TIDMSPA

RNS Number : 2901N

1Spatial Plc

29 September 2021

29 September 2021

1Spatial plc (AIM: SPA)

("1Spatial", the "Group" or the "Company")

Interim Results for the six-month period ended 31 July 2021 ("H1

2022")

Strategic plan delivering an acceleration in revenue growth

rates

H1 2022 highlights

-- 80% increase in Term Licences revenue to GBP1.0m (H1 2021: GBP0.6m)

-- 63% increase in Term Licences Annualised Recurring Revenue

("ARR") * to GBP2.1m (H1 2021: GBP1.3m at constant currency)

-- Revenue growth in the US region accelerated to 34% (48% at

constant currency) (H1 2021: 12% )

-- 12% increase in total ARR * to GBP11.6m (H1 2021: GBP10.3m at constant currency)

-- Recently announced two record value landmark contract wins,

which are expected to drive further increase in longer-term revenue

growth rate

Group financial highlights

Half-year Half-year Change Growth

to 31 to 31

July July

21 20

GBPm GBPm GBPm %

Revenue 12.6 11.7 +0.9 +8%

Adjusted EBITDA** 1.8 1.7 +0.1 +10%

Adjusted EBITDA** margin

(%) 14.5 14.2 +0.3pp

Operating loss (0.2) (0.8) +0.6

Loss before tax (0.3) (0.9) +0.6

Loss per share - basic

and diluted (p) (0.2) (0.7) +0.5p

Operating cash generated

*** 1.0 1.8 (0.8)

* Term Licences Annualised Recurring Revenue ("ARR") is the

annualised value at the period-end of committed recurring contracts

for term licences. Total ARR is the annualised value at the

period-end of committed recurring contracts for term licences and

support & maintenance

** Adjusted EBITDA is a company-specific measure which is

calculated as operating loss before depreciation (including right

of use asset depreciation), amortisation and impairment of

intangible assets, share-based payment charge and strategic,

integration, other non-recurring items

*** Excludes one-off cash costs on prior year restructuring

Group operational highlights

-- New customer wins in all regions, including multi-year

contracts with HM Land Registry in the UK and VINCI Highways in

France; software licences with three further US States for our

repeatable 911 offering

-- Land and expand strategy driving revenue growth from existing

customers, including Google Real Estate and Workplace Services, the

Department for Environment, Food and Rural Affairs , the US Federal

Highways, Northern Gas Networks, Ordnance Survey Great Britain, and

the Energy Networks Association

-- Increased investment in R&D with successful release of 3D

version of 1Integrate, and the planned beta version of Traffic

Management Plan Automation (TMPA)

-- Positive operating cash generation but lower than prior year

mainly due to investment in sales and delivery capacity and

non-recurring items (e.g. prior year restructuring costs); net cash

at period-end of GBP2.8m (H1 FY21: GBP3.4m)

Current trading & Outlook

-- Successful investment in partner collaboration resulted in

substantial contract awards post period end, which are expected to

deliver greater revenue growth in future years including:

o Major Government contract - GBP8.0m contract over five years

(announced on 27 September)

o Geospatial Commission, National Underground Asset Register

("NUAR") - GBP6.5m contract over three years (announced on 13

September)

-- The term licence Annualised Recurring Revenue ("ARR")

increased to GBP3.8m (on a pro-forma basis), with the addition of

the two recent major contract wins

-- The level of ARR is building nicely and the committed

services revenue is now at a record level for the Group of

GBP11.8m

-- The recently awarded major UK Government contract also

allowed the Board to upgrade its expectations for FY 2023, as

announced on 27 Septembe r 2021

Commenting on the results, 1Spatial CEO, Claire Milverton,

said:

"We are delighted to see such positive early indicators of the

success of our strategic growth plan. The increase in our term

licence revenue, strong growth in the US and significant recent

multi-year contract wins point to a gear change in the growth

prospects for 1Spatial.

"We believe we are just at the start of a major transformation

of our market. As evidenced by our recent contract wins, we are

increasingly seen across the globe as the specialists in the

management of spatial data issues, sitting right at the heart of

changes across multiple sectors, whether that be to facilitate

infrastructure upgrades, the transition to green energy or new

digital transformation strategies.

"New business signed since the end of H1 has been excellent and

we have a record level of committed services revenue.

"The depth of the sales pipeline, positive market landscape, our

expanding influential partner network and growing levels of

recurring revenue, provide the Board with confidence in the

expected outturn for the year and an exciting long-term future for

1Spatial."

The management team will host a presentation for analysts at

11am today. Analysts who wish to attend can register at

1Spatial@almapr.co.uk . The recording of the event will be made

available on the website shortly thereafter.

The management team will host a presentation for retail

investors on the Investor Meet Company platform at 1pm on 30

September 2021. Shareholders who already follow 1Spatial on the

platform will automatically be invited, others are invited to

register in advance via the following link:

https://www.investormeetcompany.com/1spatial-plc/register-investor

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

For further information, please contact:

1Spatial plc 01223 420 414

Claire Milverton / Andrew Fabian

Liberum 020 3100 2000

Neil Patel/Cameron Duncan / Ed Phillips

/ Miquela Bezuidenhoudt

Alma PR 020 3405 0205

Caroline Forde / Justine James / Molly 1spatial@almapr.co.uk

Gretton

LEI Code: 213800VG7OZYQES6PN67

About 1Spatial plc

Unlocking the Value of Location Data

1Spatial plc is a global leader in providing Location Master

Data Management (LMDM) software, solutions, and business

applications, primarily to the Government, Utilities and Transport

sectors via the 1Spatial platform. Our solutions ensure data

governance, facilitating the efficient, effective and sustainable

operation of customers around the world. Our global clients include

national mapping and land management agencies, utility companies,

transportation organisations, government, and defence

departments.

Today, when using and sharing trusted data provides significant

opportunities for businesses and governments to deliver against

important sustainability and Net Zero goals, our vision is clear -

to make the world safer, smarter, and more sustainable by unlocking

the value in data, enabling better decisions and greater

insights.

