Barnwell Industries, Inc. (NYSE American: BRN) today reported net

earnings of $5,513,000, $0.57 per share, for the year ended

September 30, 2022, as compared to net earnings of $6,253,000,

$0.73 per share, for the year ended September 30, 2021. For the

quarter ended September 30, 2022, Barnwell reported a net loss of

$143,000, $0.01 per share, as compared to net earnings of

$1,547,000, $0.16 per share, for the quarter ended September 30,

2021.

Mr. Alexander C. Kinzler, Chief Executive

Officer of Barnwell, commented, “We are pleased to report that our

oil and natural gas revenues more than doubled for fiscal 2022, as

compared to the prior year. This was due to higher prices and

production for all products, with oil, natural gas, and natural gas

liquids prices increasing 68%, 77%, and 51%, respectively and our

production of oil, natural gas, and natural gas liquids increasing

24%, 39%, and 100%, respectively, as compared to last year. Our

Oklahoma operations generated $3,496,000 or 15% of our oil and

natural gas segment revenues for fiscal 2022. The $740,000 decrease

in net earnings in fiscal 2022 as compared to fiscal 2021 was

primarily due to the Company’s recognition of $4,472,000 in gains

in fiscal 2021 that did not occur in fiscal 2022, which included a

$2,341,000 gain from the termination of the Company's

Post-retirement Medical plan, $1,982,000 in gains from the sales of

assets, and a $149,000 gain on debt extinguishment.

“In total our oil and natural gas segment

operating results, before income taxes, had an $8,113,000

improvement from the prior year due to both higher oil and natural

gas prices and new production from wells drilled in Canada in

fiscal 2022 and Oklahoma in late fiscal 2021. Also contributing to

the increase was a ceiling test impairment of $630,000 in the prior

year period, whereas there was no such ceiling test impairment in

the current year period.

“Equity in income from affiliates decreased

$2,393,000 and land investment segment operating results, before

non-controlling interests’ share of such profits, decreased

$532,000, due to the Kukio Resort Development Partnerships' sale of

six lots in the current year period, whereas there were eight lot

sales in the prior year period. Due to these sales, the Company

received $3,028,000 in net cash distributions in fiscal 2022.

“Contract drilling operating results also

decreased $133,000 due to the completion of a significant drilling

contract in the prior year period.

“General and administrative expenses increased

$956,000 primarily due to increases in professional fees in the

current year period as compared to the same period in the prior

year, partially offset by a decrease in stockholder costs in the

prior year period as compared to the current year period. The

Company also incurred a $484,000 foreign currency loss in the

current year period due to the effects of foreign exchange rate

changes on intercompany advances as a result of the strengthening

of the U.S. dollar against the Canadian dollar.

“In the North Twining Unit (“NTU”) in which

Barnwell holds a 29% interest, the two new wells that began

production in our second fiscal quarter continue to perform

strongly and a second drilling program consisting of four wells

(1.16 net) in the NTU began in our third quarter. Of these four,

three began production with very encouraging initial rates. The

fourth well has been completed and is expected to come online later

in our second quarter of fiscal 2023. Barnwell’s 100% working

interest well that was brought onstream in March 2022 has also

performed well.

“During the year ended September 30, 2022, the

Company sold 509,467 shares under its at-the-market offering

program for net proceeds of $2,356,000 ($4.62 per share); the Board

of directors has suspended sales under this program until further

notice. The Company ended the year with $11,170,000 in working

capital which included $12,804,000 in cash and cash

equivalents.”

“In a further expansion of our U.S. oil and gas

investments, we are pleased to announce an investment of

approximately $5,099,000 into a Permian Basin drilling opportunity,

the most prolific onshore oil and natural gas province in the US

Lower 48 states. Barnwell has acquired a non-operated working

interest in a two well pad consisting of 10,000’ laterals targeting

the Wolfcamp Formation in Loving and Ward Counties, Texas.

