WidePoint Reports First Quarter 2020 Financial Results

May 14 2020 - 4:05PM

WidePoint Corporation (NYSE American: WYY), the

leading provider of Trusted Mobility Management (TM2) specializing

in Telecommunications Lifecycle Management, Identity Management and

Digital Billing & Analytics solutions, today reported results

for the first quarter ended March 31, 2020.

First Quarter 2020 and Recent Operational

Highlights:

- Selected as strategic vendor for SYNNEX Corporation (NYSE:

SNX), which may potentially expand sales of TM2

- Received a 12-month, sole source indefinite delivery,

indefinite quantity (IDIQ) contract from the U.S. Department of

Homeland Security (DHS) for Cellular Wireless Managed Services

(CWMS)

- Supported and continuing to expand work with the United States

Census 2020 as the U.S. Census Bureau has increased the forecasted

number of field devices needed by 20%

- Partnered with KoolSpan to provide end-to-end encryption for

phone calls and text messages

- Secured $20 million in new contract wins, exercised option

periods, and contract extensions during the first quarter of

2020

First Quarter 2020 Financial Highlights

(results compared to the same year-ago

period):

- Revenues increased 81% to $39.7 million

- Managed Services revenue increased 52% to $11.5 million

- Gross profit increased 17% to $5.0 million

- Net income totaled $484,000, up 26%

- EBITDA, a non-GAAP financial measure, increased 21% to $1.2

million

First Quarter 2020 Financial Summary

|

(In millions, except per share amounts) |

March 31, 2020 |

|

March 31, 2019 |

| |

|

|

|

|

|

(Unaudited) |

|

Revenue |

$ |

39.7 |

|

|

$ |

21.9 |

|

|

Gross Profit |

$ |

5.0 |

|

|

$ |

4.3 |

|

|

Gross Profit Margin |

|

12.5 |

% |

|

|

19.4 |

% |

|

Operating Expenses |

$ |

4.2 |

|

|

$ |

3.8 |

|

|

Income from Operations |

$ |

0.7 |

|

|

$ |

0.5 |

|

|

Net Income |

$ |

0.5 |

|

|

$ |

0.4 |

|

|

Basic and Diluted Earnings per Share (EPS) |

$ |

0.01 |

|

|

$ |

0.00 |

|

|

Ebita |

$ |

1.2 |

|

|

$ |

1.0 |

|

| |

|

|

|

The following statements are forward-looking, and actual results

could differ materially depending on market conditions and the

factors set forth under the “Safe Harbor Statement” below.

Management Commentary

“In the first quarter of 2020, we continued to build upon the

momentum we generated last year and produced one of the most

successful quarters in our company’s history,” said WidePoint’s

CEO, Jin Kang. “From a financial perspective, the quarter was

highlighted by an 81% increase in total revenues to $39.7 million,

a 52% increase in managed services revenues, positive net income,

and a $2.4 million improvement in our cash position. Operationally,

we continued our work on the 2020 U.S. Census project, which was

the primary cause of the uncharacteristically large increase in our

topline, and which should continue contributing to our revenues

until the start of 2021. During the quarter, we also secured an

aggregate of $20 million in contract awards. Subsequent to the

quarter’s end, we secured a 12-month sole source contract with the

U.S. Department of Homeland Security, and we announced that we have

been selected as a SYNNEX vendor, which could open new doors and

help us expand our customer base.

“The current pandemic has diminished our ability to accurately

predict the timing of events in the near-term, but our primary goal

of simultaneously improving the topline and driving profitability

as we help large enterprises navigate the complexities of the

mobile landscape remains unchanged. Many of our customers are on

the frontlines of battling COVID-19 and are working hard to help us

all return to a sense of normalcy. We intend to ensure they have

the necessary devices and cost optimization tools in place to

continue operating in this challenging environment.

“The world may still be fraught with uncertainty, but given the

trends in our industry, our resilient customer base, and our solid

financial position, we believe we are well positioned to continue

successfully pursuing our strategic initiatives to drive growth and

profitability in the long-run.”

Conference Call

WidePoint management will hold a conference call today (May 14,

2020) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss

these results.

WidePoint President and CEO Jin Kang, Executive Vice President

and Chief Sales and Marketing Officer Jason Holloway, and Executive

Vice President and CFO Kellie Kim will host the conference call,

followed by a question and answer period.

U.S. dial-in number: 844-407-9500International number:

862-298-0850

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization. If you have any difficulty connecting with the

conference call, please contact Gateway Investor Relations at

949-574-3860.

The conference call will be broadcast live and available for

replay here and via the investor relations section of the company’s

website.

A replay of the conference call will be available after 7:30

p.m. Eastern time on the same day through May 28, 2020.

