TIDMEDEN

RNS Number : 6231H

Eden Research plc

28 July 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION

OR DISTRIBUTION WOULD BE UNLAWFUL. PLEASE SEE THE IMPORTANT

INFORMATION SECTION AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE

OR DISPOSE OF ANY SECURITIES IN EDEN RESEARCH PLC OR ANY OTHER

ENTITY IN ANY JURISDICTION WHERE TO DO SO WOULD BREACH ANY

APPLICABLE LAW OR REGULATION. NEITHER THIS ANNOUNCEMENT NOR THE

FACT OF ITS DISTRIBUTION SHALL FORM THE BASIS OF, OR BE RELIED ON

IN CONNECTION WITH, ANY INVESTMENT DECISION IN RESPECT OF EDEN

RESEARCH PLC.

THIS ANNOUNCEMENT SHOULD BE READ IN ITS ENTIRETY.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) 596/2014 WHICH FORMS PART OF UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("UK

MAR"). IN ADDITION, MARKET SOUNDINGS (AS DEFINED IN UK MAR) WERE

TAKEN IN RESPECT OF CERTAIN OF THE MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

SUCH INSIDE INFORMATION, AS PERMITTED BY UK MAR. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

28 July 2023

Eden Research Plc

("Eden" or "Company")

Proposed Firm Capital Raising of GBP1.1 million, Minimum

Conditional Capital Raising of GBP7.9 million & Retail Offer to

raise up GBP0.5 million

Eden Research plc (AIM: EDEN), the AIM-quoted company that

develops and supplies breakthrough biopesticide products and

natural microencapsulation technologies to the global crop

protection, animal health and consumer products industries, today

announces that it has raised GBP1.1 million (before expenses)

through a firm placing and subscription of new Ordinary Shares

("Firm Capital Raising") and has conditionally raised a minimum of

GBP7.9 million (before expenses) by way of a Placing of new

Ordinary Shares ("Conditional Capital Raising"). The Conditional

Capital Raising is subject to the conditions set out below,

including receipt of EIS Advance Assurance from HMRC and a

Reduction of Capital (the "Conditions"). The Directors may increase

the Conditional Capital Raising to a maximum of GBP 9.4 million

prior to Second Admission.

The Firm Capital Raising and the Conditional Capital Raising

(together the "Capital Raising") will be at the Issue Price of 6.5

pence per share (the "Issue Price") to certain institutional and

other investors. Furthermore, to enable other Shareholders not able

to participate in the Capital Raising an opportunity to subscribe

for additional Ordinary Shares, the Company is proposing to raise

up to an additional GBP0.5 million (before expenses) by way of a

retail offer to its existing shareholders via the Bookbuild

Platform (the "Retail Offer") of up to 7,692,308 new Ordinary

Shares at the Issue Price.

Eden is currently the only UK-quoted company focused on

biopesticides for sustainable agriculture and is well positioned to

capitalise on the rapidly growing biopesticides market, which is

projected to be worth over GBP11 billion by 2027. The Company

expects to apply the net proceeds of the Firm Capital Raising and

any proceeds from the Retail Offer principally to fund materials to

build up stocks for its new seed treatment. Subject to the

satisfaction of the Conditions, the Conditional Capital Raising

will be used to advance the development, registration and

commercialisation of new key product categories, including new

insecticide formulations and seed treatments.

Transaction Highlights

-- Firm Placing and Firm Subscription of 16,923,077 new Ordinary

Shares at the Issue Price with new and existing investors to raise

GBP1.1 million (before expenses), comprised of a Firm Placing of

13,945,076 ordinary shares and a Firm subscription for 2,978,001

new Ordinary Shares by Sipcam Oxon S.p.A. and certain Directors

(intend to subscribe) at the Issue Price.

-- Conditional Capital Raising of a minimum of 121,538,462 new

Ordinary Shares at the Issue Price with new and existing investors

to raise GBP7.9 million (before expenses) with potential to raise

up to an additional GBP1.5 million prior to Second Admission.

-- Retail Offer at the Issue Price to raise up to an additional

GBP0.5 million (before expenses)

-- The Directors intend to use the net proceeds from the Firm

Capital Raise and any proceeds from the Retail Offer for the

following purposes:

o Working capital to fund stock purchase for the Company's new

seed treatment product

o Territory expansion (e.g. India, LATAM, SEA) for Mevalone and

Cedroz

o Label expansion through lab screening, pot and field trials,

formulation development etc for the Company's new seed

treatment

o Expand commercial team with commercial director and market

development /Product Manager

The Directors intend to use the net proceeds from the

Conditional Capital Raise for the following purposes:

o Additional seed treatment label expansions

o Insecticide label expansions

o New product development

o US based team

The Company will shortly be posting a Notice of General Meeting

and an accompanying circular (the "Circular") to existing

shareholders following this announcement. All relevant documents

will be available to download at https://www.edenresearch.com/

.

Sean Smith, Chief Executive Officer of Eden, said :

"Just over three years ago, with the support of a strong group

of new and existing investors, Eden successfully refinanced the

Company which facilitated the building of a highly effective team

capable of accelerating the pace of innovation and commercial

progress. Subsequently, we have demonstrated the progress that can

be made when resourced adequately to support advancement and

growth. There is no better example of this than the recent

announcement of our new seed treatment product, Ecovelex, which was

developed in close collaboration with Corteva Agriscience. Ecovelex

represents not only an entirely new category of products for Eden,

but it demonstrates what a focussed, experienced and motivated team

can achieve in a relatively short period of time. Ecovelex was

invented by Eden's team working in our facilities just south of

Oxford.

Today, with the encouragement of a good number of new and

existing investors, we are pleased to take the next step along our

journey, with an accelerated pace and purposeful stride. With the

support of investors, we will be able to fulfil an order that

represents an opportunity to jump-start the commercialisation of a

new product. Moreover, in response to strong investor interest, we

will be providing the Company with the financial strength to grow

our addressable market and business overall.

