UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES

EXCHANGE ACT OF 1934

For

the month of June 2024

Commission

File Number 001-40099

GOLD

ROYALTY CORP.

(Registrant’s

name)

1188

West Georgia Street, Suite 1830

Vancouver,

BC V6E 4A2

(604)

396-3066

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

INCORPORATION

BY REFERENCE

EXHIBITS 99.1 AND 99.2, INCLUDED WITH THIS REPORT, ARE EACH HEREBY INCORPORATED

BY REFERENCE AS AN EXHIBIT TO THE REGISTRANT’S REGISTRATION STATEMENTS ON FORM F-3, AS AMENDED AND SUPPLEMENTED (FILE NOS. 333-276305,

333-265581, 333-267633, 333-270682) AND FORM S-8 (FILE NO. 333-267421), AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS

SUBMITTED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

GOLD

ROYALTY CORP. |

| |

|

|

| Date:

June 4, 2024 |

By: |

/s/

Andrew Gubbels |

| |

Name: |

Andrew

Gubbels |

| |

Title: |

Chief

Financial Officer |

EXHIBIT

INDEX

Exhibit

99.1

Gold

Royalty Completes Vares Copper Stream Acquisition

Vancouver,

British Columbia – June 4, 2024 – Gold Royalty Corp. (“Gold Royalty” or the

“Company”) (NYSE American: GROY) is pleased to announce that it has completed its previously announced

acquisition of a copper stream (the “Stream”) on the Vares Silver Project (“Vares”), operated

by a subsidiary of Adriatic Metals plc and located in Bosnia and Herzegovina (the “Transaction”).

David

Garofalo, Chairman and CEO of Gold Royalty, commented: “Closing this Transaction further solidifies our outlook for strong free

cash flow growth in 2024 and beyond. We believe Vares is an exceptional asset that supplements our robust portfolio of royalties on long-life

and low-cost projects in top-tier mining jurisdictions. We look forward as our operating partners deliver at the assets underlying our

interests and our revenue growth potential is crystalized.”

Pursuant

to the Transaction, the Company acquired the Stream from OMF Fund III (Cr) Ltd. (“OMF”), an entity managed by Orion

Mine Finance Management LP, in consideration for US$50 million, satisfied at closing by paying US$45 million in cash and issuing 2,906,977

common shares of the Company to OMF at closing.

In

connection with the Transaction, the Company completed its previously announced amendment to its credit agreement with the Bank of Montreal

and the National Bank of Canada, which expanded its existing secured revolving credit facility by US$5 million. The facility now consists

of a US$30 million secured revolving credit facility with an accordion feature providing for an additional US$5 million of availability

subject to certain conditions.

About

Gold Royalty Corp.

Gold

Royalty Corp. is a gold-focused royalty company offering creative financing solutions to the metals and mining industry. Its mission

is to invest in high-quality, sustainable, and responsible mining operations to build a diversified portfolio of precious metals royalty

and streaming interests that generate superior long-term returns for our shareholders. Gold Royalty’s diversified portfolio currently

consists primarily of net smelter return royalties on gold properties located in the Americas.

Gold

Royalty Corp. Contact

Peter

Behncke

Director,

Corporate Development & Investor Relations

Telephone:

(833) 396-3066

Email:

info@goldroyalty.com

Forward-Looking

Statements

Certain

of the information contained in this news release constitutes “forward-looking information” and “forward-looking statements”

within the meaning of applicable Canadian and U.S. securities laws (collectively, “forward-looking statements”), including

but not limited to statements regarding the Company’s the anticipated benefits of the Transaction, the Company’s expectations

regarding future cash flows and the disclosed expected activities, milestones and projections of the operators of the properties underlying

the Company’s interests . Such statements can be generally identified by the use of terms such as “may”, “will”,

