0001810140

false

0001810140

2023-08-23

2023-08-23

0001810140

POL:CommonStock0.0001ParValuePerShareMember

2023-08-23

2023-08-23

0001810140

POL:WarrantsToPurchaseCommonStockMember

2023-08-23

2023-08-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 Or 15(d) Of

The

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 23, 2023

POLISHED.COM

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39418 |

|

83-3713938 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1870

Bath Avenue, Brooklyn, NY 11214

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (800) 299-9470

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

POL |

|

NYSE American LLC |

| Warrants to Purchase Common Stock |

|

POL WS |

|

NYSE American LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.02 Termination of a Material Definitive Agreement.

As

previously reported, on March 15, 2022, Polished.com Inc. (f/k/a 1847 Goedeker Inc.) (the “Company”) entered into that certain

lease agreement (the “Office Lease”) by and between the Company and 8780 19 Ave LLC (“8780 LLC”), a New York limited

liability company owned by Albert Fouerti, the Company’s former Chief Executive Officer and director, and Elie Fouerti, the Company’s

former Chief Operating Officer, for the lease of an office building located at 8780 19th Avenue, Brooklyn, NY 11214 (the “Property”).

On

August 23, 2023, the Company entered into a Settlement and Termination Agreement with 8780 LLC pursuant to which it terminated the Office

Lease (the “Lease Termination Agreement”). The Company and 8780 LLC mutually agreed to enter

into the Lease Termination Agreement following a dispute that arose between the parties. The Company contended that the Office

Lease required 8780 LLC do certain work at 8780 LLC’s expense to improve the Property at a cost of approximately $1.2 million and

that 8780 LLC violated the Office Lease by failing to pay for the work. 8780 LLC contended that the expense was the Company’s responsibility

and that the Company was in default of the lease for failing to pay rent.

Pursuant

to the Lease Termination Agreement, the Company agreed to (i) pay 8780 LLC an aggregate settlement amount of $100,000 according to a

schedule set forth in the Lease Termination Agreement and (ii) pay three months of insurance premiums and three months of real

estate taxes on the Property. The Lease Termination Agreement contains customary mutual releases and covenants not to sue.

In

connection with the lease termination, the Company will have a non-cash charge of approximately $1.1 million representing the

accumulated costs related to the leasehold improvements.

The

foregoing description of the Lease Termination Agreement does not purport to be complete and is qualified in its entirety by reference

to the Lease Termination Agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Certain confidential information

contained in this exhibit has been redacted in accordance with Regulation S-K Item 601(b) because the information (i) is not material

and (ii) is the type that the registrant treats as private or confidential.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

By: |

/s/ Robert D. Barry |

| |

Name: |

Robert D. Barry |

| |

Title: |

Interim Chief Financial Officer and Secretary |

Dated:

August 25, 2023

Exhibit 10.1

CERTAIN

IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) THE TYPE THAT THE REGISTRANT

NORMALLY TREATS AS PRIVATE AND CONFIDENTIAL.

SETTLEMENT

AND TERMINATION AGREEMENT

This

Settlement and Termination Agreement (“Agreement”) is made on this 23rd day of August 2023 (the “Effective

Date”) and entered into by and between Polished.com f/k/a 1847 Goedeker Inc. (“Tenant”) and 8780 19 Ave

LLC (“Landlord”) (Tenant and Landlord are, collectively, the “Parties”).

WHEREAS,

on or around March 15, 2022, Tenant and Landlord entered into a lease for an office building (“Lease”) located at

8780 19th Avenue, Brooklyn, New York 11214 (“Premises”);

WHEREAS,

a dispute has arisen between Tenant and Landlord regarding payment for Landlord’s Work (as defined in the Lease) and payment of

rent commencing on February 1, 2023 (the “Dispute”);

WHEREAS,

without any Party admitting any liability whatsoever to any other Party, each of the Parties has determined that it is in their respective

best interests, including the inherent uncertainty of litigation and to avoid costly and protracted litigation, to enter into this Agreement

to effectuate compromise and resolution of the Dispute and to terminate the Lease;

