluctuations.

In the quarter, Segment EBITDA increased $17 million, or 30%,

compared to the prior year, driven by cost savings at News UK as a

result of the combination of its printing operations with those of

DMG Media and other cost savings initiatives, including lower Talk

costs, partially offset by the lower revenues discussed above.

Adjusted Segment EBITDA increased 28%.

Sky News results have now been reflected within the News Media

segment. Revenue contribution in the quarter of $17 million was

flat compared to the prior year.

Digital revenues represented 39% of News Media segment revenues

in the quarter, compared to 37% in the prior year, and represented

37% of the combined revenues of the newspaper mastheads. Digital

subscribers and users across key properties within the News Media

segment are summarized below:

- Closing digital subscribers at News Corp Australia as of

December 31, 2024 were 1,126,000 (979,000 for news mastheads),

compared to 1,051,000 (940,000 for news mastheads) in the prior

year (Source: Internal data)

- The Times and Sunday Times closing digital subscribers,

including the Times Literary Supplement, as of December 31, 2024

were 616,000, compared to 575,000 in the prior year (Source:

Internal data).

- The Sun’s digital offering reached 70 million global monthly

unique users in December 2024, compared to 143 million in the prior

year (Source: Meta Pixel)

- New York Post’s digital network reached 90 million unique users

in December 2024, compared to 124 million in the prior year

(Source: Google Analytics)

CASH FLOW

The following table presents a reconciliation of net cash

provided by operating activities from continuing operations to free

cash flow:

For the six months ended

December 31,

2024

2023

(in millions)

Net cash provided by operating activities

from continuing operations

$

278

$

251

Less: Capital expenditures

(157

)

(154

)

Free cash flow

$

121

$

97

Net cash provided by operating activities from continuing

operations of $278 million for the six months ended December 31,

2024 was $27 million higher than net cash provided by operating

activities from continuing operations of $251 million in the prior

year, primarily due to higher Total Segment EBITDA, as noted above,

partly offset by higher working capital and tax payments.

Free cash flow in the six months ended December 31, 2024 was

$121 million compared to $97 million in the prior year. The

improvement in free cash flow was primarily due to higher cash

provided by operating activities from continuing operations, as

mentioned above.

Free cash flow is a non-GAAP financial measure. Free cash flow

is defined as net cash provided by (used in) operating activities

from continuing operations less capital expenditures. Free cash

flow excludes cash flows from discontinued operations. Free cash

flow may not be comparable to similarly titled measures reported by

other companies, since companies and investors may differ as to

what items should be included in the calculation of free cash

flow.

Free cash flow does not represent the total increase or decrease

in the cash balance for the period and should be considered in

addition to, not as a substitute for, the net change in cash and

cash equivalents as presented in the Company’s consolidated

statements of cash flows prepared in accordance with GAAP, which

incorporates all cash movements during the period.

The Company believes free cash flow provides useful information

to management and investors about the Company’s liquidity and cash

flow trends.

OTHER ITEMS

Dividends

The Company declared today a semi-annual cash dividend of $0.10

per share for Class A Common Stock and Class B Common Stock. This

dividend is payable on April 9, 2025 to stockholders of record as

of March 12, 2025.

Foxtel Sale

During the second quarter of fiscal 2025, the Company entered

into a definitive agreement to sell the Foxtel Group (“Foxtel”) to

DAZN Group Limited (“DAZN”). Under the terms of the agreement,

amounts outstanding under Foxtel’s shareholder loans with News Corp

(A$574 million of outstanding principal, including capitalized

interest, as of December 31, 2024) will be repaid in full in cash

at closing. Foxtel’s third-party borrowings will transfer with the

business, and News Corp will receive a minority equity interest in

DAZN of approximately 6% and hold one seat on its Board of

Directors. Telstra Group Ltd will also sell its minority interest

in Foxtel. The transaction is expected to close in the second half

of fiscal 2025, subject to regulatory approvals and other customary

closing conditions.

As a result of the progression of the sales process and the

discontinuation of further significant business activities in the

Subscription Video Services segment, the assets and liabilities of

Foxtel were classified as held for sale and the results of

operations have been classified as discontinued operations for all

periods presented as the disposition reflects a strategic shift

that has, and will have, a major effect on the Company’s operations

and financial results. Furthermore, upon reclassification of

Foxtel’s results, the Subscription Video Services segment ceased to

be a reportable segment and the residual results of the segment

were aggregated into the News Media segment. News Media segment

results have been recast to reflect this change for all periods

presented.