The 1Spatial platform is a comprehensive set of data and system

agnostic LMDM software components which helps ensure master data is

compliant, current, complete, consistent, and coordinated - and

that customers can be confident it will remain that way as it

evolves. It allows them to master their data on any device,

anywhere, anytime and can be deployed as SaaS in the cloud,

on-premise, or as a hybrid of both.

Our domain expertise and data agnostic approach allows us to be

an integral and important part of the Geospatial Ecosystem,

supporting the wider digital economy. We partner with major

technology consultancies and GIS providers such as ESRI and bring

together our people, innovative solutions, industry knowledge and

experience from our extensive customer base to deliver world class

solutions.

1Spatial plc is AIM-listed, headquartered in Cambridge, UK, with

operations in the UK, Ireland, USA, France, Belgium, Tunisia, and

Australia.

For more information visit www.1spatial.com

Half-year review

1Spatial has continued to make excellent progress against its

three-year growth plan in the first half of the year, winning new

customers in each of its markets and target industries, expanding

its product offering and delivering growth in revenues, term

licence revenue, ARR and adjusted EBITDA. While the double-digit

revenue growth in the USA and Australia was particularly

noteworthy, it is encouraging to see that all markets delivered a

positive performance. COVID-19 continues to have some impact on the

length of sales cycle, however we are seeing a gradual return to

more normal timescales and an increased new business win rate.

We believe we are now just at the start of the transformation of

our market. We continue to see increasing interest in our

offerings, with a growing awareness across multiple industries, not

only that location data is a vital element in the delivery of

better, faster, and safer services, but that the data needs to be

accurate and shareable. Location data is increasingly being used as

the main point of reference when connecting multiple systems. Our

rules engine, 1Integrate, and cloud portal, 1Data Gateway, are

recognised, both by our customers and a growing number of

influential partners, as powerful tools to ensure good quality data

and trust when sharing data.

The proof of the success of our strategy and the growth in our

market can be seen in the recently announced strategic wins,

secured post period end. These include the award of an GBP8m

multi-year contract in partnership with a consortium to deliver a

significant digital transformation programme for a department of

the UK Government, and a GBP6.5m contract for the UK Government's

Geospatial Commission supporting Atkins to deliver the National

Underground Asset Register. These contracts provide GBP1.7m in

annual recurring revenue and underline the quality of our

world-class technology and geospatial expertise.

We continue to make positive progress both with our recently won

accounts and new customers, including:

-- a multi-year contract with the HM Land Registry in

partnership with Landmark, to support the national digital Local

Land Charges ("LLC") programme;

-- further expansion with Google in the US;

-- the addition of three further US States to our 911 Emergency Services offering;

-- a contract with the Energy Networks Association ("ENA") and

Ordnance Survey in the UK to build a digital map of the energy

system;

-- a multi-year contract with the Department for Environment,

Food and Rural Affairs ( Defra); and

-- extensions with the US Federal Highways and Ordnance Survey Great Britain.

Successes such as these, and the considerable size of our sales

pipeline, give us the confidence to continue to invest in the

business, in line with revenue growth, to ensure we have the right

structure to deliver on our opportunity, including additional

delivery and pre-sales resource, partner enablement, and marketing

and sales resource.

Delivering our strategy

We help customers make better business decisions and move

forward to a smarter world by unlocking the value of location data.

We are building our highly scalable business on three pillars:

Innovation, Customer Relationships and Smart Partnerships.

1. Innovation

Innovation lies at the heart of 1Spatial. Our technology

development hubs in the UK (Cambridge) and France (Paris) have been

at the forefront of continually adapting to provide innovative

solutions to manage location data for many years. R&D costs

capitalised in H1 increased to GBP1.3m (H1 FY 2021: GBP1.0m) as we

continued our investment in our core products, repeatable solutions

and cloud platform.

Launch of next generation LMDM cloud platform

The 1Spatial platform is a comprehensive set of Location Master

Data Management ("LMDM") software components, which ensure data

management processes are automated and repeatable across the

different technology platforms for the whole enterprise. Our

patented technology also gives them the ability to solve complex

and unique challenges in the management of their spatial and

non-spatial data.

Over the last two years we have invested in the transition of

our LMDM platform to the cloud, with the cloud platform on track

for launch in the second half of the year. The platform will enable

us to increase our addressable market and existing customer demand

for web-based access to our solutions, the need for which has been

particularly highlighted by the move to remote working. The

multi-tenancy SaaS platform will be more cost effective for

1Spatial as we will be managing fewer deployments and the elastic

nature of the platform architecture is more cost efficient.

We are also building targeted solutions on the platform, such as

Traffic Management Plan Automation ("TMPA"), due for beta testing

at select customer and partners in the second half of the year,

providing the Group with potential exciting new "go to" market

models, such as Validation as a Service ("VaaS") lowering the price

point for new customers onto the platform.

Earlier in the year, we were granted a UK Patent for

Modification and Validation of Spatial Data, recognising its power

as a tool to ensure good quality data and facilitate trust when

sharing data. The patent protects the use of 1Spatial's Rules

Engine technology, which is used in 1Integrate, further

strengthening the Group's international patent coverage, which

includes a US patent for Modification and Validation of Spatial

Data.

We continue to enhance our core products such as 1Integrate and

1Data Gateway. 1Integrate has recently been upgraded to include

added support for 3D data, allowing our customers to integrate

verified and accurate 3D data into their processes such as managing

more accurately sunlight availability, noise propagation, building

heat loss, solar panel capacity or building occupancy.

2. Customer Relationships

We want to be our customers' strategic partner and trusted

advisor in LMDM in our chosen industries and geographies. The

success of our customer focus, combined with ongoing transition to

recurring term licence contracts, is evidenced by the 80% growth in

term licence revenue driven both by new customer wins and expansion

of existing customer accounts.

Land & Expand

The Group delivered a healthy number of new customer wins in the

period across all regions, including a number of strategic wins

within our LMDM offering, with the US once again performing

particularly well, but also strategic wins in the UK & Ireland

and France. We now have a customer base of over 1,000 in total

across the Group, the majority on recurring contracts, providing a

strong basis for future expansion.

We continue to benefit from the release of our 1Data Gateway

portal last year and are seeing an increasing number of coupled

sales of 1Data Gateway and 1Integrate, with the 1Data Gateway

portal proving to be a compelling sales tool, enabling new

prospects to quickly visualise how we can transform their data

collection, cleansing and management.

