TIDMBVXP

Bioventix plc

("Bioventix" or "the Company")

Results for the year ended 30 June 2021

Bioventix plc (BVXP), a UK company specialising in the development and

commercial supply of high-affinity monoclonal antibodies for applications in

clinical diagnostics, announces its audited results for the year ended 30 June

2021.

Highlights:

* Revenue up 6% to £10.93 million (2020: £10.31 million)

* Profit before tax down 1% to £8.12 million (2020: £8.23 million)

* Cash at year end of £6.5 million (30 June 2020: £8.1 million)

* Second interim dividend of 62p per share (2020: 52p)

* Special dividend of 38p per share (2020: 53p)

Introduction and Technology

Bioventix creates, manufactures and supplies high affinity sheep monoclonal

antibodies (SMAs) for use in diagnostic applications. Bioventix antibodies are

preferred for use when they confer an improved test performance compared to

other available antibodies.

The majority of our antibodies are used on blood-testing machines installed in

hospitals and other laboratories around the world. Bioventix makes antibodies

using its SMA technology for supply to diagnostic companies for subsequent

manufacture into reagent packs used on blood-testing machines. These

blood-testing machines are supplied by large multinational in vitro diagnostics

(IVD) companies such as Roche Diagnostics, Siemens Healthineers, Abbott

Diagnostics & Beckman Coulter. Antibody-based blood tests are used to help

diagnose many different conditions including, amongst others, heart disease,

thyroid function, fertility, infectious disease and cancer.

Over the past 17 years, we have created and supplied approximately 20 different

SMAs that are used by IVD companies around the world. We currently sell a total

of 15-20 grams of purified physical antibody per year, the vast majority of

which is exported. In addition to revenues from physical antibody supplies, the

sale by our customers of diagnostic products (based on our antibodies) to their

downstream end-users attracts a modest percentage royalty payable to Bioventix.

These downstream royalties currently account for approximately 60-70% of our

annual revenue. Physical antibody sales and royalty revenues from our

multinational customers are made in either US dollars or Euros.

Bioventix adopts one of two commercial approaches when creating new antibodies.

The first is own-risk antibody creation projects which gives Bioventix the

complete freedom to commercialise the antibodies produced. The second is

contract antibody creation projects in partnership with customers who supply

materials, know-how and funding and creates antibodies that can only be

commercialised with the partner company. In both cases, after initiation of a

new project, it takes around a year for our scientists to create a panel of

purified antibodies for evaluation by our customers. The evaluation process at

customers' laboratories generally requires the fabrication of prototype reagent

packs which can be compared to other tests, for example the customer's existing

commercial test or perhaps another "gold standard" method, on the assay machine

platform being considered. The process of subsequent development thereafter by

our customers can take many years before registration or approval from the

relevant authority, for example the US FDA or EU authorities, is obtained and

products can be sold to the benefit of the customers, and of course Bioventix,

through the agreed sales royalty. This does mean that there is a lead time of

4-10 years between our own research work and the receipt by Bioventix of

royalty revenue from product sales. However, because of the resource required

to gain such approvals, after having achieved approval for an accurate

diagnostic test using a Bioventix antibody, there is a natural incentive for

continued antibody use. This results in a barrier to entry for potential

replacement antibodies, which would require at least partial repetition of the

approval process arising on a change from one antibody to another.

Another consequence of the lengthy approval process is that the antibodies

discussed in the revenue review of the current accounting period were created

many years ago. Indeed, growth over the next few years from, for example the

troponin antibodies, will come from research work already carried out many

years ago. By the same dynamics, the current research work active at our

laboratories now is more likely to influence sales in the period 2025-2035.

2020/2021 Financial Results

We are pleased to report our results for the financial year ended 30 June 2021.

Revenues for the year increased by 6% to £10.93 million (2019/20: £10.31

million). Operating profit for the year was flat at £8.09 million (2019/20; £

8.18million) due in the main to the adverse impact of foreign exchange

movements and an increased charge in respect of share options issued in

previous years. Cash balances at the year-end were lower at £6.5 million (30

June 2020 £8.1 million) reflecting increases in the turnover generated from a

material level of royalties in respect of the year received post year end and

dividends paid in the year of £7.71 million (2019/20 £6.50 million).

