UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 5)*

Seaboard Corporation

(Name of Issuer)

Common Stock, $1.00 par value per share

(Title of Class of Securities)

811543107

(CUSIP Number)

Ellen S. Bresky

c/o Seaboard Corporation

9000 West 67th Street, 3rd Floor

Merriam, Kansas 66202

(913) 676-8800

With copies to:

Bradley C. Faris, Esq.

Latham & Watkins LLP

330 N. Wabash, Suite 2800

Chicago, Illinois 60611

(312) 876-7700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

July 11, 2023

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box. ¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for

other parties to whom copies are to be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act

of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| CUSIP

No. 15117V109 |

13D |

Page 1

of 17 pages |

| 1 |

Names of Reporting Persons

Seaboard Flour LLC |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

465,825.69 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

465,825.69 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

465,825.69 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

40.1% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 2

of 17 pages |

| 1 |

Names of Reporting Persons

SFC Preferred, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

428,122.55 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

428,122.55 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

428,122.55 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

36.9% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 3

of 17 pages |

| 1 |

Names of Reporting Persons

HAB Grandchildren’s Trust A |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Massachusetts |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,775 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,775 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,775 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 4

of 17 pages |

| 1 |

Names of Reporting Persons

HAB Grandchildren’s Trust B |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Massachusetts |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,775 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,775 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,775 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 5

of 17 pages |

| 1 |

Names of Reporting Persons

SJB SEB, LLC |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,661 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

4,661 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,661 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.4% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 6

of 17 pages |

| 1 |

Names of Reporting Persons

Wally Foundation |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Kansas |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,820 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,820 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,820 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.2% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 7

of 17 pages |

| 1 |

Names of Reporting Persons

SJB Residuary HAB 2011 Trust |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Kansas |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

1,560 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

1,560 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

1,560 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.1% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 8

of 17 pages |

| 1 |

Names of Reporting Persons

PB 2011 Descendants Trust |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

Massachusetts |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

60 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

60 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

60 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.01% |

| 14 |

Type of Reporting Person

OO |

| CUSIP

No. 15117V109 |

13D |

Page 9

of 17 pages |

| 1 |

Names of Reporting Persons

Paul M. Squires |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

OO |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

4,661 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

4,661 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

4,661 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

0.4% |

| 14 |

Type of Reporting Person

IN |

| CUSIP

No. 15117V109 |

13D |

Page 10

of 17 pages |

| 1 |

Names of Reporting Persons

Ellen S. Bresky |

| 2 |

Check the Appropriate Box if a Member of a Group |

(a) x

(b) ¨ |

| 3 |

SEC Use Only

|

| 4 |

Source of Funds (See Instructions)

PF |

| 5 |

Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) ¨

|

| 6 |

Citizenship or Place of Organization

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH |

7 |

Sole Voting Power

0 |

| 8 |

Shared Voting Power

905,599.24 |

| 9 |

Sole Dispositive Power

0 |

| 10 |

Shared Dispositive Power

905,599.24 |

| 11 |

Aggregate Amount Beneficially Owned by Each Reporting Person

905,599.24 |

| 12 |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares ¨

|

| 13 |

Percent of Class Represented by Amount in Row (11)

78.02% |

| 14 |

Type of Reporting Person

IN |

| CUSIP

No. 15117V109 |

13D |

Page 11

of 17 pages |

Explanatory Note

This Amendment No. 5 (this “Amendment

No. 5” or “Schedule 13D”) amends the Schedule 13D originally filed by certain of the Reporting Persons on November 2,

2006 (as amended to date, the “Schedule 13D”), relating to the Common Stock $1.00 Par Value (the “Common Stock”)

of Seaboard Corporation (the “Issuer”). Capitalized terms used herein and not otherwise defined shall have the same meanings

ascribed to them in the Schedule 13D.

| Item

2. | Identity

and Background |

Item 2 of the Schedule 13D is hereby amended and restated as follows:

This Schedule 13D is being filed by the following

persons (each a “Reporting Person” and, collectively, the “Reporting Persons”):

| ● | Seaboard

Flour LLC, a Delaware limited liability company (“Seaboard Flour”); |

| ● | SFC

Preferred, LLC, a Delaware limited liability company (“SFC”); |

| ● | HAB

Grandchildren’s Trust A, a trust administered under the laws of the State of Illinois