“expect”, “intend”, “believe”, “plans”, “anticipate” or similar terms. Forward-looking

statements are based upon certain assumptions and other important factors, including that the operators of the properties underlying

the Company’s interests will achieve their disclosed expected timelines and milestones. Forward-looking statements are subject

to a number of risks, uncertainties and other factors which may cause the actual results to be materially different from those expressed

or implied by such forward-looking statements including, among others, any inability of the operators of the properties underlying the

Company’s interests to execute proposed plans for such properties or to achieved planned development and production estimates and

goals, risks related to the operators of the projects in which the Company holds interests, including the successful continuation of

operations at such projects by those operators, risks related to exploration, development, permitting, infrastructure, operating or technical

difficulties on any such projects, the influence of macroeconomic developments, commodities price volatility and other factors set forth

in the Company’s Annual Report on Form 20-F for the year ended December 31, 2023 and its other publicly filed documents under its

profiles at www.sedarplus.ca and www.sec.gov. . Although the Company has attempted to identify important factors that could cause actual

results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to

be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results

and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance

on forward-looking statements. The Company does not undertake to update any forward-looking statements, except in accordance with applicable

securities laws.

Exhibit

99.2

FORM

51-102F3

MATERIAL

CHANGE REPORT

| 1. |

Name

and Address of Company: |

GOLD

ROYALTY CORP.

1830-1188

West Georgia Street

Vancouver,

British Columbia V6E 4A2

| 2. |

Date

of Material Change: |

The

material change described in this report occurred on June 4, 2024.

On

June 4, 2024, Gold Royalty Corp. (the “Company”) issued a news release through the facilities of Canada Newswire,

a copy of which has been filed on SEDAR+.

| 4. |

Summary

of Material Change: |

On

June 4, 2024, the Company closed its previously announced acquisition (the “Acquisition”) of a copper stream on the

Vares Silver Project (the “Vares Stream”) from OMF Fund III (Cr) Ltd. (“OMF”) for aggregate consideration

of US$50 million, consisting of US$45 million in cash and US$5 million satisfied by the issuance of 2,906,977 common shares in the capital

of the Company (the “Consideration Shares”).

| 5. |

Full

Description of Material Change: |

On

June 4, 2024, the Company closed the Acquisition of the Vares Stream from OMF for aggregate consideration of US$50 million, consisting

of US$45 million cash and the Consideration Shares.

The

Vares Stream applies to 100% of copper production from the mining area over the Rupice deposit at the Vares Silver Project operated by

a subsidiary of Adriatic Metals plc located in Bosnia and Herzegovina. The Vares Stream has associated ongoing payments equal to 30%

of the LME spot copper price, with the effective payable copper fixed at 24.5%.

The

Acquisition was completed pursuant to a purchase and sale agreement dated May 28, 2024, between the Company and OMF, an entity managed

by Orion Mine Finance Management LP.

In

connection with the Acquisition, the Company completed its previously announced amendment to its credit agreement with the Bank of Montreal

and the National Bank of Canada, which expanded its existing secured revolving credit facility by US$5 million. The facility now consists

of a US$30 million secured revolving credit facility with an accordion feature providing for an additional US$5 million of availability

subject to certain conditions.

| 6. |

Reliance

on Subsection 7.1(2) of National Instrument 51-102 |

Not

applicable.

Not

applicable.

The

following executive officer of the Company is knowledgeable about the material change and this report and may be contacted respecting

the material change and this report:

Andrew

Gubbels

Chief

Financial Officer

Telephone:

(604) 396-3066

June

4, 2024

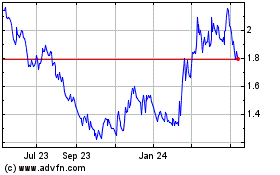

Gold Royalty (AMEX:GROY)

Historical Stock Chart

From Dec 2024 to Jan 2025

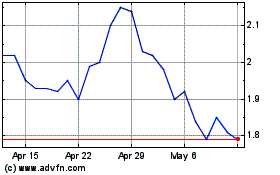

Gold Royalty (AMEX:GROY)

Historical Stock Chart

From Jan 2024 to Jan 2025