The Group secured several new clients in the period, most

notably:

-- A multi-year contract with HM Land Registry ("HMLR"), in

partnership with Landmark to support HM Land Registry's national

digital Local Land Charges (LLC) programme: a three-year digital

transformation programme of the land charges records that will

deliver a single national digital register across England and

Wales.

-- A contract with the Energy Networks Association ("ENA") and

Ordnance Survey to build a digital map of the UK's energy system

that uses the power of data to support a more efficient pathway to

Net Zero.

-- A multi-year contract with the Department for Environment,

Food and Rural Affairs ( Defra) and the Rural Payments Agency

("RPA"). The contract will enable both organisations to deliver the

Basic Payment schemes and transition to their new Environmental

Land Management Scheme as part of the UK Government's 25-year

environment plan and commitment to net zero emissions by 2050.

-- Three new contracts for next generation 911 solutions in the

US, with the States of Georgia, Minnesota and Arizona,

demonstrating the replicability of this solution.

-- Our first multi-year term licence in France, with VINCI

Highways, to supply 1Telecom, a 1Spatial app built on the Esri

platform

The Group secured multiple customer expansion contracts in the

period, including:

-- A multi-year contract with Northern Gas Networks (NGN), to

deliver the UK's first enterprise migration to Esri's new ArcGIS

Utility Network model. 1Spatial's platform, including its

1Integrate tools, will be deployed to conduct the data quality

audit, data cleanse and enhancement to ensure the data is fit for

migration to the new model, which will be implemented in the ArcGIS

Utility Network. We believe this to be another highly replicable

solution and post period end we are pleased to have signed our

first additional proof of concept with another water company for

the solution.

-- A significant contract extension with Google Real Estate and

Workplace Services, a division of Google, Inc for the use of 1Data

Gateway and 1Integrate in the management of their facilities.

-- The award of a proof of concept contract alongside Ordnance

Survey Great Britain for the Energy Networks Association to deliver

a digital map of the UK energy network.

Other expansion contracts include the US Federal Highways

Administration, Ordnance Survey Great Britain and Tours Metropole

in France, an existing customer which has expanded to use arcOpole

Pro Street Management.

In France, 11 existing customers have now completed their

migration from the Group's legacy platform to the Esri platform,

and a further 13 have commenced the migration process, paving the

way for future expansion.

3. Smart Partnerships

We use smart partnerships to extend our market reach, providing

additional scale to our capabilities. We target three types of

partners: major technology consultancies, software platform

providers, and domain industry specialists.

We continue to make good progress in adding new partnerships and

strengthening existing relationships. We are increasingly being

utilised by our partners as their data integrity provider,

cleansing the data before passing it back through wider systems.

The success of this approach can be seen in the recently announced

wins, post period end with NUAR (in partnership with Atkins), and

another major Government contract.

We were also delighted to receive a prestigious award at the

global 2021 Esri Partner Conference. The 'Web GIS Transformation

Award' was presented to 1Spatial for its innovative and extensive

product integration within ArcGIS Enterprise and the provision of

Esri-based business applications and solutions to customers with

ArcGIS Online using a SaaS model.

Corporate activity

We will continue to identify potential strategic and bolt-on

acquisitions to complement our organic growth.

Strategic priorities for the second half

We will continue to focus on the three pillars of our growth

strategy.

The successful launch of the cloud LMDM platform in the coming

months is a key strategic focus for the Group. We believe this,

alongside new SaaS solutions such as TMPA, can be transformational

for the Group in future years.

We will continue to invest in the business to support our

expanded customer base, while maintaining our focus on the

financial goals of increased revenue growth underpinned by growing

annual recurring revenue and continue our trajectory of increased

profitability at adjusted EBITDA level and higher cash generation

over the long-term.

Current Trading & Outlook

We are delighted to see such positive early indicators of the

success of our strategic growth plan. The increase in our term

licence revenue, strong growth in the US and significant recent

multi-year contract wins point to a gear change in the growth

prospects of 1Spatial.

We believe we are just at the start of the transformation of our

market. As evidenced by our recent contract wins, we are

increasingly seen across the globe as the specialists in the

management of spatial data issues, sitting right at the heart of

changes across multiple sectors, whether that be to facilitate

infrastructure upgrades, the transition to green energy or new

digital transformation strategies.

New business signed since the end of H1 2022 has been excellent

and as a result, the Board has upgraded its expectations for FY

2023, as announced on 27 September 2021.

The depth of the sales pipeline, positive market landscape,

expanding influential partner network and growing levels of

recurring revenue, provide the Board with confidence in the

expected outturn for the year and an exciting long-term future for

1Spatial.

Claire Milverton

Chief Executive Officer

Financial performance

Summary

The Group delivered an excellent financial performance in the

period, with further growth in revenues, ARR and adjusted EBITDA

profit levels, while increasing its spending on innovation,

pre-sales and delivery capacity in order to aim to secure higher

value contracts.

Revenue

Group revenue increased by 8% to GBP12.6m (11% at constant

currency) from GBP11.7m in H1 2021. The business strategy is to

grow revenue from repeatable business solutions on longer-term

contracts, including recurring term licences, rather than one-off

perpetual licences. The Board approved a three-year revenue growth

plan, with increased spending on technology, sales and delivery

capacity in order to effect a gear change in revenue growth.

Pleasingly, as a result of this focus, revenue from term

subscription licences in the period increased by 80% to GBP1.0m

from GBP0.6m and the Group achieved organic growth in revenue of

8%. The revenue by type is shown below:

Revenue by type

H1 2022 H1 2021 % change

Recurring revenue * 5.63 5.19 8%

Services 5.93 5.52 7%

Revenue (excluding perpetual

licences) 11.56 10.71 8%

Perpetual licences 1.08 1.02 6%

Total revenue 12.64 11.73 8%

* Recurring revenue comprises term licences and support and

maintenance revenue.

Committed revenue

The level of sales of committed revenue (revenue for future

services, licences and support contracts committed contracted at

the balance sheet date) increased in the period from the business

focus of extending the duration of contracts and signing higher

value service contracts.