(“Trust A”); |

| ● | HAB

Grandchildren’s Trust B, a trust administered under the laws of the State of Illinois

(“Trust B”); |

| ● | PB

2011 Descendants Trust, a trust administered under the laws of the State of Illinois (“PB

Trust”); |

| ● | SJB

Residuary HAB 2011 Trust, a trust administered under the laws of the State of Illinois (“SJB

Trust” and, collectively with Trust A, Trust B and PB Trust, the “Trusts”); |

| ● | SJB

SEB LLC, a Delaware limited liability company (“SJB SEB”); |

| ● | the

Wally Foundation, a Kansas not-for-profit corporation (the “Foundation”); |

| ● | Paul

M. Squires, a citizen of the United States of America; and |

| ● | Ellen

S. Bresky, a citizen of the United States of America. |

Ellen S. Bresky is the sole Manager of each of Seaboard Flour and SFC;

business advisor of the Trusts; and President and Treasurer of the Foundation. Paul M. Squires is the Manager of SJB SEB of which the

SJB 2014 Trust (the “2014 Trust”) is the sole Member. As Co-Trustee of the 2014 Trust, Ms. Bresky may replace the Manager

of SJB SEB at any time for any or no reason and, as a result, shares the voting and dispositive power over the shares of Common Stock

with Mr. Squires. Seaboard Flour, SFC, SJB SEB and the Trusts were each formed for the purpose of managing Bresky family interests, including

trusts created for the benefit of members of the Bresky family. Ms. Bresky has sole control over the affairs and investment decisions

of each of Seaboard Flour and SFC, including the power to vote or dispose of the shares of Common Stock held by each of them. Ms. Bresky

has the power to vote or dispose of the shares of Common Stock held by the Trusts and the Foundation.

The business address of each of Mr. Squires, Seaboard

Flour, SFC, SJB SEB, the Trusts and the Foundation is c/o Seaboard Flour LLC, 6 Liberty Square, #354, Boston, Massachusetts 02109. The

business address of Ms. Bresky is c/o Seaboard Corporation, 9000 West 67th Street, 3rd Floor, Merriam, Kansas 66202.

| CUSIP

No. 15117V109 |

13D |

Page 12

of 17 pages |

Ms. Bresky is a private investor and serves

as a director of the Issuer. Mr. Squires is Chief Operating Officer of Seaboard Flour and serves as a director of the Issuer.

None of the Reporting Persons has, during the

last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). None of the Reporting

Persons has, during the last five years, been a party to any civil proceeding as a result of which it was subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or

finding any violations with respect to such laws.

| Item

4. | Purpose

of Transaction |

Item 4 of the Schedule 13D is hereby amended and supplemented by the

following:

Exploration of Return of Capital

On July 8, 2023, to facilitate certain

internal family planning and structuring objectives among the Reporting Persons, certain of the Reporting Persons proposed that the Issuer

repurchase, directly or indirectly, at least $600 million in shares of Common Stock currently held by the Reporting Persons, at a price

per share of Common Stock to be mutually agreed. The Reporting Persons believe the proposed repurchase would be accretive to, and in

the interest of, the Issuer and its shareholders. The proposed repurchase could be funded through cash on hand at the Issuer, sale of

marketable securities held by the Issuer, third-party debt financing, debt security offerings, or any combination thereof. A special

committee of the board of directors of the Issuer (the “Board”), comprised of independent and disinterested directors, is

evaluating the proposed repurchase. There can be no guarantee that the proposed repurchase will be authorized by the special committee,

or as to the timing, amount or terms and conditions of any repurchase. Further, discussions with the special committee or Board may lead

to the evaluation of alternative forms of a return of capital, including a potential dividend. The Reporting

Persons are not currently pursuing and have no intention to pursue, nor have the Reporting Persons had any discussions with the Board

regarding, any sale or change of control transaction involving the Issuer, nor any other similar transaction involving the sale of Common

Stock by the Reporting Persons to an unrelated third party.