COMPARISON OF NON-GAAP TO U.S. GAAP INFORMATION

Adjusted Revenues, Total Segment EBITDA, Adjusted Total Segment

EBITDA, Adjusted Segment EBITDA, adjusted net income attributable

to News Corporation stockholders, Adjusted EPS, constant currency

revenues and free cash flow are non-GAAP financial measures

contained in this earnings release. The Company believes these

measures are important tools for investors and analysts to use in

assessing the Company’s underlying business performance and to

provide for more meaningful comparisons of the Company’s operating

performance between periods. These measures also allow investors

and analysts to view the Company’s business from the same

perspective as Company management. These non-GAAP measures may be

different than similar measures used by other companies and should

be considered in addition to, not as a substitute for, measures of

financial performance calculated in accordance with GAAP.

Reconciliations for the differences between non-GAAP measures used

in this earnings release and comparable financial measures

calculated in accordance with U.S. GAAP are included in Notes 1, 2,

3 and 4 and the reconciliation of net cash provided by operating

activities from continuing operations to free cash flow is included

above.

Conference call

News Corporation’s earnings conference call can be heard live at

5:00 p.m. EST on February 5, 2025. To listen to the call, please

visit http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking

Statements

This document contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements include, but are not

limited to, statements regarding trends and uncertainties affecting

the Company’s business, results of operations and financial

condition, the Company’s strategy and strategic initiatives,

including the sale of the Foxtel Group and other potential

acquisitions, investments and dispositions, the Company’s cost

savings initiatives and the outcome of contingencies such as

litigation and investigations. These statements are based on

management’s views and assumptions regarding future events and

business performance as of the time the statements are made. Actual

results may differ materially from these expectations due to the

risks, uncertainties and other factors described in the Company’s

filings with the Securities and Exchange Commission. More detailed

information about factors that could affect future results is

contained in our filings with the Securities and Exchange

Commission. The “forward-looking statements” included in this

document are made only as of the date of this document and we do

not have and do not undertake any obligation to publicly update any

“forward-looking statements” to reflect subsequent events or

circumstances, and we expressly disclaim any such obligation,

except as required by law or regulation.

About News Corporation

News Corp (Nasdaq: NWS, NWSA; ASX: NWS, NWSLV) is a global,

diversified media and information services company focused on

creating and distributing authoritative and engaging content and

other products and services. The company comprises businesses

across a range of media, including: information services and news,

digital real estate services and book publishing. Headquartered in

New York, News Corp operates primarily in the United States,

Australia, and the United Kingdom, and its content and other

products and services are distributed and consumed worldwide. More

information is available at: www.newscorp.com.

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited; in millions,

except per share amounts)

For the three months ended

December 31,

For the six months ended

December 31,

2024

2023

2024

2023

Revenues:

Circulation and subscription

$

745

$

725

$

1,488

$

1,449

Advertising

385

391

706

723

Consumer

572

527

1,093

1,029

Real estate

377

327

734

638

Other

159

165

313

327

Total Revenues

2,238

2,135

4,334

4,166

Operating expenses

(963

)

(970

)

(1,915

)

(1,948

)

Selling, general and administrative

(797

)

(765

)

(1,616

)

(1,544

)

Depreciation and amortization

(113

)

(110

)

(225

)

(211

)

Impairment and restructuring charges

(16

)

(12

)

(38

)

(49

)

Equity losses of affiliates

(8

)

(1

)

(11

)

(3

)

Interest expense, net

(3

)

(7

)

(3

)

(15

)

Other, net

92

21

114

(17

)

Income before income tax expense from

continuing operations

430

291

640

379

Income tax expense from continuing

operations

(124

)

(97

)

(185

)

(131

)

Net income from continuing operations

306

194

455

248

Net loss from discontinued operations, net

of tax

(23

)

(11

)

(28

)

(7

)

Net income

283

183

427

241

Net income attributable to noncontrolling

interests from continuing operations

(78

)

(34

)

(109

)

(64

)

Net loss attributable to noncontrolling

interests from discontinued operations

10

7

16

9

Net income attributable to News

Corporation stockholders

$

215

$

156

$

334

$

186

Weighted-average shares outstanding

Basic

568.5

571.9

568.8

572.1

Diluted

570.1

573.5

570.7

573.8

Net income (loss) attributable to News

Corporation stockholders per share:

Basic

Continuing operations

$

0.40

$

0.28

$

0.61

$

0.33

Discontinued operations

$

(0.02

)