NOW,

THEREFORE, in consideration of the mutual promises and covenants set forth herein, the receipt and adequacy of which is hereby acknowledged,

and with the intent to be legally bound hereby, the parties hereto agree as follows:

1. Settlement Amount. The total sum of One Hundred Thousand Dollars ($100,000) (the “Settlement Amount”) shall

be paid by or on behalf of Tenant to Landlord on the following schedule:

$35,000

on or before August 30, 2023;

an

additional $15,000 on or before September 30, 2023;

an

additional $15,000 on or before October 30, 2023;

an

additional $15,000 on or before November 30, 2023;

an

additional $20,000 on or before December 30, 2023.

All

payments shall be made using the following wire instructions:

Bank

Name: [***]

Account

Number: [***]

Account

Type: [***]

Routing

Number / SWIFT Code: [***]

Account

Name: [***]

Upon

receipt of each payment, Landlord will confirm in writing by email to Tenant and its counsel to akratenstein@mwe.com the receipt of the

payment.

In

addition, upon the Effective Date, Tenant shall pay three months of insurance premiums at the normal (not the force-placed) rate, and

three months of real estate taxes on the Property. Tenant shall pay no other invoices or amounts.

2. Termination of the Lease. Effective upon the Effective Date, the Lease shall be deemed terminated and neither Party shall have

any further obligations under the Lease, including, without limitation, any obligations that expressly survive the termination of the

Lease.

| 3. | Mutual

Releases and Covenant Not to Sue. |

| a. | Effective

upon the Effective Date, and except for the obligations contained herein, each Party, on

behalf of itself and its parent companies, subsidiaries, affiliates and each of their respective

officers, directors, employees, agents, members, and representatives (“Releasing Party”),

releases and forever discharges the other Party and its parent companies, subsidiaries, affiliates

and each of their respective officers, directors, employees, agents, members and representatives

(“Released Parties”) from any and

all manner of claims, causes of action, damages, demands, judgments, costs, attorney’s

fees, and rights whatsoever, whether in law or in equity, whether known or unknown, which

the Releasing Party has had, now has or may hereafter have against the Released Party concerning

the Lease, occurring from the beginning of time through the Effective Date of this Agreement. |

| b. | Each

Releasing Party agrees that they will refrain and forbear from commencing, instituting, or

prosecuting any lawsuit, action, or other proceeding, in law, equity or otherwise, against

any Released Party arising out of or relating to the claims released in this Agreement. Each

Releasing Party agrees that monetary damages alone are inadequate to compensate for injury

caused or threatened by a breach of this covenant not to sue, and that preliminary and permanent

injunctive relief restraining and prohibiting the prosecution of any action or proceeding

brought or instituted in violation hereof is a necessary and appropriate remedy in the event

of such a breach or threatened breach. An action or proceeding brought to enforce the terms

of this Agreement is excepted from this covenant not to sue. |

2. Requisite Authority. Each Party represents and warrants that the individual executing this Agreement on its behalf has been authorized

to do so, and that all necessary action to approve this Agreement has been taken.

3. Parties

Pay Own Fees, Costs and Expenses. The Parties agree to pay their own fees, costs, and expenses related to the Dispute and the negotiation

and execution of this Agreement.

4. Negotiated Agreement. This Agreement has been negotiated among the Parties, each of whom was represented by counsel. In the event

of any dispute over the interpretation of this Agreement, there shall be no rule of construction requiring that this Agreement be construed

in favor of or against any of the Parties.

5. Construction of Provisions. The following rules of construction shall apply to this Agreement and all documents supplemental

hereto unless the context clearly requires otherwise:

| a. | All

references herein to numbered sections are references to the sections hereof. |

| b. | The

terms “include,” “including,” and similar terms shall be construed

as if followed by the phrase “without being limited to.” |

| c. | Words

of masculine, feminine, or neutral gender shall mean and include the correlative words of

the other genders, and words importing the singular number shall mean and include the plural

and vice versa. |

| d. | No

inference in favor of, or against, any party shall be drawn from the fact that such party

has drafted any portion of this Agreement. |

| e. | The

terms “hereof,” “herein,” “hereby,” “hereunder,”

and similar terms in this Agreement refer to this Agreement as a whole and not to any particular

provision or section of this Agreement. |

6. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, but

all of which together shall constitute one and the same instrument; signature pages may be detached from multiple separate counterparts

and attached to a single counterpart so that all signature pages are physically attached to the same document. A signature of a Party

to this Agreement sent by facsimile, e-mail or other electronic transmission shall be deemed to constitute an original and fully effective

signature of such Party.

