Is it Time to Buy Gold? - Real Time Insight

February 28 2013 - 10:06AM

Zacks

After an impressive 12 year bull-run, gold has been in the

bearish territory for the past few months. Gold price has gone down

~7% in the last 13 weeks and ~5% year-to-date.

As a result of decline in investor interest, the most popular

gold ETF SPDR Gold Shares (GLD) has seen massive outflows recently,

while most of the popular US stock funds have gathered assets this

year.

Among the main reasons for decline in gold price:

· Many investors

are concerned that QE3 may end earlier than expected

· US economy and

some of the major emerging economies seem to be on the recovery

path

· Some

high-profile investors like George Soros reduced their gold

holdings

· US Dollar has

strengthened recently

· There is no

sign of inflation risk in most developed countries despite massive

monetary easing

Fed’s chief recently clarified that the Fed has no plans to end

easing anytime soon, which resulted in gold price recovering a bit.

Further, renewed worried over Europe and the impending sequester

should be positive for gold. (Have we seen the bottom in gold

ETFs?)

Also, central banks, mainly in the emerging countries have been

adding to their gold reserves. According to the latest report from

the World Gold Council, central bank purchases were up 17% in 2012

and were at their highest level since 1964.

Despite gold’s disappointing performance of late, I continue to

believe that gold should be a part (~5% to 10%) of any well

diversified portfolio. Please share your views.

SPDR-GOLD TRUST (GLD): ETF Research Reports

ISHARS-GOLD TR (IAU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

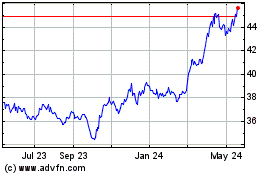

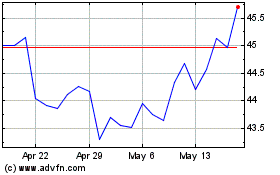

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

iShares Gold (AMEX:IAU)

Historical Stock Chart

From Jul 2023 to Jul 2024