Growth in term licence ARR

In the period since 31 July 2020, we have almost tripled the

annualised value of term licences, with the inclusion of the

contract wins recently announced, as shown in the table below.

Pro-forma * H1 2022 FY 2021** H1 2021**

ARR for term licences 3.82 2.12 1.63 1.30

* This pro-forma ARR includes the impact of term licences of

GBP1.7m signed after period end from two major contracts announced

in September 2021.

** ARR for FY 2021 and H1 2021 have been restated at constant

fx.

Total ARR Growth

The Annualised Recurring Revenue ("ARR") (annualised value at

the year-end of committed recurring contracts for term licences and

support and maintenance) increased in the twelve months by 12% (at

constant currency) from GBP10.3m to GBP11.6m as at 31 July 2021.

The growth rates varied by region as shown in the table below with

the US growing at the fastest rate of 45% and the overall renewal

rate improved to 94% from 90%.

Following the recently announced major contact awards, the

pro-forma Annualised Recurring Revenue increased to GBP13.3m.

ARR by region

Annual

H1 2022 FY 2021* H1 2021* % growth

UK/Ireland 4.00 3.86 3.45 16%

Europe 4.91 4.86 4.89 -%

US 1.45 1.22 1.00 45%

Australia 1.21 1.00 0.97 25%

-------- --------- --------- ----------

Total ARR 11.57 10.94 10.31 12%

-------- --------- --------- ----------

* ARR for FY 2021 and H1 2021 have been restated at constant

fx.

Committed services revenue

Including the recently announced contract awards, the level of

committed services revenue more than doubled from GBP5.7m at the

start of the financial year to GBP11.8m, which underpins the

Groups' strong financial footing.

The combination of growing ARR, committed services revenue and a

strong and growing pipeline of prospects means that the business is

on track to make further progress on its revenue growth plan. With

the business focus on developing and selling repeatable software

solutions under a SaaS model, there is an increased level of

revenue visibility, which allows the Board to continue to invest

with confidence.

Regional revenue

Revenue growth by region is shown in the table below:

Regional revenue

Growth

H1 2022 H1 2021 %

UK/Ireland 4.45 4.34 3%

Europe 5.31 5.09 4%

US 1.55 1.16 34%

Australia 1.33 1.14 17%

-------- --------

12.64 11.73 8%

-------- --------

Following a challenging year in FY 2021 in some regions, it was

pleasing that revenue increased in all regions. Organic growth

returned to Europe and the UK/Ireland regions, which represent the

bulk of our current revenue. Revenue in the US, which represents

12% of Group revenue, had the highest growth rate, and increased at

34% (48% at constant currency), a higher rate than the prior year.

Also, it was pleasing to have double digit revenue growth of 17% in

Australia.

Gross profit margin

The gross margin reduced to 51% compared to 52% following the

Board's decision to increase spending on innovation, sales and

delivery capacity in order to aim to secure higher value contracts.

Also, the prior year benefitted (within the cost of sales) from

GBP0.3m of grants from overseas governments as part of business

support schemes in relation to Covid-19. Excluding this benefit, on

a like-for-like basis, the gross margin improved to 51% from an

effective rate of 49%. Going forward, the management team are

focused on driving improvements to the gross margin levels, through

revenue growth of higher margin term licences.

Adjusted EBITDA

The adjusted EBITDA increased by 10% to GBP1.8m from GBP1.7m in

the prior period. The EBITDA margin was slightly higher than the

prior period at 14.5% ( H1 2021: 14.2% or 11.3% excluding the Covid

support received in the prior period mentioned above). Cost

management continues to be an important focus during FY 2022,

although the businesses is incurring some increases in costs in

order to ensure future revenue growth.

Strategic, integration and other non-recurring items

There were no strategic, integration and other non-recurring

items incurred in the period. Cash costs of GBP0.3m relating to the

provisions made in the prior year for costs for the final steps in

the integration of Geomap-Imagis ("G-I") acquisition, impacted the

cash flow for the period.

Operating loss and loss before tax

The Group recorded a significantly reduced operating loss of

GBP0.2m compared to GBP0.8m in the prior period and the Group's

loss before tax reduced to GBP0.3m from GBP0.9m for the comparable

period.

Taxation

The net tax credit for the period was GBP0.1m (H1 2021:

GBP0.1m).

Balance sheet

The Group's net assets reduced to GBP14.6m at 31 July 2021 (H1

2021: GBP15.3m). Trade and other receivables increased year on year

to GBP9.4m (H1 2021: GBP9.0m), mainly due to increased accrued

income at period end following contract wins in Q2. The reduction

in trade and other payables from GBP10.9m to GBP10.5m was primarily

driven by payments of exceptional and other items.

Cash flow

Operating cash flow inflow (before strategic, integration and

other non-recurring items) was GBP1.0m (H1 2021: GBP1.8m). This was

lower than the prior year primarily due to:

-- the Board's decision to increase spend for future revenue growth;

-- Covid support cash benefits received in the prior year

(including some reversals in current period);

-- The cash impact of the prior year's European integration.

The operating cash flow impacts of Covid support and

non-recurring items are shown in the table below:

One-off impacts on cashflow

H1 2022 H1 2021 Variance

GBP'000 GBP'000 GBP'000

Covid support from overseas Governments - 346 (346)

VAT deferral (120) 265 (385)

Lease concession - 88 (88)

Covid impact on cashflow (120) 699 (819)

Cashflow on strategic, integration

and other non-recurring items (311) (29) (282)

Total one-off impacts on cashflow (431) 670 (1,101)

Indeed, adjusting for the cash impact of Covid support, the

normalised operating cash flow in the period was similar to the

prior year as shown below:

Summarised cash flow H1 2022 H1 2021

GBP000 GBP000

Adjusted* EBITDA 1,830 1,666

Working capital adjustments (1,184) 78

--------- ---------

Cash generated from operations after strategic,

integration and other non-recurring items 646 1,744

Add back: strategic, integration and other

non-recurring items 311 29

--------- ---------

Cash generated from operations before strategic,

integration and other non-recurring items 957 1,773

Adjustments for: Covid cash support in H1

2021/reversal in H1 2022 120 (699)