The Reporting Persons, including Ms. Bresky in her position as a director

of the Issuer, intend to engage in communications, discussions and negotiations regarding the proposed return of capital, including repurchase,

with members of management and the Board, including the special committee, and their respective legal, financial, accounting and other

advisors, potential partners and counterparties in any financing transaction, current or prospective stockholders of the Issuer, and other

relevant parties, regarding the various alternatives that may from time to time be under consideration by the Reporting Persons and/or

their affiliates. To facilitate their consideration of such matters, the Reporting Persons have recently retained, and may in the future

retain, consultants and advisors and enter into discussions with other third parties. The Reporting Persons may exchange information with

any such persons pursuant to appropriate confidentiality or similar obligations or agreements.

| CUSIP

No. 15117V109 |

13D |

Page 13

of 17 pages |

General

The Reporting Persons acquired the securities

described in this Schedule 13D for investment purposes and they intend to review their investments in the Issuer on a continuing basis.

Any actions the Reporting Persons might undertake will be dependent upon the Reporting Persons’ review of numerous factors, including,

but not limited to: an ongoing evaluation of the Issuer’s business, financial condition, operations and prospects; price levels

of the Issuer’s securities; general market, industry and economic conditions; the relative attractiveness of alternative business

and investment opportunities; and other future developments.

The Reporting Persons may acquire additional securities of the Issuer,

or retain or sell all or a portion of the securities then held, in the open market or in privately negotiated transactions. In addition,

the Reporting Persons, including Ms. Bresky in her position as a director of the Issuer, may engage in discussions with management, the

Board, and other securityholders of the Issuer and other relevant parties or encourage, cause or seek to cause the Issuer or such persons

to consider or explore extraordinary corporate transactions, such as: security offerings and/or stock repurchases by the Issuer; sales

or acquisitions of assets or businesses; changes to the capitalization or dividend policy of the Issuer; or other material changes to

the Issuer’s business or corporate structure, including changes in management or the composition of the Board.

To facilitate their consideration of such matters,

the Reporting Persons may retain consultants and advisors and may enter into discussions with potential sources of capital and other

third parties. The Reporting Persons may exchange information with any such persons pursuant to appropriate confidentiality or similar

agreements. The Reporting Persons will likely take some or all of the foregoing steps at preliminary stages in their consideration of

various possible courses of action before forming any intention to pursue any particular plan or direction.

Other than as described above, the Reporting Persons

do not currently have any plans or proposals that relate to, or would result in, any of the matters listed in Items 4(a)–(j) of

Schedule 13D, although, depending on the factors discussed herein, the Reporting Persons may change their purpose or formulate different

plans or proposals with respect thereto at any time.

| Item 5. | Interest in Securities of the

Issuer. |

Item 5 of the Schedule 13D is hereby amended and restated as follows:

(a) – (b)

The following sets forth, as of the date of this

Schedule 13D, the aggregate number of shares of Common Stock and percentage of shares of Common Stock beneficially owned by each of the

Reporting Persons, as well as the number of shares of Common Stock as to which each Reporting Person has the sole power to vote or to

direct the vote, shared power to vote or to direct the vote, sole power to dispose or to direct the disposition of, or shared power to

dispose or to direct the disposition of, as of the date hereof, based on 1,160,779 shares of Common Stock outstanding as of April 24,

2023, as reported by the Issuer on its Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 3,

2023.

