Matthews Launches Five New Active ETFs to Provide Greater Customization in Emerging Markets

September 22 2023 - 10:00AM

Matthews further enhanced its Emerging Markets leadership in Active

ETFs today with the launch of five new actively managed

exchange-traded funds (ETFs) on the New York Stock Exchange.

Following the launch of its Active ETFs platform last year, this

will bring the firm’s suite of Emerging Market and Asia-focused

ETFs to 10.

“At Matthews, we are pragmatic, skeptical, risk-aware, and

fact-based in our analysis of investment opportunities.

Sophisticated investors have long sought Emerging Market exposure,

for returns and diversification,” said Cooper Abbott, CEO of

Matthews. “After a period of under-allocation, institutions and

professional investors are increasingly seeking greater control by

adding more customized Emerging Market exposures to their

portfolios. We believe these new Active ETFs provide sophisticated

investors with the power of choice to selectively express their

investment views—both strategically and tactically. Investors can

directly invest in our new range of ETFs that seek to give them

exposure to entrepreneurial businesses benefiting from structural

growth drivers in India, or leading innovative champions in Japan,

or companies that are making a positive environmental, social and

economic impact in a broader Emerging Markets portfolio.”

Matthews’ full suite of transparent Active ETF strategies will

be substantially similar to our existing mutual funds. We believe

investors can benefit from the firm’s 30+ years of experience in

Asia and Emerging Markets as we utilize the same fundamental

research and macro-aware process used to build highly

differentiated portfolios that aim to generate above-index returns

by investing in companies not typically found in most broad

international strategies. The five new ETFs are:

- ASIA - Matthews Pacific Tiger Active ETF: A

core regional fund that seeks to invest in high quality growth

companies in Asia (ex Japan)

- INDE - Matthews India Active ETF: Single

country all-cap fund that seeks to invest in innovative and

entrepreneurial businesses across sectors and themes which we

believe will benefit from the country’s long-term structural growth

drivers

- JPAN - Matthews Japan Active ETF: Single

country all-cap high conviction fund that seeks to invest in

companies that are domestic, regional and global leaders in their

sectors

- ADVE - Matthews Asia Dividend Active ETF: A

core regional fund that seeks to invest in growth companies in Asia

Pacific with lower volatility

- EMSF - Matthews Emerging Markets Sustainable

Future Active ETF: Unconstrained, high conviction all-cap fund that

seeks to invest in companies we believe are focused on making

positive environmental, social and economic impact within global

Emerging Markets

“The launch of these new Active ETFs underscores our commitment

to building a high-quality ETF platform that enables our clients to

tailor their allocations within global Emerging Markets,” added

Mike Barrer, Head of ETF Capital Markets. “In a little over a year,

we believe we have built a platform of attractively priced ETFs

that were designed to allow investment professionals to benefit

from transparency, liquidity, and tax efficiency.”

The full Matthews Active ETF platform consists of: Emerging

Markets:

- Matthews Emerging Markets Equity Active ETF (NYSE Arca:

MEM)

- Matthews Emerging Markets ex China Active ETF (NYSE Arca:

MEMX)

- Matthews Emerging Markets Sustainable Future Active ETF (NYSE

Arca: EMSF)

Asia Growth:

- Matthews Asia Innovators Active ETF (NYSE Arca: MINV)

- Matthews Pacific Tiger Active ETF (NYSE Arca: ASIA)

Asia Growth and Income:

- Matthews Asia Dividend Active ETF (NYSE Arca: ADVE)

Country Specific:

- Matthews China Active ETF (NYSE Arca: MCH)

- Matthews Korea Active ETF (NYSE Arca: MKOR)

- Matthews India Active ETF (NYSE Arca: INDE)

- Matthews Japan Active ETF (NYSE Arca: JPAN)

About Matthews:

Matthews is an independent, privately owned investment manager

founded in 1991 on a belief that Global Emerging Markets offer

exceptional long-term growth potential. As a trusted and

experienced guide, Matthews takes a long-term, active, fundamental

investment approach to construct highly differentiated portfolios

that focus on Emerging Markets, Asia and China. The firm manages

assets on behalf of institutions, advisors and individual investors

globally in vehicles that include SMAs, mutual funds and active

ETFs. For more information about Matthews, please visit

www.matthewsasia.com.

You should carefully consider the investment objectives, risks,

charges and expenses of the Matthews Asia Funds before making an

investment decision. A prospectus with this and other information

about the Funds may be obtained by visiting matthewsasia.com.

Please read the prospectus carefully before investing.

The value of an investment in the Fund can go down as well as up

and possible loss of principal is a risk of investing. Investments

in international, emerging and frontier markets involve risks such

as economic, social and political instability, market illiquidity,

currency fluctuations, high levels of volatility, and limited

regulation. Additionally, investing in emerging and frontier

securities involves greater risks than investing in securities of

developed markets, as issuers in these countries generally disclose

less financial and other information publicly or restrict access to

certain information from review by non-domestic authorities.

Emerging and frontier markets tend to have less stringent and less

uniform accounting, auditing and financial reporting standards,

limited regulatory or governmental oversight, and limited investor

protection or rights to take action against issuers, resulting in

potential material risks to investors. Investing in Chinese

securities involve risks. Heightened risks related to the

regulatory environment and the potential actions by the Chinese

government could negatively impact performance. In addition,

single-country and sector funds may be subject to a higher degree

of market risk than diversified funds because of concentration in a

specific industry, sector or geographic location. Pandemics and

other public health emergencies can result in market volatility and

disruption.

ETFs may trade at a premium or discount to NAV. Shares of any

ETF are bought and sold at market price (not NAV) and are not

individually redeemed from the Fund. Brokerage commissions will

reduce returns.

Matthews Asia Funds are distributed in the U.S. by Foreside

Distributors LLC and in Latin America by Picton, S.A.

Dukas Linden PRSarah Lazarus/Stephanie

Dressler+617-335-7823/+949-269-2535sarah@dlpr.com/stephanie@dlpr.com

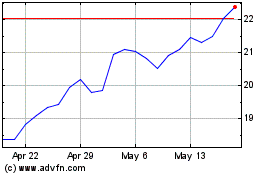

Matthews China Active ETF (AMEX:MCH)

Historical Stock Chart

From Feb 2025 to Mar 2025

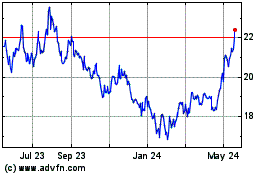

Matthews China Active ETF (AMEX:MCH)

Historical Stock Chart

From Mar 2024 to Mar 2025