7. Entire Agreement / Modes of Modification. This Agreement constitutes the sole and entire agreement between the Parties with respect

to the subject matter hereof, and there are no other covenants, promises, agreements, or understandings regarding the same. This Agreement,

including the provisions of this Section, may not be modified except by written amendment to this Agreement signed by the parties affected

by the same, and the Parties hereby: (a) expressly agree that it shall not be reasonable for them to rely on any alleged, non-written

amendment to this Agreement; (b) irrevocably waive any and all right to enforce any alleged, non-written amendment to this Agreement;

and (c) expressly agree that it shall be beyond the scope of authority (apparent or otherwise) for any of their respective agents to

agree to any non-written modification of this Agreement.

8. No

Admissions. The Parties acknowledge and agree that nothing in this Agreement may be construed as evidence of any admission by any

of the Parties of the validity of any of the claims, liabilities, losses, demands, or damages of any nature or kind asserted or that

could be asserted against any other Party, its liability therefor, or of any wrongdoing on its or his part.

9. Jurisdiction, Venue, Choice of Law. This Agreement, the rights and obligations of the Parties under this Agreement and any claim

or controversy directly or indirectly based upon or arising out of this Agreement (whether based on contract, tort, or any other theory),

including all matters of construction, validity, and performance, shall in all respects be governed by and interpreted, construed, and

determined in accordance with, the internal laws of the State of New York (without regard to any conflicts of law provision thereof

that would require the application of the laws of any other jurisdiction). Each of the Parties submits to the jurisdiction of the federal

or state courts located in the State of New York, County of Brooklyn for any action, suit, or proceeding arising out of or based on this

Agreement or any matter relating to it and waive any objection that they may have to the laying of venue in any such court or that any

such court is an inconvenient forum or does not have personal jurisdiction over them.

10. Jury

Trial Waiver. THE PARTIES HEREBY IRREVOCABLY AND UNCONDITIONALLY WAIVE TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY

RIGHT THEY MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO ANY ACTION, SUIT OR PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF, UNDER

OR IN CONNECTION WITH THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. THE PARTIES EACH HEREBY (I) CERTIFY THAT NO

REPRESENTATIVE, AGENT OR ATTORNEY OF THE OTHERS HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PERSON WOULD NOT, IN THE

EVENT OF ANY ACTION, SUIT OR PROCEEDING, SEEK TO ENFORCE THE FOREGOING WAIVER AND (II) ACKNOWLEDGES THAT IT HAS BEEN INDUCED TO

ENTER INTO THIS AGREEMENT BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS CONTAINED IN THIS SECTION 10.

IN

WITNESS WHEREOF, the Parties have signed this Agreement as of the day and year first above written.

| |

Polished.com f/k/a 1847 Goedeker Inc. |

| |

|

|

|

| |

By: |

/s/ Robert D. Barry |

| |

|

Name: |

Robert D. Barry |

| |

|

Title: |

CFO |

| |

|

|

|

| |

|

|

|

| |

8780 19 Ave LLC |

| |

|

|

|

| |

By: |

/s/ Elie Fouerti |

| |

|

Name: |

Elie Fouerti |

| |

|

Title: |

Authorized Signatory |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POL_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=POL_WarrantsToPurchaseCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

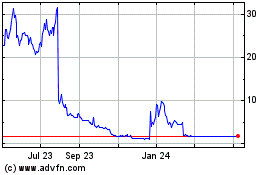

Polished (AMEX:POL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Polished (AMEX:POL)

Historical Stock Chart

From Jan 2024 to Jan 2025