$

(0.01

)

$

(0.02

)

$

—

$

0.38

$

0.27

$

0.59

$

0.33

Diluted

Continuing operations

$

0.40

$

0.28

$

0.61

$

0.32

Discontinued operations

$

(0.02

)

$

(0.01

)

$

(0.02

)

$

—

$

0.38

$

0.27

$

0.59

$

0.32

NEWS CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited; in

millions)

As of

December 31, 2024

As of

June 30, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

1,751

$

1,872

Receivables, net

1,655

1,420

Inventory, net

296

266

Other current assets

554

474

Current assets held for sale

2,196

340

Total current assets

6,452

4,372

Non-current assets:

Investments

365

429

Property, plant and equipment, net

1,241

1,272

Operating lease right-of-use assets

769

805

Intangible assets, net

1,893

1,948

Goodwill

4,265

4,336

Deferred income tax assets, net

241

332

Other non-current assets

935

957

Non-current assets held for sale

—

2,233

Total assets

$

16,161

$

16,684

LIABILITIES AND EQUITY

Current liabilities:

Accounts payable

$

365

$

254

Accrued expenses

832

986

Deferred revenue

431

483

Current borrowings

19

9

Other current liabilities

759

772

Current liabilities held for sale

1,324

551

Total current liabilities

3,730

3,055

Non-current liabilities:

Borrowings

1,948

2,093

Retirement benefit obligations

126

125

Deferred income tax liabilities, net

14

21

Operating lease liabilities

872

912

Other non-current liabilities

446

472

Non-current liabilities held for sale

—

995

Commitments and contingencies

Equity:

Class A common stock

4

4

Class B common stock

2

2

Additional paid-in capital

11,141

11,254

Accumulated deficit

(1,574

)

(1,889

)

Accumulated other comprehensive loss

(1,424

)

(1,251

)

Total News Corporation stockholders'

equity

8,149

8,120

Noncontrolling interests

876

891

Total equity

9,025

9,011

Total liabilities and equity

$

16,161

$

16,684

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited; in

millions)

For the six months ended

December 31,

2024

2023

Operating activities:

Net income

$

427

$

241

Net loss from discontinued operations, net

of tax

28

7

Net income from continuing operations

455

248

Adjustments to reconcile net income from

continuing operations to net cash provided by operating activities

from continuing operations:

Depreciation and amortization

225

211

Operating lease expense

37

36

Equity losses of affiliates

11

3

Impairment charges

—

24

Deferred income taxes

80

60

Other, net

(112

)

20

Change in operating assets and

liabilities, net of acquisitions:

Receivables and other assets

(247

)

(79

)

Inventories, net

(31

)

23

Accounts payable and other liabilities

(140

)

(295

)

Net cash provided by operating activities

from continuing operations

278

251

Investing activities:

Capital expenditures

(157

)

(154

)

Acquisitions, net of cash acquired

(13

)

(20

)

Purchases of investments in equity

affiliates and other

(107

)

(52

)

Proceeds from sales of investments in

equity affiliates and other

234

30

Other, net

(13

)

—

Net cash used in investing activities from

continuing operations

(56

)

(196

)

Financing activities:

Borrowings

61

273

Repayment of borrowings

(196

)

(268

)

Repurchase of shares

(78

)

(56

)

Dividends paid

(92

)

(85

)

Other, net

(37

)

(39

)

Net cash used in financing activities from

continuing operations

(342

)

(175

)

Cash flows from discontinued

operations:

Net cash provided by operating activities

from discontinued operations

90

53

Net cash used in investing activities from

discontinued operations

(43

)

(82

)

Net cash (used in) provided by financing

activities from discontinued operations

(11

)

31

Net cash provided by discontinued

operations

36

2

Net change in cash, cash equivalents, and

restricted cash

(84

)

(118

)

Cash, cash equivalents and restricted

cash, beginning of year

1,960

1,833

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(30

)

9

Cash, cash equivalents and restricted

cash, end of period

1,846

1,724

Less: Cash and cash equivalents at end of

period of discontinued operations

(58

)

(17

)

Less: Restricted cash included in Other

current assets(a)

(37

)

—

Cash and cash equivalents

$

1,751

$

1,707

(a) Represents restricted cash in escrow

to fund an acquisition at the Book Publishing segment which closed

in the third quarter of fiscal 2025

NOTE 1 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses

and selling, general and administrative expenses. Segment EBITDA

does not include: depreciation and amortization, impairment and

restructuring charges, equity losses of affiliates, interest

(expense) income, net, other, net, income tax (expense) benefit and

net income (loss) from discontinued operations, net of tax.