Our most significant revenue stream continues to come from the vitamin D

antibody called vitD3.5H10. This antibody is used by a number of small, medium

and large diagnostic companies around the world for use in vitamin D deficiency

testing. Sales of vitD3.5H10 remained relatively unchanged at £4.8 million

during the year due to a flatter downstream market for vitamin D testing and

pandemic effects. The importance of vitamin D in human biology is widely

acknowledged and does indicate that vitamin D testing will continue to be part

of clinical diagnostics in the long term.

Sales of our other lead antibodies are featured below with the respective

percentage increase/decrease from 2019/20:

- NT-proBNP: £1.28 million (+6%) (this revenue stream expired in

July 2021)

- T3 (tri-iodothyronine): £0.74 million (+2%);

- progesterone: £0.54 million (+15%);

- estradiol: £0.44 million (+40%);

- testosterone: £0.44 million (-7%);

- drug-testing antibodies: £0.40 million (-48%);

Total troponin antibody sales from Siemens Healthineers and another separate

technology sub-license doubled during the year to £0.68 million (2019/20: £0.33

million). This significant increase clearly demonstrates a gathering momentum

of product roll-outs for the new high sensitivity troponin assays supported by

SMAs and we believe that these revenues will continue to grow in the next

financial years.

Our shipments of physical antibody to China continued to increase. Some sales

are made directly but the majority are made through five appointed

distributors. Regulatory approvals for domestic Chinese customers have

considerable lead times but we are now seeing modest increases in royalty

payments flowing from these customers. The prospects for further growth in

China are good though we recognise that the development of antibody technology

companies in China represents a longer term challenge. In addition, relative

global geopolitical stability will be important for the continued trade in

technology products such as our antibodies.

Our underlying revenues continue to be dominated by US Dollars and Euros. When

converting revenues to Sterling, in the absence of hedging mechanisms, they

will be influenced by movements in exchange rates. Sales invoiced in foreign

currencies are recorded in Sterling at the exchange rate on the date of sale.

When Dollar and Euro monies are received, they are immediately converted into

Sterling at the exchange rate applying on the date of arrival. Any difference

in exchange rate between the date of invoice and the date of receipt is

reported in the form of an exchange rate adjustment and is recorded in the

period as a loss or gain when it is crystallised. The effect of these

adjustments during the current year has been particularly large and provided a

negative effect of £0.29 million which has been crystalised and recognised in

our results for this year compared to a positive effect of £0.20 million for

the previous year; a total movement between the years of almost £0.5 million.

The critical period for such differences arises around the time of royalty

receipts in February and August when debtors, in respect of turnover recognised

in the six month periods ended 31st December and 30th June respectively, is

recorded in Sterling at exchange rates applicable at those balance sheet dates

rather than at the exchange rates at the date the royalties are received. We

have no current plans to institute any hedging mechanisms to cover these short

periods or indeed any longer periods and therefore any future changes in

exchange rates, up or down, may impact our reported Sterling revenues

accordingly.

Included in the cost of sales are significant expenditures on external contract

services linked to the industrial pollution exposure project described below.

This level of expenditure will be maintained in 2021/22 reflecting the

continued investment in this research project. In accordance with our

longstanding accounting policy, all such research and development costs are

charged in full in the profit and loss account when they are incurred and there

is no capitalisation of these costs.

As we observed earlier in the pandemic, through our multinational in vitro

diagnostics (IVD) customers, our main business is intrinsically linked to the

diagnostic pathways that exist at hospitals and clinics around the world. The

activity within these routine diagnostic pathways continues to be adversely

affected by the COVID-19 pandemic as hospital resources are diverted to cope

with the additional patient burden created by the pandemic. Even where

diagnostic capability exists, there is still evidence that concerned patients

have chosen not to enter diagnostic pathways and have not presented to

healthcare professionals as would normally be expected.

The evolution of the pandemic has proved difficult for Governments and their

expert advisors to forecast and the timing of a return to normality remains

uncertain. Nevertheless, we are confident of the robustness of our business and

that as circumstances change and as healthcare pathways continue to be

re-established and normalised, Bioventix sales will revert to an established

trajectory.

Cash Flows and Dividends

As reported above, the performance of the business during the year generated

cash balances at the year-end of £6.5 million and royalties received during

Q3.2021 have added to this balance. Whilst considering the impact of the

pandemic on the core business, the Board has determined that is appropriate to

maintain the established dividend policy in the immediate future. For the

current year, the Board is pleased to announce a second interim dividend of 62

pence per share which, when added to the first interim dividend of 43 pence per

share makes a total of 105 pence per share for the current year.