| CUSIP

No. 15117V109 |

13D |

Page 14

of 17 pages |

| Reporting Person | |

Amount

beneficially

owned | | |

Percent

of class | | |

Sole power

to vote or

to direct

the vote | | |

Shared

power to

vote or to

direct the

vote | | |

Sole power

to dispose

or to direct

the

disposition | | |

Shared

power to

dispose or to

direct the

disposition | |

| Seaboard Flour LLC | |

| 465,825.69 | | |

| 40.1 | % | |

| 0 | | |

| 465,825.69 | | |

| 0 | | |

| 465,825.69 | |

| SFC Preferred, LLC | |

| 428,122.55 | | |

| 36.9 | % | |

| 0 | | |

| 428,122.55 | | |

| 0 | | |

| 428,122.55 | |

| HAB Grandchildren’s Trust A | |

| 1,775 | | |

| 0.2 | % | |

| 0 | | |

| 1,775 | | |

| 0 | | |

| 1,775 | |

| HAB Grandchildren’s Trust B | |

| 1,775 | | |

| 0.2 | % | |

| 0 | | |

| 1,775 | | |

| 0 | | |

| 1,775 | |

| SJB SEC, LLC | |

| 4,661 | | |

| 0.4 | % | |

| 0 | | |

| 4,661 | | |

| 0 | | |

| 4,661 | |

| Wally Foundation | |

| 1,820 | | |

| 0.2 | % | |

| 0 | | |

| 1,820 | | |

| 0 | | |

| 1,820 | |

| SJB Residuary HAB 2011 Trust | |

| 1,560 | | |

| 0.1 | % | |

| 0 | | |

| 1,560 | | |

| 0 | | |

| 1,560 | |

| PB 2011 Descendants Trust | |

| 60 | | |

| 0.01 | % | |

| 0 | | |

| 60 | | |

| 0 | | |

| 60 | |

| Paul M. Squires | |

| 4,661 | | |

| 0.4 | % | |

| 0 | | |

| 4,661 | | |

| 0 | | |

| 4,661 | |

| Ellen S. Bresky | |

| 905,599.24 | | |

| 78.02 | % | |

| 0 | | |

| 905,599.24 | | |

| 0 | | |

| 905,599.24 | |

(c) During the past sixty days, no transactions

in the Common Stock were effected by the Reporting Persons.

(d) None.

(e) Not applicable.

| Item 6. | Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Company. |

Item 6 of the Schedule 13D is hereby amended and supplemented as follows:

On July 7, 2023, Seaboard Flour, Patricia A.

Bresky (“PAB”) and certain affiliates of PAB (together with PAB, each a “PAB Party” and, collectively, the “PAB

Parties”) entered into a letter agreement (the “Agreement”) in connection with certain internal transactions between

the PAB Parties, on the one hand, and Seaboard Flour and certain of its affiliates, on the other hand, (the closing of such transactions,

the “Closing”), subject to customary conditions.

Pursuant to the Agreement, on the terms and subject

to the conditions set forth therein, each of the PAB Parties agreed to sell or otherwise dispose of, or cause to be sold or otherwise

disposed of, all Common Stock held, directly or indirectly, by such PAB Party, to one or more third-party buyer(s) in open market

transactions prior to the two year anniversary of the Closing.

Other than as described above, none of the Reporting Persons has any

contracts, arrangements, understandings or relationships (legal or otherwise) with any person with respect to any securities of the Issuer,

including but not limited to any contracts, arrangements, understandings or relationships concerning the transfer or voting of such securities,

finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or losses,

or the giving or withholding of proxies.

| CUSIP

No. 15117V109 |

13D |

Page 15

of 17 pages |

| Item

7. | Materials

to be Filed as Exhibits |

Item 7 of the Schedule 13D is hereby amended and restated as follows:

| CUSIP

No. 15117V109 |

13D |

Page 16

of 17 pages |

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date:

July 11, 2023

| |

Seaboard Flour LLC |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

Manager |

| |

|

| |

SFC Preferred, LLC |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

Manager |

| |

|

| |

HAB Grandchildren’s Trust A |

| |

|

| |

By: |

/s/ Stephen M. Berman |

| |

|

Stephen M. Berman, not individually, but solely as Trustee |

| |

|

| |

HAB Grandchildren’s Trust B |

| |

|

| |

By: |

/s/ Patricia A. Bresky |

| |

|

Patricia A. Bresky, not individually, but solely as Trustee |

| |

|

| |

By: |

/s/ Jonathan Graber |

| |

|

Jonathan Graber, not individually, but solely as Trustee |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

|

Ellen S. Bresky, not individually, but solely as Business Advisor |

| |

|

| |

SJB SEB LLC |

| |

|

| |

By: |

/s/ Paul M. Squires |

| |

Name: |

Paul M. Squires |

| |

Title: |

Manager |

| CUSIP

No. 15117V109 |

13D |

Page 17

of 17 pages |

| |

Wally Foundation |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

President |

| |

|

| |

SJB Residuary HAB 2011 Trust |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