Management believes that Segment EBITDA is an appropriate measure

for evaluating the operating performance of the Company’s business

segments because it is the primary measure used by the Company’s

chief operating decision maker to evaluate the performance of and

allocate resources within the Company’s businesses. Segment EBITDA

provides management, investors and equity analysts with a measure

to analyze the operating performance of each of the Company’s

business segments and its enterprise value against historical data

and competitors’ data, although historical results may not be

indicative of future results (as operating performance is highly

contingent on many factors, including customer tastes and

preferences).

Total Segment EBITDA is a non-GAAP measure and should be

considered in addition to, not as a substitute for, net income

(loss) from continuing operations, cash flow from continuing

operations and other measures of financial performance reported in

accordance with GAAP. In addition, this measure does not reflect

cash available to fund requirements and excludes items, such as

depreciation and amortization and impairment and restructuring

charges, which are significant components in assessing the

Company’s financial performance. The Company believes that the

presentation of Total Segment EBITDA provides useful information

regarding the Company’s operations and other factors that affect

the Company’s reported results. Specifically, the Company believes

that by excluding certain one-time or non-cash items such as

impairment and restructuring charges and depreciation and

amortization, as well as potential distortions between periods

caused by factors such as financing and capital structures and

changes in tax positions or regimes, the Company provides users of

its consolidated financial statements with insight into both its

core operations as well as the factors that affect reported results

between periods but which the Company believes are not

representative of its core business. As a result, users of the

Company’s consolidated financial statements are better able to

evaluate changes in the core operating results of the Company

across different periods. The following tables reconcile net income

from continuing operations to Total Segment EBITDA for the three

and six months ended December 31, 2024 and 2023:

For the three months ended

December 31,

2024

2023

Change

% Change

(in millions)

Net income from continuing operations

306

194

112

58

%

Add:

Income tax expense from continuing

operations

124

97

27

28

%

Other, net

(92

)

(21

)

(71

)

(338

)%

Interest expense, net

3

7

(4

)

(57

)%

Equity losses of affiliates

8

1

7

700

%

Impairment and restructuring charges

16

12

4

33

%

Depreciation and amortization

113

110

3

3

%

Total Segment EBITDA

$

478

$

400

$

78

20

%

For the six months ended December

31,

2024

2023

Change

% Change

(in millions)

Net income from continuing operations

455

248

207

83

%

Add:

Income tax expense from continuing

operations

185

131

54

41

%

Other, net

(114

)

17

(131

)

**

Interest expense, net

3

15

(12

)

(80

)%

Equity losses of affiliates

11

3

8

267

%

Impairment and restructuring charges

38

49

(11

)

(22

)%

Depreciation and amortization

225

211

14

7

%

Total Segment EBITDA

$

803

$

674

$

129

19

%

**Not meaningful

NOTE 2 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND

ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment

EBITDA excluding the impact of acquisitions, divestitures, fees and

costs, net of indemnification, related to the claims and

investigations arising out of certain conduct at The News of the

World (the “U.K. Newspaper Matters”), charges for other

significant, non-ordinary course legal or regulatory matters

(“litigation charges”) and foreign currency fluctuations (“Adjusted

Revenues,” “Adjusted Total Segment EBITDA” and “Adjusted Segment

EBITDA,” respectively) to evaluate the performance of the Company’s

core business operations exclusive of certain items that impact the

comparability of results from period to period such as the

unpredictability and volatility of currency fluctuations. The

Company calculates the impact of foreign currency fluctuations for

businesses reporting in currencies other than the U.S. dollar by

multiplying the results for each quarter in the current period by

the difference between the average exchange rate for that quarter

and the average exchange rate in effect during the corresponding

quarter of the prior year and totaling the impact for all quarters

in the current period.