--------- ---------

Normalised * operating cash flow 1,077 1,074

--------- ---------

Whilst H2 is typically stronger for cash generation than H1, the

reduced operating cash flow impacted the free cash flow* in the

period, as shown in the table below:

Free cash flow H1 2022 H1 2021

GBP'000 GBP'000

-------- --------

Cash generated from operations before strategic,

integration and other non-recurring items

(see note 10) 957 1,773

Net interest paid (105) (72)

Net tax paid - (70)

Expenditure on product development and

intellectual property capitalised (1,291) (965)

Purchase of property, plant and equipment (88) (102)

Lease payments (580) (598)

-------- --------

Free cash flow before strategic, integration

and other non-recurring items (1,107) (34)

Cashflow on strategic, integration and

other non-recurring items (311) (29)

-------- --------

Free cash flow * (1,418) (63)

-------- --------

* Free cash flow is defined as net increase/ (decrease) in cash

for the year before cash flows from the acquisition of

subsidiaries, cash flows from new borrowings and repayments of

borrowings and cash flow from new share issue.

After the period end, GBP0.2m has been received in relation to

R&D Tax credit from HMRC.

Investment in R&D

Development costs capitalised in the period amounted to GBP1.3m

(H1 2021: GBP1.0m). Amortisation of development costs was GBP0.9m

(H1 2021: GBP1.0m).

Financing

The Group repaid as scheduled GBP0.2m (H1 2021: GBP6,000) in

relation to its bank loans. At the period-end the total loans

outstanding were GBP2.7m. With a gross cash position of GBP5.5m at

31 July 2021 (H1 2021: GBP6.6m) and with a growing order backlog

and pipeline, the business is in a much stronger financial position

than a year ago, which gives the Board the confidence to continue

to invest in its three-pillared growth plan.

Going forward, the Board and management teams are focused on

increasing revenues, in particular recurring revenues, whilst

maintaining or improving the Group's profitability and cash

generation.

Andrew Fabian

Chief Financial Officer

Condensed consolidated statement of comprehensive income

Six months ended 31 July 2021

Unaudited Audited Unaudited

Six months Six months

ended Year ended ended

31 July 31 January 31 July

2021 2021 2020

Note GBP'000 GBP'000 GBP'000

---------------------------------------- ----- ----------- ------------ -----------

Revenue 3 12,637 24,600 11,726

Cost of sales ( net of government

grants of nil (H1 2021: GBP346,000)

) (6,237) (11,451) (5,655)

---------------------------------------- ----- ----------- ------------ -----------

Gross profit 6,400 13,149 6,071

Administrative expenses (6,556) (14,395) (6,861)

---------------------------------------- ----- ----------- ------------ -----------

(156) (1,246) (790)

---------------------------------------- ----- ----------- ------------ -----------

Adjusted* EBITDA 1,830 3,632 1,666

Less: depreciation (99) (202) (97)

Less: depreciation on right of use

asset (503) (1,106) (559)

Less: amortisation and impairment

of intangible assets 8 (1,184) (2,806) (1,500)

Less: share-based payment charge (200) (272) (175)

Less: strategic, integration and

other non-recurring items 7 - (492) (125)

---------------------------------------- ----- ----------- ------------ -----------

Operating loss (156) (1,246) (790)

Finance income 5 39 13

Finance cost (110) (226) (85)

---------------------------------------- ----- ----------- ------------ -----------

Net finance cost (105) (187) (72)

Loss before tax (261) (1,433) (862)

Income tax credit 4 61 308 135

---------------------------------------- ----- ----------- ------------ -----------

Loss for the period (200) (1,125) (727)

Other comprehensive income

Items that may subsequently be reclassified

to profit or loss:

Actuarial losses arising on defined - (15) -

benefit pension, net of tax

Exchange differences on translating

foreign operations (166) 148 381

Other comprehensive (loss)/income

for the period, net of tax (166) 133 381

======================================== ===== =========== ============ ===========

Total comprehensive loss for the

period attributable to the equity

shareholders of the Parent (366) (992) (346)

======================================== ===== =========== ============ ===========

* Adjusted for strategic, integration and other non-recurring

items (note 7) and share-based payments.

Loss per ordinary share from continuing operations attributable

to the equity shareholders of the Parent during the period (expressed

in pence per ordinary share):

Basic and diluted loss per share 5 (0.2) (1.0) (0.7)

Condensed consolidated statement of financial position

As at 31 July 2021

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2021 2021 2020

--------------------------------------------------------------- ----- ---------- ------------ ----------

Note GBP'000 GBP'000 GBP'000

--------------------------------------------------------------- ----- ---------- ------------ ----------

Assets

Non-current assets

Intangible assets including goodwill 8 14,994 15,187 15,590

Property, plant and equipment 376 392 415

Right-of-use assets 2,144 2,694 3,265

Total non-current assets 17,514 18,273 19,270

--------------------------------------------------------------- ----- ---------- ------------ ----------

Current assets

Trade and other receivables 9 9,353 10,890 8,951

Current income tax receivable 279 164 308

Cash and cash equivalents 10 5,493 7,278 6,569

--------------------------------------------------------------- ----- ---------- ------------ ----------

Total current assets 15,125 18,332 15,828

--------------------------------------------------------------- ----- ---------- ------------ ----------

Total assets 32,639 36,605 35,098

--------------------------------------------------------------- ----- ---------- ------------ ----------

Liabilities

Current liabilities

Bank borrowings 10 (468) (470) (1,267)

Trade and other payables 11 (10,469) (13,418) (10,861)

Lease liabilities (847) (925) (985)

Total current liabilities (11,784) (14,813) (13,113)

--------------------------------------------------------------- ----- ---------- ------------ ----------

Non-current liabilities

Bank borrowings 10 (2,217) (2,542) (1,869)

Lease liabilities (1,276) (1,743) (2,330)

Deferred consideration (376) (390) (398)

Defined benefit pension obligation (1,594) (1,606) (1,567)

Deferred tax (823) (776) (537)

Total non-current liabilities (6,286) (7,057) (6,701)

--------------------------------------------------------------- ----- ---------- ------------ ----------