As I said three years ago, the outlook for the biopesticides

market remains undoubtedly positive, with a clear, growing demand

from a consumer market for sustainably grown produce and a notable

shift towards greener farming practices. Eden's biopesticide

solutions combine high levels of efficacy that are comparable to

synthetic pesticides and are aligned with the direction of

regulatory travel, which has seen restrictions and, in some cases,

the removal of conventional products from the market, such as we

have seen in the bird repellent seed treatment market, the target

for Ecovelex."

The information contained within this announcement (the

"Announcement") is deemed by the Company to constitute inside

information as stipulated under the Market Abuse Regulations (EU)

No. 596/2014. Upon the publication of this Announcement via

Regulatory Information Service, this inside information is now

considered to be in the public domain.

For further information contact:

Eden Research plc www.edenresearch.com

Sean Smith

Alex Abrey 01285 359 555

Cenkos Securities (Nominated advisor and

broker)

Giles Balleny / Max Gould (corporate finance)

Michael Johnson / Dale Bellis / Tamar

Cranford-Smith (sales) 020 7397 8900

Hawthorn Advisors (Financial PR)

Simon Woods eden@hawthornadvisors.com

Felix Meston

1. Introduction

On 28 July 2023, the Company announced a proposed Fundraising,

pursuant to which it proposes to raise, subject to certain

conditions up to GBP11.0 million (before expenses) by (i) the Firm

Capital Raising of GBP1.1 million at the Issue Price with certain

institutional and other investors, including Sipcam; (ii) the

Conditional Capital Raising of a minimum GBP7.9 million at the

Issue Price to certain institutional investors with the potential

to increase the Conditional Capital Raise by up to GBP1.5 million;

and (iii) up to approximately GBP0.5 million (before expenses) by

way of a Retail Offer made to existing Shareholders of up to

7,692,308 new Ordinary Shares at the Issue Price.

The net proceeds of the Firm Capital Raising and any proceeds of

the Retail Offer will be used principally to fund materials to

build up inventory for the new seed treatment. Subject to the

satisfaction of the Conditions, the Conditional Capital Raising

will be used to advance the development, registration and

commercialisation of new key product categories, including new

insecticide formulations and seed treatments , as well as to

provide additional working capital for the Group associated with

the new development areas, as described in more detail in paragraph

4 of the Circular.

The Conditional Capital Raising is conditional (amongst other

things) upon (i) the approval of the Resolutions at the General

Meeting; (ii) the Advanced Assurance being obtained from HMRC;

(iii) the Capital Reduction becoming effective; and (iv) Second

Admission.

The Issue Price equates to a discount of 13.3 per cent. to the

closing middle market price of 7.5 pence per Ordinary Share on 27

July 2023 (being the last Business Day before announcement of the

Fundraising).

In addition to the Fundraising, the Company is proposing to

carry out a capital reduction through the cancellation of the

Company's share premium account. This would have the effect of

creating distributable reserves, which would be used to eliminate

any accumulated deficit on the Company's profit and loss account

and to the extent that the balance arising upon completion of the

proposed reduction exceeds such deficit, to create distributable

reserves.

The background to and reasons for the Capital Reduction are set

out in paragraph 3 of the Circular. The Capital Reduction is

conditional upon, amongst other things, the approval of the Court

and of the Shareholders at the General Meeting.

2. Background and rationale for the Placing and Retail Offer

The Company's vision is for the Group to become the leader in

sustainable bioactive products and the Board believes that the

Group is well positioned to capitalise on the global shift towards

more environmentally friendly methods of crop protection. The

Company is currently the only UK quoted company focused on

biopesticides for sustainable agriculture. The Group develops and

supplies innovative biopesticide products to the global crop

protection market, using the Company's patented microencapsulation

technology, Sustaine(R). Sustaine microcapsules are naturally

sourced, plastic-free, biodegradable micro-spheres derived from

yeast extract. Importantly, the Sustaine microencapsulation

technology enables the technical viability of naturally occurring

terpenes for use in commercial crop protection. The Company's

current products include biofungicide, Mevalone; bionematicide,

Cedroz; and bird repellent seed treatment, Ecovelex(TM).

The Group's presence grew in 2020-23 through new authorisations

for both Cedroz and Mevalone, including in the USA in September

2022 and in Poland and New Zealand in 2023. The Directors

anticipate further approvals in Europe and further abroad in 2023,

with various submissions pending including in Brazil, South Africa,

Chile and Argentina. The Directors expect the UK and a range of

other Central EU countries to approve Mevalone in 2023.

The Company is pursuing the Fundraising to continue to drive

commercial progress on the back of recent approvals and expected

further overseas approvals; to expand the Company's product

portfolio; and to commercialise the first seed treatment

product.

Market Opportunity for Biopesticides

While the use of effective pesticides has been fundamental to

the farming revolution over the last 100 years, governments and

consumers have increasingly begun to acknowledge the risk to the

environment and human health posed by some conventional pesticides.

This has led to the banning or restriction (especially in Europe)

of some common pesticides such as Neonicotinoids and

Chlorothalonil.

This has subsequently increased the use of biopesticides and, as

a result, the biopesticides market is growing at a compound annual

growth rate (CAGR) of approximately 15% per annum and is projected

to be worth more than $11 billion by 2027. The global seed

treatment market is projected to be worth more than $12.5 billion

by 2027.

The Group's biopesticide solutions solve a number of the issues

of conventional pesticides. Using plant derived active ingredients

that are generally accepted as safe by regulators around the world

means that the products are not subject to residue limits or long

pre-harvest intervals, and can be used to treat post-harvest

storage diseases on some produce, subject to regulatory

approval.