The calculation of Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA may not be comparable to

similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events

warrant adjustment. Adjusted Revenues, Adjusted Total Segment

EBITDA and Adjusted Segment EBITDA are not measures of performance

under generally accepted accounting principles and should not be

construed as substitutes for amounts determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues and reported

Total Segment EBITDA to Adjusted Revenues and Adjusted Total

Segment EBITDA for the three and six months ended December 31, 2024

and 2023:

Revenues

Total Segment EBITDA

For the three months ended

December 31,

For the three months ended

December 31,

2024

2023

Difference

2024

2023

Difference

(in millions)

(in millions)

As reported

$

2,238

$

2,135

$

103

$

478

$

400

$

78

Impact of acquisitions

(2

)

—

(2

)

—

—

—

Impact of foreign currency

fluctuations

(11

)

—

(11

)

(1

)

—

(1

)

Net impact of U.K. Newspaper Matters

—

—

—

4

2

2

As adjusted

$

2,225

$

2,135

$

90

$

481

$

402

$

79

Revenues

Total Segment EBITDA

For the six months ended December

31,

For the six months ended December

31,

2024

2023

Difference

2024

2023

Difference

(in millions)

(in millions)

As reported

$

4,334

$

4,166

$

168

$

803

$

674

$

129

Impact of acquisitions

(4

)

—

(4

)

1

—

1

Impact of foreign currency

fluctuations

(35

)

—

(35

)

(7

)

—

(7

)

Net impact of U.K. Newspaper Matters

—

—

—

6

5

1

As adjusted

$

4,295

$

4,166

$

129

$

803

$

679

$

124

Foreign Exchange Rates

Average foreign exchange rates used in the calculation of the

impact of foreign currency fluctuations for the three and six

months ended December 31, 2024 and 2023 are as follows:

Fiscal Year 2025

Q1

Q2

U.S. Dollar per Australian Dollar

$0.67

$0.65

U.S. Dollar per British Pound Sterling

$1.30

$1.28

Fiscal Year 2024

Q1

Q2

U.S. Dollar per Australian Dollar

$0.65

$0.65

U.S. Dollar per British Pound Sterling

$1.27

$1.24

Adjusted Revenues and Adjusted Segment EBITDA by segment for the

three and six months ended December 31, 2024 and 2023 are as

follows:

For the three months ended

December 31,

2024

2023

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

Dow Jones

$

599

$

584

3

%

Digital Real Estate Services

470

419

12

%

Book Publishing

593

550

8

%

News Media

563

582

(3

)%

Other

—

—

—

%

Adjusted Total Revenues

$

2,225

$

2,135

4

%

Adjusted Segment EBITDA:

Dow Jones

$

175

$

163

7

%

Digital Real Estate Services

184

147

25

%

Book Publishing

101

85

19

%

News Media

73

57

28

%

Other

(52

)

(50

)

(4

)%

Adjusted Total Segment EBITDA

$

481

$

402

20

%

For the six months ended December

31,

2024

2023

% Change

(in millions)

Better/(Worse)

Adjusted Revenues:

Dow Jones

$

1,148

$

1,121

2

%

Digital Real Estate Services

919

822

12

%

Book Publishing

1,136

1,075

6

%

News Media

1,092

1,148

(5

)%

Other

—

—

—

%

Adjusted Total Revenues

$

4,295

$

4,166

3

%

Adjusted Segment EBITDA:

Dow Jones

$

305

$

287

6

%

Digital Real Estate Services

322

269

20

%

Book Publishing

181

150

21

%

News Media

90

74

22

%

Other

(95

)

(101

)

6

%

Adjusted Total Segment EBITDA

$

803

$

679

18

%

The following tables reconcile reported revenues and Segment

EBITDA by segment to Adjusted Revenues and Adjusted Segment EBITDA

by segment for the three and six months ended December 31, 2024 and

2023:

For the three months ended

December 31, 2024

As

Reported

Impact of

Acquisitions

Impact of

Foreign

Currency

Fluctuations

Net Impact

of U.K.

Newspaper

Matters

As

Adjusted

(in millions)

Revenues:

Dow Jones

$

600

$

(1

)

$

—

$

—

$

599

Digital Real Estate Services

473

(1

)

(2

)

—

470

Book Publishing

595

—

(2

)

—

593

News Media

570

—

(7

)

—

563

Other

—

—

—

—

—

Total Revenues

$

2,238

$

(2

)

$

(11

)

$

—

$

2,225

Segment EBITDA:

Dow Jones

$

174

$

—

$

1

$

—

$

175

Digital Real Estate Services

185

—

(1

)

—

184

Book Publishing

101

—

—

—

101

News Media

74

—

(1

)

—

73

Other

(56

)

—

—

4

(52

)

Total Segment EBITDA

$

478

$

—

$

(1

)

$

4

$

481

For the three months ended

December 31, 2023

As

Reported

Impact of

Acquisitions

Impact of

Foreign

Currency

Fluctuations

Net Impact

of U.K.

