Globe Capital Limited Interim Results to 30 June 2022

September 30 2022 - 11:36AM

UK Regulatory

TIDMGCAP

30th September 2022

Globe Capital Limited

("Globe Capital" or the "Company")

Interim Results for the six months period to 30 June 2022

Globe Capital Limited is pleased to announce its unaudited interim results for

the 6 months period to 30 June 2022. Operational costs for the period amounted

to £35k compared to £31k for the 6 months to June 2021.

The Company's investment strategy continues to be that to seek medium-to-long

term investments in businesses that exhibit growth potential. The Company

continues to be an active investor in situations where the Company can make a

clear contribution to the growth and development of the investment.

The Company continues to receive support from its shareholders and loan note

holders to meet its ongoing costs.

Executive Director, Burns Singh Tennent-Bhohi commented,

"We are living through quite extraordinary times in global financial markets.

The world is gripped by a myriad of complex economic & geo-political problems

that shine light on our dependency on globalisation and how challenging

deglobalisation and realistic closed economic models are.

This palpable shift is being felt by the consumer and general public, resulting

in an acute disconnect between monetary and fiscal policy after more than

10-years of monetary policy dominating financial market capital inflows.

Whilst the Company still progresses final elements of our corporate

restructure, we do so knowing that the Company is well positioned to perform as

a publicly quoted investment issuer. The Board remain in active commercial

discussions for which the majority is inbound and should anything materialise

the Company will update the market accordingly."

Globe Capital Limited

Consolidated Profit and Loss and Other Comprehensive Income

Six months ended 30 June 2022

6 months ended 30 6 months ended 30 Year ended

June 2022 June 2021 31 December

2021

GBP '000 GBP '000 GBP '000

Revenue - - -

Cost of services - - -

Gross Profit - - -

Other Income - - -

Administrative Expenses (35) (31) (7)

Finance Costs (3) (6)

(3)

Loss Before Taxation (38) (34) (13)

Taxation - -

-

Other Comprehensive Loss - -

-

Loss for the period (38) (34) (13)

Earning / (Loss) per share

Basic & Diluted (pence) (0.01)p (0.01) (0.005)p

p

Globe Capital Limited

Consolidated Statement of financial position as at 30 June 2022

30 June 30 June 31 December

2022 2021 2021

GBP '000 GBP '000 GBP '000

Non-current assets

Property, plant and equipment - - -

Goodwill - - -

Financial assets at fair value through profit or 1 10 8

loss

Current assets

Other receivables and prepayments 12 8 9

Cash and cash equivalents 4 23 27

Other debtors and receivables - -

Total Assets 17 41 36

Current Liabilities

Other payables 45 145 72

Creditors: falling due after more than one year

Amounts due to directors 71 34 54

Amounts due to a related company 50 - 33

Other payables 127 121 124

Total Liabilities 293 300 211

Net Assets (276) (259) (238)

Shareholders' Equity

Share Capital 645 645 645

Reserves (921) (904) (883)

Total Equity (276) (259) (238)

Globe Capital Limited

Consolidated Statement of Cash Flows

Period ended 30 June 2022

6 months 6 months Year ended

ended ended 31 December

30 June 2022 30 June 2021 2021

GBP '000 GBP '000 GBP '000

Loss before income tax (34) (34) (13)

Adjustment:

Decrease/(Increase) in value of financial assets 1 - (7)

Interest expenses 3 3 6

Gain on financial assets - (9) -

Non cash transactions written off - - (30)

Operating loss before working capital changes (30) (40) (44)

Changes in working capital:

Other receivables and prepayments (3) (1) (1)

Other payables (24) 37 (28)

Amounts due to directors - 10 -

Amounts due to shareholders - - -

Net cash used in operating activities - 6 -

Cash flows from investing activities

Other loan repayments - - (18)

Increase in loans receivable - - 20

Increase in loans from related parties 17 - 32

Increase in directors' loan 17 - 48

Interest received - - -

Net cash from investing activities 34 - 83

Increase in cash and cash equivalents (23) 6 10

Cash and cash equivalents at the beginning of the 27 17

period 17

Cash and cash equivalents at end of period 4 23 27

Cash at Bank C/F 4 23 27

The financial information set out above has not been reviewed or audited by the

company's auditors.

Basic and diluted profit per share is calculated by dividing the loss for the

period of £38,000 (2021: loss £34,000) by the weighted average number of

ordinary shares of 255,919,752 (2021: 255,919,752).

The directors of Globe Capital Limited accept responsibility for this

announcement.

For further information

Globe Capital Limited

Darren Edmonston

Tel: +44 (0) 1279 635511

CORPORATE ADVISER AND CONTACT DETAILS:

Peterhouse Capital Limited

Guy Miller / Anwyl

Tel: +44 (0) 207 469 0930

END

(END) Dow Jones Newswires

September 30, 2022 11:36 ET (15:36 GMT)

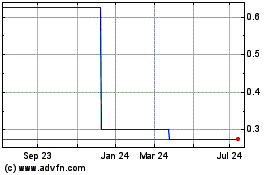

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Jan 2024 to Jan 2025