In addition, the Group's yeast based Sustaine encapsulation

technology allows the Group's products and conventional pesticides

to be used without the addition of micro-plastics. There are

currently global concerns regarding the volume of micro-plastics in

the environment and the impact their presence has on human health

and wildlife. In response, there have been new regulations proposed

which could restrict the intentional addition of plastic to crop

protection and health products, which has created a need for the

major pesticide producers to actively look for alternative

approaches to the encapsulation of existing chemical treatments. In

addition, the time and cost of bringing new agrochemical products

to market has increased to around 10 to 12 years and approximately

$300 million respectively.

From a broader perspective, concerns regarding the impact on

human health of some pesticides has increased the consumer desire

for sustainable and organic products and encouraged regulators to

put stricter controls around spraying of crops and the residue

limits that are applied to farm produce.

Eden's Current Products and Technology

Mevalone(R) - Fungicide Product

Eden's first biopesticide, Mevalone, is a fungicide used in the

prevention and treatment of botrytis in table and wine grapes, as

well as the control of powdery mildew on grapevines and, in certain

territories, the treatment of botrytis on a range of crops ranging

from kiwis to onions.

In the last 12 months the Company has received regulatory

approvals for use on a range of new crops in countries such as

Italy, the USA (now approved in 17 states), New Zealand and Poland.

Approval in the state of California, a key market for Mevalone, is

expected in time for the 2024 growing season. Cedroz has already

received approval in California.

The Company recently signed a distribution agreement with large

agriscience business, Corteva, which allows Corteva to market,

distribute and sell the Group's fungicide product, Mevalone(R), in

France on an exclusive basis. There are existing distribution

agreements for Mevalone with Sipcam and Sumi Agro for other major

territories, and the Company recently announced Anasac Colombia Ltd

as its exclusive distributor of Mevalone in Colombia.

Given the recent flow of regulatory approvals and the

distribution agreements now in place, the Directors believe the

Group is well placed to begin delivering material sales of the

product. Proceeds from the Fundraising will be deployed to further

commercialise this product for new uses and for as-yet untapped

markets such as India and S.E Asia.

Cedroz ä - Nematicide Product

In addition to Mevalone, Eden has developed a nematicide product

which is used to tackle nematode infestations which can damage

crops and affect yield. Nematodes are parasites that affect a wide

range of crops grown in open fields and in greenhouses.

In 2016, Eden signed an exclusive distribution agreement with

Eastman Chemical for the nematicide product which has since been

branded Cedroz. Eastman acquired the rights to register and sell

Cedroz in 29 countries. Sales of Cedroz began in the EU in 2020.

Cedroz is approved in South and Central EU on a wide range of high

value crops. In September 2022, Cedroz(TM) received approval for

use in various states in the USA, including Florida and California.

Further submissions for approvals in various additional key markets

around the world have been made.

Given recent progress and approvals, the Directors expect a

return to sales growth for Cedroz(TM) in 2023.

Ecovelex(TM) - Bird repellent seed treatment

Ecovelex(TM) is a biological bird repellent seed treatment

initially for use on maize. Subject to regulatory approvals,

Ecovelex(TM) represents a new entrant into the seed treatment

market and is intended to replace conventional chemicals banned in

the EU and UK. It was developed to tackle crop destruction caused

by birds - a major cause of losses in maize and other crops.

Ecovelex(TM) works by affecting the bird's olfactory system,

creating an unpleasant taste or odour that repels the bird, leaving

the seeds safely intact and the bird unaffected and free to find

alternative food sources. The product is based on plant-derived

chemistry and formulated using the Group's Sustaine

microencapsulation system, supporting farmers as they strive to

meet consumer demands for more sustainable agriculture.

Ecovelex(TM) has been developed over three years through a

collaboration with Corteva, for which a development agreement was

signed in May 2021. Field trials undertaken by both parties were

successful and demonstrated efficacy. An application for regulatory

authorization has been submitted to the EU and UK regulatory

authorities, with the approval process expected to take between 18

and 24 months, and therefore the possibility of sales in time for

the 2024 growing season, subject to emergency use authorisations.

Initial markets targeted are the EU plus the UK.

It is expected that the product will be commercialised in

additional regions and further developed for use on additional

crops in due course and part of the proceeds from the Fundraising

will be utilised to progress these aims.

Sustaine (R) - Microencapsulation Technology

The Group proposes to use part of the proceeds from the

Conditional Placing to continue actively developing formulations

with traditional chemical products using its Sustaine

microencapsulation technology.

By 2025 in the EU, pesticides containing synthetic polymer

microplastics are likely to be severely restricted or banned

entirely and removed from the market. The Directors believe that

the only acceptable alternative is the substitution with

biodegradable formulations. Reformulated products will likely need

to be evaluated and registered within the five-year transition

period.

The Group has developed a natural formulation technology,

Sustaine(R), using particles derived from natural yeast cells. The

technology was originally developed as a drug delivery method for

human health applications before the Group adapted it for use in

the encapsulation of pesticides. By creating a stabilised aqueous

emulsion, Sustaine(R) enables the formulation of pesticides using a

number of terpene-based active ingredients which would not be

suitable without being encapsulated. The encapsulation provides for

the sustained release of these ingredients when in contact with

water slowing or stopping release in dry conditions, enabling their

safe, more efficient use. The benefit of Sustaine(R) is that it is

cost effective, useful for a wide range of active ingredients,

plastic-free, high capacity, robust, sustainable and facilitates

reduced phytotoxicity.

Sustaine(R) is a proven, commercially-used solution to the

microplastics problem in formulations requiring encapsulation. The

Group currently has a number of projects underway where it is

testing the compatibility of Sustaine(R) with third-party active

ingredients to determine whether benefits such as formulation

stability, dose reduction or resistance management could be

achieved. The regulatory restriction of microplastics used as

components of crop protection and many other products contributes

significantly to the opportunity for Eden to deploy its Sustaine(R)

technology on a very large scale.