Our current view continues to be that maintaining a cash balance of

approximately £5 million is sufficient to facilitate operational and strategic

agility both with respect to possible corporate or technological opportunities

that might arise in the foreseeable future and to provide comfort against the

ongoing impact of the pandemic and any economic uncertainty arising from it. We

have therefore decided to distribute surplus cash that is in excess of

anticipated needs and we are pleased to announce a special dividend of 38 pence

per share.

Accordingly, dividends totalling 100 pence per share will be paid in November

2021. The shares will be marked ex-dividend on 28 October 2021 and the dividend

will be paid on 12 November 2021 to shareholders on the register at close of

business on 29 October 2021.

Research and Future Developments

Over the next few years, the commercial development of the new troponin assays

will have the most significant influence on Bioventix sales. There are

currently no antibodies in the future pipeline that are comparable to our

troponin products in potential value and the ability to influence revenues in

the next few years.

We have undertaken a range of research projects over the previous few years and

in the table below we have illustrated our current view of their potential

value and probability of success;

^ high Secretoneurin (CardiNor)

| Amyloid (Pre-Diagnostics)

Increasing Tau (alzheimers, own-risk)

potential

value medium Industrial biomonitoring (new Pyrene biomonitoring

markers) T4 (thyroxine) [1]

Biotin blockers

Low Thyroglobulin (contract) [2] Cancer (contract) [1]

THC (sandwich)

Low Medium high

Increasing probability of success -->

Table notes:

[1] Modest sales now contribute to miscellaneous sales

[2] Project de-prioritised at customer

Our partners at CardiNor (Oslo) have continued with their work to try and

identify the possible utility of secretoneurin in heart failure patients and in

particular those patients who might be candidates for implantable cardiac

devices .This work is on-going and we hope to have more definitive news in the

months to come.

Pre-Diagnostics (also in Oslo) and their clinical collaborators now have two

amyloid beta assays in development based on Bioventix antibodies. The goal of

the project is to identify fragments of amyloid beta in patient samples that

would be helpful in Alzheimers diagnostics. Additional data on patient samples

will be generated next year to help define the utility of these assays in

Alzheimers diagnostics.

Another biomarker that has shown potential in Alzheimers diagnostics is the Tau

protein in the form of total Tau and phosphorylated Tau. During the year we

created a number of anti-Tau antibodies and this work will continue into 2022.

Our objective is to use our antibody skills to create useful antibodies and to

work with a leading academic group to investigate their use in Alzheimers

assays.

We now have two candidate biotin "blocker" antibodies that are intended to

mitigate the interference that biotin vitamin supplements can have on certain

blood tests supplied by some IVD manufacturers. Some customer results from

evaluation samples have demonstrated the effectiveness of these blocker

antibodies. However, as this project has evolved, it has become clear through

FDA guidelines that much larger quantities of biotin blockers will be required

in assay reagent packs. This imposes cost/price constraints in addition to

manufacturing/capacity challenges. Over the next year, we will explore

production systems (such as e.coli) in order to identify improved production

techniques which could facilitate commercial feasibility.

We are particularly pleased with the progress of the pyrene exposure project.

Pyrene is a common industrial combustion pollutant and we now have a prototype

lateral flow device that would be suited to testing for pyrene exposure in

industrial field use. After running the urine sample, the plastic lateral flow

cassette is loaded into 3-D printed phone holder and an app directs the phone

camera to quantify the result line. The operator then estimates the urine

strength by colour enabling the workers' recent pyrene exposure to be

estimated. Internal results (using a small bank of industrial urine samples)

are encouraging and we are working with a UK industrial site to conduct a field

trial of the device and app over the next few months. We accept that the

creation, manufacture and supply of final assay products is outside our normal

focus of bulk antibody sales but we believe that through our own efforts we can

substantiate the viability of such products and generate demand, thereby

stimulating the interest of future commercial partners.

The progress of the pyrene project has encouraged us to consider additional

assays in the field of industrial health and safety. Work on these new analytes

has only just started and is planned to continue into 2022 and 2023.

