Australia's ACCC To Decide On NAB Undertakings On AXA Asia Pacific Bid By Sept. 9

August 08 2010 - 8:37PM

Dow Jones News

Australia's competition regulator said Monday it will take

another month to consider if an undertaking by National Australia

Bank Ltd. (NAB.AU) to sell AXA Asia Pacific Holdings Ltd.'s

(AXA.AU) North retail investment platform alleviates the concerns

that led to it rejecting NAB's A$13.3 billion bid for the wealth

management firm.

"The undertakings provide for the divestiture of the North

platform administration business carried out by AXA, using the

Bluedoor software owned by DST Global Solutions, to IOOF Ltd.," the

Australian Competition and Consumer Commission said in a

statement.

The ACCC rejected NAB's original proposal on April 19 after

ruling that it would result in a substantial lessening of

competition in the market for supply of retail investment

platforms.

The regulator said it has commenced market consultation on the

undertakings by NAB and will take public submissions until Aug. 23

ahead of an expected decision on Sept. 9.

"Following market consultation, the ACCC will decide whether to

accept or reject the proposed undertakings, including IOOF as a

proposed purchaser of the divestiture business," the ACCC said.

-By Bill Lindsay, Dow Jones Newswires; 61-2-8272-4694;

bill.lindsay@dowjones.com

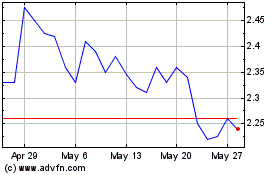

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Insignia Financial (ASX:IFL)

Historical Stock Chart

From Feb 2024 to Feb 2025