Total liabilities (18,070) (21,870) (19,814)

Net assets 14,569 14,735 15,284

=============================================================== ===== ========== ============ ==========

Share capital and reserves

Share capital 12 20,150 20,150 20,150

Share premium account 30,479 30,479 30,479

Own shares held (303) (303) (303)

Equity-settled employee benefits

reserve 3,804 3,604 3,507

Merger reserve 16,465 16,465 16,465

Reverse acquisition reserve (11,584) (11,584) (11,584)

Currency translation reserve 166 332 565

Accumulated losses (44,131) (43,931) (43,518)

Purchase of non-controlling interest

reserves (477) (477) (477)

--------------------------------------------------------------- ----- ---------- ------------ ----------

Equity attributable to shareholders

of the parent company 14,569 14,735 15,284

--------------------------------------------------------------- ----- ---------- ------------ ----------

Total equity 14,569 14,735 15,284

=============================================================== ===== ========== ============ ==========

Condensed

consolidated

statement

of changes in

equity

Period ended

31 July 2021

Purchase

Equity-settled of

Share Own employee Reverse Currency non-controlling

Share premium shares benefits Merger acquisition translation interest Accumulated Total

GBP'000 capital account held reserve reserve reserve reserve reserve losses equity

Balance at 1

February 2020 20,150 30,479 (303) 3,332 16,465 (11,584) 184 (477) (42,791) 15,455

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Comprehensive

income/(loss)

Loss for the

year - - - - - - - - (1,125) (1,125)

Other

comprehensive

(loss)/income

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Actuarial

gains arising

on

defined

benefit

pension - - - - - - - - (15) (15)

Exchange

differences

on

translating

foreign

operations - - - - - - 148 - - 148

Total other

comprehensive

income - - - - - - 148 - (15) 133

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Total

comprehensive

(loss)/income - - - - - - 148 - (1,140) (992)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Transactions

with owners

recognised

directly in

equity

Recognition of

share-based

payments - - - 272 - - - - - 272

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

- - - - - - - - - 272

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Balance at

31 January

2021

(Audited) 20,150 30,479 (303) 3,604 16,465 (11,584) 332 (477) (43,931) 14,735

=============== ======== ======== ======= =============== ======== ============ ============ ================ ============ ========

Comprehensive

loss

Loss for the

period - - - - - - - - (200) (200)

Other

comprehensive

income

Exchange

differences

on

translating

foreign

operations - - - - - - (166) - - (166)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Total other

comprehensive

income - - - - - - (166) - (200) (366)

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Total

comprehensive

(loss)/income - - - - - - (166) - (200) (366)

Transactions

with owners

recognised

directly in

equity

Recognition of

share-based

payments - - - 200 - - - - - 200

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

- - - - - - - - - -

--------------- -------- -------- ------- --------------- -------- ------------ ------------ ---------------- ------------ --------

Balance at

31 July 2021

(Unaudited) 20,150 30,479 (303) 3,804 16,465 (11,584) 166 (477) (44,131) 14,569

=============== ======== ======== ======= =============== ======== ============ ============ ================ ============ ========

* Total equity attributable to the equity shareholders of the

parent.

Purchase

Equity-settled of

Share Own employee Reverse Currency non-controlling

Share premium shares benefits Merger acquisition translation interest Accumulated Total

GBP'000 capital account held reserve reserve reserve reserve reserve losses equity

Balance at 1

February 2020 20,150 30,479 (303) 3,332 16,465 (11,584) 184 (477) (42,791) 15,455

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Comprehensive

income/(loss)

Loss for the

period - - - - - - - - (727) (727)

Other

comprehensive

(loss)/income)

Exchange

differences on

translating

foreign

operations - - - - - - 381 - - 381

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Total other

comprehensive

income - - - - - - 381 - - 381

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Total

comprehensive

(loss)/income - - - - - - 381 - (727) (346)

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Transactions

with owners

recognised

directly in

equity

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Recognition of

share-based

payments - - - 175 - - - - - 175

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

- - - 175 - - 381 - (727) (171)

---------------- -------- -------- ------- --------------- -------- ------------ ------------ ----------------- ------------ --------

Balance at 31

July 2020

(Unaudited) 20,150 30,479 (303) 3,507 16,465 (11,584) 565 (477) (43,518) 15,284

================ ======== ======== ======= =============== ======== ============ ============ ================= ============ ========

* Total equity attributable to the equity shareholders of the

parent.

Condensed consolidated statement of cash flows

Period ended 31 July 2021

Unaudited Audited Unaudited

31 July 31 January 31 July

2021 2021 2020

Note GBP'000 GBP'000 GBP'000

---------------------------------------- ----- ---------- ----------- ----------

Cash flows from operating activities

Cash generated from operations 10 646 3,983 1,744

Interest received 5 39 13

Interest paid (110) (218) (85)

Tax (paid)/received - 484 (70)

Net cash from operating activities 541 4,288 1,602

---------------------------------------- ----- ---------- ----------- ----------

Cash flows from investing activities

Acquisition of subsidiaries (net

of cash acquired) - - (585)

Purchase of property, plant and

equipment (88) (192) (102)

Expenditure on product development

and intellectual property capitalised (1,291) (2,120) (965)

Net cash used in investing activities (1,379) (2,312) (1,652)

---------------------------------------- ----- ---------- ----------- ----------

Cash flows from financing activities

New borrowings - 1,800 1,832

Repayment of borrowings (218) (146) (6)

Repayment of obligations under

leases (580) (1,069) (598)

Payment of deferred consideration (585)

on acquisition - -

Net cash (used in)/generated from

financing activities (798) - 1,228

---------------------------------------- ----- ---------- ----------- ----------

Net (decrease)/increase in cash

and cash equivalents (1,636) 1,976 1,178

Cash and cash equivalents at start

of period 7,278 5,108 5,108

Effects of foreign exchange on

cash and cash equivalents (149) 194 283

Cash and cash equivalents at end

of period 10 5,493 7,278 6,569

---------------------------------------- ----- ---------- ----------- ----------

Notes to the Interim Financial Statements

1. Principal activity

1Spatial plc is a public limited company which is listed on the

AIM London Stock Exchange and is incorporated and domiciled in the

UK. The address of the registered office is Tennyson House,

Cambridge Business Park, Cowley Road, Cambridge, CB4 0WZ. The

registered number of the Company is 5429800.