Regarding our core SMA antibody technology, we have successfully generated

superior antibodies over the last 17 years and these antibodies are now in

routine use at our customers. The antibody technology landscape has evolved

over this time-period. We are aware that rabbit monoclonal technology - a

competitive antibody technology - does exist at some of our customers'

laboratories and this is likely to have resulted in some lost opportunities for

our SMA technology. In addition, the steady development of "synthetic" antibody

technology (known in the industry as antibody "library" technology") has

continued. This technology is perhaps not so directly competitive but is useful

for targets which are fragile and liable to dissociation upon immunisation into

sheep.

During 2020, we used this library technology by contracting work at a third

party to make a "sandwich" assay format for THC/cannabis using a parental SMA

that we created many years ago. This has yielded an antibody "pair" candidate

that does appear to facilitate improved lateral flow tests for THC/cannabis in

saliva. The quantity of antibody used per test together with the modest selling

price of THC tests does present cost/price challenges. We will attempt to

utilise improved manufacturing technology (eg using e.coli) during 2022 to

improve the economics of this project.

The Bioventix Team and Facility

The composition of the Bioventix team of 12 full-time equivalents has remained

relatively stable over the year facilitating excellent performance and know how

retention. The past 18 months has been a challenging period for everyone and we

are very grateful to the

team at Bioventix for their dedication over this

period which has allowed us the adapt and modify our business to cope with the

effects of the pandemic whilst still maintaining our progress.

Development of the lab facilities concluded earlier in 2021 with some updated

and additional laboratory utilities including a new autoclave machine and the

modernisation and upgrading of office areas. This significant investment in our

Farnham facility will provide an excellent base for our future and ongoing

research activities as well as giving us room to explore and deliver improved

production systems for our SMAs.

In the general manufacturing sector, there have been a variety of reports

relating to supply chain issues caused by a range of contributing factors. We

have also experienced such supply delays during the year covering reagents,

plastics and filters. We have successfully managed these issues through careful

stock planning and sourcing alternatives where possible and we will continue to

utilise such mitigations to minimise any future impact.

Conclusion and Outlook

We are pleased with our financial results for the year considering the

continued negative impact of the global pandemic. The core business is linked

to routine testing at hospitals around the world and this has undoubtedly been

affected by the COVID-19 pandemic. The timing of a return to normality is

uncertain but when it does, we expect our business will revert to an

established trajectory, albeit without the income from NT-proBNP which ceased

from July 2021. Regardless of the pandemic effects, we anticipate the continued

roll-out of the high sensitivity troponin assays and the royalties associated

with this. Excellent technical progress has been made with our research

projects including the industrial pollution exposure project and we anticipate

that this project and others in our pipeline will create additional shareholder

value in the years ahead.

For further information please contact:

Bioventix plc Tel: 01252 728 001

Peter Harrison Chief Executive Officer

finnCap Ltd Tel: 020 7220 0500

Geoff Nash/Simon Hicks Corporate Finance

Alice Lane ECM

About Bioventix plc:

Bioventix (

www.bioventix.com

) specialises in the development and commercial

supply of high-affinity monoclonal antibodies with a primary focus on their

application in clinical diagnostics, such as in automated immunoassays used in

blood testing. The antibodies created at Bioventix are generated in sheep and

are of particular benefit where the target is present at low concentration and

where conventional monoclonal or polyclonal antibodies have failed to produce a

suitable reagent. Bioventix currently offers a portfolio of antibodies to

customers for both commercial use and R&D purposes, for the diagnosis or

monitoring of a broad range of conditions, including heart disease, cancer,

fertility, thyroid function and drug abuse. Bioventix currently supplies

antibody products and services to the majority of multinational clinical

diagnostics companies. Bioventix is based in Farnham, UK and its shares are

traded on AIM under the symbol BVXP.

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed

in accordance with the company's obligations under Article 17 of MAR.

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEARED 30 JUNE 2021

2021 2020

£ £

Turnover 10,930,588 10,313,576

Cost of sales (817,448) (821,823)

Gross profit 10,113,140 9,491,753

Administrative expenses (1,506,741) (1,416,766)

Difference on foreign exchange (294,046) 202,668

Research and development tax credit 32,878 21,817

Share option charge (257,629) (115,481)

Operating profit 8,087,602 8,183,991

Interest receivable and similar income 30,628 41,068

Profit before tax 8,118,230 8,225,059

Tax on profit (1,386,882) (1,022,362)

Profit for the financial year 6,731,348 7,202,697

Other comprehensive income for the year

Total comprehensive income for the year 6,731,348 7,202,697

Earnings per share:

2021 2020

Basic £ 129.22 £ 139.41

Diluted 127.94 137.93

STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021

2021 2020

£ £

Fixed assets

Tangible assets 843,720 718,496

Investments 610,039 610,039

1,453,759 1,328,535

Current assets

Stocks 332,459 245,423

Debtors: amounts falling due 4,625,967 3,649,369

within one year

Cash at bank and in hand 6,494,985 8,076,468

11,453,411 11,971,260

Creditors: amounts falling due

within one year (1,008,772) (728,630)

Net current assets 10,444,639 11,242,630

Total assets less current 11,898,398 12,571,165

liabilities

Provisions for liabilities

Deferred tax (78,084) (50,238)

(78,084) (50,238)

Net assets 11,820,314 12,520,927

Capital and reserves

Called up share capital 260,467 260,392

Share premium account 1,332,471 1,312,323

Capital redemption reserve 1,231 1,231

Profit and loss account 10,226,145 10,946,981

11,820,314 12,520,927

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30 JUNE 2021

Called up Share Capital Profit and Total

share premium redemption loss account equity

capital account reserve

£ £ £ £ £

At 1 July 2020 260,392 1,312,323 1,231 10,946,981 12,520,927

Comprehensive income for the

year

Profit for the year - - - 6,731,348 6,731,348

Dividends: Equity capital - - - (7,709,813) (7,709,813)

Shares issued during the year 75 20,148 - - 20,223

Share option charge - - - 257,629 257,629

Total transactions with owners 75 20,148 - (7,452,184) (7,431,961)

At 30 June 2021 260,467 1,332,471 1,231 10,226,145 11,820,314

STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30 JUNE 2020

Called up Share Capital Profit and Total

share premium redemption loss account equity

capital account reserve

£ £ £ £ £

At 1 July 2019 257,134 435,908 1,231 10,132,030 10,826,303

Comprehensive income for the

year

Profit for the year - - - 7,202,697 7,202,697

Dividends: Equity capital - - - (6,503,227) (6,503,227)

Shares issued during the year 3,258 876,415 - - 879,673

Share option charge - - - 115,481 115,481

Total transactions with owners 3,258 876,415 - (6,387,746) (5,508,073)

At 30 June 2020 260,392 1,312,323 1,231 10,946,981 12,520,927

STATEMENT OF CASH FLOWS FOR THE YEARED 30 JUNE 2021

2021 2020

£ £

Cash flows from operating activities

Profit for the financial year 6,731,348 7,202,697

Adjustments for:

Depreciation of tangible assets 135,103 133,569

(Profit ) / Loss on disposal of tangible assets (500) 2,376

Interest received (30,628) (41,068)

Taxation charge 1,386,882 1,022,362

(Increase) in stocks (87,036) (6,128)

(Increase)/decrease in debtors (976,596) 284,546

Increase in creditors 59,514 133,976

Corporation tax (paid) (1,138,410) (1,164,897)

Share option charge 257,629 115,481

Net cash generated from operating activities 6,337,306 7,682,914

Cash flows from investing activities

Purchase of tangible fixed assets (260,327)

(339,620)

Sale of tangible fixed assets 500 -

Purchase of unlisted and other investments - (221,662)

Interest received 30,628 41,068

Net cash from investing activities (229,199) (520,214)

Cash flows from financing activities

Issue of ordinary shares 20,223 879,673

Dividends paid (7,709,813) (6,503,227)

Net cash used in financing activities (7,689,590) (5,623,554)

Net (decrease)/increase in cash and cash equivalents (1,581,483) 1,539,146

Cash and cash equivalents at beginning of year 8,076,468 6,537,322

Cash and cash equivalents at the end of year 6,494,985 8,076,468

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEARED 30 JUNE 2021

1. Accounting policies

1.1 Basis of preparation of financial statements

The financial statements have been prepared under the historical cost

convention unless otherwise specified within these accounting policies and in

accordance with Financial Reporting Standard 102, the Financial Reporting

Standard applicable in the UK and the Republic of Ireland and the Companies Act

2006.

The preparation of financial statements in compliance with FRS 102 requires the

use of certain critical accounting estimates. It also requires management to

exercise judgment in applying the Company's accounting policies.

