TIDMCVSG

RNS Number : 9477N

CVS Group plc

26 January 2023

26 January 2023

CVS Group plc

("CVS" or the "Company" and, together with its subsidiaries, the

"Group")

Half year Trading Update

Strong demand continues - trading in line with full year

expectations

CVS, the AIM-quoted veterinary group and one of the UK's leading

providers of integrated veterinary services, issues the following

update on trading covering the six months ended 31 December 2022

("H1 2023"). The Company expects to announce its H1 2023 interim

results on 24 February 2023.

Summary

-- Strong H1 2023 results with revenue up 8.2% vs H1 2022

-- H1 2023 like-for-like (LFL)(1) sales growth of 7.5%, within

the Group's organic revenue growth ambition of between 4% and

8%

-- Adjusted EBITDA (2) margin of c.19%, in line with the prior year

-- The Group has completed a further two acquisitions bringing

the total to six acquisitions comprising of nine practice sites in

the financial year to date, for initial consideration of

GBP26.5m

-- In December 2022, the Group opened a new Greenfield site in

Southport, and is on track to open a further two in H2 2023

-- Further investment in practice relocations, refurbishments

and technology with GBP19.9m capex spent year to date (H1 2022:

GBP10.6m)

-- Operating cash conversion remains strong and leverage (5) at

0.60x as at 31 December 2022 provides significant headroom to drive

further growth

-- c. 5.0% increase in the average number of vets employed vs

December 2021 with vet attrition continuing to fall

-- Trading in line with market expectations for the full year

H1 2023 Performance

We continue to see positive trading across the Group, with total

Group revenue up 8.2% to GBP296.3m (H1 2022: GBP273.7m). LFL (1)

sales increased 7.5% in H1 2023, the Group continues to see strong

demand across our integrated veterinary services.

Our Healthy Pet Club preventative medicine scheme (3) has seen a

further increase in membership, up 4.3% to 481,000 as at 31

December 2022, from 461,000 as at 31 December 2021 (30 June 2022:

470,000).

Group Adjusted EBITDA (2) margin continues to remain in line

with the prior year, benefiting from operating leverage and strong

revenue growth. The Group has continued to increase its investment

in practice refurbishment , relocations, clinical equipment and

technology with GBP19.9m invested in H1 2023 vs GBP10.6m in H1

2022. In addition, in December 2022 we opened a new Greenfield site

in Southport.

The Group remains on track to open a further two Greenfield

sites in H2 2023.

Acquisitions

The Group has completed a further two acquisitions bringing the

total to six acquisitions comprising nine practice sites in the

financial year to date, for a combined initial consideration of

GBP26.5m:

-- Werrington Vets - Single site practice in Peterborough acquired July 2022

-- Woodlands Vets - Two site practice in Cheltenham acquired September 2022

-- Market Cross Veterinary Clinic - Single site practice in Edinburgh acquired October 2022

-- Seadown Vets - Three site practice in Southampton acquired November 2022

-- The Harrogate Vet - single site practice in Harrogate acquired November 2022

-- Stokewood Vets - single site practice in Bournemouth acquired January 2023

Net bank borrowings

Net bank borrowings(4) increased to GBP57.6m (30 June 2022:

GBP36.0m) primarily as a result of the investment in capex and

acquisitions in the half, demonstrative of the Group's commitment

to investing for the future. Leverage(5) on a bank test basis of

0.60x is in line with management expectations (30 June 2022:

0.40x), providing significant headroom for growth.

Our People

The upward trend in our employee Net Promoter Score (eNPS) has

continued as a result of our continued effort to engage and empower

our teams. We have been focused on improving equity, diversity and

inclusion (EDI) and have been rolling out our own EDI course with

the aim of making everybody feel welcome at CVS. With this

investment in our people, we are pleased that the average number of

vets we employ has increased c.5.0% vs December 2021.

Outlook

Whilst the Group remains mindful of the challenging economic

backdrop, demand for veterinary care remains resilient. We continue

to focus on our purpose to provide the best possible care to

animals through our integrated platform and to invest in our

practices and clinical equipment to drive organic growth, whilst

continuing to explore acquisition opportunities in both the UK and

internationally as outlined at our recent Capital Markets Day .

The Board is pleased with H1 2023 performance and considers that

current trading remains in line with market expectations for the

full year. The Group remains well placed to deliver on further

growth opportunities over the longer term.

The Board would like to acknowledge and thank all members of the

CVS team for their continued dedication and support.

Notes

1. Like-for-like sales shows revenue generated from

like-for-like operations compared to the prior year, adjusted for

the number of working days. For example, for a practice acquired in

September 2021 , revenue is included from September 2022 in the

like-for-like calculations.

2. Adjusted EBITDA (Earnings Before Interest, Tax, Depreciation

and Amortisation) is profit before tax adjusted for interest (net

finance expense), depreciation, amortisation, costs relating to

business combinations, and exceptional items. Adjusted EBITDA

provides information on the Group's underlying performance and this

measure is aligned to our strategy and KPIs.

3. Healthy Pet Club is our preventative care scheme offering

routine preventative care to clients for a monthly or annual

membership fee.

4. Net bank borrowings is drawn bank debt less cash and cash equivalents.

5. Leverage on a bank test basis is net bank borrowings, divided

by adjusted EBITDA annualised for the effect of acquisitions,

including costs relating to business combinations and excluding

share option costs, prior to the adoption of IFRS 16.

CVS Group plc via Camarco

Richard Fairman, CEO

Ben Jacklin, COO

Robin Alfonso, CFO

Peel Hunt LLP (Nominated Adviser & Broker) +44 (0)20 7418

8900

Adrian Trimmings / Michael Burke / Andrew Clark / Lalit Bose

Berenberg (Joint Broker) +44 (0)20 3207 7800

Toby Flaux / Ben Wright / James Thompson / Milo Bonser

Camarco (Financial PR)

Geoffrey Pelham-Lane +44 (0)7733 124 226

Ginny Pulbrook +44 (0)7961 315 138

Toby Strong

+44 (0)7789 151 644

About CVS Group plc ( www.cvsukltd.co.uk )

CVS Group is an AIM-quoted fully-integrated provider of

veterinary services in the UK, with practices in the Netherlands

and the Republic of Ireland. CVS is focused on providing high

quality clinical services to its customers and their animals, with

outstanding and dedicated clinical teams and support colleagues at

the core of its strategy.

The Group has c.500 veterinary practices across its three

markets, including eight specialist referral hospitals and 37

dedicated out-of-hours sites. Alongside the core Veterinary

Practices division, CVS operates Laboratories (providing diagnostic

services to CVS and third-parties), Crematoria (providing pet

cremation and clinical waste disposal for CVS and third-party

practices), Buying Groups and the Group's online retail business

("Animed Direct").

The Group employs c.8,300 personnel, including c.2,200

veterinary surgeons and c.3,100 nurses.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDZGZMKVRGFZG

(END) Dow Jones Newswires

January 26, 2023 02:00 ET (07:00 GMT)

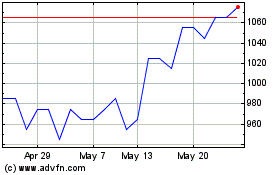

CVS (AQSE:CVSG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

CVS (AQSE:CVSG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024