|

Ellen S. Bresky, not individually, but solely as Co-Trustee |

| |

|

| |

By: |

/s/ Stephen M. Berman |

| |

|

Stephen M. Berman, not individually, but solely as Co-Trustee |

| |

|

| |

PB 2011

Descendants Trust |

| |

|

| |

By: |

/s/ Patricia A. Bresky |

| |

|

Patricia A. Bresky, not individually, but solely as Trustee |

| |

|

| |

By: |

/s/ Jonathan Graber |

| |

|

Jonathan Graber, not individually, but solely as Trustee |

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

|

Ellen S. Bresky, not individually, but solely as Business Advisor |

| |

|

| |

/s/ Paul M. Squires |

| |

Paul M. Squires |

| |

|

| |

/s/ Ellen S. Bresky |

| |

Ellen S. Bresky |

Exhibit A

Execution

Version

Seaboard

Flour LLC

6 liberty

square, #354

boston,

massachusetts 02109

July 7, 2023

PATRICIA A. BRESKY

c/o Faegre Drinker Biddle & Reath LLP

Attn: Jonathan Graber

Drinker Biddle &

Reath LLP

320 South Canal Street, Suite 3300

Chicago, IL 60606

Re: Sale of Seaboard Corporation Common Stock

As you are aware, the undersigned

parties (each a “PAB Party” and, collectively, the “PAB Parties”), are members of Seaboard Flour

LLC, a Delaware limited liability company (“Seaboard Flour”), and, in connection with certain transactions between

the PAB Parties, on the one hand, and Seaboard Flour and certain of its affiliates, on the other hand, providing liquidity to PAB Parties

(collectively, the “Internal Planning and Structuring Transactions” and the closing thereof, the “Closing”),

the parties hereto desire to set forth their agreements with respect to the shares of common stock of Seaboard Corporation, par value

$1.00 (“Seaboard Stock”) held by the PAB Parties and the other transactions contemplated by this letter agreement.

In consideration of the mutual

covenants, agreements and understandings contained herein, the sufficiency of which are hereby acknowledged, and intending to be legally

bound, each of the PAB Parties covenants and agrees that, prior to the two (2) year anniversary of the Closing, such PAB Party will

sell or otherwise dispose of, or cause to be sold or otherwise disposed of, all Seaboard Stock, held, directly or indirectly, by such

PAB Party, including all shares of Seaboard Stock held by such PAB Party set forth on Schedule I hereto, to one or more third-party

buyer(s) in open market transactions (which third-party buyer(s) are acknowledged and agreed to expressly exclude any PAB Party

or affiliates thereof).

Each PAB Party represents

and warrants that such party (a) has requisite power and authority to enter into this letter agreement and perform its obligations

hereunder, (b) has duly executed this letter agreement, which constitutes a valid and binding legal obligation of such party, enforceable

against such party, subject to customary bankruptcy and insolvency exceptions and (c) no other agreement or obligation of such party

would prevent such party from performing its obligations hereunder.

This letter agreement shall

terminate and be of no further force of effect upon the earliest to occur of (i) the mutual agreement of each PAB Party and Seaboard

Flour, (ii) the termination of the definitive agreement(s) contemplating the Internal Planning and Structuring Transactions

and (iii) the full performance by the parties hereto of the obligations contemplated by this letter agreement.

Any amendment, supplement

or modification of or to any provision of this letter agreement, any waiver of any provision of this letter agreement, shall be effective

only if it is made in writing and signed by the applicable party or parties hereto. This letter agreement may be executed in any number

of counterparts, and signature pages may be delivered by portable document format (PDF) or any electronic signature complying with

the U.S. federal ESIGN Act of 2000, each of which when so executed shall be deemed to be an original and all of which taken together shall

constitute one and the same letter agreement. This letter agreement and the rights of each of the parties hereto shall be governed by

and construed in accordance with the substantive and procedural laws of the State of Delaware without giving effect to any conflicts or

choice of laws provisions that would cause the application of the domestic substantive laws of any other jurisdiction. Any controversy,

claim or dispute between the parties hereto relating to or arising from this letter agreement shall be brought exclusively in the state

or federal courts located in New Castle County in the State of Delaware. Each party hereto hereby irrevocably waives, to the fullest extent

permitted by applicable law, any objection which it may now or hereafter have to the laying of venue of any such dispute in any such court.

Each party hereto agrees that service of any process, summons, notice or document sent in accordance with this letter agreement shall

be effective service of process in any dispute with respect hereto.

The parties hereto hereby

acknowledge and agree that irreparable damage will occur in the event that any covenant or other obligation set forth in this letter agreement

is not complied with in accordance with its terms or is otherwise breached or threatened to be breached and that an award of money damages

would be inadequate in such event. Accordingly, each party hereto acknowledges and agrees that each of the other parties hereto is entitled

to equitable relief, without proof of actual damages, in addition to any other remedy to which such other party is entitled at law or

in equity for any such non-compliance or other breach or threatened breach or termination. Each party hereto further acknowledges and

agrees that no other party hereto or any other person shall be required to obtain, furnish or post any bond or similar instrument in connection

with or as a condition to obtaining any remedy referred to herein. This letter agreement and any rights and obligations hereunder may

not be assigned or otherwise transferred by any party hereto (by operation of law or otherwise) without the prior written consent of the

other parties hereto (such consent not to be unreasonably withheld, conditioned or delayed).

