TIDMSPA

RNS Number : 5877E

1Spatial Plc

09 November 2020

9 November 2020

1SPATIAL PLC

("1Spatial", the "Company" or the "Group")

Employee Share Awards and PDMR Dealings

1Spatial, (AIM: SPA), a global leader in Location Master Data

Management (LMDM) software and solutions, is pleased to announce

that it has made new annual awards ("New Awards") under its

Employee Share Plan ("Plan") and revised the performance targets

applying to certain awards made in 2018 ("Revised Awards").

New Awards

On 6 November 2020, the Company granted awards to acquire

ordinary shares of 10p each in the Company ("Ordinary Shares") to

certain directors and employees of the Company and its subsidiaries

pursuant to the Plan as detailed further below.

LTIP Awards

LTIP awards (consisting of either a contingent right or a

nil-cost option to acquire Ordinary Shares for no consideration)

have been granted over 1,980,000 Ordinary Shares in total ("LTIP

Awards"). Such awards were granted to certain employees, members of

the senior management team and to the following directors/PDMRs of

the Company:

Director/PDMR No. of LTIP Awards

Claire Milverton (Chief Executive Officer) 650,000

Andrew Fabian (Chief Financial Officer) 330,000

These new LTIP Awards vest subject to the achievement of the

following performance targets:

-- 25 per cent. of the shares vest subject to the achievement of

a revenue target for the year ending 31 January 2024 ("2024

Revenue"). 50 per cent. of the shares subject to this target vest

if the 2024 Revenue exceeds GBP30m, 75 per cent. if the 2024

Revenue exceeds GBP32m and 100 per cent. if the 2024 Revenue

exceeds GBP34m.

-- 25 per cent. of the shares vest subject to the achievement of

an EBITDA target for the year ending 31 January 2024 ("2024

EBITDA"). 50 per cent. of the shares subject to this target vest if

the 2024 EBITDA exceeds GBP5.5m, 75 per cent. if the 2024 EBITDA

exceeds GBP6m and 100 per cent. if the 2024 EBITDA exceeds

GBP7m.

-- 50 per cent. of the shares vest subject to the achievement of

a share price target which will be calculated based on the average

closing mid-price for the 20 trading days following the Company's

Annual General Meeting in 2024 ("2024 Share Price"). 50 per cent.

of the shares subject to this target vest if the 2024 Share Price

exceeds GBP0.50, 75 per cent. if the 2024 Share Price exceeds

GBP0.60 and 100 per cent. if the 2024 Share Price exceeds

GBP0.80.

Following vesting, the LTIP Awards will be subject to an

additional one-year holding period (before the award can be

exercised or the shares otherwise be released).

In the event of a takeover of the Company completing, either by

way of a contractual takeover offer becoming wholly unconditional

or a scheme of arrangement becoming effective, the LTIP Awards

would vest in full, provided that the award holder continues to be

an employee at that time.

Option Awards

Market-priced options (consisting of a right to acquire Ordinary

Shares at an exercise price of GBP0.265 per share, being the

closing middle market price on 6 November 2020) have been granted

over 2,442,000 Ordinary Shares in total ("Option Awards"). Such

Option Awards were granted to certain employees, members of the

senior management team and to the following directors/ PDMRs of the

Company:

Director/PDMR No. of Options

Claire Milverton (Chief Executive Officer) 25,000

Andrew Fabian (Chief Financial Officer) 25,000

It is proposed that the Option Awards will vest as to 25 per

cent. of the shares subject to the option on the second anniversary

of the date of grant, as to a further 25 per cent. of the shares on

the third anniversary of the date of grant and as to the balance on

the fourth anniversary of the date of grant. Option Awards granted

to employees outside of the UK may, in order to comply with local

tax rules, vest in two tranches on the third and fourth

anniversaries of the date of grant (50 per cent. and 50 per cent.

respectively).

In the event of a takeover of the Company completing, either by

way of a contractual takeover offer becoming wholly unconditional

or a scheme of arrangement becoming effective, the Option Awards

would vest in full provided that the award holder continues to be

an employee at that time.

Revised Awards

On 5 September 2018, the Company announced that LTIP awards

(consisting of either a contingent right or a nil-cost option to

acquire Ordinary Shares for no consideration) were granted under

the Plan on 4 September 2018 ("2018 LTIP Awards"). These awards

vest from 2021 onwards. 50% of these awards vest based on an EBITDA

target and 50% vest on reaching share price targets. In total, and

as at today's date, 1,256,600 Ordinary Shares remain subject to

these LTIP awards, including awards held by the following

director/PDMR:

Director No. of LTIP Awards

Claire Milverton (Chief Executive Officer) 659,368

The Company's remuneration committee ("Remuneration Committee")

has, in accordance with the Plan, exercised its discretion to amend

the performance targets applying to the 2018 LTIP Awards as

follows:

EBITDA target

50 per cent. of the shares vest subject to the achievement of an

EBITDA target for the year ending 31 January 2021 ("2021 EBITDA").

