Costain Group PLC Costain Refinancing of Bank and Bonding Facilities (1819H)

July 26 2023 - 2:00AM

UK Regulatory

TIDMCOST

RNS Number : 1819H

Costain Group PLC

26 July 2023

Costain Group PLC

26 July 2023

Costain Completes Refinancing of its Bank and Bonding

Facilities

Costain Group PLC ("Costain" or the "Group") announces that it

has successfully concluded negotiations with its bank and surety

facility providers to refinance a new three-year agreement of its

bank and bonding facilities.

The Group's new facilities agreement to September 2026 comprises

an GBP85m sustainability-linked revolving credit facility (RCF),

and surety and bank bonding facilities totalling GBP270m, with the

reduction in facilities reflecting the Group's positive cash

generation and cash position . This new agreement replaces the

previous one-year "amend and extend" of its facilities from

September 2023 to September 2024, as announced in November

2022.

The new facility is backed by a group of four banks and five

sureties, with Lloyds Bank acting as coordinator, Lloyds Bank and

HSBC as joint sustainability coordinators, together with Crédit

Industriel et Commercial (CIC) and National Westminster Bank

(NatWest), the latter being a new addition to the banking

group.

Costain had a positive net cash balance of GBP123.8m as of 31

December 2022, comprising Costain cash balances of GBP67.3m and

cash held by joint operations of GBP56.5m. The revolving credit

facility was undrawn throughout 2022 and 2023 to date. Utilisation

of the total bonding facilities as of 31 December 2022 was GBP88.8m

(FY 21: GBP100.7m).

The sustainability linkage includes three key performance

indicators (KPIs) relating to reduction in greenhouse gas

emissions, spend with small, local business and charities, and an

increase in gender diversity.

Alex Vaughan, Chief Executive Officer, commented:

"I am pleased that we have successfully secured a new three-year

facilities agreement , with Costain's continuing strong cash

generation enabling us to reduce our overall level of bank and bond

requirements for the Group. I am also delighted that NatWest has

joined our banking group, demonstrating its confidence in our

business plan. "

Costain will issue its results for the six months to 30 June

2023 on 23 August 2023.

Enquiries

Investors and analysts paul.sharma@costain.com

Paul Sharma, Costain +44 (0) 7867 501188

Financial media - Headland costain@headlandconsultancy.com

Andy Rivett-Carnac +44 (0) 7968 997 365

Charlie Twigg +44 (0) 7946 494 568

--------------------------------

Notes to editors

Costain helps to improve people's lives by creating connected,

sustainable infrastructure that enables people and the planet to

thrive. We shape, create and deliver pioneering solutions that

transform the performance of the infrastructure ecosystem across

the UK's transport, energy, water, and defence markets.

We are organised around our customers anticipating and solving

their challenges and helping to improve performance. By bringing

together our unique mix of construction, consulting and digital

experts we engineer and deliver sustainable, efficient and

practical solutions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZGZNFKFGFZZ

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

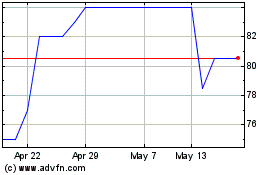

Costain (AQSE:COST.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Costain (AQSE:COST.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024