3. Background and rationale for the Capital Reduction

The Company had accumulated losses of GBP43.3 million and

GBP39.3 million standing to the credit of its share premium account

shown by its audited accounts for the period to 31 December

2022.

The Company's share premium account will be increased by up to

approximately GBP1,353,846 on the issue of the Firm Shares and the

Retail Offer Shares, assuming an aggregate maximum of GBP1,600,000

raised following First Admission.

It is proposed to cancel the Company's share premium account

which would have the effect of leaving it with distributable

reserves of an estimated GBP0.5 million to GBP1.0 million,

depending on the outcome of the Retail Offer.

Whilst the Board and management remain focussed on the continued

execution of the Company's stated growth strategy as the primary

means of delivering shareholder value in the near term and has no

current intention of declaring dividends, the proposed Capital

Reduction would provide greater scope to do so in the future if the

Board determined that the declaration of dividends were

appropriate.

In addition, the Capital Reduction would provide the Board with

the option, should it so wish, and should it be appropriate to do

so, of purchasing the Company's own Ordinary Shares pursuant to the

power granted at the Company's annual general meeting on 29 June

2023, which requires sufficient distributable reserves to do

so.

4. Use of proceeds

The Directors intend to use the net proceeds from the Firm

Capital Raising and Retail Offer of approximately GBP1.35 million

and net proceeds of the Conditional Capital Raising, assuming full

take up, of approximately GBP8.8 million for the following

purposes:

Firm Capital Raising and Retail Offer:

-- c. GBP0.5 million for the launch of the new seed treatment and label expansion;

-- c. GBP0.2 million to expand the Group's commercial team; and

-- c. GBP0.3 million to expand territories for Mevalone and Cedroz products.

Conditional Capital Raising:

-- c. GBP2.5 million for the further development of the seed

treatment product and additional label expansions;

-- c. GBP2.5 million for insecticide label expansion into new territories;

-- c. GBP2.5 million for new product development;

-- c. GBP0.5 million to expand the Group's commercial team; and

-- c. GBP0.5 to 1.5 million for general working capital

There can be no certainty that the Conditions will be satisfied

and the Conditional Shares will be issued. If that is the case, the

proceeds of the Conditional Capital Raising will not be

received.

5. Current Trading and Prospects

The first half of 2023 has seen a modest increase in product

sales. Though it is relatively early in the season to know with any

certainty, early indications from southern Europe, in particular,

are that the sales of Mevalone are developing well. Sales of Cedroz

have also shown a strong return to growth in the first half of the

year.

The Company also believes that there is a reasonable opportunity

to gain emergency authorisations for Ecovelex, and if this is

granted it is possible that product sales revenue overall may

exceed the current forecast, although it is, of course, too early

to say at this stage.

In 2024, the Company expects to see further, strong product

sales growth off the back of approvals for both Mevalone and Cedroz

in the US and Central Europe, as well as label extensions for

Mevalone in various countries. Sales in the US for Mevalone are,

however, materially influenced by the timing of receipt of the

approval in California, which is currently expected before the end

of 2023.

In addition and subject to the receipt of regulatory clearance,

the Company expects sales of Ecovelex to contribute significantly

to the top line in 2024.

Subject to successful field trials undertaken by several

interested parties, the Company expects to move into commercial

negotiations for its insecticide product towards the end of 2023

and into early 2024. It is currently expected that the insecticide

will be ready for sale in 2024/25 in the US and 2025/6 in the EU,

subject to regulatory timing and approvals.

6. Related parties' participation

Directors' participation in the Firm Capital Raising

As part of the Firm Capital Raising, all of the Directors have

subscribed (either personally or through a nominee) for an

aggregate of 2,398,077 Firm Shares at the Issue Price. Details of

the Firm Shares for which the Directors have subscribed (either

personally or through a nominee) are set out below:

Name Title Number Number Value of Resulting

of existing of Firm Firm Shares shareholding

Ordinary Shares to be subscribed following

Shares# subscribed for# subscription

for#

Lykele

van der

Broek Chairman 929,500 692,308 GBP45,000.02 1,621,808

---------- ------------- ------------ ------------------ --------------

Sean Smith CEO 731,039 461,538 GBP29,999.97 1,192,577

---------- ------------- ------------ ------------------ --------------

Alex Abrey CFO 1,620,346 153,846 GBP9,999.99 1,774,192

---------- ------------- ------------ ------------------ --------------

Robin Cridland NED 130,167 615,385 GBP40,000.03 745,552

---------- ------------- ------------ ------------------ --------------

Richard

Horsman NED 0 475,000 GBP30,875.00 475,000

---------- ------------- ------------ ------------------ --------------

# The number of Ordinary Shares presented in this table as being

held or subscribed for by Directors refers to the number of

Ordinary Shares held or subscribed for by them either personally or

through a nominee.

The participation by the Directors referred to above in the Firm

Capital Raising is classified as a related party transaction for

the purposes of the AIM Rules. As all of the Directors are

participating in the Firm Capital Raising, Cenkos Securities

confirms that it considers that the terms of the transaction are

fair and reasonable insofar as the Company's Shareholders are

concerned.

7. Details of the Placings

The Company has raised approximately GBP1.1 million before

expenses by the issue of the Firm Placing Shares at the Issue Price

to certain Shareholders and new investors. The Firm Placing Shares

will, when issued, rank pari passu with the Existing Ordinary

Shares.

Institutional and other investors have conditionally agreed to

subscribe for the Firm Placing Shares at the Issue Price. The Firm

Placing has not been underwritten. The issue of the Firm Placing

Shares is conditional, inter alia, upon First Admission becoming

effective on the First Admission Date (or such later date as the

Company and Cenkos Securities may agree, being not later than the

First Admission Long Stop Date).