The following principal accounting policies have been applied:

1.2 Revenue

Turnover is recognised for product supplied or services rendered to the extent

that it is probable that the economic benefits will flow to the Company and the

turnover can be reliably measured. Turnover is measured as the fair value of

the consideration received or receivable, excluding discounts, rebates, value

added tax and other sales taxes. The following criteria determine when turnover

will be recognised:

Direct sales

Direct sales are generally recognised at the date of dispatch unless

contractual terms with customers state that risk and title pass on delivery of

goods, in which case revenue is recognised on delivery.

R&D income

Subcontracted R&D income is recognised based upon the stage of completion at

the year-end.

Licence revenue and royalties

Annual licence revenue is recognised, in full, based upon the date of invoice.

Royalties are accrued over period to which they relate and revenue is

recognised based upon returns and notifications received from customers. In the

event that subsequent adjustments to royalties are identified they are

recognised in the period in which they are identified.

1.3 Foreign currency translation Functional and presentation currency

The Company's functional and presentational currency is GBP.

Transactions and balances

Foreign currency transactions are translated into the functional currency using

the spot exchange rates at the dates of the transactions.

At each period end foreign currency monetary items are translated using the

closing rate. Non- monetary items measured at historical cost are translated

using the exchange rate at the date of the transaction and non-monetary items

measured at fair value are measured using the exchange rate when fair value was

determined.

1.4 Interest income

Interest income is recognised in profit or loss using the effective interest

method.

1.5 Pensions

Defined contribution pension plan

The Company operates a defined contribution plan for its employees. A defined

contribution plan is a pension plan under which the Company pays fixed

contributions into a separate entity. Once the contributions have been paid the

Company has no further payment obligations.

The contributions are recognised as an expense in profit or loss when they fall

due. Amounts not paid are shown in accruals as a liability in the Statement of

financial position. The assets of the plan are held separately from the Company

in independently administered funds.

1.6 Current and deferred taxation

Current and deferred tax are recognised as an expense or income in the

Statement of Comprehensive Income, except when they relate to items credited or

debited directly to equity, in which case the tax is also recognised directly

in equity. The current income tax charge is calculated on the basis of tax

rates and laws that have been enacted or substantively enacted by the reporting

date in the countries where the Company operates and generates income.

The current income tax charge is calculated on the basis of tax rates and laws

that have been enacted or substantively enacted by the reporting date in the

countries where the Company operates and generates income.

Deferred tax balances are recognised in respect of all timing differences that

have originated but not reversed by the Statement of financial position date,

except that:

· The recognition of deferred tax assets is limited to the extent that it

is probable that they will be recovered against the reversal of deferred tax

liabilities or other future taxable profits; and

· Any deferred tax balances are reversed if and when all conditions for

retaining associated tax allowances have been met.

Deferred tax balances are not recognised in respect of permanent differences

except in respect of business combinations, when deferred tax is recognised on

the differences between the fair values of assets acquired and the future tax

deductions available for them and the differences between the fair values of

liabilities acquired and the amount that will be assessed for tax. Deferred tax

is determined using tax rates and laws that have been enacted or substantively

enacted by the reporting date.

1.7 Research and development

Research and development expenditure is written off in the year in which it is

incurred.

1.8 Tangible fixed assets

Tangible fixed assets under the cost model are stated at historical cost less

accumulated depreciation and any accumulated impairment losses. Historical cost

includes expenditure that is directly attributable to bringing the asset to the

location and condition necessary for it to be capable of operating in the

manner intended by management.

Land is not depreciated. Depreciation on other assets is charged so as to

allocate the cost of assets less their residual value over their estimated

useful live

Freehold property - 2% straight line

Plant and equipment - 25% reducing balance

Motor Vehicles - 25% straight line

Fixtures & Fittings - 25% reducing balance

Equipment - 25% straight line

1.9 Valuation of investments

Investments in unlisted Company shares, whose market value can be reliably

determined, are remeasured to market value at each balance sheet date. Gains

and losses on remeasurement are recognised in the Statement of comprehensive

income for the period. Where market value cannot be reliably determined, such

investments are stated at historic cost less impairment.

1.10 Stocks

Stocks are stated at the lower of cost and net realisable value, being the

estimated selling price less costs to complete and sell. Cost includes all

direct costs and an appropriate proportion of fixed and variable overheads.

At each balance sheet date, stocks are assessed for impairment. If stock is

impaired, the carrying amount is reduced to its selling price less costs to

complete and sell. The impairment loss is recognised immediately in profit or

loss.

1.11 Debtors

Short term debtors are measured at transaction price, less any impairment.