[Signature Pages Follow]

| |

Very truly yours, |

| |

|

| |

SEABOARD FLOUR LLC |

| |

|

| |

|

| |

By: |

/s/ Ellen S. Bresky |

| |

Name: |

Ellen S. Bresky |

| |

Title: |

Manager |

[Signature Page to Letter

Agreement]

Accepted and Agreed:

PAB PARTIES

| /s/ Patricia A. Bresky |

|

| Patricia A. Bresky |

|

| |

|

| /s/ David Steinbrink |

|

| David Steinbrink |

|

| |

|

| /s/ Daniel Steinbrink |

|

| Daniel Steinbrink |

|

| |

|

| /s/ Jeffrey Steinbrink |

|

| Jeffrey Steinbrink |

|

| |

|

| /s/ Maria del Rosario Novoa Steinbrink |

|

| Maria del Rosario Novoa Steinbrink |

|

| |

|

| /s/ Latoya Downes-Steinbrink |

|

| Latoya Downes-Steinbrink |

|

[Signature Page to Letter

Agreement]

H. Harry Bresky Retained Annuity Trust #2

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| The Bresky Family SFC Trust – Patty Share |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| Patricia A. Bresky Remainder Trust |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| Patricia A. Bresky 2021-2 Annuity Trust |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| Patricia A. Bresky 2022-2 Annuity Trust |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| Patricia A. Bresky 2021-2 Annuity Trust |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| Patricia A. Bresky 2021-2 Annuity Trust |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

[Signature Page to Letter

Agreement]

| Patricia Bresky GST Exempt Trust |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| PAB Children’s Trust |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky, not individually,

but solely as Trustee |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Ellen S. Bresky |

|

| |

Ellen S. Bresky, not individually, but solely as Business Advisor |

|

| |

|

| Patricia A. Bresky Gift Trust |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

|

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| The H. Harry Bresky Family Trust |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

|

Patricia A. Bresky, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Stephen M. Berman |

|

| |

Stephen M. Berman, not individually, but solely as Trustee |

|

[Signature Page to Letter

Agreement]

| HAB Grandchildren’s Trust B |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Ellen S. Bresky |

|

| |

Ellen S. Bresky, not individually, but solely as Business Advisor |

|

| |

|

| PB 2011 Descendants Trust |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber, not individually, but solely as Trustee |

|

| |

|

| By: |

/s/ Ellen S. Bresky |

|

| |

Ellen S. Bresky, not individually, but solely as Business Advisor |

|

| |

|

| Patricia A. Bresky Family Foundation |

|

| |

|

| By: |

/s/ Patricia A. Bresky |

|

| |

Patricia A. Bresky |

|

| |

Its: President |

|

| |

|

| PAB SEB LLC |

|

| |

|

| By: |

/s/ Jonathan Graber |

|

| |

Jonathan Graber |

|

| |

Its: Manager |

|

[Signature Page to Letter

Agreement]

Schedule I

SEB Shares

| Entity |

Number of Shares |

|

| |

|

|

| PB 2011 Descendants Trust |

60 |

|

| |

|

|

| PAB SEB LLC |

113 |

|

| |

|

|

| Patricia A. Bresky Family Foundation |

1,820 |

|

| |

|

|

| HAB Grandchildren’s Trust B |

1,775 |

|

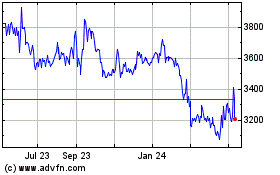

Seaboard (AMEX:SEB)

Historical Stock Chart

From Dec 2024 to Jan 2025

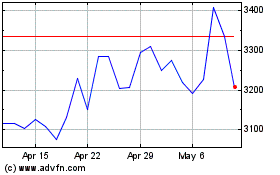

Seaboard (AMEX:SEB)

Historical Stock Chart

From Jan 2024 to Jan 2025