The Placing of the Conditional Placing Shares is conditional,

inter alia, on (i) the approval of the Resolutions at the General

Meeting, (ii) the Advanced Assurance being obtained from HMRC,

(iii) the Capital Reduction becoming effective and (iv) Second

Admission. It is expected that Second Admission will occur on the

third Business Day from the Conditional Placing becoming

unconditional in all respects (save for Second Admission), and in

any event not later than the Second Admission Long Stop Date. The

Conditional Placing has not been underwritten.

In the event that the Conditions have not been fulfilled prior

to the Second Admission Long Stop Date (or at such time as HMRC has

informed the Company the Advanced Assurance will not be obtained),

then the Conditional Placing will not complete and the funds from

the Conditional Capital Raising will not be received.

It should be noted that First Admission is not conditional upon

Second Admission. However, Second Admission is conditional on First

Admission.

The Directors believe that, following the Capital Reduction, the

Conditional Placing Shares to be issued pursuant to the Conditional

Placing will meet the requirements of section 173 ITA for the

purposes of the EIS and the Company will be a Qualifying Holding

and the Conditional Placing Shares will be eligible shares for the

purposes of investment by VCTs.

Under the terms of the Placing Agreement, Cenkos Securities has

agreed to use its reasonable endeavours to procure subscribers for

the Placing Shares at the Issue Price. The Placing Agreement

contains certain warranties and indemnities from the Company in

favour of Cenkos Securities.

Under the Placing Agreement, the Company has agreed to pay to

Cenkos Securities a fixed sum and commissions based on the

aggregate value of the Fundraising, and the costs and expenses

incurred by it in relation to the Fundraising.

The Placing Agreement contains customary warranties given by the

Company in favour of Cenkos Securities in relation to, amongst

other things, the accuracy of the information in this Document and

other matters relating to the Group and its business. In addition,

the Company has agreed to indemnify Cenkos Securities (and their

respective affiliates) in relation to certain liabilities which

they may incur in respect of the Fundraising.

Cenkos Securities has the right to terminate the Placing

Agreement in certain circumstances prior to First Admissions and in

respect only of the Conditional Capital Raising (but not the Firm

Capital Raising or the Retail Offer) prior to Second Admission, in

particular, in the event of breach of the warranties, the

occurrence of a material adverse change in circumstances material

to the Fundraising, or if the Placing Agreement does not become

unconditional.

8. Details of the Firm Subscription

In addition, Eden has entered into a conditional Subscription

Agreement with Sipcam, one of its commercial partners, pursuant to

which Sipcam will subscribe for 1,670,308 Firm Subscription Shares

conditional on First Admission.

Please see paragraph 6 above for details of the Directors'

participation in the Firm Capital Raising.

The Issue Price of 6.5 pence per share equates to a discount of

13.3 per cent. to the closing price of 7.5 pence on 27 July 2023,

the latest Business Day prior to the announcement of the

Fundraising.

9. The Retail Offer

The Company values its Shareholder base and believes that it is

appropriate to provide eligible retail Shareholders in the United

Kingdom the opportunity to participate in the Retail Offer. The

Retail Offer will allow retail Shareholders to participate in the

Fundraising by subscribing for Retail Shares at the Issue

Price.

Eligible retail Shareholders can contact their intermediary

(normally a broker, investment platform or wealth manager) to

participate in the Retail Offer. In order to participate in the

Retail Offer, each intermediary must be on-boarded onto the

BookBuild Platform, have an active trading account with Cenkos

Securities (who is acting as the Retail Offer Coordinator) and have

been approved by the Retail Offer Coordinator as an intermediary in

respect the Retail Offer, and agree to the final terms and the

Retail Offer terms and conditions, which regulate the conduct of

the Retail Offer on market standard terms and provide for the

payment of commission to any intermediary that elects to receive a

commission and/or fee (to the extent permitted by the FCA Handbook

Rules) from the Retail Offer Coordinator (on behalf of the

Company).

Any expenses incurred by any intermediary are for its own

account. Eligible retail Shareholders who wish to participate in

the Retail Offer should confirm separately with any intermediary

whether there are any commissions, fees or expenses that will be

applied by such intermediary in connection with any application

made through that intermediary pursuant to the Retail Offer.

The Retail Offer will be open to eligible retail Shareholders in

the United Kingdom at 5.00 p.m. on 28 July 2023 on the following

website:

https://www.bookbuild.live/deals/VZ7ZE7/authorised-intermediaries.

The Retail Offer is expected to close by no later than 10.00 a.m.

on 2 August 2023. Eligible retail Shareholders should note that

financial intermediaries may have earlier closing times. The Retail

Offer may close early if it is oversubscribed.

To be eligible to participate in the Retail Offer, applicants

must meet the following criteria before they can submit an order

for Retail Shares: (i) be a customer of one of the participating

intermediaries listed on the above website; (ii) be resident in the

United Kingdom; and (iii) be a shareholder in the Company (which

may include individuals aged 18 years or over, companies and other

bodies corporate, partnerships, trusts, associations and other

unincorporated organisations and includes persons who hold their

Ordinary Shares directly or indirectly through a participating

intermediary).

The Company reserves the right to scale back any order at its

discretion. The Company reserves the right to reject any

application under the Retail Offer without giving any reason for

such rejection.

It is vital to note that once an application for Retail Offer

Shares has been made and accepted via an intermediary, it cannot be

withdrawn.

The Retail Offer is an offer to subscribe for transferable

securities, the terms of which ensure that the Company is exempt

from the requirement to issue a prospectus under Regulation (EU)

2017/1129 as it forms part of UK law by virtue of the European

Union (Withdrawal) Act 2018. The aggregate total consideration for

the Retail Offer will not exceed GBP500,000 and therefore the

exemption from the requirement to publish a prospectus, set out in

section 86(1) FSMA, will apply.

The Retail Shares are not being offered generally in the UK or

elsewhere. It is expected that the proceeds of the Retail Offer due

to the Company will be received by it soon after Admission.