Initial production is expected in our second fiscal quarter ending

March 31, 2023. Barnwell holds a 15% working interest in the unit,

with additional possible inventory in the Bone Spring Formation and

other Wolfcamp zones. Following on from Barnwell’s successful 2021

investment in the Anadarko Basin of Oklahoma, this acquisition in

the premier oilfield of the United States represents Barnwell’s

commitment to growing its oil and gas division with strategic

entries into highly economic modern plays. We view non-operated

leasehold as an exciting subset of exploration and production,

allowing us to assemble a diversified portfolio of domestic

opportunities that offers attractive return on capital, builds on

our corporate legacy, supports our commitment to shareholder

returns, and potentially utilizing our net operating loss

carryforwards.”

Forward-Looking

Statements

The information contained in this press release

contains “forward-looking statements,” within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. A forward-looking

statement is one which is based on current expectations of future

events or conditions and does not relate to historical or current

facts. These statements include various estimates, forecasts,

projections of Barnwell’s future performance, statements of

Barnwell’s plans and objectives, and other similar statements.

Forward-looking statements include phrases such as “expects,”

“anticipates,” “intends,” “plans,” “believes,” “predicts,”

“estimates,” “assumes,” “projects,” “may,” “will,” “will be,”

“should,” or similar expressions. Although Barnwell believes that

its current expectations are based on reasonable assumptions, it

cannot assure that the expectations contained in such

forward-looking statements will be achieved. Forward-looking

statements involve risks, uncertainties and assumptions which could

cause actual results to differ materially from those contained in

such statements. The risks, uncertainties and other factors that

might cause actual results to differ materially from Barnwell’s

expectations are set forth in the “Forward-Looking Statements,”

“Risk Factors” and other sections of Barnwell’s annual report on

Form 10-K for the last fiscal year and Barnwell’s other filings

with the SEC. Investors should not place undue reliance on the

forward-looking statements contained in this press release, as they

speak only as of the date of this press release, and Barnwell

expressly disclaims any obligation or undertaking to publicly

release any updates or revisions to any forward-looking statements

contained herein.

|

COMPARATIVE OPERATING RESULTS |

| |

| |

|

|

|

(Unaudited) |

|

|

|

Year ended |

|

Three months

ended |

|

|

|

September 30, |

|

September 30, |

|

|

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

28,545,000 |

|

$ |

18,113,000 |

|

$ |

8,384,000 |

|

|

$ |

4,614,000 |

| |

|

|

|

|

|

|

|

|

| Net earnings

(loss) attributable to Barnwell Industries, Inc. |

|

$ |

5,513,000 |

|

$ |

6,253,000 |

|

$ |

(143,000 |

) |

|

$ |

1,547,000 |

| |

|

|

|

|

|

|

|

|

| Net earnings (loss) per share – basic and diluted |

|

$ |

0.57 |

|

$ |

0.73 |

|

$ |

(0.01 |

) |

|

$ |

0.16 |

| |

|

|

|

|

|

|

|

|

|

Weighted-average shares and equivalent shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic

and diluted |

|

|

9,732,936 |

|

|

8,592,154 |

|

|

9,956,687 |

|

|

|

9,407,336 |

| |

|

|

|

|

|

|

|

|

| CONTACT: |

|

Alexander C.

Kinzler |

| |

|

Chief Executive Officer and President |

| |

|

|

| |

|

Russell M. Gifford |

| |

|

Executive Vice President and Chief Financial Officer |

| |

|

|

| |

|

Tel: (808) 531-8400 |

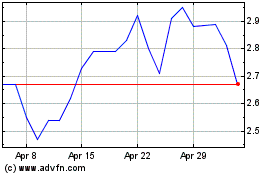

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Aug 2024 to Sep 2024

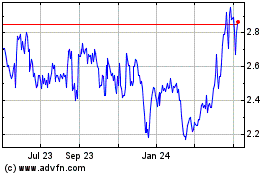

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Sep 2023 to Sep 2024