GAMCO Global Gold, Natural Resources & Income Trust Declares Monthly Distributions of $0.03 Per Share

May 16 2024 - 9:09AM

The Board of Trustees of GAMCO Global Gold, Natural Resources &

Income Trust (NYSE American:GGN) (the “Fund”) approved the

continuation of its policy of paying monthly cash distributions.

The Board of Trustees declared cash distributions of $0.03 per

share for each of July, August, and September 2024. Based on

current dynamics, the Fund may make distributions in excess of the

Fund’s earnings. It is currently expected that distributions to

common shareholders in 2024 will primarily constitute a return of

capital for tax purposes.

|

Distribution Month |

Record Date |

Payable Date |

Distribution Per Share |

|

July |

July 17, 2024 |

July 24, 2024 |

$0.03 |

|

August |

August 16, 2024 |

August 23, 2024 |

$0.03 |

|

September |

September 16, 2024 |

September 23, 2024 |

$0.03 |

Each quarter, the Board of Trustees reviews the

amount of any potential distribution from the income, realized

capital gain, or capital available. The Board of Trustees will

continue to monitor the Fund’s distribution level, taking into

consideration the Fund’s net asset value and the financial market

environment. The distribution rate should not be considered the

dividend yield or total return on an investment in the Fund.

Because the Fund’s current monthly distributions

are subject to modification by the Board of Trustees at any time

and the Fund’s income will fluctuate, there can be no assurance

that the Fund will pay distributions at a particular rate or

frequency. Shareholders should not draw any conclusions about the

Fund’s investment performance from the amount of the current

distribution.

Short-term capital gains, qualified dividend

income, ordinary income, and return of capital, if any, will be

allocated on a pro-rata basis to all distributions to common

shareholders for the year. There are no capital loss carryforwards

for book purposes. Therefore the Fund, on a book basis, may be

distributing short term gains generated from option premiums that

will not be taxable in 2024 because of the capital loss

carryforwards available on a tax basis. The estimated components of

each distribution are updated and provided to shareholders of

record in a notice accompanying the distribution and are available

on our website (www.gabelli.com). The final determination of the

sources of all distributions in 2024 will be made after year end

and can vary from the monthly estimates. Shareholders should not

draw any conclusions about the Fund’s investment performance from

the amount of the current distribution. All individual shareholders

with taxable accounts will receive written notification regarding

the components and tax treatment for all 2024 distributions in

early 2025 via Form 1099-DIV.

Investors should carefully consider the

investment objectives, risks, charges, and expenses of the Fund

before investing. For more information regarding the Fund’s

distribution policy and other information about the Fund, call:

Molly Marion(914) 921-5681

The Fund’s NAV per share will fluctuate with

changes in the market value of the Fund’s portfolio securities.

Stocks are subject to market, economic, and business risks that

cause their prices to fluctuate. Investors acquire shares of the

Fund on a securities exchange at market value, which fluctuates

according to the dynamics of supply and demand. When Fund shares

are sold, they may be worth more or less than their original cost.

Consequently, you can lose money by investing in the Fund.

Covered Call and Other Option Transaction Risks.

There are several risks associated with writing covered calls and

entering into other types of option transactions. For example,

there are significant differences between the securities and

options markets that could result in an imperfect correlation

between these markets, resulting in a given transaction not

achieving its objectives. In addition, a decision as to whether,

when, and how to use covered call options involves the exercise of

skill and judgment, and even a well-conceived transaction may be

unsuccessful because of market behavior or unexpected events. As

the writer of a covered call option, the Fund forgoes, during the

option’s life, the opportunity to profit from increases in the

market value of the security covering the call option above the

exercise price of the call option, but has retained the risk of

loss should the price of the underlying security decline.

About The GAMCO Global Gold, Natural

Resources & Income TrustThe GAMCO Global Gold, Natural

Resources & Income Trust is a non-diversified, closed-end

management investment company with $717 million in total net assets

whose primary investment objective is to provide a high level of

current income. The Fund invests primarily in equity securities of

gold and natural resources companies and intends to earn income

primarily through a strategy of writing (selling) primarily covered

call options on equity securities in its portfolio. The Fund is

managed by Gabelli Funds, LLC, a subsidiary of GAMCO Investors,

Inc. (OTCQX: GAMI).

NYSE American – GGNCUSIP – 36465A109

GAMCO GLOBAL GOLD, NATURAL RESOURCES & INCOME TRUST

Investor Relations Contact: Molly Marion(914)

921-5681mmarion@gabelli.com

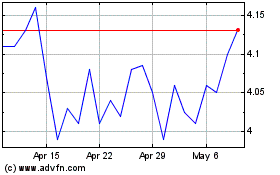

GAMCO Global Gold Natura... (AMEX:GGN)

Historical Stock Chart

From Nov 2024 to Dec 2024

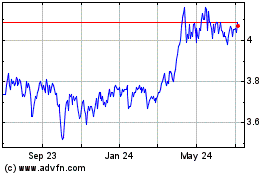

GAMCO Global Gold Natura... (AMEX:GGN)

Historical Stock Chart

From Dec 2023 to Dec 2024