50 per cent. of the shares subject to this target vest if the 2021

EBITDA exceeds GBP2m, 75 per cent. if the 2021 EBITDA exceeds

GBP2.5m and 100 per cent. if the 2021 EBITDA exceeds GBP3m. As a

result of a change in accounting standards (IFRS 16), the

Remuneration Committee has determined to make the following

increase to each of the targets (to reflect the anticipated impact

on the Company's EBITDA brought about by the change in accounting

standard):

% vesting Previous target Revised target

50% GBP2m GBP3m

---------------- ---------------

75% GBP2.5m GBP3.5m

---------------- ---------------

100% GBP3m GBP4m

---------------- ---------------

Share price target

In order that the 2018 LTIP Awards continue to provide an

appropriate incentivisation mechanism, the Remuneration Committee

has reduced each of the share price targets and extended the period

over which the targets will be measured. The target share price

date was originally the 2021 AGM but this has now been changed to

the 2022 AGM. Following vesting, the awards will be subject to an

additional one-year holding period (as before). The revised targets

are as follows:

% vesting Previous hurdle Revised hurdle

50% GBP0.80 GBP0.40

---------------- ---------------

75% GBP1.00 GBP0.50

---------------- ---------------

100% GBP1.20 GBP0.60

---------------- ---------------

The Remuneration Committee considered it appropriate to revisit

the share price hurdles and timings, given the current economic

backdrop and the impact of Covid-19 on share prices (both

immediately and over the medium term). The Remuneration Committee

considers that the revised targets constitute a fairer measure of

performance and ensure that the 2018 LTIP Awards provide a more

effective incentive to the employees. The Remuneration Committee

also considers that the revised targets better reflect the level of

stretch performance that the Remuneration Committee had anticipated

when the targets were originally set.

For further information, please contact:

1Spatial plc 01223 420 414

Claire Milverton / Andrew Fabian

Liberum (Nomad and Broker) 020 3100 2000

Neil Patel / Cameron Duncan/ Ed Phillips /

Miquela Bezuidenhoudt

Alma PR 020 3405 0205

Caroline Forde / Justine James / Harriet Jackson 1spatial@almapr.co.uk

About 1Spatial plc

1Spatial plc is a global leader in providing Location Master

Data Management (LMDM) software and solutions, primarily to the

Government, Utilities and Transport sectors. Our global clients

include national mapping and land management agencies, utility

companies, transportation organisations, government and defence

departments.

Today - as location data from smartphones, the Internet of

Things and great lakes of commercial Big Data increasingly drive

commercial decision-making - our technology drives efficiency and

provides organisations with confidence in the data they use.

We unlock the value of location data by bringing together our

people, innovative solutions, industry knowledge and our extensive

customer base. We are striving to make the world more sustainable,

safer and smarter for the future. We believe the answers to

achieving these goals are held in data. Our 1Spatial Location

Master Data Management (LMDM) platform incorporating our 1Integrate

rules engine delivers powerful data solutions and focused business

applications on-premise, on-mobile and in the cloud. This ensures

data is current, complete, and consistent through the use of

automated processes and always based on the highest quality

information available.

1Spatial plc is AIM-listed, headquartered in Cambridge, UK, with

operations in the UK, Ireland, USA, France, Belgium, Tunisia and

Australia.

For more information visit www.1spatial.com

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Claire Milverton

-------------------------- ----------------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------- ----------------------------------------------

b) Initial notification Initial

/Amendment

-------------------------- ----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name 1Spatial plc

-------------------------- ----------------------------------------------

b) LEI 213800VG7OZYQES6PN67

-------------------------- ----------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the LTIP Awards and Option Awards over ordinary

financial instrument, shares of 10 pence each

type of instrument

Identification code GB00BFZ45C84

-------------------------- ----------------------------------------------

b) Nature of the transaction (a) LTIP Awards

(b) Option Awards

-------------------------- ----------------------------------------------

c) Price(s) and volume(s) Price Volume

-------------------------- ------------------------ --------------------

(a) NIL (a) 650,000

(b) GBP0.265 (b) 25,000

-------------------------- ------------------------ --------------------

d) Aggregated information (a) N/A

(b) N/A

- Aggregated volume

- Price

-------------------------- ----------------------------------------------

e) Date of the transaction (a) 6 November 2020

(b) 6 November 2020

-------------------------- ----------------------------------------------

f) Place of the transaction (a) Off-market transaction

(b) Off-market transaction

-------------------------- ----------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Andrew Fabian

-------------------------- ----------------------------------------------

2 Reason for the notification

--------------------------------------------------------------------------

a) Position/status Chief Financial Officer

-------------------------- ----------------------------------------------

b) Initial notification Initial

/Amendment

-------------------------- ----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------------

a) Name 1Spatial plc

-------------------------- ----------------------------------------------

b) LEI 213800VG7OZYQES6PN67

-------------------------- ----------------------------------------------

4 Details of the transaction(s): section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions have

been conducted

--------------------------------------------------------------------------

a) Description of the LTIP Awards and Option Awards over ordinary

financial instrument, shares of 10 pence each

type of instrument

Identification code GB00BFZ45C84

-------------------------- ----------------------------------------------

b) Nature of the transaction

(a) LTIP Awards

(b) Option Awards

-------------------------- ----------------------------------------------

c) Price(s) and volume(s) Price Volume

-------------------------- ------------------------ --------------------

(a) NIL (a) 330,000

(b) GBP0.265 (b) 25,000

-------------------------- ------------------------ --------------------

d) Aggregated information (a) N/A

(b) N/A

- Aggregated volume

- Price

-------------------------- ----------------------------------------------

e) Date of the transaction (a) 6 November 2020

(b) 6 November 2020

-------------------------- ----------------------------------------------

f) Place of the transaction (a) Off-market transaction

(b) Off-market transaction

-------------------------- ----------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHUWUSRRKUARAA

(END) Dow Jones Newswires

November 09, 2020 02:00 ET (07:00 GMT)

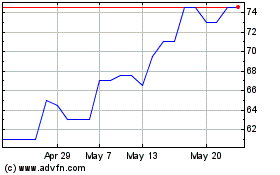

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

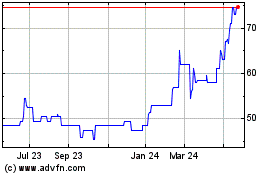

1Spatial (AQSE:SPA.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025