The Retail Announcement was made on 28 July 2023 and contains

further information on how investors can participate in the Retail

Offer.

The Retail Offer remains conditional on, inter alia:

-- the Firm Placing being or becoming wholly unconditional;

-- Admission of the New Ordinary Shares becoming effective by no

later than 8.00 a.m. on 3 August 2023 or such later time and/or

date as Cenkos Securities and the Company may agree.

The Retail Shares will be issued free of all liens, charges and

encumbrances and will, when issued and fully paid, rank pari passu

in all respects with the Existing Ordinary Shares, including the

right to receive all dividends and other distributions declared,

made or paid after the date of their issue.

Application will be made to the London Stock Exchange for

Admission of the Retail Shares to trading on AIM. It is expected

that Admission will occur and that dealings will commence at 8.00

a.m. on 3 August 2023, at which time it is also expected that the

Retail Shares will be enabled for settlement in CREST.

If you are in any doubt as to what action you should take, you

should immediately seek your own personal financial advice from

your stockbroker, bank manager, solicitor, accountant or other

independent professional adviser duly authorised under the

Financial Services and Markets Act 2000 (as amended) if you are

resident in the United Kingdom or, if not, from another

appropriately authorised independent financial adviser.

10. The Capital Reduction

Under the Act, with the sanction of a resolution of the

Shareholders and the confirmation of the Court, the Company may

reduce or cancel its share premium account.

In seeking this approval, the Court will need to be satisfied

that the interests of the Company's creditors will not be

prejudiced as a result of the Capital Reduction. The Court may

require the Company to put in place protection for the benefit of

the Company's creditors at the date of the Court application. The

Board anticipates that the Company will provide such protection as

so required.

The Board reserves the right to abandon or to discontinue (in

whole or in part) any application to the Court in the event that

the Board considers that the terms on which the Capital Reduction

would be (or would be likely to be) confirmed by the Court would

not be in the best interests of the Company and/or the Shareholders

as a whole. The Directors will, prior to the making of any

application to the Court for the approval of the Capital Reduction,

undertake a careful review of the Company's liabilities (including

contingent liabilities) and consider the Company's ability to

satisfy the Court that, as at the date (if any) on which the Court

Order relating to the Capital Reduction and the statement of

capital in respect of the Capital Reduction have both been

registered by the Registrar of Companies at Companies House and the

Capital Reduction therefore becomes effective, the Company's

creditors will be sufficiently protected.

11. General Meeting

The Directors do not currently have authority to allot the

Conditional Shares and, accordingly, the Board is seeking the

approval of Shareholders to allot the Conditional Shares at the

General Meeting.

A notice convening the General Meeting, which is to be held at

the offices of Milton Park Innovation Centre, 99 Park Drive, Milton

Park, Oxfordshire, OX14 4RY at 9:00 a.m. on 17 August 2023, is set

out at the end of the Circular. At the General Meeting, the

following Resolutions will be proposed:

-- Resolution 1, which is an ordinary resolution, to authorise

the Directors to allot relevant securities for cash up to an

aggregate nominal amount of GBP1,446,153.85, being equal to

144,615,385 Conditional Shares;

-- Resolution 2, which is conditional on the passing of

Resolution 1 and is a special resolution, to authorise the

Directors to allot 144,615,385 Conditional Shares on a

non-pre-emptive basis; and

-- Resolution 3, which is conditional on the passing of

Resolution 1 and Resolution 2 and is a special resolution, to

authorise the directors, subject to approval from the Court, to

cancel the share premium account of the Company.

The authorities to be granted pursuant to Resolutions 1 and

Resolution 2 will expire on whichever is the earlier of (a) the

conclusion of the next Annual General Meeting of the Company; and

(b) the date falling six months from the date of the passing of the

Resolutions (unless renewed, varied or revoked by the Company prior

to or on that date) and shall be in addition to the Directors'

authorities to allot relevant securities and dis-apply statutory

pre-emption rights granted at the Company's Annual General Meeting

held on 29 June 2023.

For the purposes of section 571(6)(c) of the Act, the Directors

determined the Issue Price after consideration of applicable market

and other considerations and having taken appropriate professional

advice.

Shareholders will find instructions within the Circular on how

to complete a Form of Proxy for use in connection with the General

Meeting. The Form of Proxy should be completed and returned in

accordance with the instructions thereon so as to be received by

Link Group, PXS 1, Central Square, 29 Wellington Street, Leeds, LS1

4DL, as soon as possible and in any event not later than 48 hours (

excluding any part of a day that is not a working day ) before the

time of the General Meeting. Completion and return of the Form of

Proxy will not prevent a Shareholder from attending and voting at

the General Meeting.

12. Recommendation

The Directors believe the Capital Reduction, the Fundraising and

the passing of the Resolutions to be in the best interests of the

Company and its Shareholders as a whole. Accordingly, the Directors

unanimously recommend Shareholders to vote in favour of the

Resolutions as they intend so to do in respect of their beneficial

shareholdings amounting to 3,411,052 Ordinary Shares, representing

approximately 0.9 per cent. of the existing issued ordinary share

capital of the Company.

