Globe Capital Limited Interim Results to 30 June 2021

November 15 2021 - 1:44PM

UK Regulatory

TIDMGCAP

15 November

Globe Capital Limited

("Globe Capital" or the "Company")

Interim Results for the six months period to 30 June 2021

Chairman's Statement

Globe Capital Limited is pleased to announce its unaudited interim results for

the 6 months period to 30 June 2021. Operational costs for the period amounted

to £31k compared to £61k for the 6 months to June 2020.

The Company's investment strategy continues to be that to seek medium-to-long

term investments in businesses that exhibit growth potential. The Company

continues to be an active investor in situations where the Company can make a

clear contribution to the growth and development of the investment.

The Company continues to receive support from its shareholders and loan note

holders to meet its ongoing costs.

The Company is still well placed to take advantage of any opportunities as they

arise through 2021 onwards and will continue to look for further fund raising

opportunities and investments.

15 November 2021

David Barnett

Chairman

Globe Capital Limited

Consolidated Profit and Loss and Other Comprehensive Income

Six months ended 30 June 2021

6 months 6 months Year ended

ended 30 ended 31 December

June 2021 30 June 2020 2020

GBP '000 GBP '000 GBP '000

Revenue - 10

10

Cost of services - - -

Gross Profit - 10 10

Other Income - 2 4

Administrative Expenses (31) (61) (145)

Finance Costs (3) (6) (6)

Loss Before Taxation (34) (55) (137)

Taxation - -

-

Other Comprehensive Loss - -

-

Loss for the period (34) (55) (137)

Earning / (Loss) per share

Basic & Diluted (pence) (0.01)p (0.05)p

(0.02)p

Globe Capital Limited

Consolidated Statement of financial position as at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

GBP '000 GBP '000 GBP '000

Non-current assets

Property, plant and equipment - - -

Goodwill - - -

Financial assets at fair value through profit or 10 - 1

loss

Current assets

Other receivables and prepayments 8 15 7

Cash and cash equivalents 23 14 17

Other debtors and receivables - 56 -

Total Assets 41 85 25

Current Liabilities

Other payables 145 66 108

Creditors: falling due after more than one year

Amounts due to directors 34 26 24

Amounts due to a shareholder - 18 -

Other payables 121 118 118

Total Liabilities 300 228 250

Net Assets (259) (143) (225)

Shareholders' Equity

Share Capital 645 645 645

Reserves (904) (788) (870)

Total Equity (259) (143) (225)

Globe Capital Limited

Consolidated Statement of Cash Flows

Period ended 30 June 2021

6 months 6 months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

GBP '000 GBP '000 GBP '000

Loss before income tax (34) (55) (137)

Adjustment:

Depreciation - 9 3

Loan receivables written off - - 55

Loss on disposal of property, plant and equipment - - 6

Other receivables written off - - 7

Interest expenses 3 6 6

Gain on financial assets (9)

Other income - (2) (4)

Operating loss before working capital changes (40) (42) (64)

Changes in working capital:

Other receivables and prepayments (1) 5 9

Other payables 37 (13) 30

Amounts due to directors 10 10 8

Amounts due to shareholders - 18 -

Net cash used in operating activities 6 (22) (17)

Cash flows from investing activities

Interest received - 2 -

Loans receivable - 29 29

Net cash from investing activities 31 29

Increase in cash and cash equivalents 6 9 12

Cash and cash equivalents at the beginning of the 17 5

period 5

Cash and cash equivalents at end of period 23 14 17

Cash at Bank C/F 23 14 17

The financial information set out above has not been reviewed or audited by the

company's auditors.

Basic and diluted profit per share is calculated by dividing the loss for the

period of £34,000 (2020: loss £55,000) by the weighted average number of

ordinary shares of 255,919,752 (2020: 255,919,752).

The directors of Globe Capital Limited accept responsibility for this

announcement.

For further information

COMPANY:

Globe Capital Limited

Darren Edmonston

+1-855-280-6793

CORPORATE ADVISER:

Peterhouse Capital Limited

Guy Miller / Mark Anwyl

Tel: +44 (0) 207 469 0930

END

(END) Dow Jones Newswires

November 15, 2021 13:44 ET (18:44 GMT)

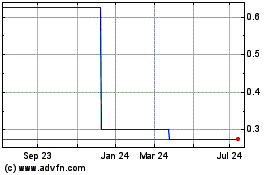

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Dec 2024 to Jan 2025

Globe Capital (AQSE:GCAP)

Historical Stock Chart

From Jan 2024 to Jan 2025