Toll-free replay number: 877-481-4010International replay

number: 919-882-2331Replay ID: 34584

About WidePoint

WidePoint Corporation (NYSE American: WYY) is a leading provider

of trusted mobility management (TM2) solutions, including telecom

management, mobile management, identity management, and digital

billing and analytics. For more information,

visit widepoint.com.

Non-GAAP Financial Measures

WidePoint uses a variety of operational and financial metrics,

including non-GAAP financial measures such as EBITDA, to enable it

to analyze its performance and financial condition. The

presentation of non-GAAP financial information should not be

considered in isolation or as a substitute for, or superior to, the

financial information prepared and presented in accordance with

GAAP. A reconciliation of GAAP Net income to EBITDA is included on

the schedules attached

hereto.

| |

|

THREE MONTHS

ENDED |

| |

|

MARCH 31, |

| |

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

|

NET INCOME |

$ |

483,900 |

|

|

$ |

384,100 |

|

|

Adjustments to reconcile net (loss) income to EBITDA: |

|

|

|

| |

Depreciation

and amortization |

|

422,800 |

|

|

|

472,700 |

|

| |

Amortization

of deferred financing costs |

|

1,300 |

|

|

|

1,300 |

|

| |

Income tax

provision (benefit) |

|

177,200 |

|

|

|

28,000 |

|

| |

Interest

income |

|

(3,100 |

) |

|

|

(4,500 |

) |

| |

Interest

expense |

|

80,800 |

|

|

|

76,200 |

|

| |

|

|

|

|

|

EBITDA |

$ |

1,162,900 |

|

|

$ |

957,800 |

|

| |

|

|

|

|

Safe Harbor Statement

The information contained in any materials that may be accessed

above was, to the best of WidePoint Corporations’ knowledge, timely

and accurate as of the date and/or dates indicated in such

materials. However, the passage of time can render information

stale, and you should not rely on the continued accuracy of any

such materials. WidePoint Corporation has no responsibility to

update any information contained in any such materials. In

addition, you should refer to periodic reports filed by WidePoint

Corporation with the Securities and Exchange Commission for

information regarding the risks and uncertainties to which

forward-looking statements made in such materials are subject. Such

risks and uncertainties may cause WidePoint Corporation’s actual

results to differ materially from those described in the

forward-looking statements.

Investor Relations:

Gateway Investor RelationsMatt Glover or Charlie

Schumacher949-574-3860WYY@gatewayir.com

WIDEPOINT CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS

| |

MARCH

31, |

|

DECEMBER 31, |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

|

| |

(Unaudited) |

|

ASSETS |

| CURRENT

ASSETS |

|

|

|

|

Cash and cash equivalents |

$ |

9,323,673 |

|

|

$ |

6,879,627 |

|

|

Accounts receivable, net of allowance for doubtful accounts |

|

|

|

|

of $123,097 and $126,235 in 2020 and 2019, respectively |

|

11,715,126 |

|

|

|

14,580,928 |

|

|

Unbilled accounts receivable |

|

20,982,875 |

|

|

|

13,976,958 |

|

|

Other current assets |

|

814,233 |

|

|

|

1,094,847 |

|

| |

|

|

|

| Total

current assets |

|

42,835,907 |

|

|

|

36,532,360 |

|

| |

|

|

|

| NONCURRENT

ASSETS |

|

|

|

|

Property and equipment, net |

|

594,293 |

|

|

|

681,575 |

|

|

Operating lease right of use asset, net |

|

5,768,669 |

|

|

|

5,932,769 |

|

|

Intangibles, net |

|

2,320,924 |

|

|

|

2,450,770 |

|

|

Goodwill |

|

18,555,578 |

|

|

|

18,555,578 |

|

|

Other long-term assets |

|

463,062 |

|

|

|

140,403 |

|

| |

|

|

|

| Total

assets |

$ |

70,538,433 |

|

|

$ |

64,293,455 |

|

| |

|

|

|

| LIABILITIES

AND STOCKHOLDERS' EQUITY |

| |

|

|

|

| CURRENT

LIABILITIES |

|

|

|

|

Accounts payable |

$ |

12,218,629 |

|

|

$ |

13,581,822 |

|

|

Accrued expenses |

|

22,070,191 |

|

|

|

14,947,981 |

|

|

Deferred revenue |

|

2,052,361 |

|

|

|

2,265,067 |

|

|

Current portion of operating lease liabilities |

|

581,389 |

|

|

|

599,619 |

|

|

Current portion of other term obligations |

|

79,298 |

|

|

|

133,777 |

|

| |

|

|

|

| Total

current liabilities |

|

37,001,868 |

|

|

|

31,528,266 |

|

| |

|

|

|

| NONCURRENT

LIABILITIES |

|

|

|

|

Operating lease liabilities, net of current portion |

|

5,466,798 |

|

|

|

5,593,649 |

|

|

Other term obligations, net of current portion |

|

- |

|

|

|

- |

|

|

Deferred revenue, net of current portion |

|

362,567 |

|

|

|

363,560 |

|

|

Deferred tax liability |

|

2,049,896 |

|

|

|

1,868,562 |

|

| |

|

|

|

| Total

liabilities |

|

44,881,129 |

|

|

|

39,354,037 |

|

| |

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares |

|

|

|

|

authorized; 2,045,714 shares issued and none outstanding |

|

- |

|

|

|

- |

|

|

Common stock, $0.001 par value; 110,000,000 shares |

|

|

|

|

authorized; 83,837,289 and 83,861,453 shares |

|

|

|

|

issued and outstanding, respectively |

|

83,837 |

|

|

|

83,861 |

|

|

Additional paid-in capital |

|

95,550,466 |

|

|

|

95,279,114 |

|

|

Accumulated other comprehensive loss |

|

(279,924 |

) |

|

|

(242,594 |

) |

|

Accumulated deficit |

|

(69,697,075 |

) |

|

|

(70,180,963 |

) |

| |

|

|

|

| Total

stockholders’ equity |

|

25,657,304 |

|

|

|

24,939,418 |

|

| |

|

|

|

| Total

liabilities and stockholders’ equity |

$ |

70,538,433 |

|

|

$ |

64,293,455 |

|

| |

|

|

|

WIDEPOINT CORPORATION AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

| |

THREE MONTHS

ENDED |

| |

MARCH 31, |

| |

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

|

| |

(Unaudited) |

|

REVENUES |

$ |

39,665,356 |

|

|

$ |

21,916,902 |

|

| COST OF

REVENUES (including amortization and depreciation of |

|

|

|

|

$159,618 and $232,191, respectively) |

|

34,700,024 |

|

|

|

17,663,059 |

|

| |

|

|

|

| GROSS

PROFIT |

|

4,965,332 |

|

|

|

4,253,843 |

|

| |

|

|

|

| OPERATING

EXPENSES |

|

|

|

|

Sales and marketing |

|

492,231 |

|

|

|

393,411 |

|

|

General and administrative expenses (including

share-based |

|

|

|

|

compensation of $281,441 and $89,266,

respectively) |

|

3,470,092 |

|

|

|

3,134,709 |

|

|

Product development |

|

- |

|

|

|

- |

|

|

Depreciation and amortization |

|

263,228 |

|

|

|

240,548 |

|

| |

|

|

|

|

Total operating expenses |

|

4,225,551 |

|

|

|

3,768,668 |

|

|

|

|

|

|

| INCOME FROM

OPERATIONS |

|

739,781 |

|

|

|

485,175 |

|

|

|

|

10.7 |

% |

|

|

17.2 |

% |

| OTHER

(EXPENSE) INCOME |

|

|

|

|

Interest income |

|

3,093 |

|

|

|

4,462 |

|

|

Interest expense |

|

(82,117 |

) |

|

|

(77,545 |

) |

|

Other income |

|

331 |

|

|

|

9 |

|

|

|

|

|

|

|

Total other expense |

|

(78,693 |

) |

|

|

(73,074 |

) |

|

|

|

|

|

| INCOME

BEFORE INCOME TAX PROVISION |

|

661,088 |

|

|

|

412,101 |

|

| INCOME TAX

PROVISION |

|

177,200 |

|

|

|

28,000 |

|

|

|

|

|

|

| NET

INCOME |

$ |

483,888 |

|

|

$ |

384,101 |

|

| |

|

|

|

| BASIC

EARNINGS PER SHARE |

$ |

0.01 |

|

|

$ |

0.00 |

|

| |

|

|

|

| BASIC

WEIGHTED-AVERAGE SHARES OUTSTANDING |

|

83,840,079 |

|

|

|

83,812,448 |

|

| |

|

|

|

| DILUTED

EARNINGS PER SHARE |

$ |

0.01 |

|

|

$ |

0.00 |

|

| |

|

|

|

| DILUTED

WEIGHTED-AVERAGE SHARES OUTSTANDING |

|

84,428,065 |

|

|

|

83,814,670 |

|

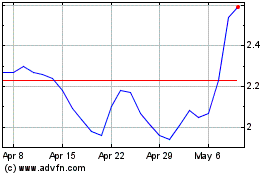

WidePoint (AMEX:WYY)

Historical Stock Chart

From Aug 2024 to Sep 2024

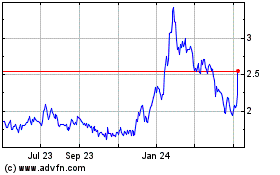

WidePoint (AMEX:WYY)

Historical Stock Chart

From Sep 2023 to Sep 2024