PLACINGS AND SUBSCRIPTIONS STATISTICS

Issue Price (per share) 6.5 pence

Number of Existing Ordinary Shares 381,108,607

Total number of Firm Placing Shares and Firm Subscription

Shares

16,923,077

Gross proceeds of the Firm Capital Raising GBP1.1 million

Minimum number of Conditional Shares 121,538,462

Maximum number of Conditional Shares 161,538,462

Minimum gross proceeds of the Conditional Capital Raising GBP7.9

million

Maximum number of Firm Shares and Conditional Shares as a

percentage of the Enlarged Share Capital* 31.5%

Maximum gross proceeds of the Capital Raising up to GBP10.5

million

RETAIL OFFER STATISTICS

Issue Price (per share) 6.5 pence

Number of Retail Offer Shares up to 7,692,308

Gross proceeds of the Retail Offer* up to

GBP0.5 million

Enlarged Share Capital following the Fundraising* up to

567,262,454

Retail Offer Shares as a percentage of the Enlarged Share

Capital*

up to 1.4%

* on the assumption that the maximum number of New Ordinary

Shares are issued pursuant to the Capital Raising and that the

Retail Offer is fully subscribed

7

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

2023

Announcement of the Placings 28 July

Announcement of the Retail Offer 28 July

Announcement of the results of the Retail 2 August

Offer

First Admission effective and dealings in 8.00 a.m. on 3 August

the First Placing Shares and Retail Offer

Shares expected to commence on AIM

CREST accounts credited in respect of the 8.00 a.m. on 3 August

First Placing Shares and Retail Offer Shares

to be held in uncertificated form (subject

to First Admission)

Where applicable, expected date for dispatch within 10 Business

of definitive share certificates First Placing Days following First

Shares and Retail Offer Shares to be held Admission

in certificated form

Latest time and date for receipt of completed 9 a.m. on 15 August

Forms of Proxy and receipt of electronic

proxy appointments via the CREST system

General Meeting 9 a.m. on 17 August

Announcement of result of General Meeting 17 August

Expected date for final hearing and confirmation 12 September

of the Capital Reduction by the Court

Expected date that the Capital Reduction 14 September

become effective

Second Admission Long Stop Date 8.00 a.m. on 20 October

Notes:

(i) References to times in this annoucement are to London time (unless otherwise stated).

(ii) If any of the details contained in the timetable above

should change, the revised times and dates will be notified by

means of an announcement through a Regulatory Information

Service.

DEFINITIONS

The following definitions apply throughout the announcement and

Circular unless the context otherwise requires:

Act the Companies Act 2006 (as amended)

Admissions together the First Admission and the Second Admission

and "Admission" shall mean either of them as the context may

require

Advanced Assurance the assurance from HMRC issued under the

Income Tax Act 2007 in a form and on terms satisfactory to Cenkos

that, for investors who themselves meet the conditions, an

investment by them in the Conditional Placing Shares would qualify

for relief from taxation under the enterprise investment scheme

regime

AIM the market of that name operated by the London Stock

Exchange

AIM Rules the AIM Rules for Companies published by the London

Stock Exchange from time to time

Bookbuild Platform a technology platform providing issuers and

their advisers access to primary capital markets deals and is owned

BB Technology Ltd, a private limited company incorporated in

England and Wales with registered number 13508012.

Business Day a day (other than a Saturday or Sunday) on which

commercial banks are open for general business in London,

England

Capital Raising the Firm Capital Raising and the Conditional

Capital Raising

Capital Reduction means the reduction of the Company's share

capital by means of the reduction of some of its share premium as

more particularly described in this circular

Cenkos or Cenkos Securities Cenkos Securities plc

certificated form or in an Ordinary Share recorded on a

company's share register as being

certificated form held in certificated form (namely, not in CREST)

Company or Eden Eden Research plc, a company incorporated and

registered in England and Wales under the Companies Act 2006 with

registered number 03071324

Conditional Capital Raising the Conditional Placing together

with any additional Conditional Shares issued pursuant to

subscriptions

Conditional Placing the conditional placing of the Conditional

Placing Shares pursuant to the Placing Agreement and conditional

on, amongst other things, satisfaction of the Conditions

Conditional Placing Shares the minimum 121,538,462 new Ordinary

Shares to be allotted and issued by the Company pursuant to the

Conditional Placing

Conditional Shares up to 144,615,385 New Ordinary Shares issued

pursuant to the Conditional Capital Raising

Conditions the conditions set out in the Placing Agreement for

allotment and issue of the Conditional Shares being, inter alia,

receipt of Advanced Assurance and the Capital Reduction becoming

effective

CREST the relevant system (as defined in the CREST Regulations)

in respect of which Euroclear is the operator (as defined in those

regulations)

CREST Manual the rules governing the operation of CREST,

consisting of the CREST Reference Manual, CREST International

Manual, CREST Central Counterparty Service Manual, CREST Rules,

Registrars Service Standards, Settlement Discipline Rules, CREST

Courier and Sorting Services Manual, Daily Timetable, CREST

Application Procedures and CREST Glossary of Terms (all as defined

in the CREST Glossary of Terms promulgated by Euroclear on 15 July

1996 and as amended since) as published by Euroclear

CREST member a person who has been admitted to CREST as a

system-member (as defined in the CREST Manual)

CREST participant a person who is, in relation to CREST, a

system-participant (as defined in the CREST regulations)

CREST Regulations the Uncertificated Securities Regulations 2001

(SI 2001/3755) (as amended)

CREST sponsor a CREST participant admitted to CREST as a CREST

sponsor

CREST sponsored member a CREST member admitted to CREST as a sponsored member

Dealing Day a day on which the London Stock Exchange is open for

business in London

Directors or Board the directors of the Company whose names are

set in the Circular, or any duly authorised committee thereof

Document the Circular document which, for the avoidance of

doubt, does not comprise a prospectus (under the Prospectus

Regulation) or an admission document (under the AIM Rules)

EIS Enterprise Investment Scheme (as defined in Part 5 ITA

2007)

Enlarged Share Capital the entire issued share capital of the

Company following completion of the Fundraising on Second

Admission

EU the European Union

Euroclear Euroclear UK & International Limited, the operator

of CREST

EUWA the European Union (Withdrawal) Act 2018 as amended and

supplemented from time to time (including, but not limited to, by

the EU (Withdrawal) Act 2020)