Newspaper

Matters

As

Adjusted

(in millions)

Revenues:

Dow Jones

$

584

$

—

$

—

$

—

$

584

Digital Real Estate Services

419

—

—

—

419

Book Publishing

550

—

—

—

550

News Media

582

—

—

—

582

Other

—

—

—

—

—

Total Revenues

$

2,135

$

—

$

—

$

—

$

2,135

Segment EBITDA:

Dow Jones

$

163

$

—

$

—

$

—

$

163

Digital Real Estate Services

147

—

—

—

147

Book Publishing

85

—

—

—

85

News Media

57

—

—

—

57

Other

(52

)

—

—

2

(50

)

Total Segment EBITDA

$

400

$

—

$

—

$

2

$

402

For the six months ended December

31, 2024

As

Reported

Impact of

Acquisitions

Impact of

Foreign

Currency

Fluctuations

Net Impact

of U.K.

Newspaper

Matters

As

Adjusted

(in millions)

Revenues:

Dow Jones

$

1,152

$

(2

)

$

(2

)

$

—

$

1,148

Digital Real Estate Services

930

(2

)

(9

)

—

919

Book Publishing

1,141

—

(5

)

—

1,136

News Media

1,111

—

(19

)

—

1,092

Other

—

—

—

—

—

Total Revenues

$

4,334

$

(4

)

$

(35

)

$

—

$

4,295

Segment EBITDA:

Dow Jones

$

305

$

—

$

—

$

—

$

305

Digital Real Estate Services

325

1

(4

)

—

322

Book Publishing

182

—

(1

)

—

181

News Media

92

—

(2

)

—

90

Other

(101

)

—

—

6

(95

)

Total Segment EBITDA

$

803

$

1

$

(7

)

$

6

$

803

For the six months ended December

31, 2023

As

Reported

Impact of

Acquisitions

Impact of

Foreign

Currency

Fluctuations

Net Impact

of U.K.

Newspaper

Matters

As

Adjusted

(in millions)

Revenues:

Dow Jones

$

1,121

$

—

$

—

$

—

$

1,121

Digital Real Estate Services

822

—

—

—

822

Book Publishing

1,075

—

—

—

1,075

News Media

1,148

—

—

—

1,148

Other

—

—

—

—

—

Total Revenues

$

4,166

$

—

$

—

$

—

$

4,166

Segment EBITDA:

Dow Jones

$

287

$

—

$

—

$

—

$

287

Digital Real Estate Services

269

—

—

—

269

Book Publishing

150

—

—

—

150

News Media

74

—

—

—

74

Other

(106

)

—

—

5

(101

)

Total Segment EBITDA

$

674

$

—

$

—

$

5

$

679

NOTE 3 – ADJUSTED NET INCOME (LOSS) ATTRIBUTABLE TO NEWS

CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income (loss) attributable to News

Corporation stockholders from continuing operations and diluted

earnings per share from continuing operations (“EPS”) excluding

expenses related to U.K. Newspaper Matters, litigation charges,

impairment and restructuring charges and “Other, net”, net of tax,

recognized by the Company or its equity method investees, as well

as the settlement of certain pre-Separation tax matters (“adjusted

net income (loss) attributable to News Corporation stockholders”

and “adjusted EPS,” respectively), to evaluate the performance of

the Company’s operations exclusive of certain items that impact the

comparability of results from period to period, as well as certain

non-operational items. The calculation of adjusted net income

(loss) attributable to News Corporation stockholders and adjusted

EPS may not be comparable to similarly titled measures reported by

other companies, since companies and investors may differ as to

what type of events warrant adjustment. Adjusted net income (loss)

attributable to News Corporation stockholders and adjusted EPS are

not measures of performance under generally accepted accounting

principles and should not be construed as substitutes for

consolidated net income (loss) attributable to News Corporation

stockholders from continuing operations and net income (loss) per

share from continuing operations as determined under GAAP as a

measure of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported net income attributable

to News Corporation stockholders from continuing operations and

reported diluted EPS to adjusted net income attributable to News

Corporation stockholders and adjusted EPS for the three and six

months ended December 31, 2024 and 2023:

For the three months ended

December 31, 2024

For the three months ended

December 31, 2023

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net income attributable to

stockholders

EPS

Net income from continuing

operations

$

306

$

194

Less: Net income attributable to

noncontrolling interests from continuing operations

(78

)

(34

)

Net income attributable to News

Corporation stockholders from continuing operations

$

228

$

0.40

$

160

$

0.28

U.K. Newspaper Matters

4

0.01

2

0.01

Impairment and restructuring

charges(a)

16

0.03

12

0.02

Other, net

(92

)

(0.16

)

(21

)

(0.04

)

Tax impact on items above

—

—

—

—

Impact of noncontrolling interest on items

above

33

0.05

(1

)

—

As adjusted

$

189

$

0.33

$

152

$

0.27

(a)

During the three months ended

December 31, 2023, the Company recognized non-cash impairment

charges of $1 million at the News Media segment related to the

write-down of fixed assets associated with the combination of News

UK’s printing operations with those of DMG Media.