The principal activity of the Group is the development and sale

of software along with related consultancy and support.

2. Basis of preparation

This condensed consolidated interim financial report for the

half-year reporting period ended 31 July 2021 has been prepared in

accordance with UK adopted IAS 34 Interim Financial Reporting. The

interim report does not include all the information required for a

complete set of IFRS financial statements. Accordingly, this report

is to be read in conjunction with the annual report for the year

ended 31 January 2021 and any public announcements made by 1Spatial

Plc during the interim reporting period. The annual financial

statements of the Group were prepared in accordance UK adopted

international accounting standards.

The accounting policies adopted in the preparation of the

interim financial statements are consistent with those followed in

the preparation of the Group's consolidated financial statements as

at and for the year ended 31 January 2021.The Group has not early

adopted any standard, interpretation or amendment that has been

issued but is not yet effective.

Several amendments and interpretations apply for the first time

in 2021, but do not have a material impact on the interim financial

statements of the Group.

The financial information for the six months ended 31 July 2021

and 31 July 2020 is neither audited nor reviewed and does not

constitute statutory financial statements within the meaning of

section 434(3) of the Companies Act 2006 for 1Spatial plc or for

any of the entities comprising the 1Spatial Group. Statutory

financial statements for the preceding financial year ended 31

January 2021 were filed with the Registrar and included an

unqualified auditors' report.

After making enquiries, the Directors have a reasonable

expectation that the Company and the Group have adequate resources

to continue in operational existence for the foreseeable future.

Accordingly, they continue to adopt the going concern basis in

preparing the half-yearly condensed consolidated financial

statements.

These interim financial statements were authorised for issue by

the Company's Board of Directors on 28 September 2021.

3. Revenue

The following table provides an analysis of the Group's revenue

by type:

Revenue by type

H1 2022 H1 2021

GBP000 GBP000

Term licences 1.01 0.56 80%

Support & maintenance 4.62 4.63 -

-------- --------

Recurring revenue 5.63 5.19 8%

--------------------------------- -------- --------

Services 5.93 5.52 7%

Perpetual licences 1.08 1.02 6%

--------------------------------- -------- --------

Total revenue 12.64 11.73 8%

--------------------------------- -------- --------

Percentage of recurring revenue 45% 44%

4. Taxation

The tax credit on the result for the six months ended 31 July

2021 is based on the estimated tax rates in the jurisdictions in

which the Group operates, for the year ending 31 January 2022.

5. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period plus

the EUR0.03m deferred shares to be satisfied in March 2023.

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2021 2021 2020

GBP'000 GBP'000 GBP'000

Loss attributable to equity holders

of the Parent (200) (1,125) (727)

------------------------------------- ---------- ------------ ----------

Number Number Number

000s 000s 000s

------------------------------------- ---------- ------------ ----------

Ordinary shares with voting rights 110,486 110,486 110,486

------------------------------------- ---------- ------------ ----------

Deferred consideration payable

in shares 72 1,394 1,628

------------------------------------- ---------- ------------ ----------

Basic weighted average number of

ordinary shares 110,558 111,880 112,114

------------------------------------- ---------- ------------ ----------

Impact of share options/LTIPs 3,986 2,495 1,355

------------------------------------- ---------- ------------ ----------

Diluted weighted average number

of ordinary shares 114,544 114,375 113,469

------------------------------------- ---------- ------------ ----------

Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2021 2021 2020

Pence Pence pence

---------------------------------- ---------- ------------ ----------

Basic and diluted loss per share (0.2) (1.0) (0.7)

---------------------------------- ---------- ------------ ----------

Basic loss per share and diluted loss per share are the same

because the options are anti-dilutive. Therefore, they have been

excluded from the calculation of diluted weighted average number of

ordinary shares.

6. Dividends

No dividend is proposed for the six months ended 31 July 2021

(31 January 2021: nil; 31 July 2020: nil).

7. Strategic, integration and other non-recurring items

In accordance with the Group's policy for strategic, integration

and other non-recurring items, the following charges were included

in this category for the period:

Six months Six months

ended Year ended ended

31 July 31 January 31 July

2021 2021 2020

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------ ------------ -----------

Costs associated with acquisitions and

disposals - 492 125

Total - 492 125

---------------------------------------- ------------ ------------ -----------

8 . Intangible assets including goodwill

Goodwill Brands Customers Software Development Website Intellectual Total

and related costs costs property

contracts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February

2021 17,447 464 4,764 6,757 19,285 - 72 48,789

Additions - - - 22 1,269 - - 1,291

Effect of foreign

exchange (214) (8) (130) (125) (285) - - (762)

----------------------

At 31 July 2021 17,233 456 4,634 6,654 20,269 - 72 49,318

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February

2021 11,548 252 3,641 4,696 13,454 - 11 33,602

Amortisation - 23 79 223 856 - 3 1,184

Effect of foreign

exchange (131) (2) (90) (56) (183) - - (462)

At 31 July 2021 11,417 273 3,630 4,863 14,127 - 14 34,324

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Net book amount

at

31 July 2021 5,816 183 1,004 1,791 6,142 - 58 14,994

====================== ========= ======== ============= ========= ============ ======== ============= ========

Goodwill Brands Customers Software Development Website Intellectual Total

and related costs costs property

contracts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February

2020 17,291 452 4,579 6,487 16,932 30 66 45,837

Additions - - - - 962 - 3 965

Effect of foreign

exchange 351 16 251 258 471 - - 1,347

----------------------

At 31 July 2020 17,642 468 4,830 6,745 18,365 30 69 48,149

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February

2020 11,363 204 3,113 4,185 11,374 30 8 30,277

Amortisation - 23 297 221 957 - 2 1,500

Effect of foreign

exchange 249 1 154 94 284 - - 782

At 31 July 2020 11,612 228 3,564 4,500 12,615 30 10 32,559

Net book amount

at

31 July 2020 6,030 240 1,266 2,245 5,750 - 59 15,590

====================== ========= ======== ============= ========= ============ ======== ============= ========

