ROBO Global Robotics & Automation ETF (ROBO) Celebrates 4 Years on Nasdaq with $1.5 Billion under Management

October 24 2017 - 9:05AM

Business Wire

The First Robotics Fund Marches Into Fifth

Year

The ROBO Global Robotics & Automation ETF (Nasdaq: ROBO) is

heading into its fifth year of trading with the wind at its back,

having attracted over $1.5 billion in assets since inception on

Oct. 22, 2013. Year-to-date, it’s delivered a total return of 37.73

percent.*

Comprised of 85 securities that span 14 countries, the fund

invests in the robotics, automation and artificial intelligence

(RAAI) sector, as defined by the ROBO Global Robotics &

Automation Index. A team of financial and robotics experts,

including five Ph.D.s, constructed the Index that the ROBO ETF

tracks.

“From the beginning, our goal was to compile a world-class team

of researchers and investment experts so investors had a turnkey

way to access the exciting robotics revolution,” said Travis

Briggs, CEO of ROBO Global U.S.

ROBO Global’s Index has been licensed across four continents,

and Briggs noted that the team remains interested in finding and

working with new partners.

“The response to the concept of investing in robotics has been

overwhelming and gratifying, and we are committed to dedicating 100

percent of our resources to understanding and unlocking the

potential value of this multi-decade investment opportunity,”

Briggs added.

About ROBO Global

ROBO Global is the creator of the first benchmark

index to track the global robotics and automation

industry. By offering access to the entire value chain of robotics,

automation and artificial intelligence,

the ROBO Global Robotics and Automation

Index seeks to capture the growth potential of

the global robotics revolution and brings these solutions

to investors.

The index is comprised of more than 80 rapidly developing

companies spanning more than 14 countries that are categorized

into 12 subsectors. With the expertise

of ROBO Global’s leadership team and strategic advisors,

which includes five Ph.Ds. ROBO Global searches

worldwide to find cutting-edge companies across a multitude of

industries from healthcare to industrials to aerospace.

ROBO Global has offices in Dallas and London, and

indices listed on multiple exchanges. For more information,

please visit http://roboglobal.com/.

Performance data for ROBO as of 09/30/17 is as follows: 1 year:

36.76% (NAV) & 37.19% (Mkt Price); Annualized Since Inception:

11.84% (NAV) & 11.93% (Mkt Price)

Performance data quoted represents past performance and is no

guarantee of future results. Investment return and principal value

of an investment will fluctuate so that an investor`s shares, when

redeemed, may be worth more or less than the original cost. Current

performance may be lower or higher than the original cost. Returns

for periods of less than one year are not annualized. One cannot

invest directly in an index. Returns are determined based on the

midpoint of the bid/ask spread at 4:00pm Eastern time, when the NAV

is typically calculated. Market returns does not represent the

returns you would receive if you traded shares at other times.

Expense ratio: 0.95%

Carefully consider the Fund's investment objectives, risk

factors, charges and expenses before investing. This and additional

information can be found on the Funds' full or summary prospectus,

which may be obtained at www.roboglobaletfs.com. Read

the prospectus carefully before investing.

Exchange Traded Concepts, LLC serves as the investment advisor,

and Vident Investment Advisory, LLC serves as a sub advisor to the

fund. The Funds are distributed by SEI Investments Distribution Co.

(SIDCO), which is not affiliated with Exchange Traded Concepts, LLC

or any of its affiliates.

Investing involves risk, including the possible loss of

principal. International investments may also involve risk from

unfavorable fluctuations in currency values, differences in

generally accepted accounting principles, and from economic or

political instability. Emerging markets involve heightened risks

related to the same factors as well as increased volatility and

lower trading volume. Narrowly focused investments and investments

in smaller companies typically exhibit higher volatility. There is

no guarantee the fund will achieve its stated objective. Indices

are unmanaged and one cannot invest directly in an index.

*As of Oct. 18, 2017

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171024005348/en/

Gregory FCA for ROBO GlobalLauren Davis,

610-228-2103robo@gregoryfca.com

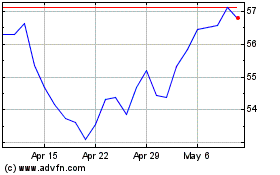

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Jan 2025 to Feb 2025

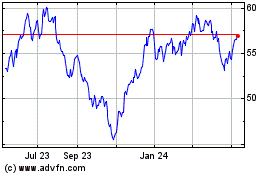

ROBO Global Robotics and... (AMEX:ROBO)

Historical Stock Chart

From Feb 2024 to Feb 2025