Berkeley Energia Signs Uranium Sale Deal with Interalloys

November 28 2016 - 4:42AM

Dow Jones News

LONDON--Berkeley Energia (BKY.LN) Monday said it has signed a

binding off-take agreement with Interalloys Trading Ltd. to sell

the first production from its Salamanca uranium mine in Spain.

The parties have converted a previously announced letter of

intent into a binding agreement that includes a doubling of annual

contracted volumes to a total of 2 million pounds ($2.5 million)

over a five-year period. The potential exists to increase annual

volumes further as well as extend the contract to a total of GBP3

million.

Berkeley is in talks with other potential off-takers about

contracts with terms similar to those outlined in the Interalloys

Agreement, with pricing at or around long-term benchmark levels for

term contracts.

While uranium prices may remain flat in the near-term, from

2018, when Salamanca is scheduled to come into production, Berkeley

said it expects the market to be dominated by U.S. utilities

looking to re-contract, who will also be competing with Chinese new

reactor demand, which may lead to higher spot and term contract

prices.

"We're receiving growing interest from major utilities looking

to diversify their off-take from a low-cost producer in Europe,"

Managing Director Paul Atherley said.

Shares at 0847 GMT were up 1.5 pence, or 2%, at 75 pence.

Write to Philip Waller at philip.waller@wsj.com

(END) Dow Jones Newswires

November 28, 2016 04:27 ET (09:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

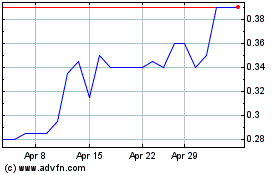

Berkeley Energia (ASX:BKY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Berkeley Energia (ASX:BKY)

Historical Stock Chart

From Jan 2024 to Jan 2025