For the six months ended December

31, 2024

For the six months ended December

31, 2023

(in millions, except per share data)

Net income attributable to

stockholders

EPS

Net income attributable to

stockholders

EPS

Net income from continuing

operations

$

455

$

248

Less: Net income attributable to

noncontrolling interests from continuing operations

(109

)

(64

)

Net income attributable to News

Corporation stockholders from continuing operations

$

346

$

0.61

$

184

$

0.32

U.K. Newspaper Matters

6

0.01

5

0.01

Impairment and restructuring charges

(a)

38

0.07

49

0.09

Other, net

(114

)

(0.20

)

17

0.03

Tax impact on items above

(3

)

(0.01

)

(19

)

(0.04

)

Impact of noncontrolling interest on items

above

33

0.06

1

—

As adjusted

$

306

$

0.54

$

237

$

0.41

(a)

During the six months ended

December 31, 2023, the Company recognized non-cash impairment

charges of $22 million at the News Media segment related to the

write-down of fixed assets associated with the combination of News

UK’s printing operations with those of DMG Media.

NOTE 4 – CONSTANT CURRENCY REVENUES

The Company believes that the presentation of revenues excluding

the impact of foreign currency fluctuations (“constant currency

revenues”) provides useful information regarding the performance of

the Company’s core business operations exclusive of distortions

between periods caused by the unpredictability and volatility of

currency fluctuations. The Company calculates the impact of foreign

currency fluctuations for businesses reporting in currencies other

than the U.S. dollar as described in Note 2.

Constant currency revenues are not measures of performance under

generally accepted accounting principles and should not be

construed as substitutes for revenues as determined under GAAP as

measures of performance. However, management uses these measures in

comparing the Company’s historical performance and believes that

they provide meaningful and comparable information to investors to

assist in their analysis of our performance relative to prior

periods and our competitors.

The following tables reconcile reported revenues to constant

currency revenues for the three and six months ended December 31,

2024:

Q2 Fiscal 2024

Q2 Fiscal 2025

FX impact

Q2 Fiscal 2025 constant

currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Consolidated results:

Circulation and subscription

$

725

$

745

$

5

$

740

3

%

2

%

Advertising

391

385

2

383

(2

)%

(2

)%

Consumer

527

572

2

570

9

%

8

%

Real estate

327

377

1

376

15

%

15

%

Other

165

159

1

158

(4

)%

(4

)%

Total revenues

$

2,135

$

2,238

$

11

$

2,227

5

%

4

%

Dow Jones:

Circulation and subscription

$

441

$

461

$

—

$

461

5

%

5

%

Advertising

126

121

—

121

(4

)%

(4

)%

Other

17

18

—

18

6

%

6

%

Total Dow Jones segment revenues

$

584

$

600

$

—

$

600

3

%

3

%

Digital Real Estate Services:

Circulation and subscription

$

2

$

2

$

—

$

2

—

%

—

%

Advertising

32

35

—

35

9

%

9

%

Real estate

327

377

1

376

15

%

15

%

Other

58

59

1

58

2

%

—

%

Total Digital Real Estate Services segment

revenues

$

419

$

473

$

2

$

471

13

%

12

%

REA Group revenues

$

292

$

343

$

2

$

341

17

%

17

%

Q2 Fiscal 2024

Q2 Fiscal 2025

FX impact

Q2 Fiscal 2025 constant

currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Book Publishing:

Consumer

$

527

$

572

$

2

$

570

9

%

8

%

Other

23

23

—

23

—

%

—

%

Total Book Publishing segment revenues

$

550

$

595

$

2

$

593

8

%

8

%

News Media:

Circulation and subscription

$

282

$

282

$

5

$

277

—

%

(2

)%

Advertising

233

229

2

227

(2

)%

(3

)%

Other

67

59

—

59

(12

)%

(12

)%

Total News Media segment revenues

$

582

$

570

$

7

$

563

(2

)%

(3

)%

News UK

Circulation and subscription

$

141

$

143

$

5

$

138

1

%

(2

)%

Advertising

76

71

1

70

(7

)%

(8

)%

Other

22

12

—

12

(45

)%

(45

)%

Total News UK revenues

$

239

$

226

$

6

$

220

(5

)%

(8

)%

News Corp Australia

Circulation and subscription

$

106

$

105

$

—

$

105

(1

)%

(1

)%

Advertising

96

93

—

93

(3

)%

(3

)%

Other

34

35

—

35

3

%

3

%

Total News Corp Australia revenues

$

236

$

233

$

—

$

233

(1

)%

(1

)%

Q2 YTD Fiscal 2024

Q2 YTD Fiscal 2025

FX impact

Q2 YTD Fiscal 2025 constant

currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

Consolidated results:

Circulation and subscription

$

1,449

$

1,488

$

13

$

1,475

3

%

2

%

Advertising

723

706

7

699

(2

)%

(3

)%

Consumer

1,029

1,093

5

1,088

6

%

6

%

Real estate

638

734

7

727

15

%

14

%

Other

327

313

3

310

(4

)%

(5

)%

Total revenues

$

4,166

$

4,334

$

35

$

4,299

4

%

3

%

Dow Jones:

Circulation and subscription

$

877

$

920

$

2

$

918

5

%

5

%

Advertising

217

206

—

$

206

(5

)%

(5

)%

Other

27

26

—

$

26

(4

)%

(4

)%

Total Dow Jones segment revenues

$

1,121

$

1,152

$

2

$

1,150

3

%

3

%

Digital Real Estate Services:

Circulation and subscription

$

5

$

4

$

—

$

4

(20

)%

(20

)%

Advertising

67

73

—

$

73

9

%

9

%

Real estate

638

734

7

$

727

15

%

14

%

Other

112

119

2

$

117

6

%

4

%

Total Digital Real Estate Services segment

revenues

$

822

$

930

$

9

$

921

13

%

12

%

REA Group revenues

$

553

$

661

$

9

$

652

20

%

18

%

Book Publishing:

Consumer

1,029

1,093

5

$

1,088

6

%

6

%

Other

46

48

—

$

48

4

%

4

%

Total Book Publishing segment revenues

$

1,075

$

1,141

$

5

$

1,136

6

%

6

%

News Media:

Circulation and subscription

$

567

$

564

$

11

$

553

(1

)%

(2

)%

Advertising

439

427

7

$

420

(3

)%

(4

)%

Other

142

120

1

$

119

(15

)%

(16

)%

Total News Media segment revenues

$

1,148

$

1,111

$

19

$

1,092

(3

)%

(5

)%

Q2 YTD Fiscal 2024

Q2 YTD Fiscal 2025

FX impact

Q2 YTD Fiscal 2025 constant

currency

% Change - reported

% Change - constant currency

($ in millions)

Better/(Worse)

News UK

Circulation and subscription

$

285

$

289

$

9

$

280

1

%

(2

)%

Advertising

135

121

3

$

118

(10

)%

(13

)%

Other

47

23

—

$

23

(51

)%

(51

)%

Total News UK revenues

$

467

$

433

$

12

$

421

(7

)%

(10

)%

News Corp Australia

Circulation and subscription

$

213

$

208

$

2

$

206

(2

)%

(3

)%

Advertising

189

183

2

$

181

(3

)%

(4

)%

Other

72

76

1

$

75

6

%

4

%

Total News Corp Australia revenues

$

474

$

467

$

5

$

462

(1

)%

(3

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205444476/en/

Investor Relations Michael Florin

212-416-3363 mflorin@newscorp.com

Anthony Rudolf 212-416-3040 arudolf@newscorp.com

Corporate Communications Arthur

Bochner 646-422-9671 abochner@newscorp.com

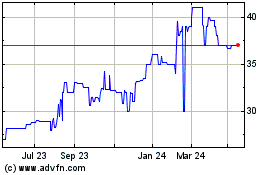

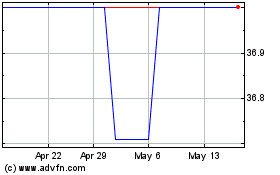

News (ASX:NWSLV)

Historical Stock Chart

From Jan 2025 to Feb 2025

News (ASX:NWSLV)

Historical Stock Chart

From Feb 2024 to Feb 2025