Existing Ordinary Shares the 381,108,607 Ordinary Shares in

issue at the date of this announcement, all of which are admitted

to trading on AIM

FCA the UK Financial Conduct Authority

First Admission admission of the Firm Shares and the Retail

Offer Shares to trading on AIM becoming effective in accordance

with the AIM Rules

First Admission Date 3 August 2023, or such later date as the

Company and Cenkos may agree in writing, being in any event, not

later than 8.00 a.m. on the First Admission Long Stop Date

First Admission Long Stop Date 31 August 2023

Firm Capital Raising the Firm Placing and Firm Subscription

Firm Placing the placing of the Firm Placing Shares pursuant to

the Placing Agreement

Firm Placing Shares the 13,945,076 new Ordinary Shares to be

allotted and issued by the Company pursuant to the Firm Placing

Firm Shares the Firm Placing Shares and the Firm Subscription

Shares

Firm Subscription the subscription of the Firm Subscription

Shares by Sipcam and certain directors

Firm Subscription Shares the 1,670,308 Ordinary Shares to be

allotted and issued to Sipcam on the terms of the Sipcam

Subscription Agreement pursuant to the Firm Subscription and

1,307,693 Ordinary Shares to be allotted and issued to certain

Directors under subscription agreements

Form of Proxy the form of proxy for use in connection with the

General Meeting which accompanies the Document

FSMA the Financial Services and Markets Act 2000 (as

amended)

Fundraising the Placings, Firm Subscription and the Retail

Offer

General Meeting the general meeting of the Company to be held at

the offices of Milton Park Innovation Centre, 99 Park Drive, Milton

Park, Oxfordshire, OX14 4RY at 9 a.m. on 17 August 2023 (or any

adjournment of that general meeting)

Group the Company and its subsidiaries

HMRC His Majesty's Revenue and Customs (which shall include its

predecessors, the Inland Revenue and HM Customs and Excise)

Intermediaries broker or wealth manager to an eligible retail

Shareholder in the Retail Offer and "Intermediary" shall mean any

one of them

ISIN International Securities Identification Number

Issue Price 6.5 pence per Placing Share, per Subscription Share

and per Retail Offer Share

ITA UK Income Tax Act 2007

Link Group or Link a trading name of Link Market Services Limited

London Stock Exchange London Stock Exchange plc

MAR the UK version of the Market Abuse Regulation ((EU) No

596/2014) which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented from time to

time

Money Laundering Regulations The Money Laundering, Terrorist

Financing and Transfer of Funds (Information on the Payer)

Regulations 2017, the Criminal Justice Act 1993 and the Proceeds of

Crime Act 2002

New Ordinary Shares together, the Ordinary Shares to be issued

pursuant to the Fundraising

Notice of General Meeting the notice convening the General

Meeting which is set out at the end of the Circular subject to the

conditions set out in Part III of the Circular and, where relevant,

in the Application Form

Ordinary Shares ordinary shares of GBP0.01 each in the capital

of the Company

Placee the subscribers for the Placing Shares pursuant to the

Placings

Placing Announcement the Regulatory Information Service

announcement of the Company announcing the Fundraising

Placings the Firm Placing and the Conditional Placing

Placing Agreement the agreement entered into between the Company

and Cenkos in respect of the Placings and

Retail Offer dated 28 July 2023, as described

in this Document

Placing Shares the Firm Placing Shares and the Conditional

Placing Shares

Prospectus Regulation the UK version of commission delegated

regulation (EU) 2017/1129 of the European Parliament and of the

Council, which is part of UK law by virtue of EUWA

Qualifying Holding means a qualifying holding for the purposes

of Chapter 4 of Part 6 of ITA Restricted Jurisdiction)

Regulatory Information Service has the meaning given in the AIM Rules

Resolutions the resolutions set out in the Notice of General

Meeting

Restricted Jurisdiction each and any of Australia, Canada,

Japan, New Zealand, the Republic of South Africa or the United

States and any other jurisdiction where the Offer would breach any

applicable law or regulations

Retail Offer means the retail offer to be made by the Company on

the day of the Placing Announcement via the Bookbuild Platform to

retail investors situated in the United Kingdom to subscribe for

Retail Offer Shares at the Issue Price

Retail Offer Shares up to 7,692,308 new Ordinary Shares being

made available pursuant to the Retail Offer

Second Admission admission of the Conditional Shares to trading

on AIM becoming effective in accordance with the AIM Rules

Second Admission Date The to be determined date post the Capital

Reduction, or such later date as the Company and Cenkos may agree

in writing, being in any event, not later than 8.00 a.m. on the

Second Admission Long Stop Date

Second Admission Long Stop Date 20 October 2023

Shareholders holders of Ordinary Shares

Sipcam Sipcam Oxon S.p.A.

Sipcam Subscription Agreement the subscription agreement entered

into by the Company and Sipcam on or around the date of this

announcement and as referred to in the Placing Announcement

UK or United Kingdom the United Kingdom of Great Britain and Northern Ireland

Uncertificated or Uncertificated recorded on the relevant

register or other record of the shares or

form other security concerned as being held in uncertificated

form in CREST, and title to which, by virtue of the CREST

Regulations, may be transferred by means of CREST

US Person has the meaning given in the United States Securities

Act 1933 (as amended)

VCT Venture Capital Trust (as defined in Part 6 ITA 2007)

voting rights means all voting rights attributable to the share

capital of the Company which are currently exercisable at a general

meeting

GBP and p United Kingdom pounds sterling and pence respectively,

the lawful currency of the United Kingdom

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUWVVROSUBUAR

(END) Dow Jones Newswires

July 28, 2023 12:00 ET (16:00 GMT)

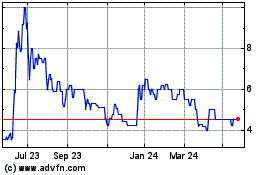

Eden Research (AQSE:EDEN.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

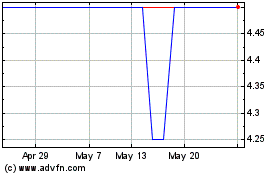

Eden Research (AQSE:EDEN.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024