8 . Intangible assets including goodwill (continued)

Goodwill Brands Customers Software Development Website Intellectual Total

and related costs costs property

contracts

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 February 2020 17,291 452 4,579 6,487 16,932 30 66 45,837

Additions - - - 75 2,039 - 6 2,120

Written-off - - - - - (30) - (30)

Effect of foreign

exchange 156 12 185 195 314 - - 862

----------------------

At 31 January 2021 17,447 464 4,764 6,757 19,285 - 72 48,789

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Accumulated

impairment

and amortisation

At 1 February 2020 11,363 204 3,113 4,185 11,374 30 8 30,277

Amortisation - 47 422 445 1,889 - 3 2,806

Written-off - - - - - (30) - (30)

Effect of foreign

exchange 185 1 106 66 191 - - 549

At 31 January 2021 11,548 252 3,641 4,696 13,454 - 11 33,602

---------------------- --------- -------- ------------- --------- ------------ -------- ------------- --------

Net book amount

at

31 January 2021 5,899 212 1,123 2,061 5,831 - 61 15,187

====================== ========= ======== ============= ========= ============ ======== ============= ========

9. Trade and other receivables

As at As at As at

31 July 31 January 31 July

2021 2021 2020

Current GBP'000 GBP'000 GBP'000

----------------------------------------- --------- ------------ ---------

Trade receivables 2,858 5,607 3,462

Less: provision for impairment of trade

receivables (59) (80) (44)

----------------------------------------- --------- ------------ ---------

2,799 5,527 3,418

Other receivables 1,573 1,497 1,445

Prepayments and accrued income 4,981 3,866 4,088

----------------------------------------- --------- ------------ ---------

9,353 10,890 8,951

----------------------------------------- --------- ------------ ---------

10. Notes to the condensed consolidated statement of cash flows

a) Cash used in operations

Unaudited Audited Unaudited

As at 31 As at

As at January 31 July

31 July 2021 2021 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------- ---------------- ---------- -----------

Loss before tax (261) (1,433) (862)

Adjustments for:

Net finance cost 105 187 72

Depreciation 602 1,308 656

Amortisation and impairment 1,184 2,806 1,500

Share-based payment charge 200 272 175

Decrease/(Increase) in trade and

other receivables 1,241 (655) 1,392

(Decrease)/Increase in trade and

other payables (2,527) 1,446 (1,177)

Increase in defined benefit pension

obligation 43 86 46

Net foreign exchange movement 59 (34) (58)

Cash from operations 646 3,983 1,744

------------------------------------------------- ---------------- ---------- -----------

Reconciliation of cash generated

before and after impact of strategic,

integration and other non-recurring

items Unaudited Audited Unaudited

As at As at As at

31 July 31 January 31 July

2021 2021 2020

Cash generated from/(used in) operations

before strategic, integration and

other non-recurring items 957 4,156 1,773

Cashflow on strategic, integration

and other non-recurring items (311) (173) (29)

------------------------------------------ ---------- ------------ ----------

Cash generated from/(used in) operations

after strategic, integration and

other non-recurring items 646 3,983 1,744

------------------------------------------ ---------- ------------ ----------

b) Reconciliation of net cash flow to movement in net funds

Unaudited Audited Unaudited

As at 31 As at

As at January 31 July

31 July 2021 2021 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------- ---------------- ---------- -----------

(Decrease)/Increase in cash in the

period (1,636) 1,976 1,178

------------------------------------------------- ---------------- ---------- -----------

Changes resulting from cash flows (1,636) 1,976 1,178

Net cash inflow in respect of new

borrowings - (1,800) (1,832)

Net cash outflow in respect of borrowings

repaid 218 146 6

Effect of foreign exchange (40) 57 194

------------------------------------------------- ---------------- ---------- -----------

Change in net funds (1,458) 379 (454)

Net funds at beginning of period 4,266 3,887 3,887

-------------------------------------------------

Net funds at end of period 2,808 4,266 3,433

------------------------------------------------- ---------------- ---------- -----------

Analysis of net funds

Cash and cash equivalents classified

as:

Current assets 5,493 7,278 6,569

Bank and other loans (2,685) (3,012) (3,136)

Net funds at end of period 2,808 4,266 3,433

------------------------------------------------- ---------------- ---------- -----------

Net funds is defined as cash and cash equivalents net of bank

loans.

11. Trade and other payables

As at As at As at

31 July 31 January 31 July

2021 2021 2020

Current GBP'000 GBP'000 GBP'000

------------------------------------ --------- ------------ -----------

Trade payables 1,789 1,736 1,587

Other taxation and social security 2,792 3,496 2,829

Other payables 430 852 693

Accrued liabilities 1,280 1,464 1,137

Deferred income 4,178 5,870 4,615

------------------------------------ --------- ------------ -----------

10,469 13,418 10,861

------------------------------------ --------- ------------ -----------

12. Share capital

As at As at As at

31 July 31 January 31 July

2021 2021 2020

GBP'000 GBP'000 GBP'000

------------------------------------------- --------- ------------ ---------

Allotted, called up and fully paid

110,805,795 (H1 and FY 2021: 110,805,795)

ordinary shares of 10p each 11,082 11,082 11,082

226,699,878 (H1 and FY 2021: 226,699,878)

deferred shares of 4p each 9,068 9,068 9,068

------------------------------------------- --------- ------------ ---------

20,150 20,150 20,150

------------------------------------------- --------- ------------ ---------

There are 110,805,795 ordinary shares of 10p in issue, including

319,635 ordinary shares which are held in treasury. Consequently,

the total issued share capital is 110,486,160, each share having

equal voting rights.

The deferred shares of 4p each do not carry voting rights or a

right to receive a dividend. Accordingly, the deferred shares will

have no economic value.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUMPBUPGGMR

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

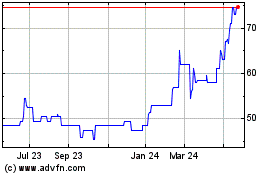

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

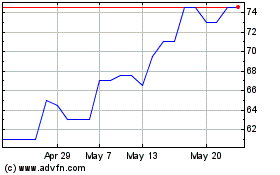

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025