Loans receivable are measured initially at fair value, net of transaction

costs, and are measured subsequently at amortised cost using the effective

interest method, less any impairment.

1.12 Cash and cash equivalents

Cash is represented by cash in hand and deposits with financial institutions

repayable without penalty on notice of not more than 24 hours. Cash equivalents

are highly liquid investments that mature in no more than twelve months from

the date of acquisition and that are readily convertible to known amounts of

cash with insignificant risk of change in value.

In the Statement of cash flows, cash and cash equivalents are shown net of bank

overdrafts that are repayable on demand and form an integral part of the

Company's cash management.

1.13 Creditors

Short term creditors are measured at the transaction price. Other financial

liabilities, including bank loans, are measured initially at fair value, net of

transaction costs, and are measured subsequently at amortised cost using the

effective interest method.

1.14 Provisions for liabilities

Provisions are made where an event has taken place that gives the Company a

legal or constructive obligation that probably requires settlement by a

transfer of economic benefit, and a reliable estimate can be made of the amount

of the obligation.

Provisions are charged as an expense to profit or loss in the year that the

Company becomes aware of the obligation, and are measured at the best estimate

at the Statement of financial position date of the expenditure required to

settle the obligation, taking into account relevant risks and uncertainties.

When payments are eventually made, they are charged to the provision carried in

the Statement of financial position.

1.15 Financial instruments

The Company only enters into basic financial instrument transactions that

result in the recognition of financial assets and liabilities like trade and

other debtors and creditors, loans from banks and other third parties, loans to

related parties and investments in ordinary shares.

1.16 Dividends

Equity dividends are recognised when they become legally payable. Interim

equity dividends are recognised when paid. Final equity dividends are

recognised when approved by the shareholders at an annual general meeting.

1.17 Employee benefits-share-based compensation

The company operates an equity-settled, share-based compensation plan. The fair

value of the employee services received in exchange for the grant of the

options is recognised as an expense over the vesting period. The total amount

to be expensed over the vesting period is determined by reference to the fair

value of the options granted. At each balance sheet date, the company will

revise its estimates of the number of options are expected to be exercisable.

It will recognise the impact of the revision of original estimates, if any, in

the profit and loss account, with a corresponding adjustment to equity. The

proceeds received net of any directly attributable transaction costs are

credited to share capital (nominal value) and share premium when the options

are exercised.

2. Judgments in applying accounting policies and key sources of

estimation uncertainty

In the application of the company's accounting policies, management is required

to make judgments, estimates and assumptions. These estimates and underlying

assumptions and are reviewed on an ongoing basis.

Carrying value of Unlisted Investments

The Company holds two unlisted investments in companies carrying out research

in identifying biomarkers for diagnosing health conditions. The Directors have

reviewed the progress of this research over the last year and, in common with

much scientific research there is uncertainty, both in relation to the science

and to the commercial outcome, and no information to be able to reliably

calculate a fair value for these investments. The carrying value of these

investments will continue to be historic cost.

3. Turnover

An analysis of turnover by class of business is as

follows:

2021 2020

£ £

Product revenue and R&D income 3,620,416 4,048,847

Royalty and licence fee income 7,310,172 6,264,729

10,930,588 10,313,576

2021 2020

£ £

United Kingdom 824,518 832,895

European Union 1,246,024 1,206,854

Rest of the world 8,860,046 8,273,827

10,930,588 10,313,576

4. Operating profit

The operating profit is stated after charging:

2021 2020

£ £

Depreciation of tangible fixed assets 135,104 133,569

Fees payable to the Company's auditor and its associates

for the audit of the Company's annual financial statements 12,500 10,650

Exchange differences 294,046 (202,668)

Research and development costs 1,201,236 1,175,602

5. Taxation

2021 2020

£ £

Corporation tax

1,359,036 1,002,978

Current tax on profits for the year

1,359,036 1,002,978

Total current tax 1,359,036 1,002,978

Deferred tax

27,846 19,384

Origination and reversal of timing differences

Total deferred tax 27,846 19,384

Taxation on profit on ordinary activities 1,386,882 1,022,362

Factors affecting tax charge for the year

The tax assessed for the year is lower than (2020 - lower than) the standard

rate of corporation tax in the UK of 19% (2020 - 19%). The differences are

explained below:

2021 2020

£ £

Profit on ordinary activities before tax 8,118,230 8,225,059

Profit on ordinary activities multiplied by standard rate

of corporation tax in the UK of 19% (2020 - 19%) 1,542,464 1,562,761

Effects of:

Expenses not deductible for tax purposes, other than

goodwill amortisation and impairment 42 559

Capital allowances for year in excess of depreciation (6,398) (21,325)

Research and development tax credit (226,022) (246,383)

Share based payments 48,950 (292,634)

Other differences leading to an increase in the tax charge 27,846 19,384

Total tax charge for the year 1,386,882 1,022,362

Factors that may affect future tax charges

The UK rate of corporation tax is set to be increased from the current rate of

19% to 25% with effect from 1 April 2023. This change will increase the tax

charge in future years such that, had the change been in place for the current

year, it would have increased by £429,169 from £1,359,036 to £1,788,205.

6. Dividends

2021 2020

£ £

Dividends paid 7,709,813 6,503,227

7,709,813 6,503,227

7. Share capital

2021 2020

£ £

Allotted, called up and fully paid

5,209,333 (2020 - 5,207,835) Ordinary shares of £0.05 260,467 260,392

each

The holders of ordinary shares are entitled to receive dividends as declared

and are entitled to one vote per share at meetings of the Company. All ordinary

shares rank equally with regard to the Company's residual assets.

1,498 ordinary shares were issued during the year at £13.50 per share. The

aggregated nominal value was £74.90.

8. Share based payments

During the year the company operated 2 share option schemes; an Approved EMI

Share Option Scheme and an Unapproved Share Option Scheme to incentivise

employees.

The company has applied the requirements of FRS 102 Section 26 Share-based

Payment to all the options granted under both schemes. The terms for granting

share options under both schemes are the same and provide for an option price

equal to the market value of the Company's shares on the date of the grant and

for the Approved EMI Share Option Scheme this price is subsequently agreed with

HMRC Shares and Assets Valuation Division.

The contractual life of an option under both schemes is 10 years from the date

of grant. Options granted become exercisable on the third anniversary of the

date of grant. Exercise of an option is normally subject to continued

employment, but there are also considerations for good leavers. All share based

remuneration is settled in equity shares.

Weighted Weighted

average average

exercise exercise

price price

(pence) Number (pence)

2021 2021 2020 Number

2020

Outstanding at the beginning of the 2942.00 57,103 1350.00 85,938

year

Granted during the year - 3153.00 50,401

Forfeited during the year 3855.00 (3,401) 1350.00 (14,075)

Exercised during the year 1350.00 (1,498) 1350.00 (65,161)

Outstanding at the end of the year 2928.00 52,204 2942.00 57,103

2021 2020

Black Black

Scholes Scholes

Option pricing model used £13.50- £13.50 -

Issue price £38.55 £38.55

Exercise price (pence) £13.50- £13.50 -

£38.55 £38.55

Option life 10 years 10 years

Expected volatility 25.15% 25.15%

Fair value at measurement date Risk-free interest rate £4.66 - £4.66 -

£26.91 £26.91

0.18% 0.18%

The expected volatility is based upon the historical volatility over the period

since the Company's shares were listed on AIM.

9. Publication of Non-Statutory Accounts

The financial information set out in this preliminary announcement does not

constitute the Group's financial statements for the year ended 30 June 2021.

The financial statements for the year ended 30 June 2020 have been delivered to

the Registrar of Companies. The financial statements for the year ended 30 June

2021 will be delivered to the Registrar of Companies following the Company's

Annual General Meeting. The auditors' report on both accounts was unqualified,

did not include references to any matters to which the auditors drew attention

by way of emphasis without qualifying their report and did not contain

statements under sections 498(2) or (3) of the Companies Act 2006. The audited

financial statements of Bioventix plc for the period ended 30 June 2021 are

expected to be posted to shareholders shortly, will be available to the public

at the Company's registered office, 7 Romans Business Park, East Street,

Farnham, Surrey, GU9 7SX and available to view on the Company's website at

www.bioventix.com once posted.

END

(END) Dow Jones Newswires

October 18, 2021 02:00 ET (06:00 GMT)

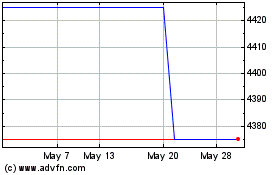

Bioventix (AQSE:BVXP.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bioventix (AQSE:BVXP.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024